Welcome to 2023… Pipsmanship will be used as one of my trading journals going forward.

The reason for this is to encourage traders to keep one for two major reasons:

- Track their weekly trading performance.

- Work on their trading technique and psychology

Both can only be done when you keep a comprehensive journal, and review it every week.

MONDAY 23/01/2023

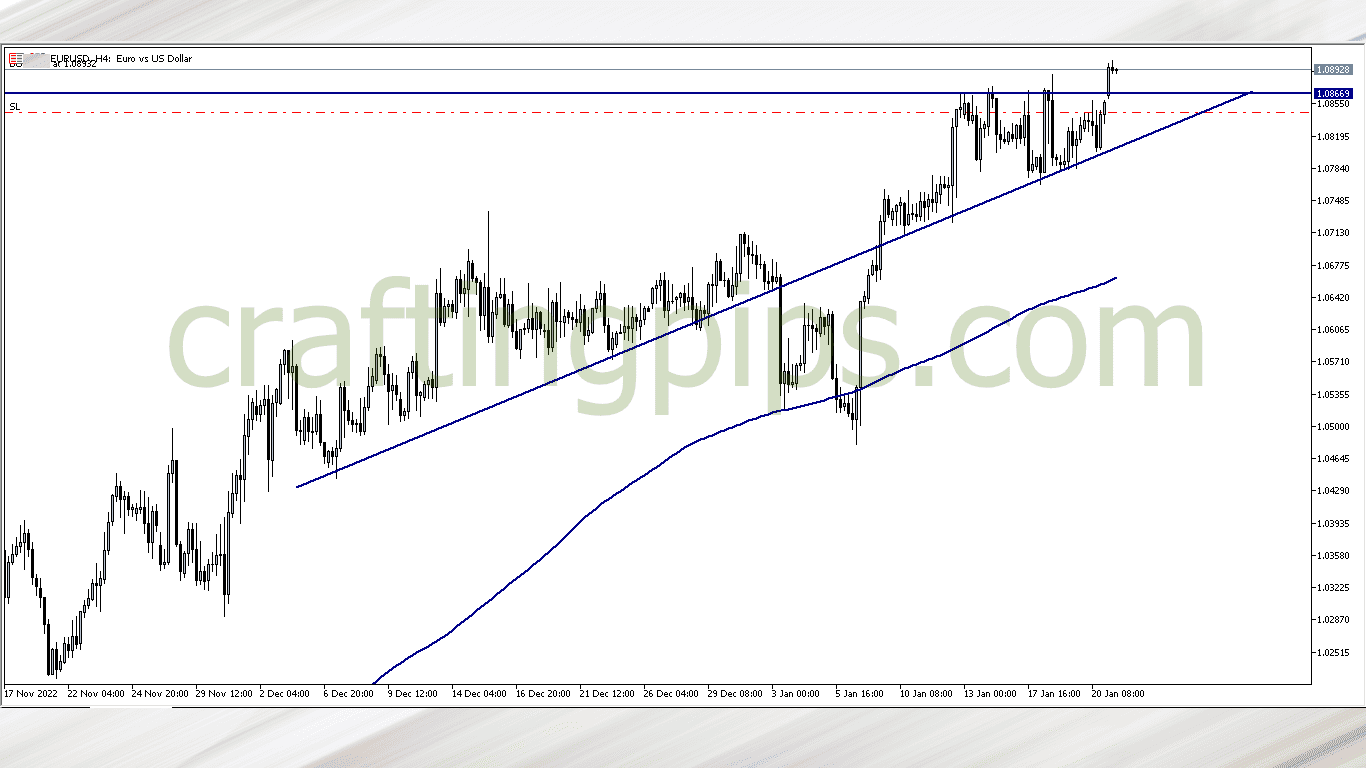

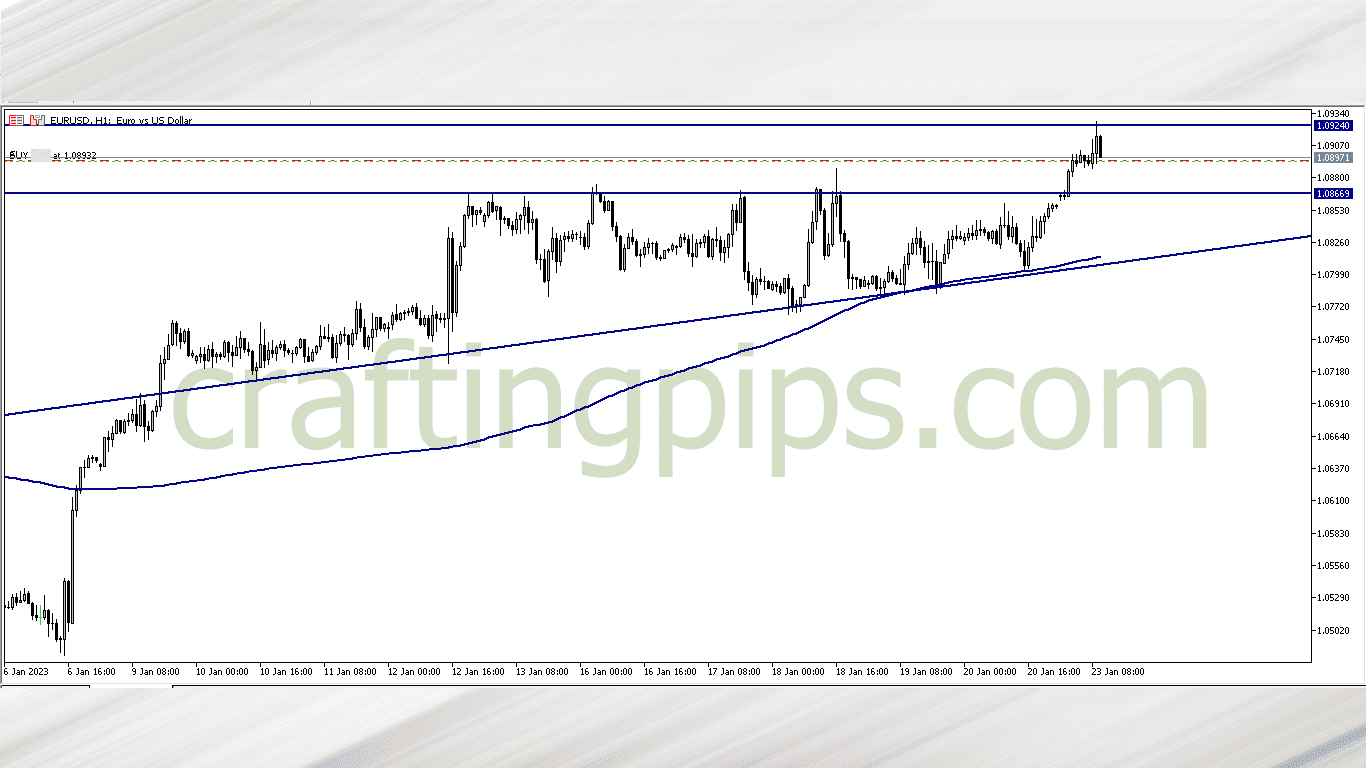

EUR/USD (7.03am)

Analysis: On the daily time frame EUR/USD is bullish. On the 4hr tf we can see that the bulls struggled all through last week to break the 1.08677. Today there is a decent breakout which we are capitalizing on, and price is above the 200 ma.

EUR/USD Update (11.15am)

Price hit trailing SL. Reason I placed one was because there was a minor resistance level which could cause a deep pull back that could take out my initial SL, so I had to safeguard my trade

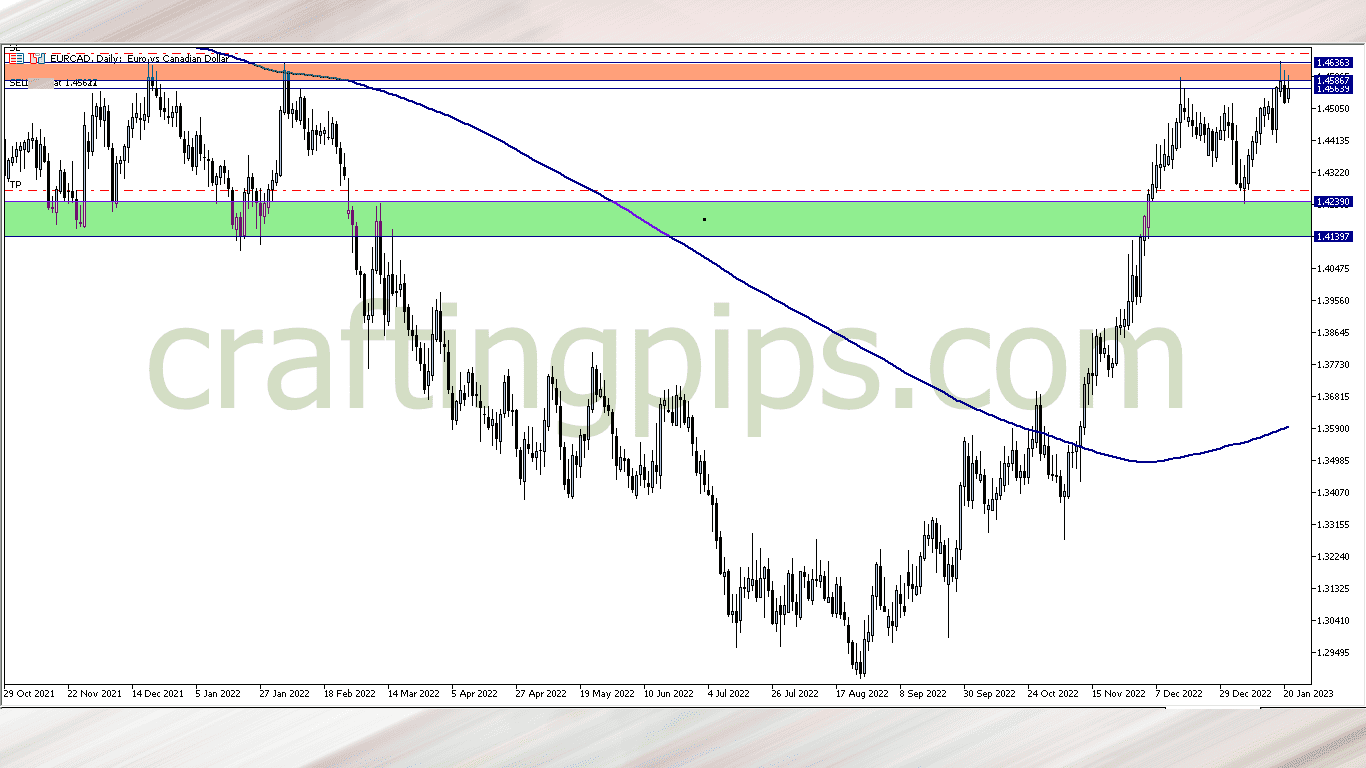

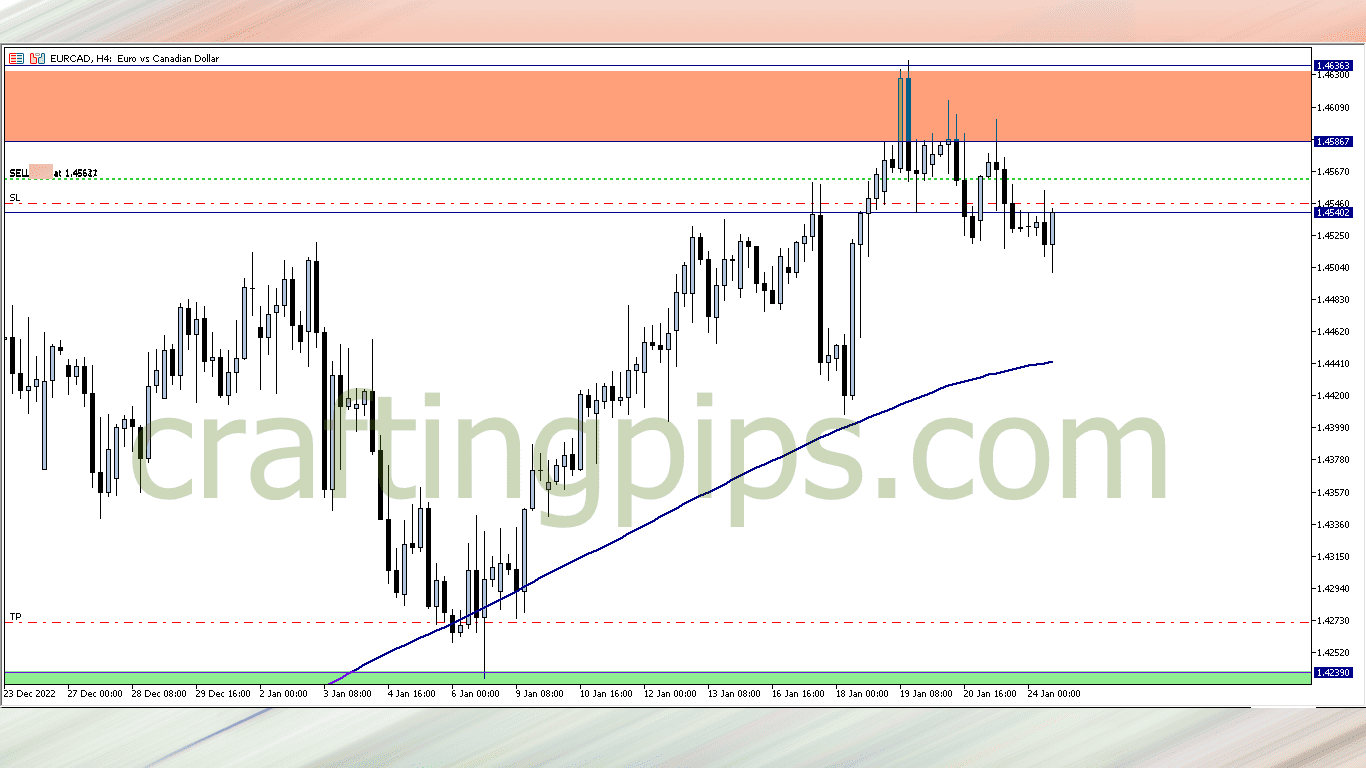

EUR/CAD (11.50 am)

Analysis: This was one pair I shared during our weekly analysis

TUESDAY 24/01/2023

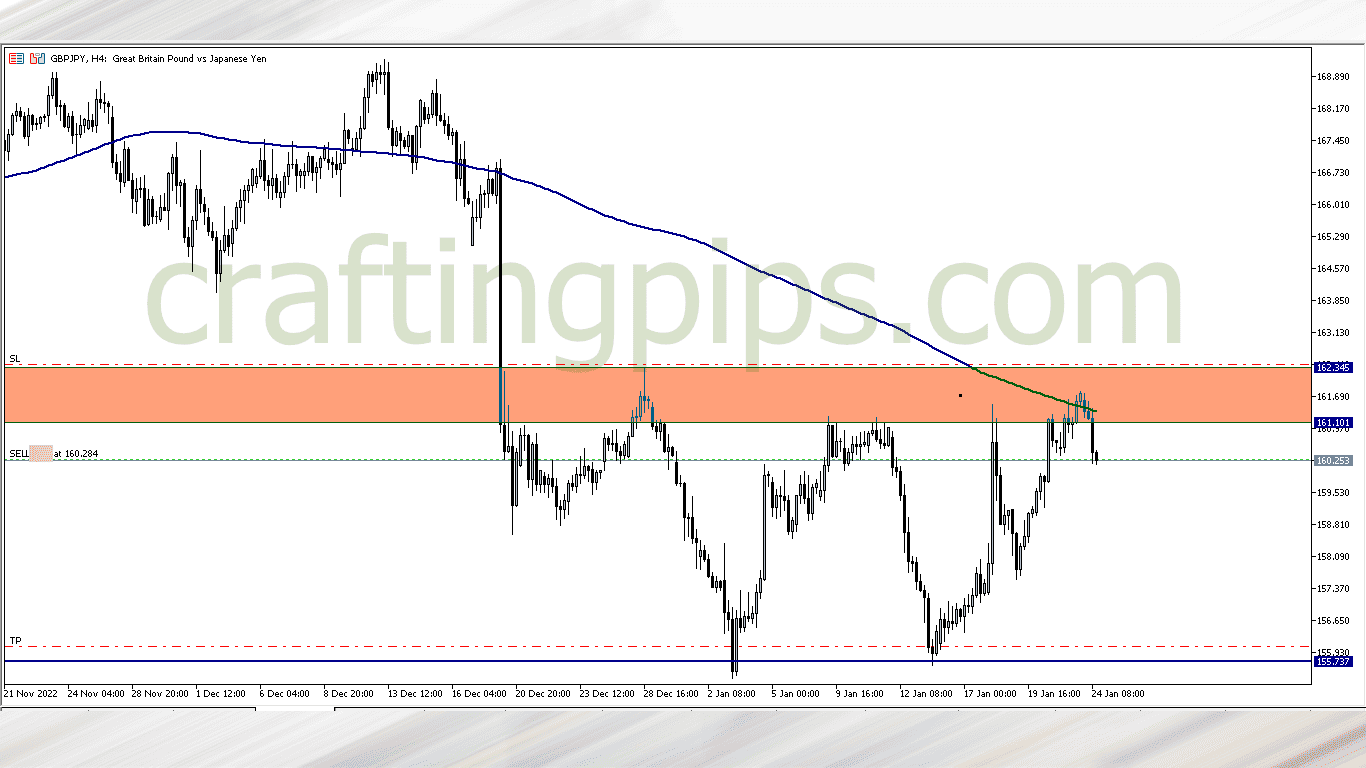

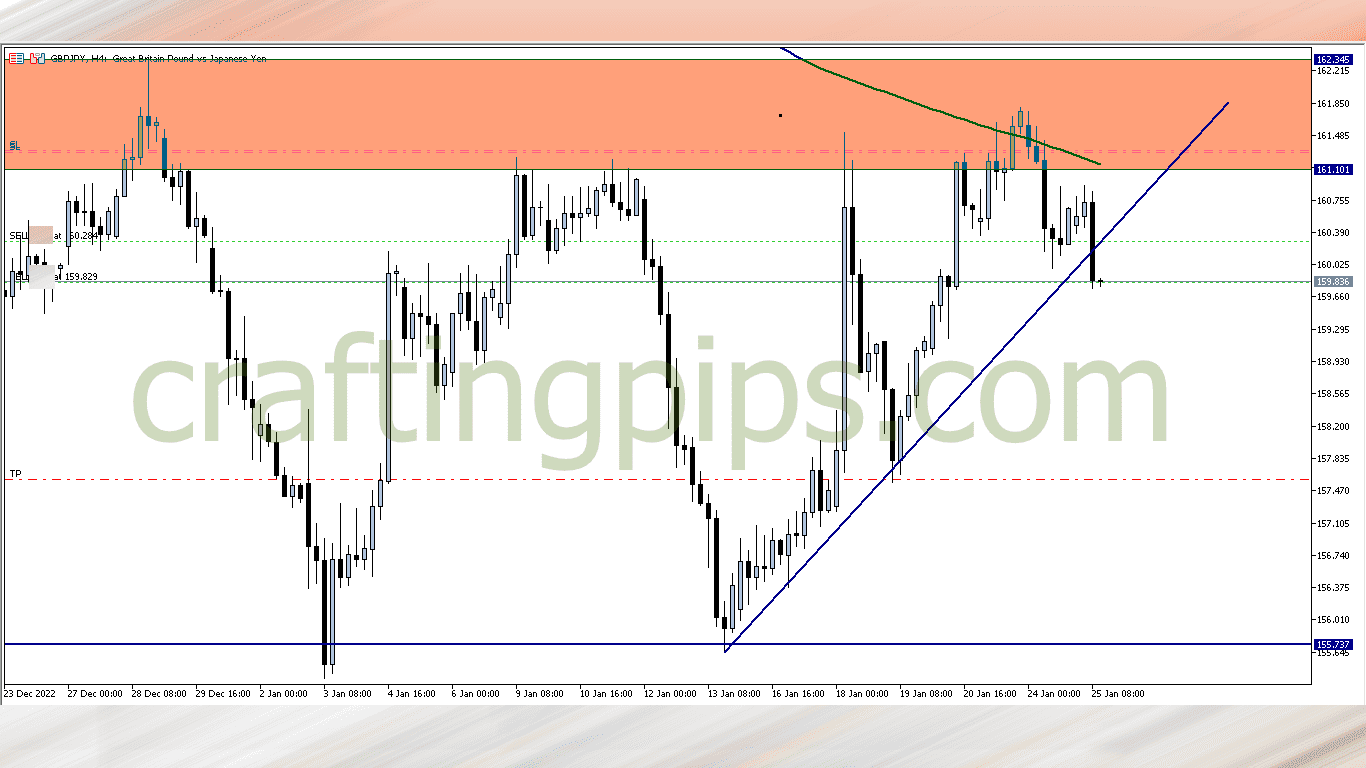

GBP/JPY (1.30PM)

Analysis: The brown zone is a key resistance zone for GBP/JPY on both the daily and 4 hour time frame, this can be seen on our weekly market analysis. All I needed was a strong reversal candlestick, and that happened after price hit the 200 ma

EUR/CAD update (2.20pm)

Price took out our trailing SL, and I closed with +32 pips (two positions were opened)

WEDNESDAY 25/01/2023

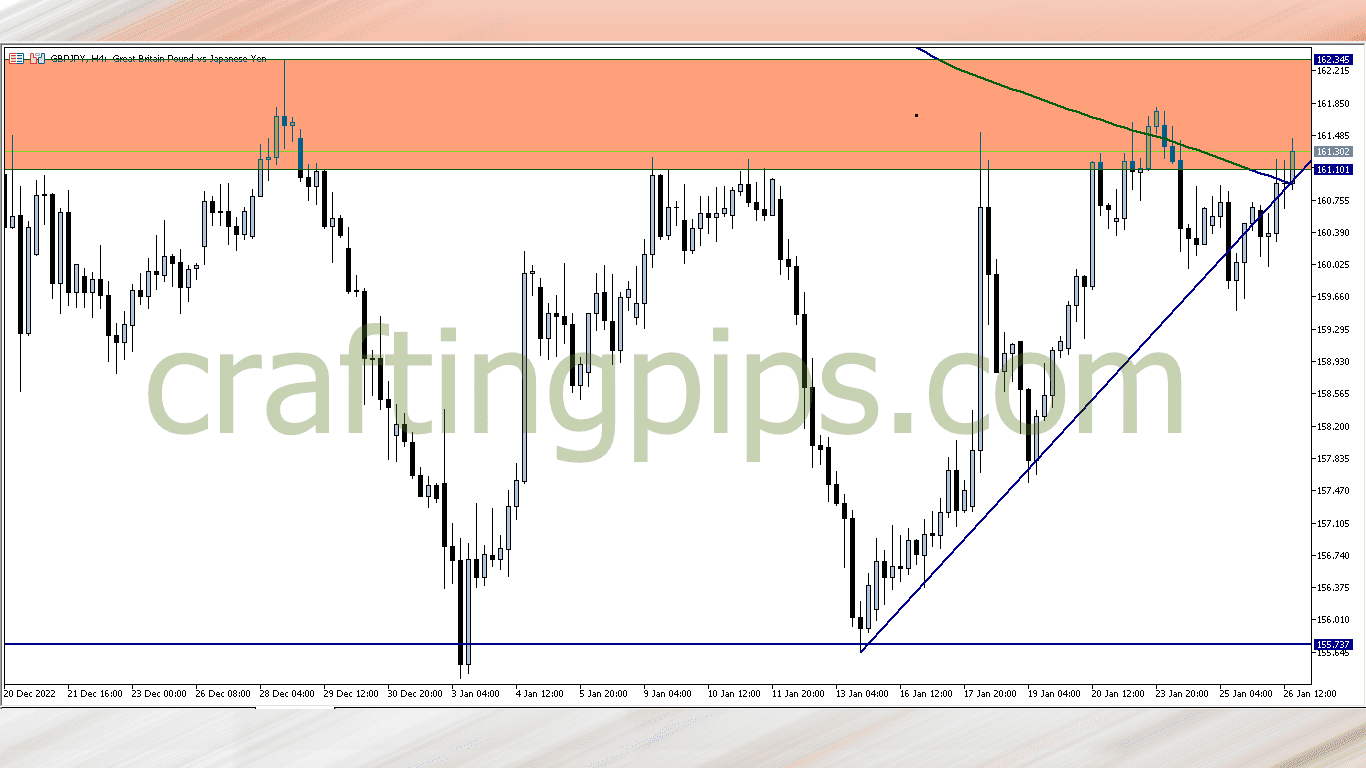

GBP/JPY follow up (11.05am)

Analysis: Added to the GBP/JPY sell trade after the ascending trendline which served as a support zone on the 4hr time frame broke.

THURSDAY 26/01/2023

GBP/JPY (2pm)

Price reversed and took both of my positions out. Closed with -247 pips loss

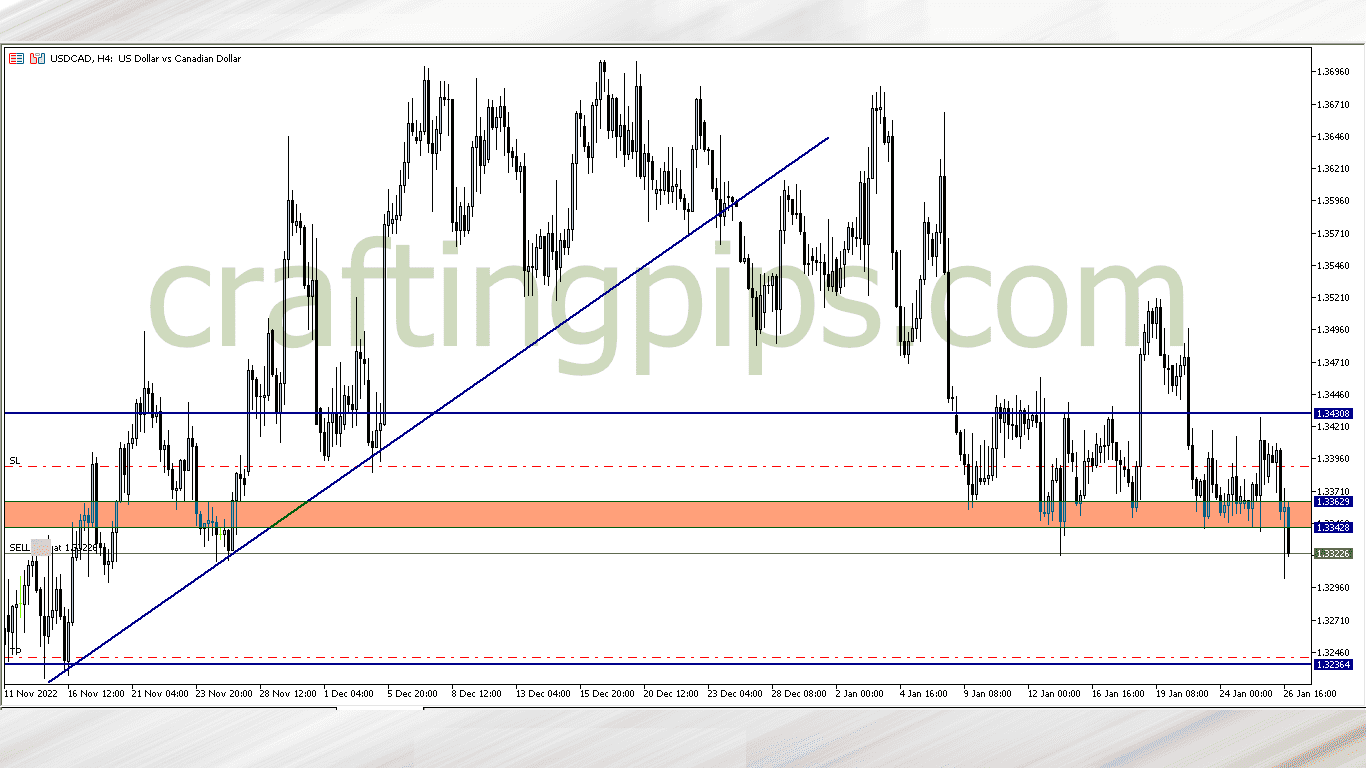

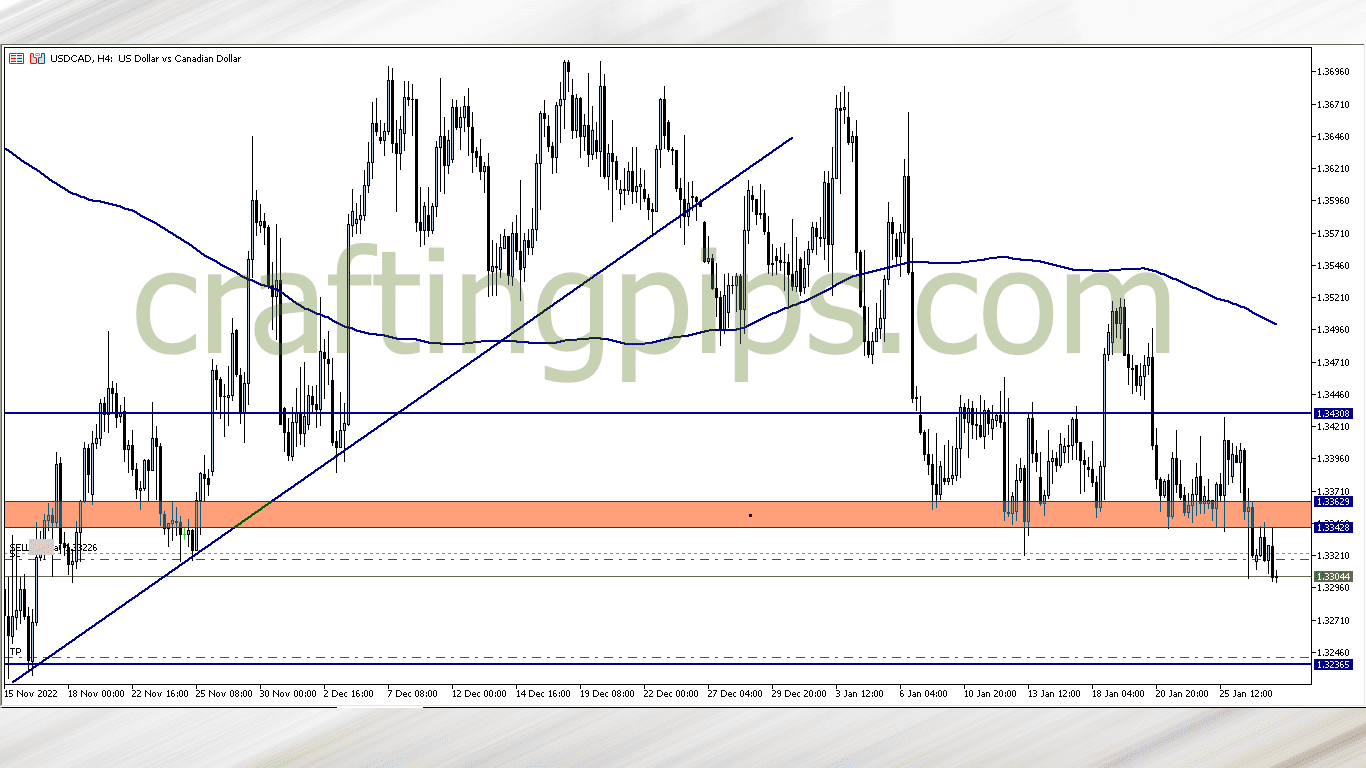

USD/CAD (10.35 pm)

The bears took over price as we slipped into the the Asian session, and a head and shoulders formation is broken, but not completely broken since we are 25 minutes away from the close of the daily candlestick

High spreads are the reason why I took the early trade

FRIDAY 27/01/2023

USD/CAD follow up (7.30pm)

USD/CAD bears fought a good fight but price barely moved in our direction. +5 pips is locked already and I will allow this trade run into next week.

Trade activity summary for the week

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST |

| MON (23/01/2023) | EUR/USD | BUY | Breakout |

| MON (23/01/2023) | EUR/CAD | SELL | +32 pips |

| TUE (24/01/2023) | GBP/JPY | SELL | -247 pips |

| THUS (26/01/2023) | USD/CAD | SELL | +5 pips |

| TOTAL | –210 pips |

In conclusion:

GBP/JPY was our biggest loser for the week due to two opened positions. That said I lost less than -0.8% on this trade due to my risk management rules. If the trade had gone our way, we could have easily made slightly over +1.8% profits, but it is what it is.

No regrets on GBP/JPY, it was well executed, and I also did well on my other trade executions this week. Hopefully the USD/CAD will give us some profits next week, and if we still close with the +5 pips I have locked, I will keep you posted.

Do have a fab weekend.

MONDAY (30/01/2023)

USD/CAD Update

Sunday market opened and took out my USD/CAD stop loss, so we closed with +5 pips

NOTE:

Hey traders,

If you are into trading for proprietary firms which I believe you should due to the many advantages involved, check out these carefully selected proprietary firms listed below.

The funded trader needs no introduction, as they are currently becoming one of the most sorted proprietary firms in the industry due to their flexible challenge rules which consist of you being able to use an EA (expert advisory or trading robot) on one of their packages.

Also their packages are pretty affordable, which also comes with unlimited trials even if you fail to hit the set target within the 35 days period.

If you are interested in getting a 5% discount upon purchase, hit THE FUNDED TRADER and use THE0CRAFTER as the coupon code