This is where I share all my trade taken each and every week.

My reason for this is to encourage traders to also keep one for two major reasons:

- Track weekly trading performance.

- To have enough date to be able to work on their trading technique and psychology

Both can only be done when you keep a comprehensive journal, and review it every week.

MONDAY (06/02/2023)

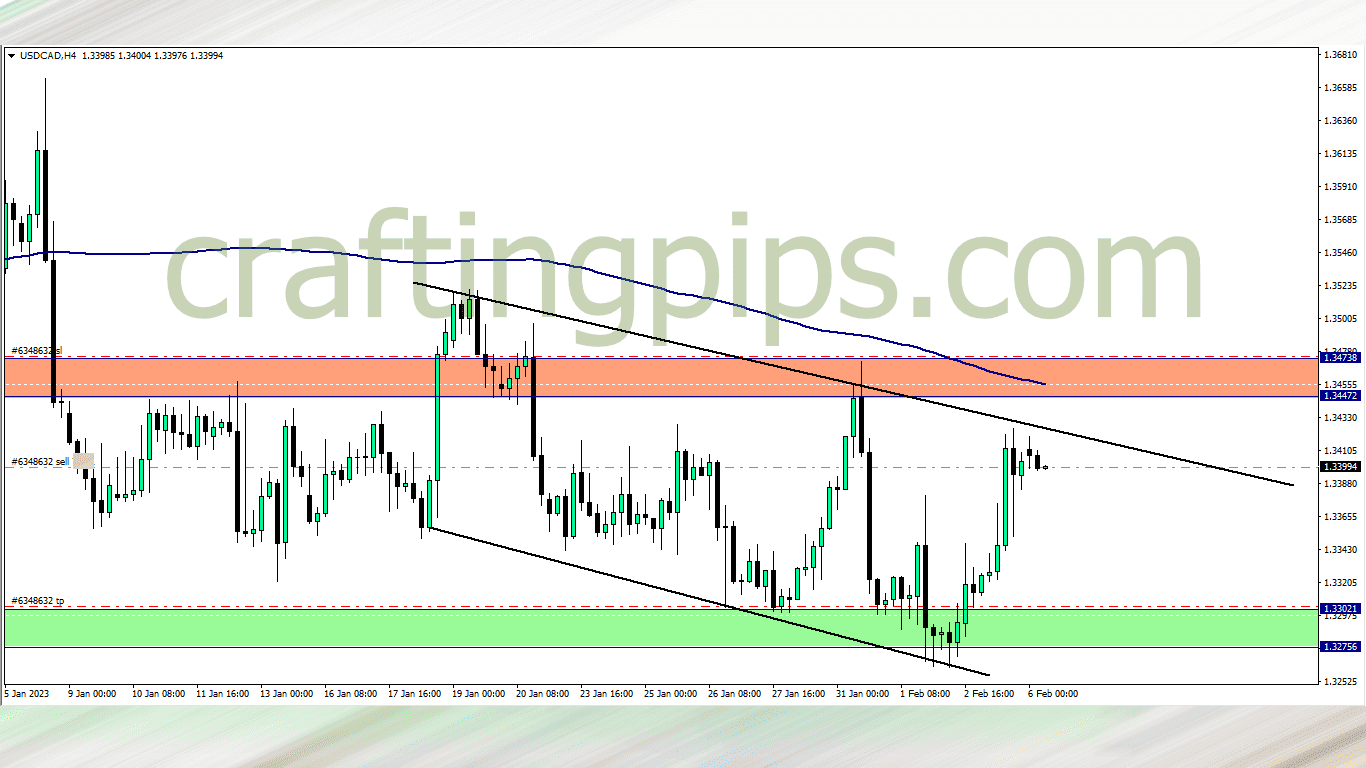

USD/CAD (7.05am)

Analysis: My reasons for selling USD/CAD can be seen here

USD/CAD Update (4 pm)

Price hit SL, lost -74 pips

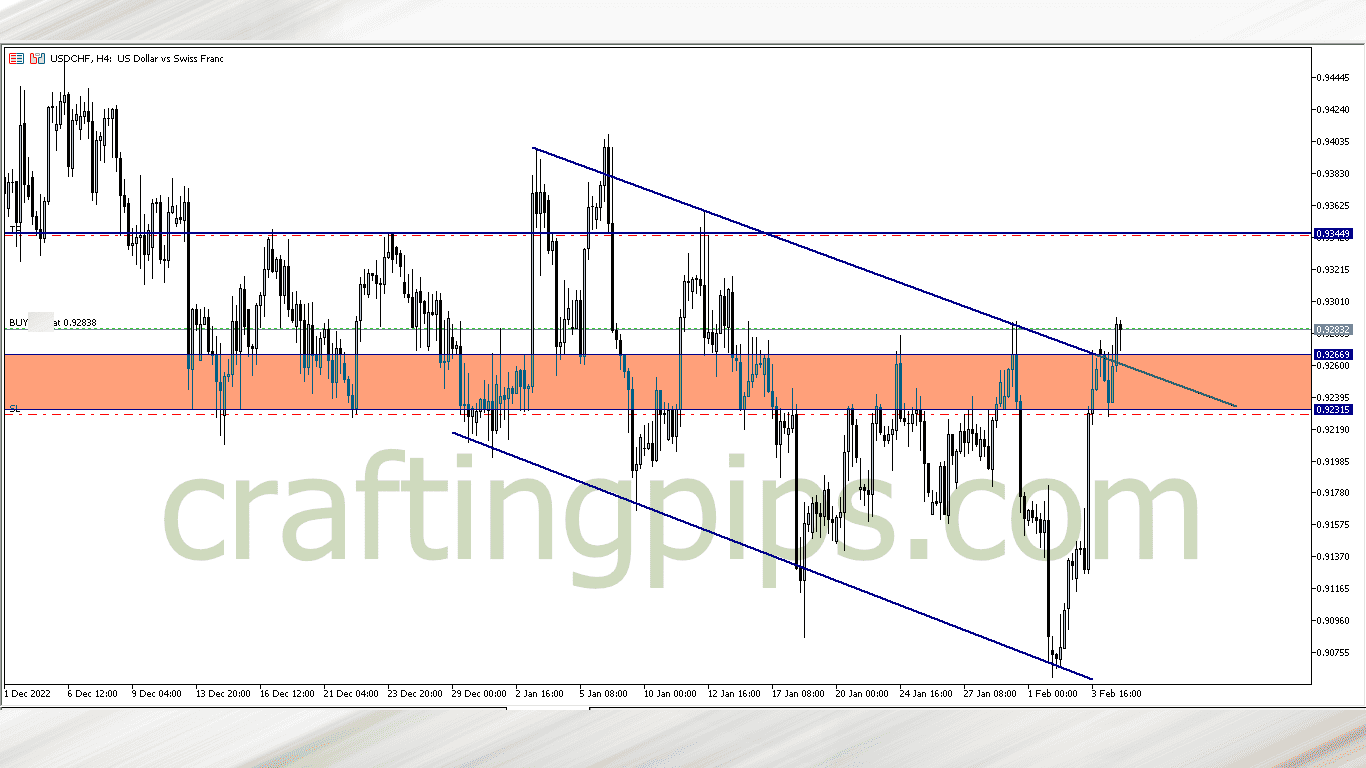

USD/CHF (10.25pm)

Analysis: Bought USD/CHF shortly before the close of the daily candlestick, analysis for my reason can be spotted here

TUESDAY 07/02/2023)

USD/CHF Update (7 pm)

Price hit SL, lost -54 pips…

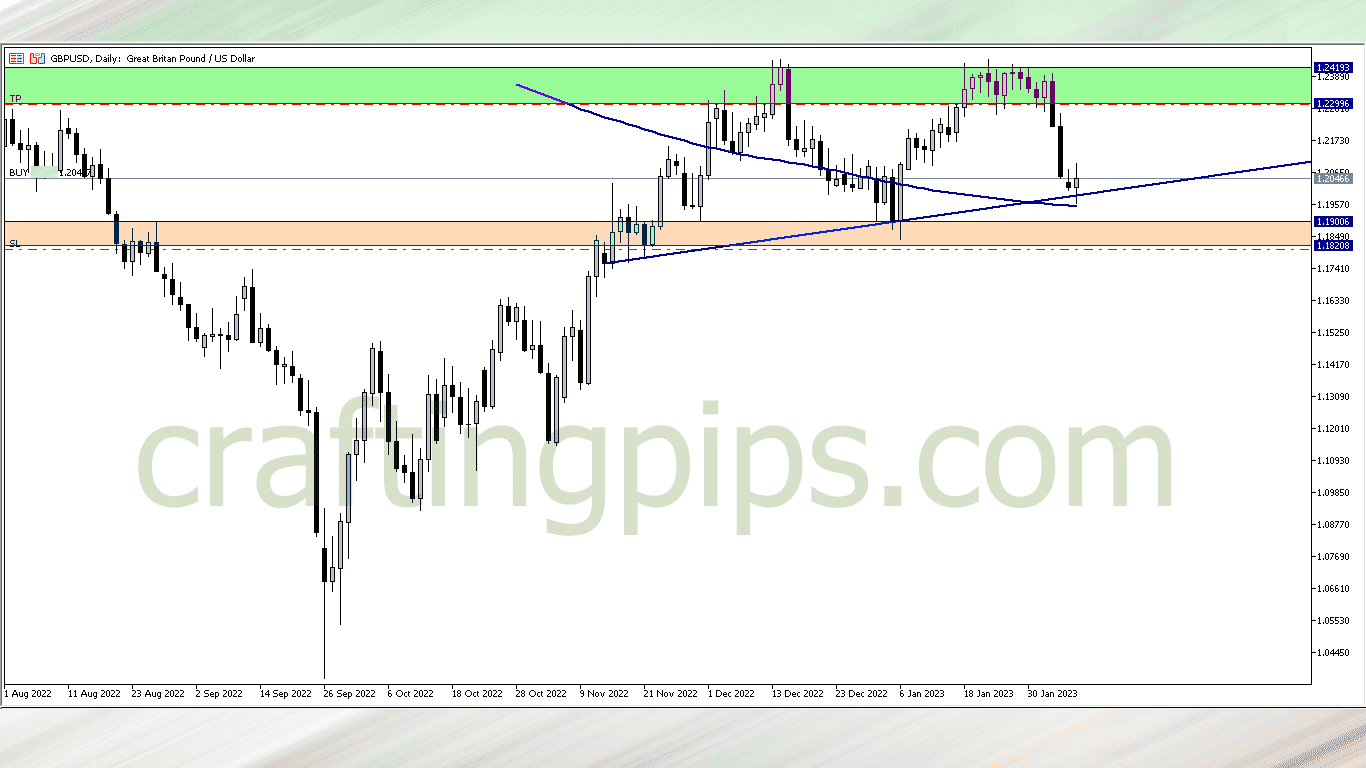

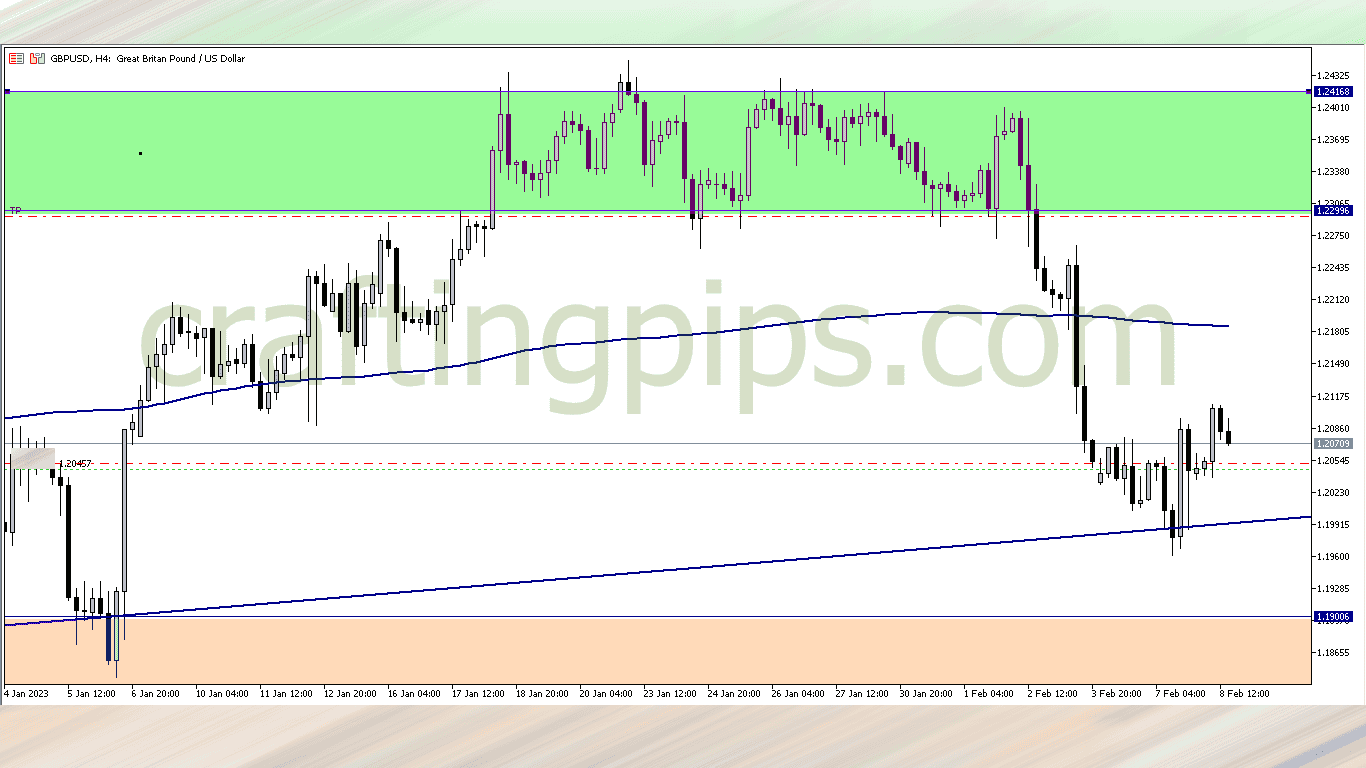

GBP/USD (10.35 pm)

Analysis: My reason for buying can be seen on our Wednesday analysis of the market.

WEDNESDAY (08/02/2023)

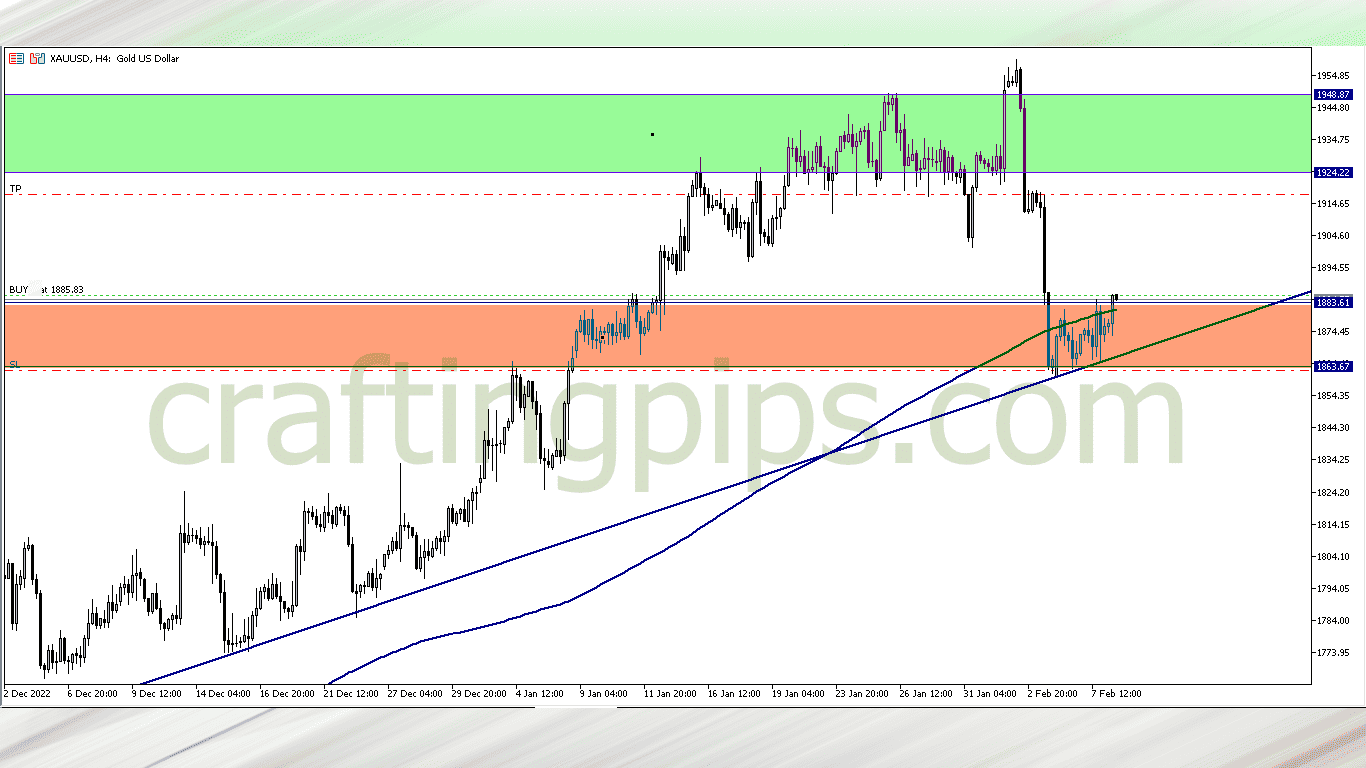

Analysis: Gold has been struggling within a key resistance zone. The 7 am candlestick finally reared its head above the resistance zone, after forming a series of higher highs, and also using the 200 ma as a staircase. I see prospects here…. Let’s see how it unfolds

THURSDAY (09/02/2023)

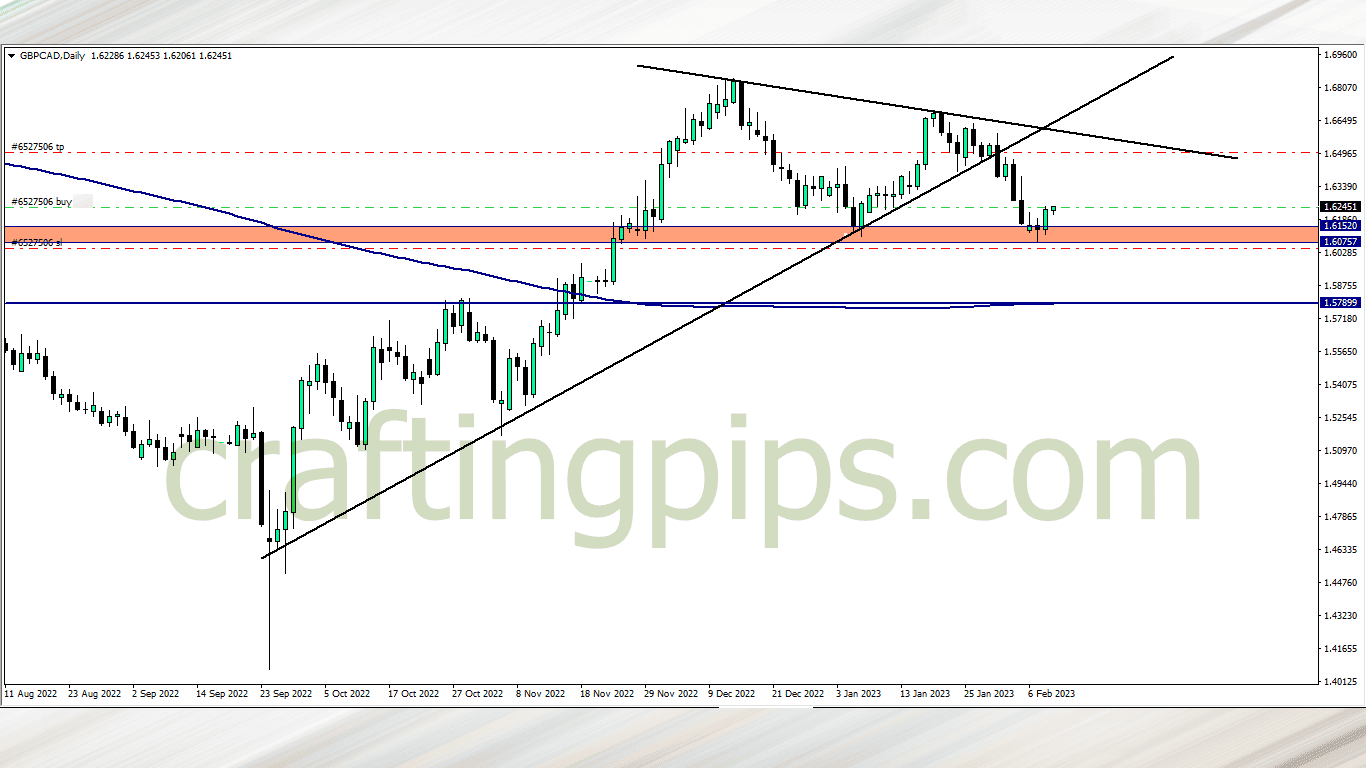

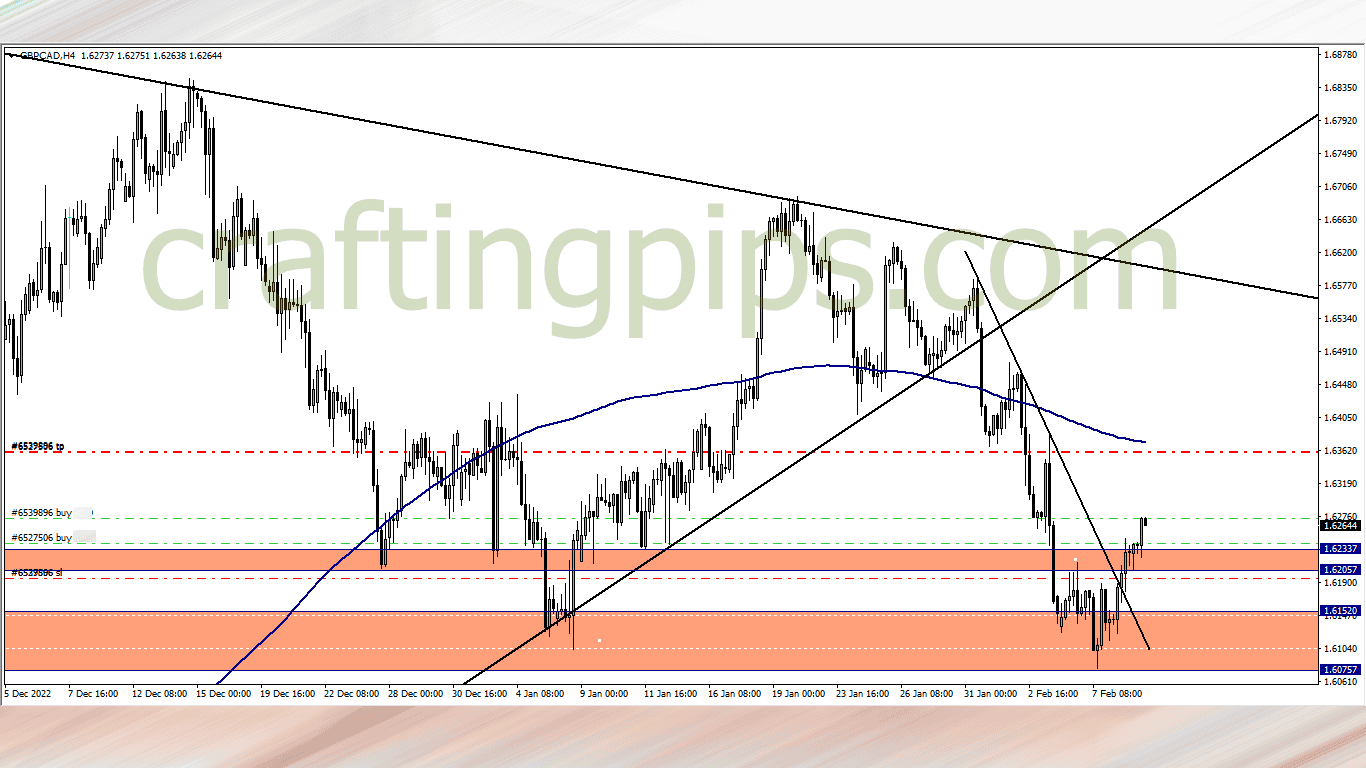

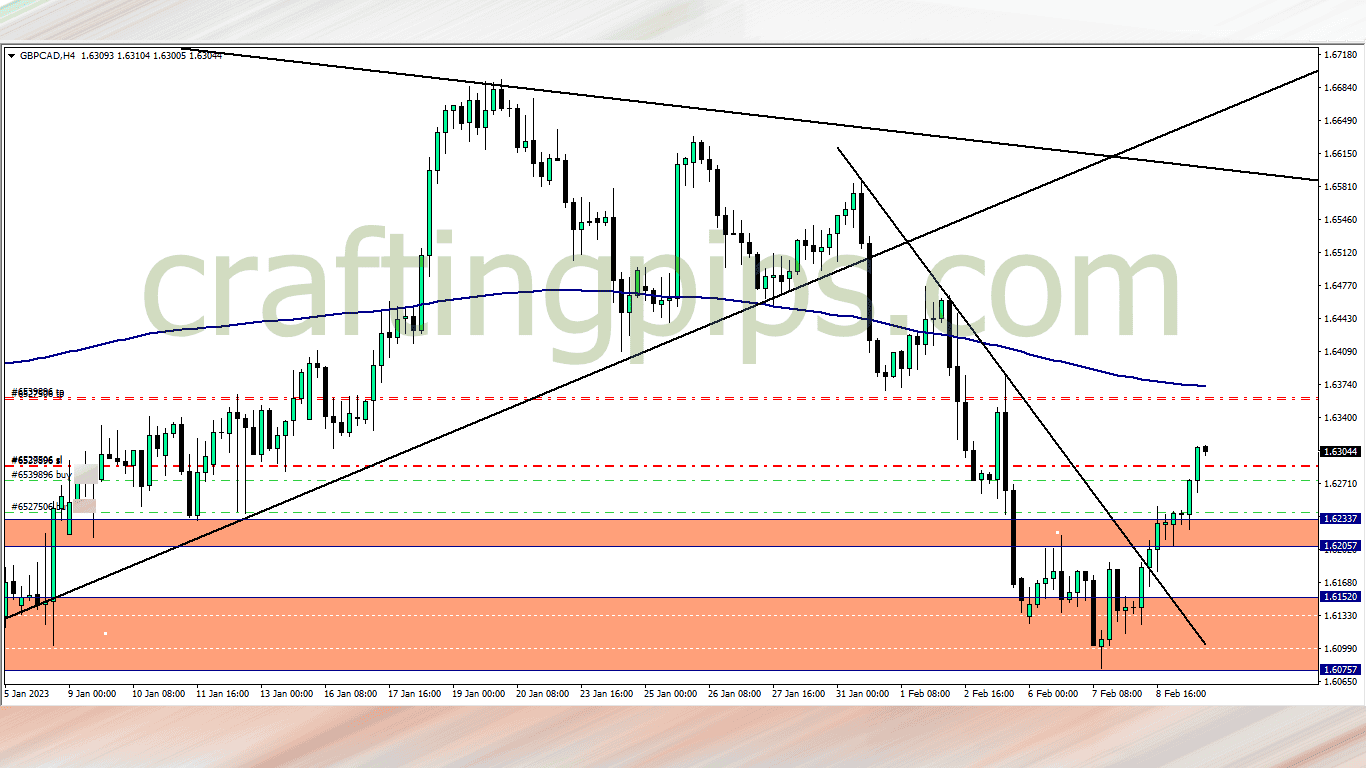

GBP/CAD (7am)

Analysis: This was our Thursday setup, and reasons for buying can be seen here

GBP/CAD Update (11.01 am)

Analysis: Yes I am very bullish on this pair, but let’s face it. Price may most likely get rejected by the 200 ma. Today is Thursday, and I don’t see myself holding trades into the weekend, especially negative trades, if I had the opportunity to leverage on a good breakout

So I added another buy position, while ensuring my risk is kept constant as my initial trade by closing the gap, using the 4hr time frame as a guide.

GBP/CAD Update (4.50 pm)

My trailing stop loss got hit and I got out with +105 pips

GBP/USD Update ( 5pm)

Closed with +41 pips… trailing SL kicked me out of this trade

FRIDAY (10/02/2023)

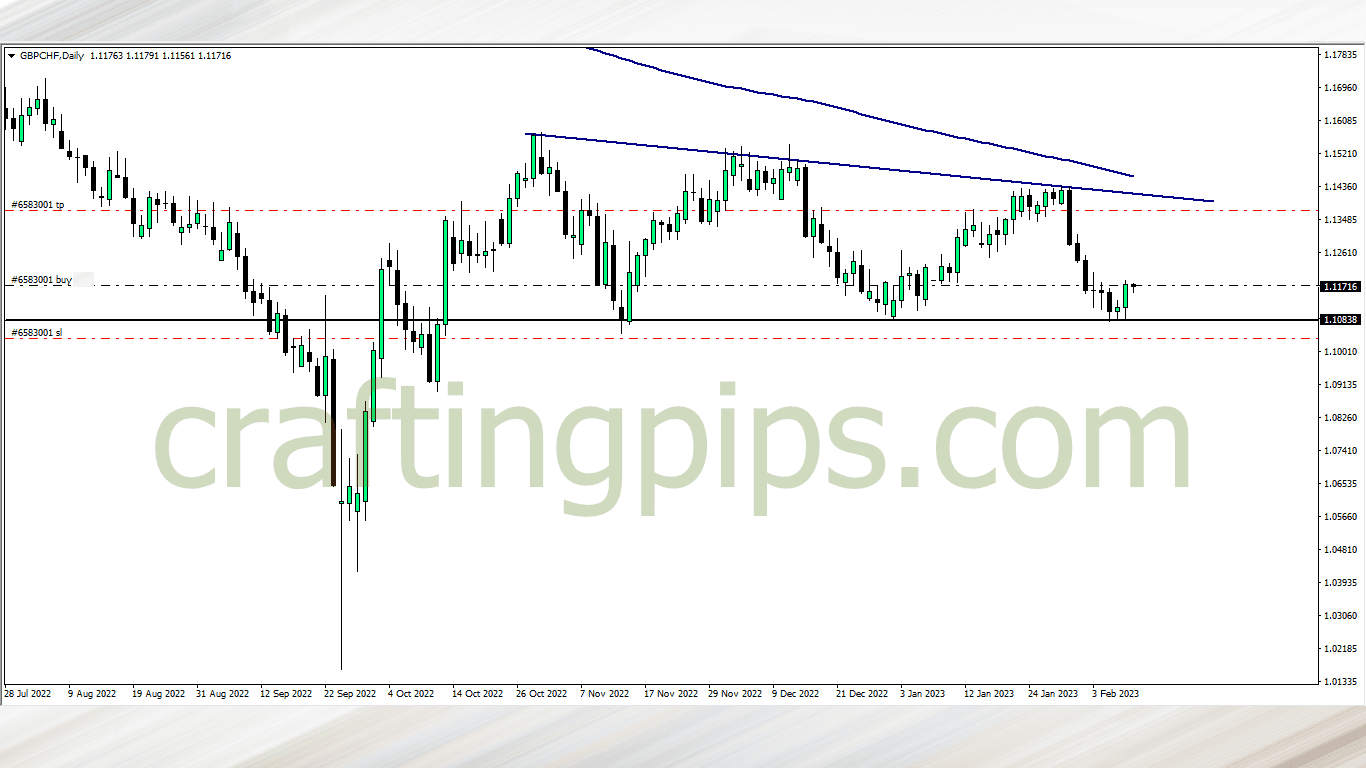

GBP/CHF (2 am)

Analysis: This was our Friday setup, and reasons for buying can be seen here

Gold update (2.15 am)

Gold finally hit my SL (-230 pips)

Trade activity summary for the week

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST |

| MON (06/02/2023) | USD/CAD | SELL | – 74 pips |

| USD/CHF | BUY | – 54 pips | |

| TUE (07/02/2023) | GBP/USD | BUY | + 41 pips |

| WED (08/02/2023) | XAU/USD | BUY | -230 pips |

| THUS (09/02/2023) | GBP/CAD | BUY | + 105 pips |

| FRI (10/02/2023) | GBP/CHF | BUY | + 32 pips |

| TOTAL | – 180 PIPS |

In conclusion:

It was a busy week in the market for me, but not a profitable one ( A clear case of activity in the market does not always translate to profitability)

Lessons learnt this week are:

I will be staying off that precious metal called “Gold”. So far, I have suffered losing streaks trading Gold this year, so its off my charts for now

Secondly, I will work on becoming less active on Monday’s since my winning streak is declining

My trade executions were flawless, so I give myself kudos for that, especially when managing the GBP/CAD trade.

GBP/CHF update (Tuesday 14/02/2023)

Finally got to close the pending GBP/CHF trade prematurely due to the CPI news event on Tuesday. If I had left, I would have made over 100 pips on GBP/CHF, but it’s all good.

Trading rules are there to protect us, and one of the down sides of sticking to them is that: At some point you will exit some really profitable trades, but if you always play by your age, its only a matter of time, you will be profitable

How did your trading week go?

NOTE:

Hey traders,

If you are into trading for proprietary firms which I believe you should due to the many advantages involved, check out these carefully selected proprietary firms listed below.

The funded trader needs no introduction, as they are currently becoming one of the most sorted proprietary firms in the industry due to their flexible challenge rules which consist of you being able to use an EA (expert advisory or trading robot) on one of their packages.

Also their packages are pretty affordable, which also comes with unlimited trials even if you fail to hit the set target within the 35 days period.

If you are interested in getting a 5% discount upon purchase, hit THE FUNDED TRADER and use THE0CRAFTER as the coupon code