My reason for sharing my trade journal is to encourage traders to also keep one for two major reasons:

- Track your weekly trading performance.

- Build a better psychology, which will sharpen your trading intuition

Both can only be done when you keep a comprehensive journal, and review it every week.

MONDAY 05/02/2024

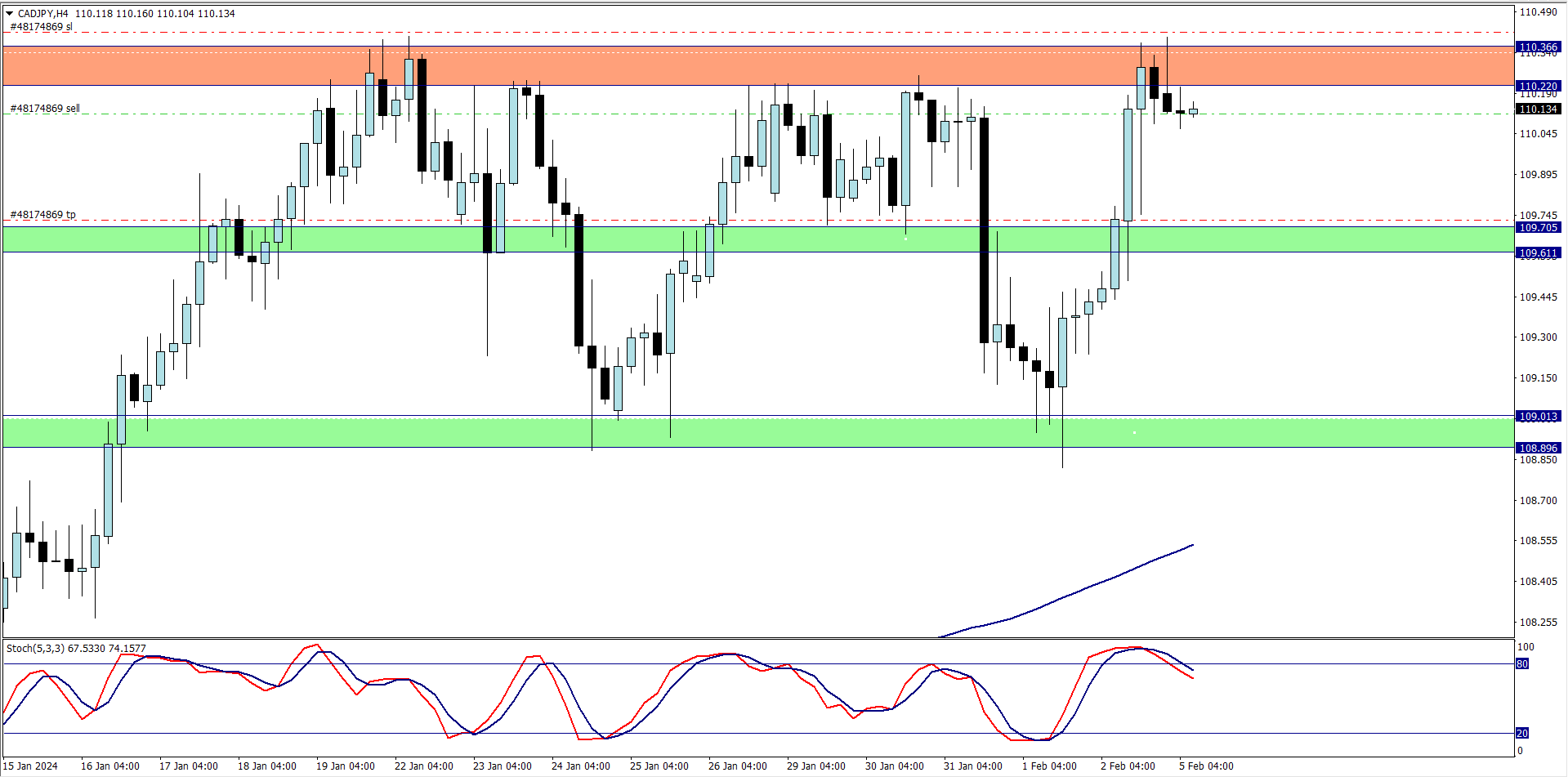

CAD/JPY (7.15am)

Analysis: This trade is taken because of multiple rejections at a key resistance zone. I closed this trade at breakeven. Price took out my trailing SL

TUESDAY 06/02/2024

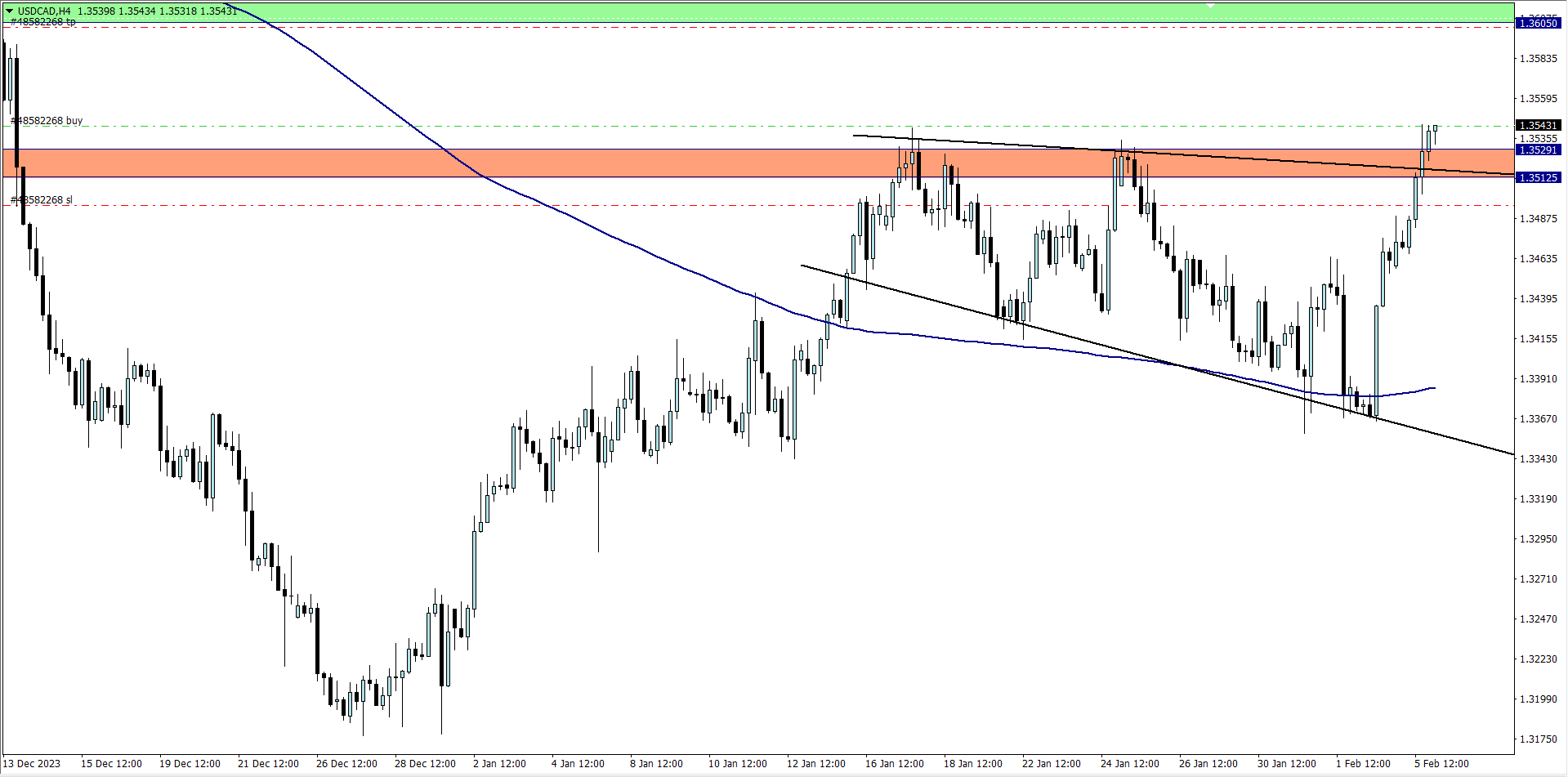

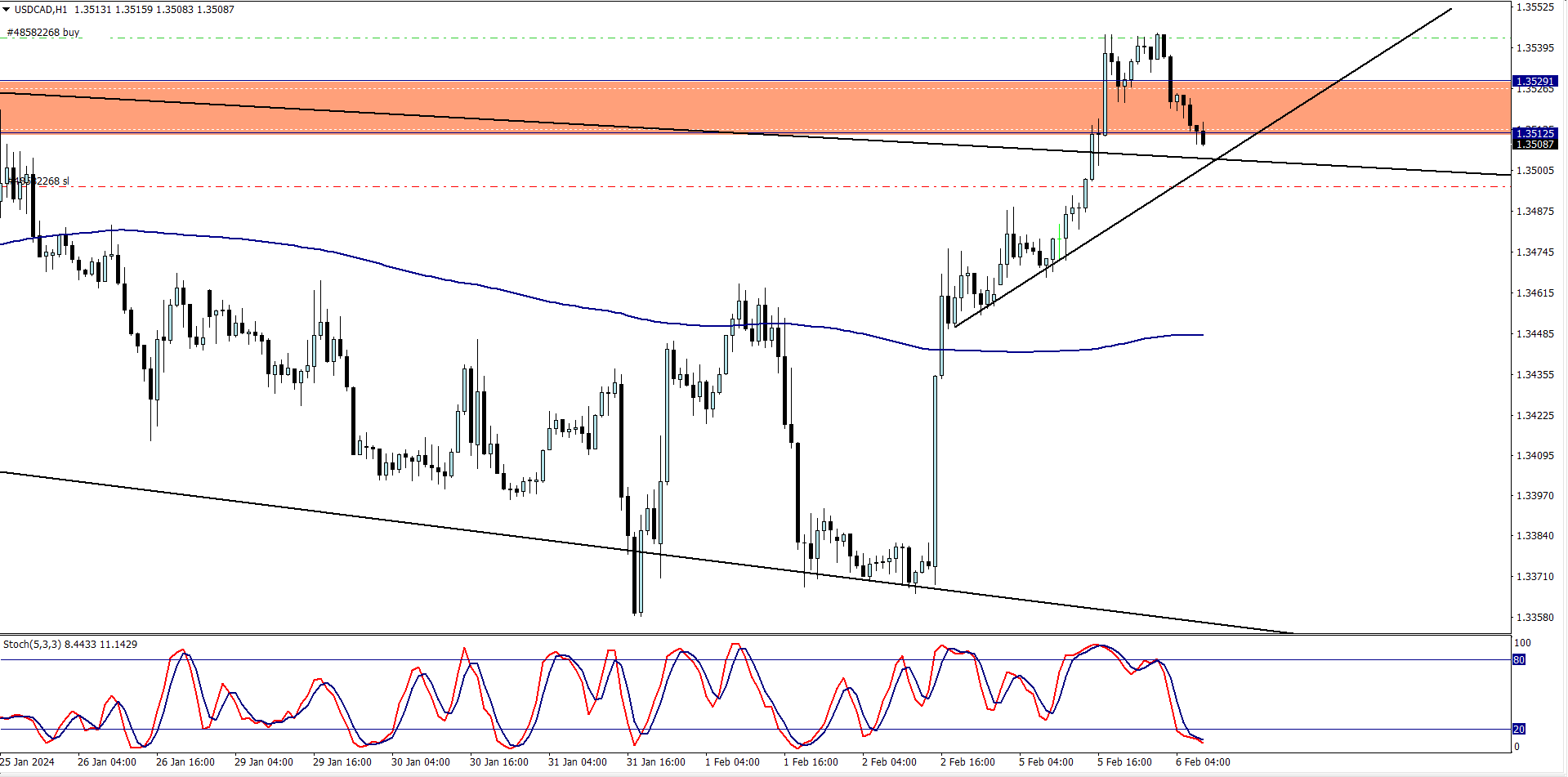

USD/CAD (1.15am)

Analysis: I bought USD/CAD based on our Tuesday Market Analysis

USD/CAD Update (5.50pm)

Analysis: I manually closed the USD/CAD with -36 pips

WEDNESDAY 07/02/2024

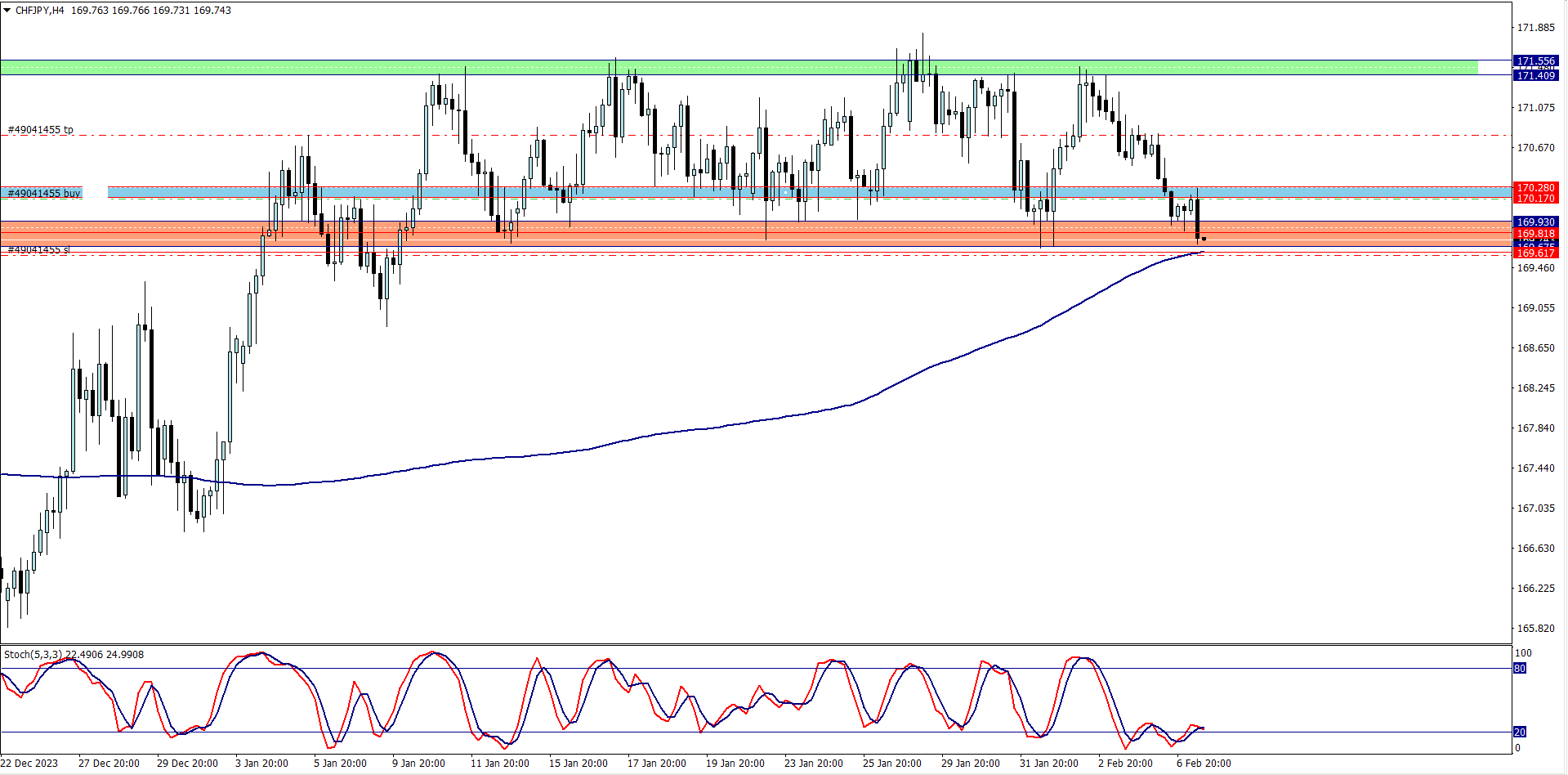

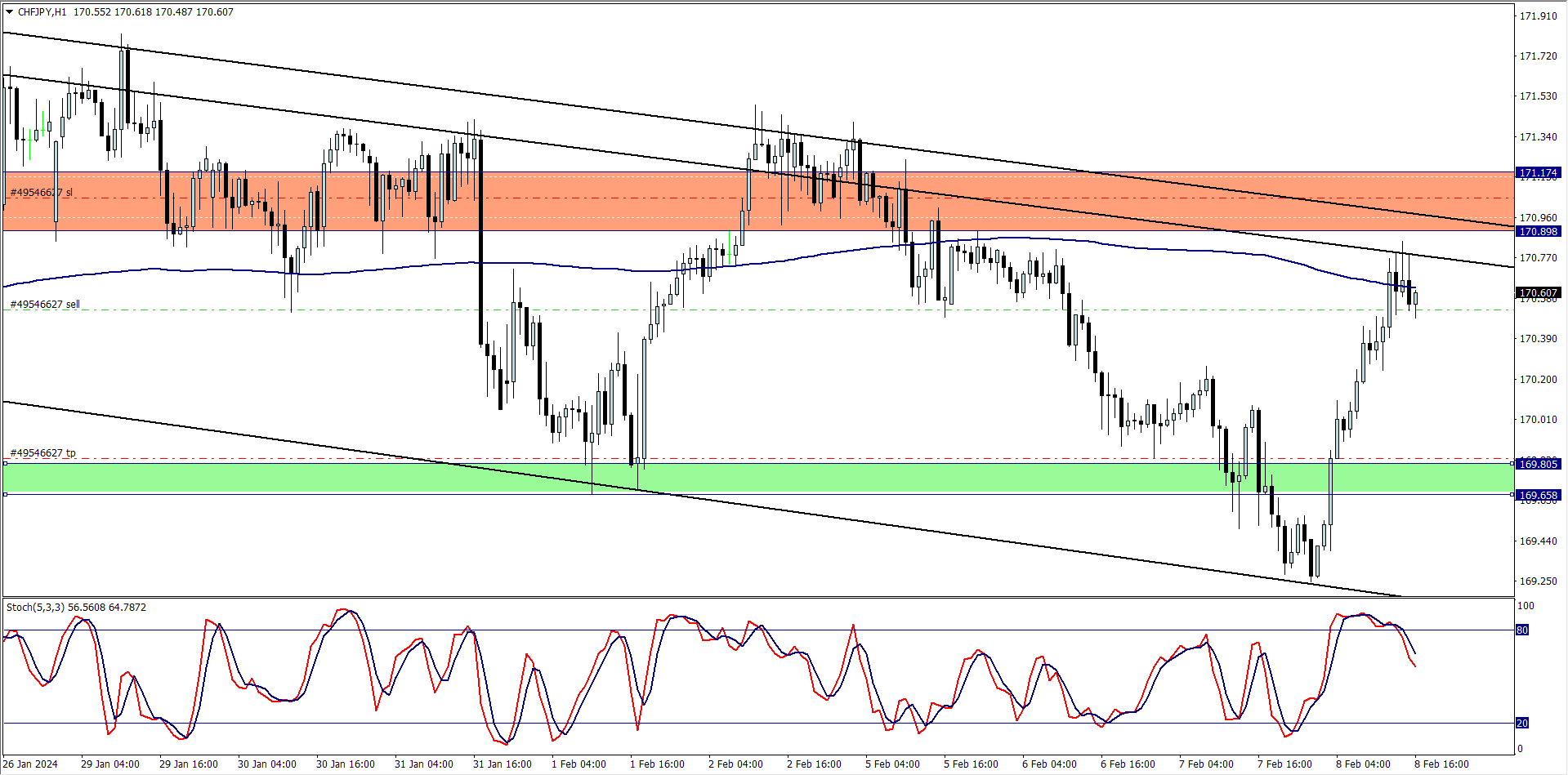

CHF/JPY (6.34am)

Analysis: Key resistance zone and 200 ma were tested severally, so it’s ripe for a buy.

CHF/JPY Update (11.30am)

Analysis: Manually closed CHF/JPY with -53 pips

THURSDAY 08/02/2024

CHF/JPY (3.30 pm)

Analysis: I am selling CHF/JPY due to the consolidation around the 200 ma and a key resistance zone.

CHF/JPY Update (5.12 pm)

I could not screen grab the chart, but I manually closed with -33 pips

Trade activity summary for the week

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST |

| MON (05/01/2024) | CAD/JPY | SELL | Breakeven |

| TUE (06/01/2024) | USD/CAD | BUY | -36 pips |

| WED (07/01/2024) | CHF/JPY | BUY | – 53 pips |

| THUS (07/01/2024) | CHF/JPY | SELL | – 33 PIPS |

| TOTAL | – 122 PIPS |

In conclusion:

It’s been a while I have had negative emotions meddle with my trading process, but if I were to be honest, this week, my emotions had the better part of me

My second twitter account was suspended on Monday for no justifiable reasons, and this seriously affected my mood trading the market.

Monday – My CAD/JPY trade could have hit TP, but I pulled out of the trade prematurely because I could not manage the trade mentally. On most of my accounts, it was a breakeven trade, while on others, I made little profits.

Tuesday – I bought USD/CAD, but along the line, USD/CAD gave me enough clues of an impending reversal which I ignored, and this made me close this trade with a loss

Wednesday – I diligently managed the CHF/JPY trade, though it still ended with a loss, so I can’t even complain here

Thursday – I call this a forced trade, because I was trading off the 1-hour time frame. I had to manually close the trade when it went against me, but the trade would have ended as a breakeven, if I had closed it. Again, I pulled out because at some point I had to accept that the trade was half baked

Last week my mental game was at its all time low, and I should have limited my trading activities, but you know how it is… Money has to be made. I closed the week with an average of about -2.3% loss on my trading accounts

Looking forward to the week ahead

How did your trading week go?

NOTE:

-

THE FUNDED TRADER: (Use the coupon code: THE0CRAFTER)

- BESPOKE FUNDING PROGRAMME

- FUNDED ENGINEER

- BLUE GUARDIAN (Use the coupon code: CRAFTER)

- GOAT FUNDED

- LARK FUNDING

- SKILLED FUNDED TRADER

- MAVEN TRADING

- MY FLASH FUNDING (Use the coupon code: “FILLIPO” for a -25% discount)

- THE5ERS