My reason for sharing my trade journal is to encourage traders to also keep one for two major reasons:

- Track your weekly trading performance.

- Build a better psychology, which will sharpen your trading intuition

Both can only be done when you keep a comprehensive journal, and review it every week.

MONDAY 29/01/2024

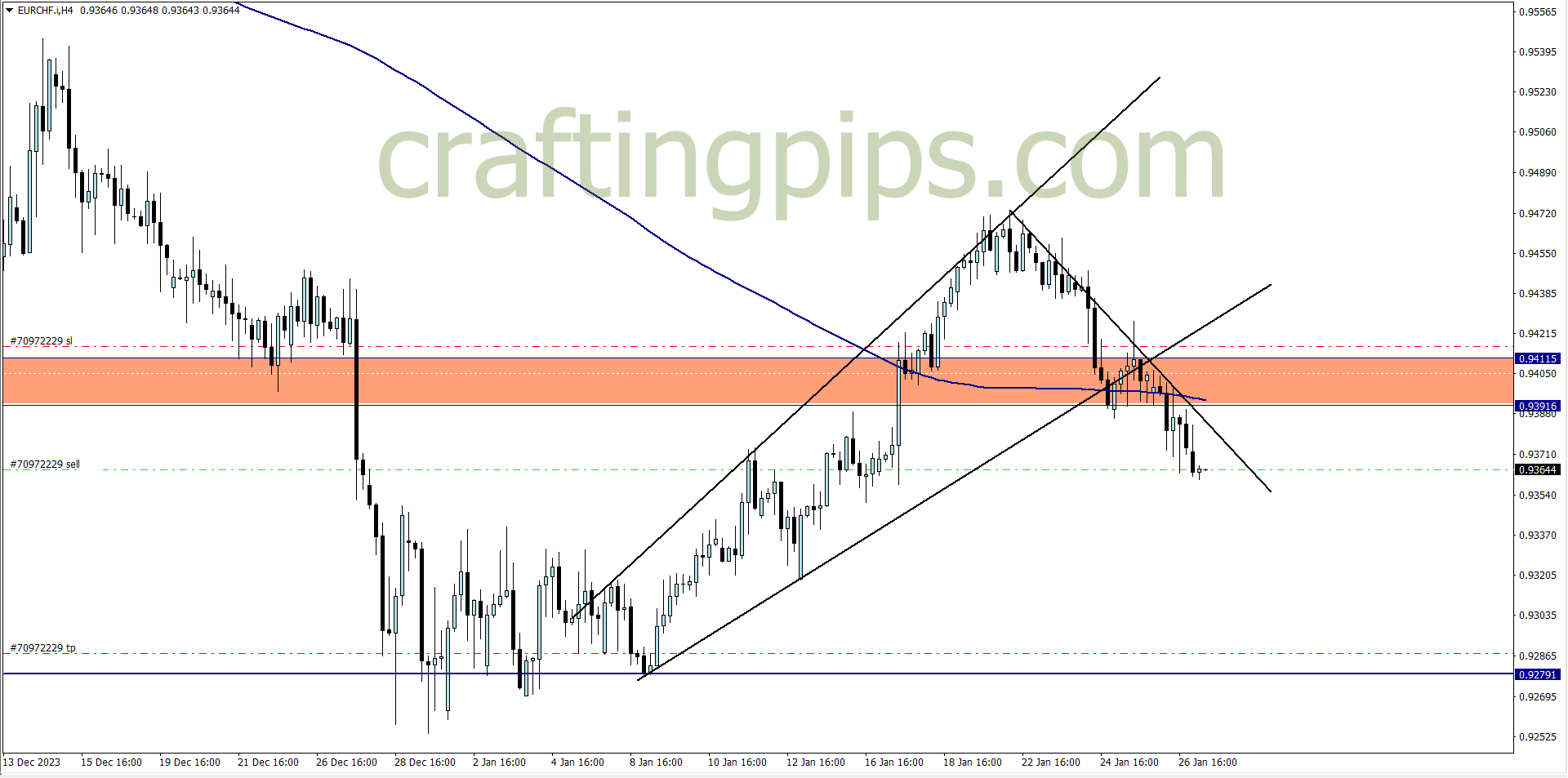

EUR/CHF (7.30am)

Analysis: Inspiration to sell EUR/CHF came from our Weekly Market Analysis

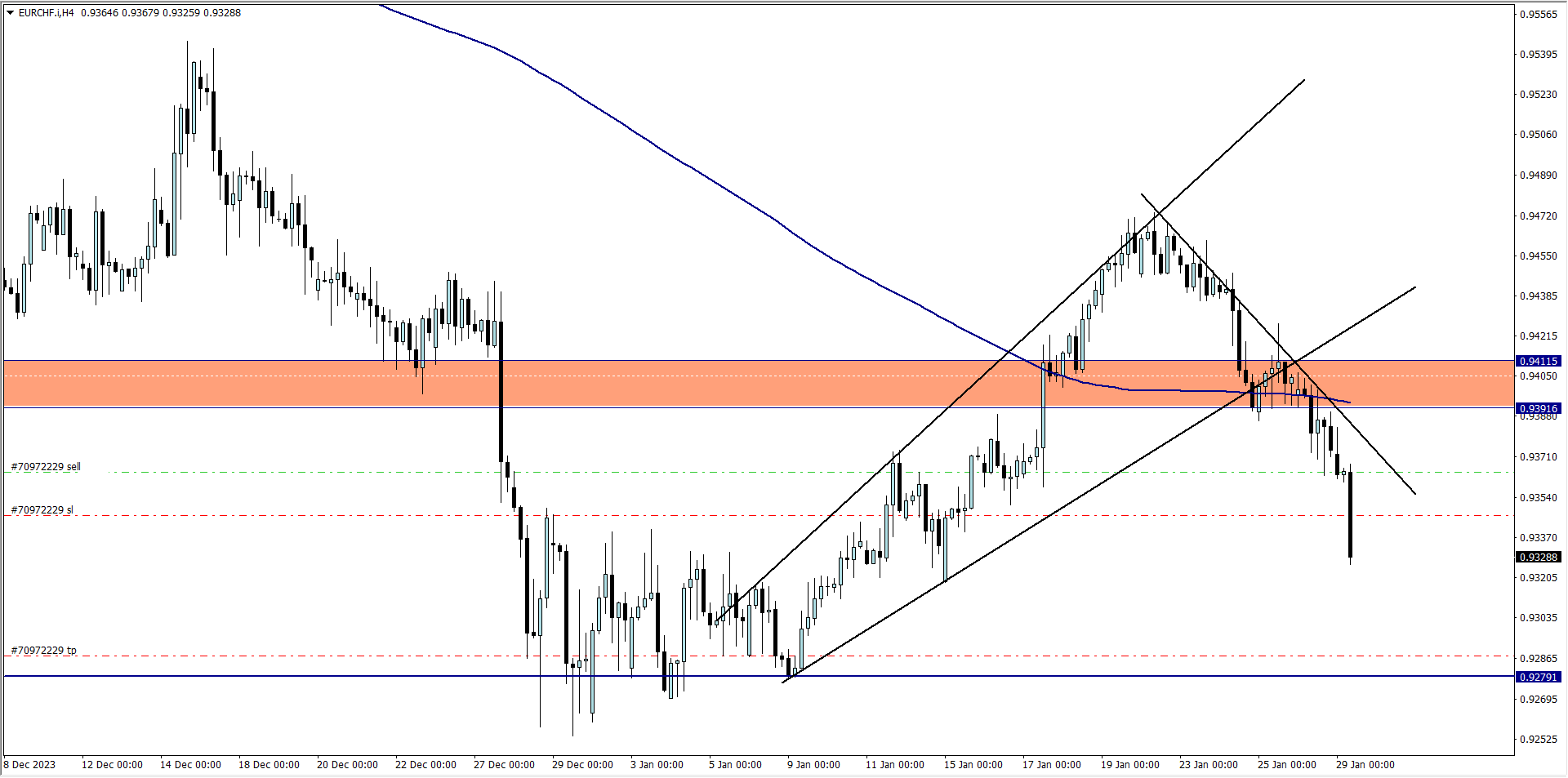

EUR/CHF Update (10.45am)

Analysis: Trailing SL got hit at +30 pips

TUESDAY 30/01/2024

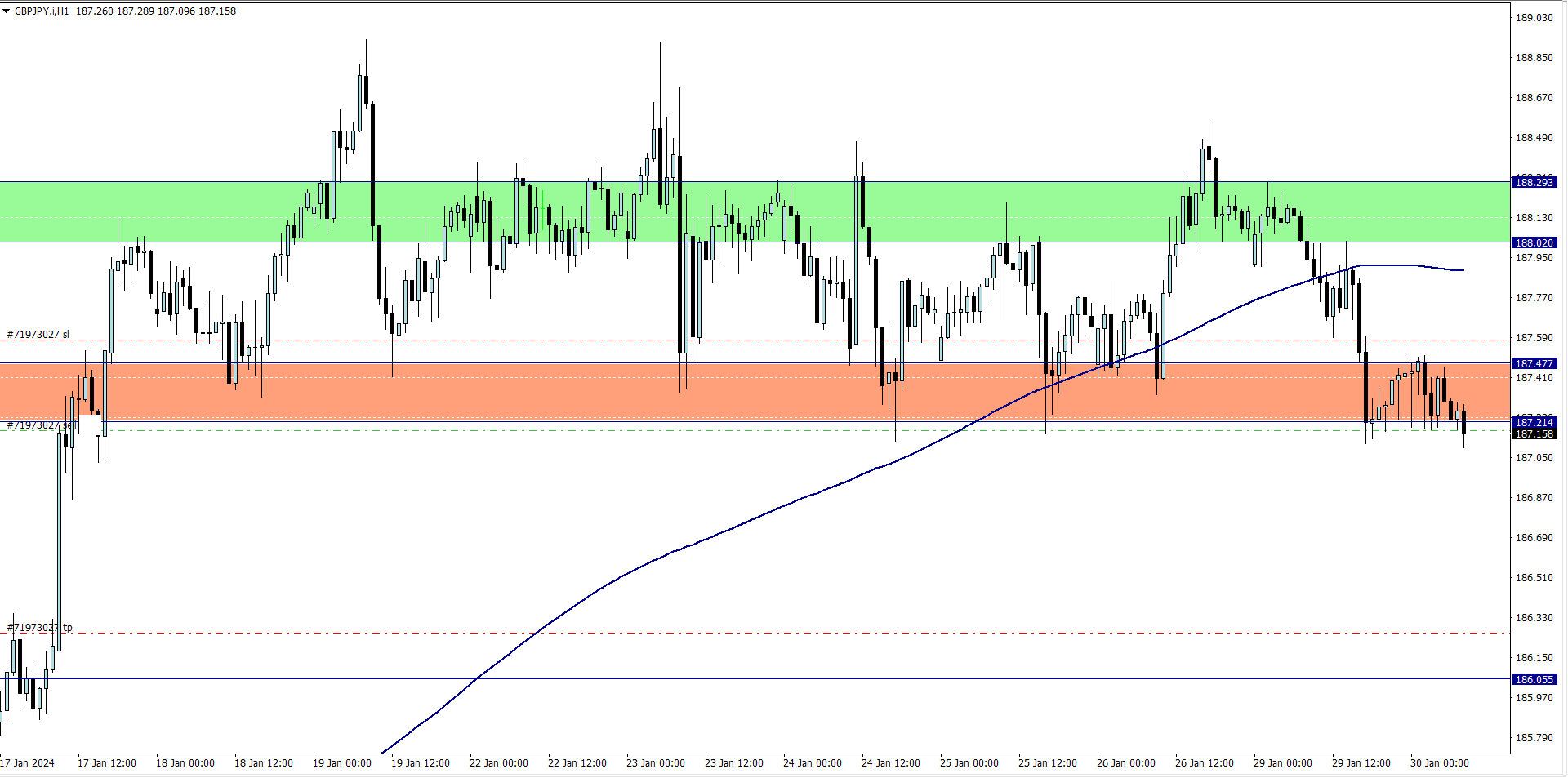

GBP/JPY (7.30am)

Analysis: My reason for selling is break of key support zone

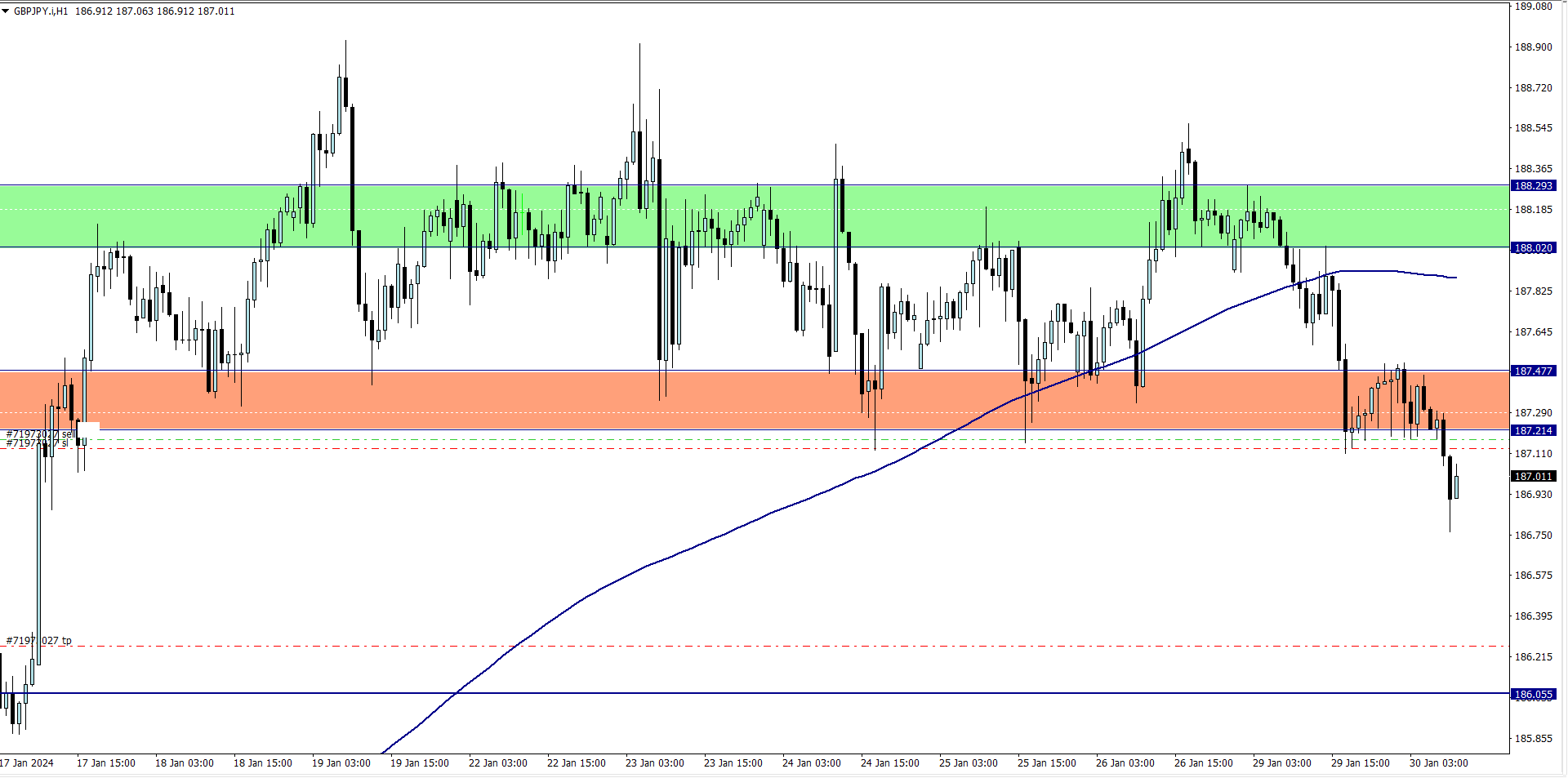

GBP/JPY Update (11am – High Risk Account)

Analysis: While my trailing SL was taken out by price at +4 pips, my high risk account (one of my accounts) was stopped out +67 pips

Trade activity summary for the week

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST |

| MON (29/01/2024) | EUR/CHF | SELL | +30 pips |

| GBP/JPY | SELL | +71 pips | |

| TOTAL | + 101 pips |

In conclusion:

Just before January closed, I took a big gamble on the GBP/JPY, and it paid off. I closed with about +3.2% profits on one of my accounts, but closed with about +0.9% on my conservative accounts

Trade activity summary for the month of January

| 1st TRADING WEEK |

|

|||

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST | |

| TUE (02/01/2024) | USD/JPY | SELL | – 196 pips | |

| GBP/USD | BUY | + 57 pips | ||

| THUS (04/01/2024) | GBP/JPY | SELL | – 92 pips | |

| TOTAL | -231 pips | |||

| 2nd TRADING WEEK | ||||

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST | |

| MON (08/01/2024) | USD/CAD | SELL | Breakeven | |

| WED (10/01/2024) | AUD/JPY | BUY | +16 pips | |

| TOTAL | +16 pips | |||

| 3rd TRADING WEEK |

|

|||

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST | |

| MON (15/01/2024) | EUR/JPY | BUY | +33 pips | |

| TUE (16/01/2024) | AUD/JPY | BUY | -17 pips | |

| WED (17/01/2024) | EUR/JPY | BUY | +80 pips | |

| THUS (18/01/2024) | XAU/USD | SELL | -212 pips | |

| TOTAL | -116 pips | |||

| 4th TRADING WEEK |

|

|||

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST | |

| WED (24/01/2024) | GBP/JPY | SELL | +19 pips | |

| EUR/CHF | SELL | – 30 pips | ||

| TOTAL | -11 pips | |||

| 5th TRADING WEEK |

|

|||

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST | |

| MON (29/01/2024) | EUR/CHF | SELL | +30 pips | |

| GBP/JPY | SELL | +71 pips | ||

| TOTAL | + 101 pips | |||

| GRAND | TOTAL | – 241 pips |

In conclusion:

For the month of January, I closed one of my accounts which I traded Gold with -1.3%

One of my high risk account is up 4%

While the other accounts were closed for the month of January at breakeven.

Two thing I did thoroughly well in the month of January was:

- My risk management game was tight, hence I closed most of my accounts at breakeven despite the rough market

- The high risk account is almost done with phase (I rarely traded this account this month)

One thing I messed up was:

- The Gold trade I took was unnecessary. If I had not taken it, I would have closed January in profits on all my account

This month again proves the fact that the amount of pips a trader makes, is not a direct reflection of how profitable he/she is. This is below par for me as regarding performance.

Hopefully the month of February will be a whole lot better

How did the month of January go for you?

NOTE:

-

THE FUNDED TRADER: (Use the coupon code: THE0CRAFTER)

- BESPOKE FUNDING PROGRAMME

- FUNDED ENGINEER

- BLUE GUARDIAN (Use the coupon code: CRAFTER)

- GOAT FUNDED

- LARK FUNDING

- SKILLED FUNDED TRADER

- MAVEN TRADING

- MY FLASH FUNDING (Use the coupon code: “FILLIPO” for a -25% discount)

- THE5ERS