This is where I share all my trade taken each and every week.

My reason for this is to encourage traders to also keep one for two major reasons:

- Track weekly trading performance.

- To have enough date to be able to work on their trading technique and psychology

Both can only be done when you keep a comprehensive journal, and review it every week.

WEDNESDAY (01/02/2023)

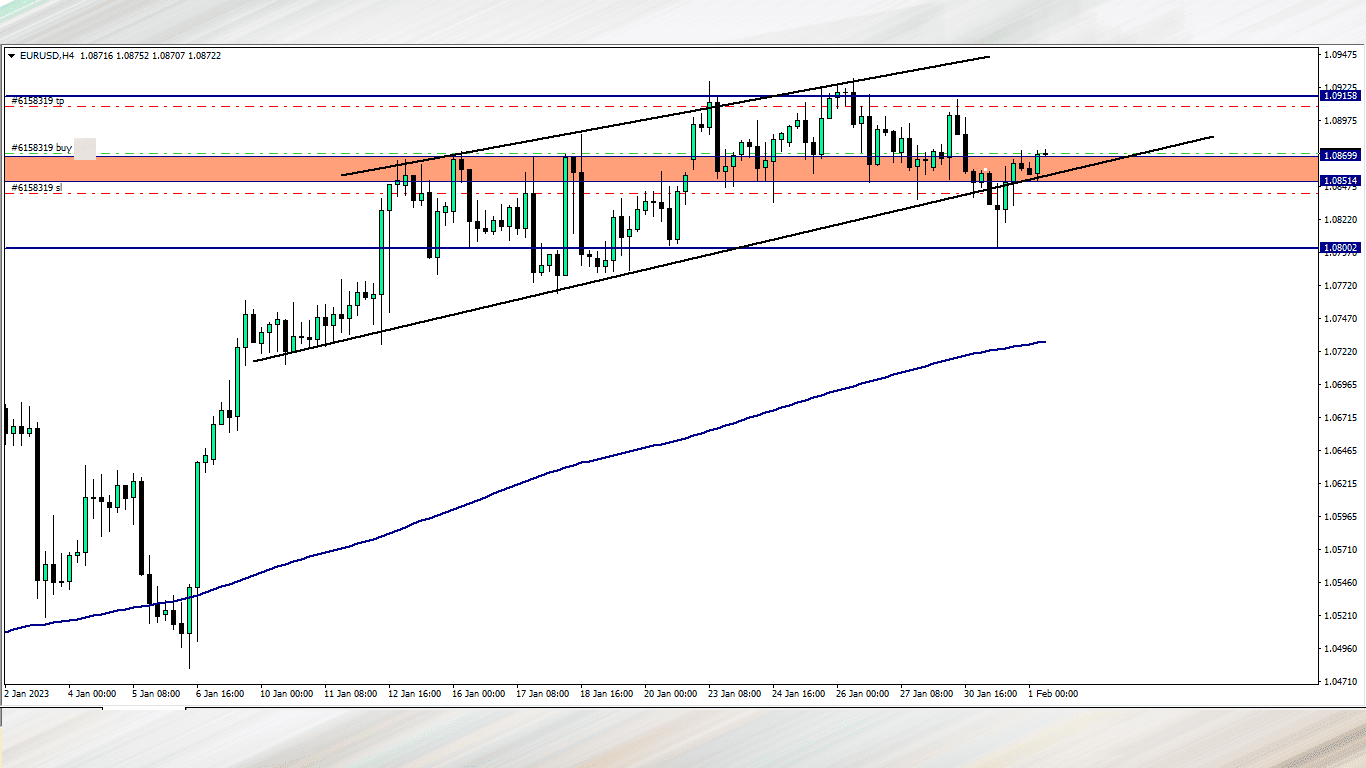

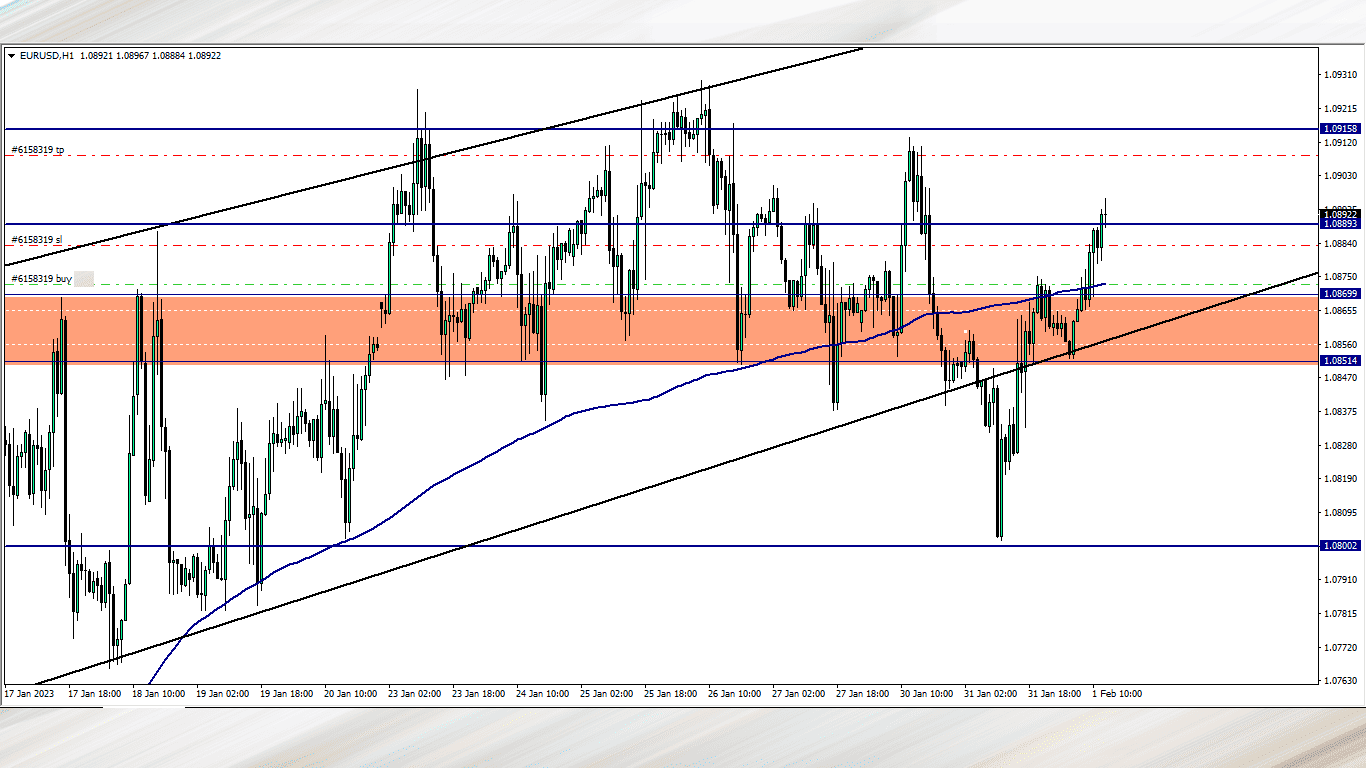

EUR/USD (7.05AM)

Analysis: The daily closed with a beautiful bullish pinbar bouncing off around a key support zone. On the 4-hour time frame we can see a previous support zone, now a resistance zone broken by the 3am candlestick. Today is heavily loaded with high impact news events on the US dollar starting from 2.15 pm, so I will not be holding this trade beyond 2pm.

EUR/USD follow up (3.30pm)

I trailed EUR/USD, and closed with +30 pips after price kicked me out and continued its bullish move

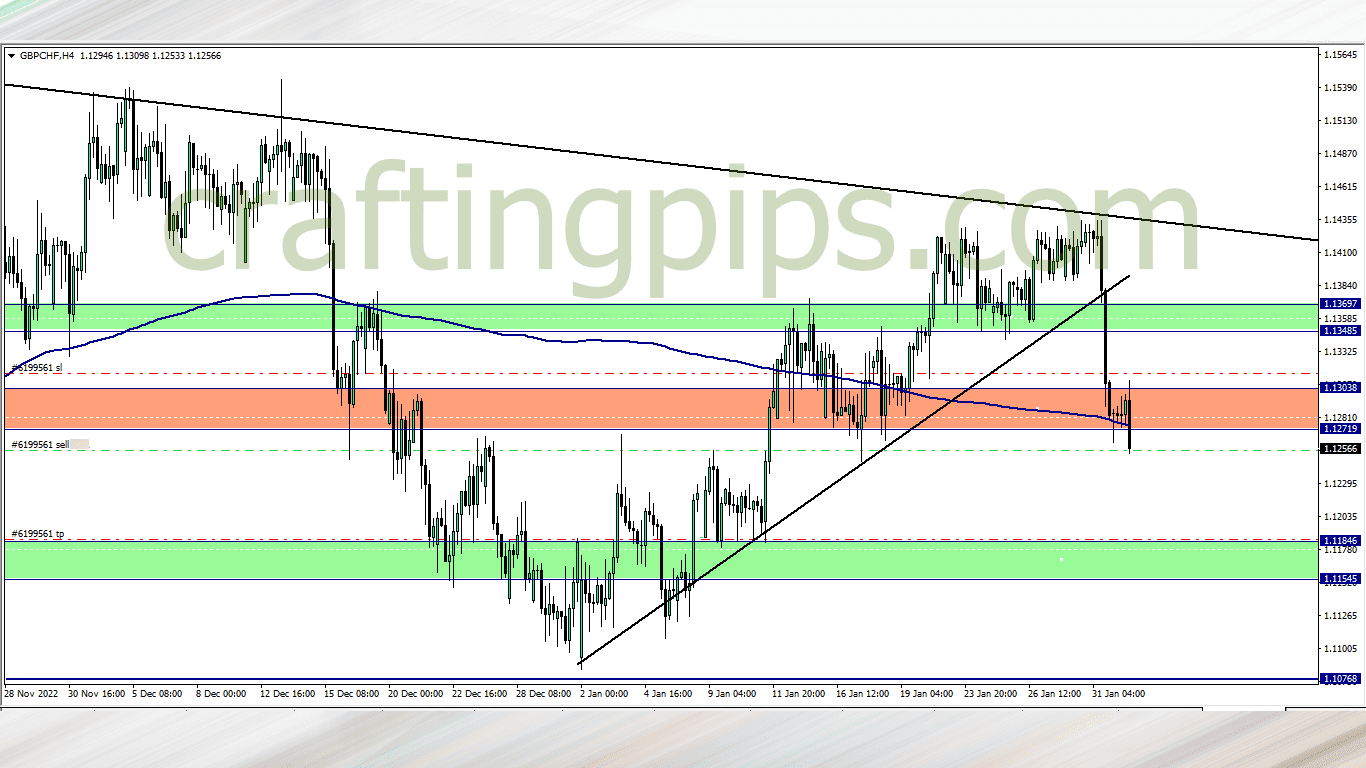

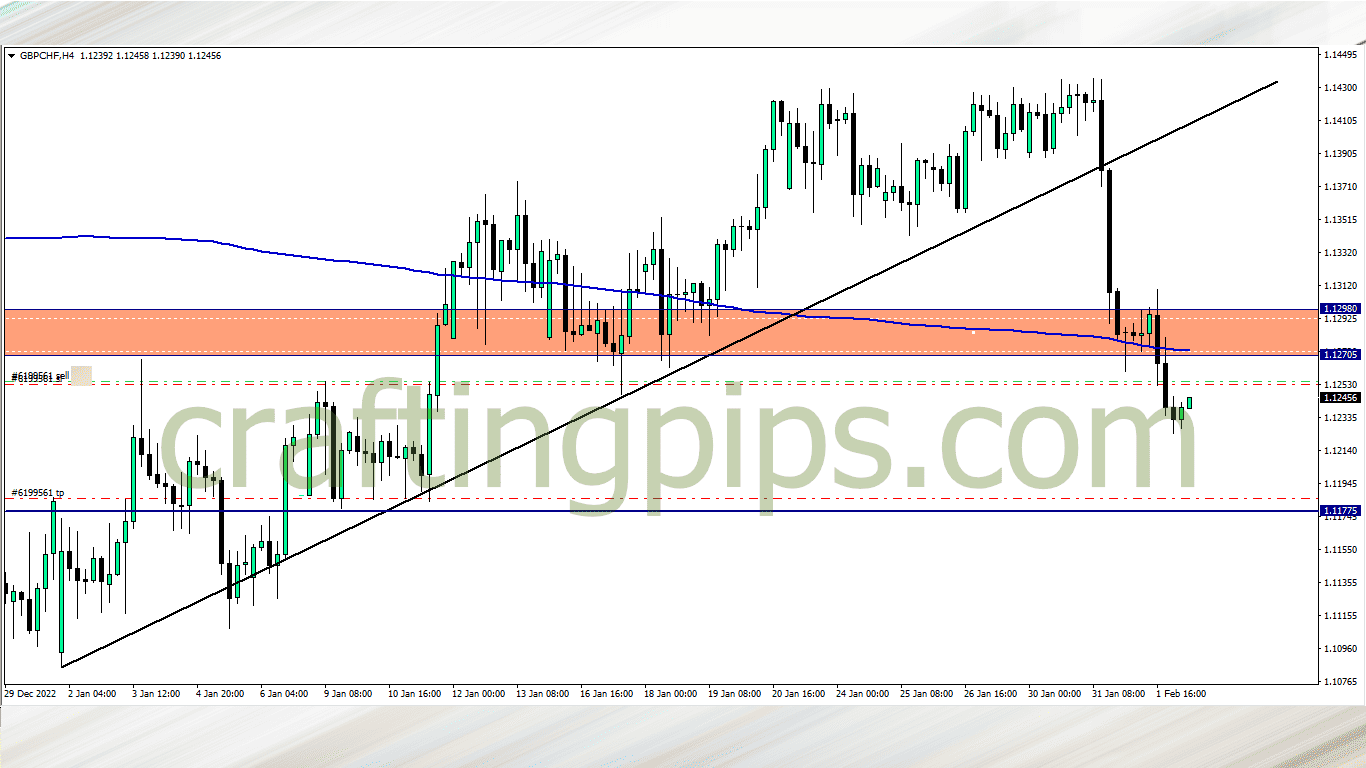

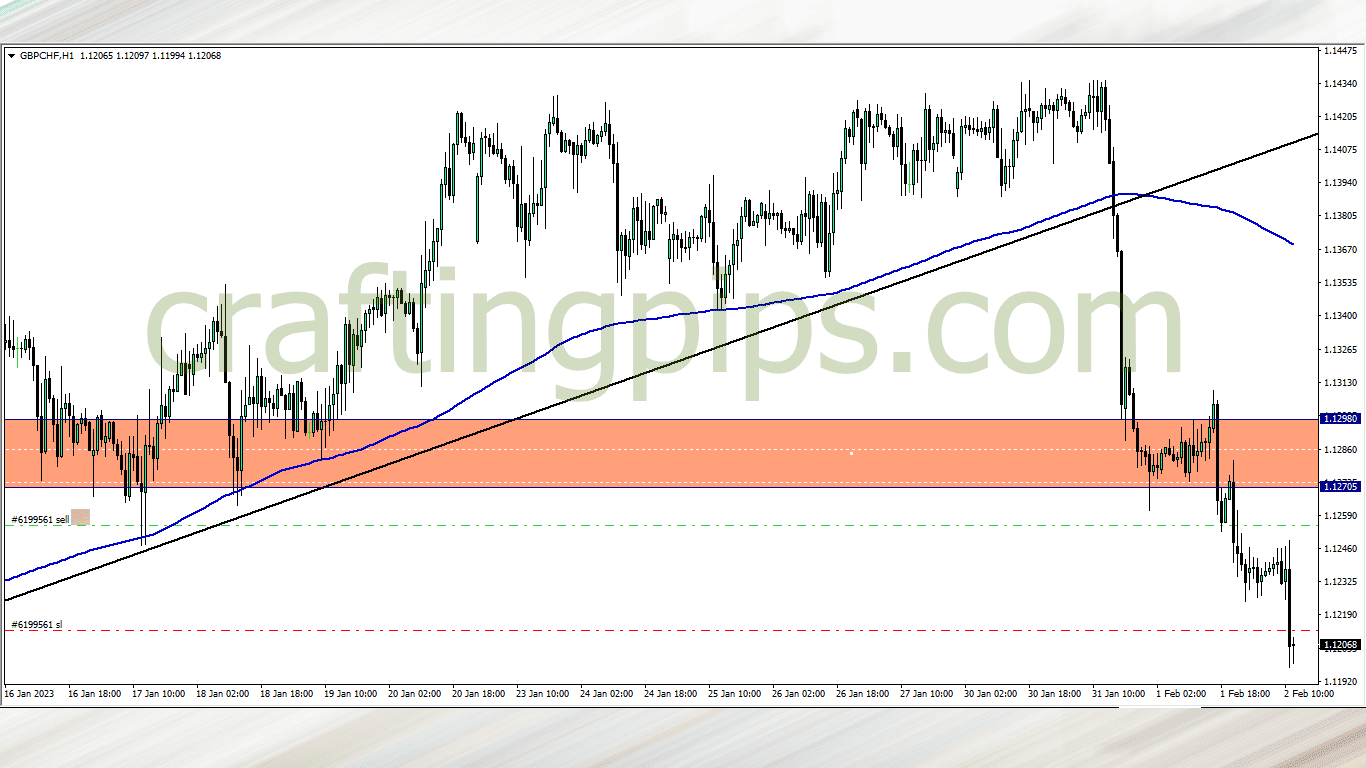

GBP/CHF (5.45 pm)

Analysis: It’s from our Thursday analysis

I went in a little too early, but I am risking below my usual risk threshold, if it pan’s out, we may add to the sell

THURSDAY (02/02/2023)

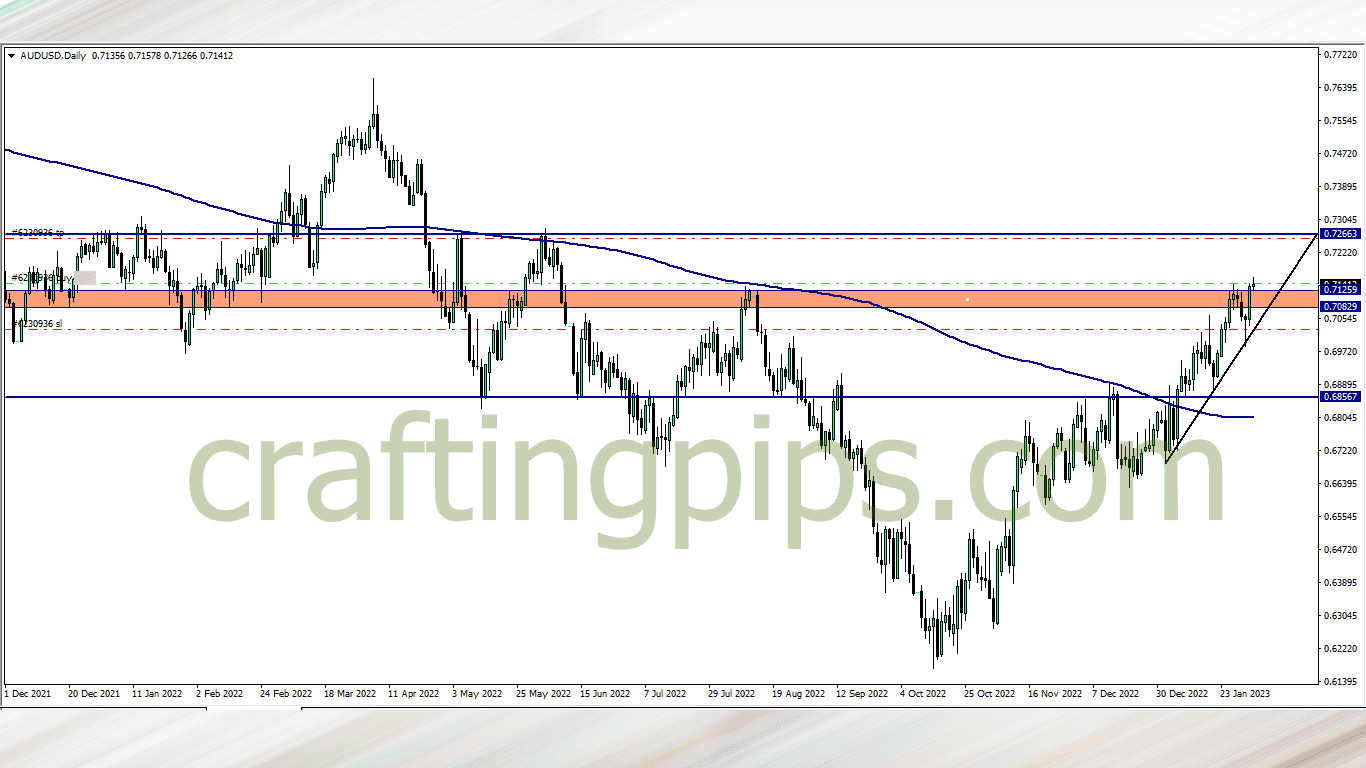

AUD/USD (8 am)

Analysis: A higher low formed on the AUD/USD, and price also broke a long standing resistance zone. Planning to hold this trade into Friday

GBP/CHF follow up (9am)

High impact news on the GBP is by 1 pm, so I have shifted my SL to breakeven, just in case price goes against us during the news hour. That said, if price moves well in our favour, I may just take what it offers me and close the trade all together before news

GBP/CHF follow up (11.20am)

At this point price was about 18 pips away from TP, and news at 1pm just made me close this trade manually instead of following standard procedures.

I closed with +42 pips

FRIDAY (03/02/2023)

AUD/USD (8 am)

Sadly there are no charts showing how I manually closed the AUD/USD trade. I did so when I briefly woke up to check my charts during the Asian session.

This was an “A trade”, but for some funny reason we closed with a -85 pips loss. This is a constant reminder that there are no assurances in this profession. We are all working with probabilities

Trade activity summary for the week

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST |

| WED (01/02/2023) | EUR/USD | BUY | + 30 pips |

| GBP/CHF | SELL | +42 pips | |

| THUS (02/02/2023) | AUD/USD | BUY | -85 pips |

| TOTAL | – 13 PIPS |

In conclusion:

You may be wondering why I inked a negative total pips for the week green (-13 pips). It means the week was profitable.

In total I executed 5 trades this week. Only 3 were recorded for the new month (you can check the other two trades here). Out of the 5 trades, I had just one bad trade, which is a great result.

I have no worries about my execution this week, If I were to rate myself, I would say I scored 100%. Hopefully this is the beginning of a winning streak in the month of February.

See you guys next week… Cheers

NOTE:

Hey traders,

If you are into trading for proprietary firms which I believe you should due to the many advantages involved, check out these carefully selected proprietary firms listed below.

The funded trader needs no introduction, as they are currently becoming one of the most sorted proprietary firms in the industry due to their flexible challenge rules which consist of you being able to use an EA (expert advisory or trading robot) on one of their packages.

Also their packages are pretty affordable, which also comes with unlimited trials even if you fail to hit the set target within the 35 days period.

If you are interested in getting a 5% discount upon purchase, hit THE FUNDED TRADER and use THE0CRAFTER as the coupon code