My reason for sharing my trade journal is to encourage traders to also keep one for two major reasons:

- Track weekly trading performance.

- Build a better psychology, which will sharpen your trading intuition

Both can only be done when you keep a comprehensive journal, and review it every week.

MONDAY 30/10/2023

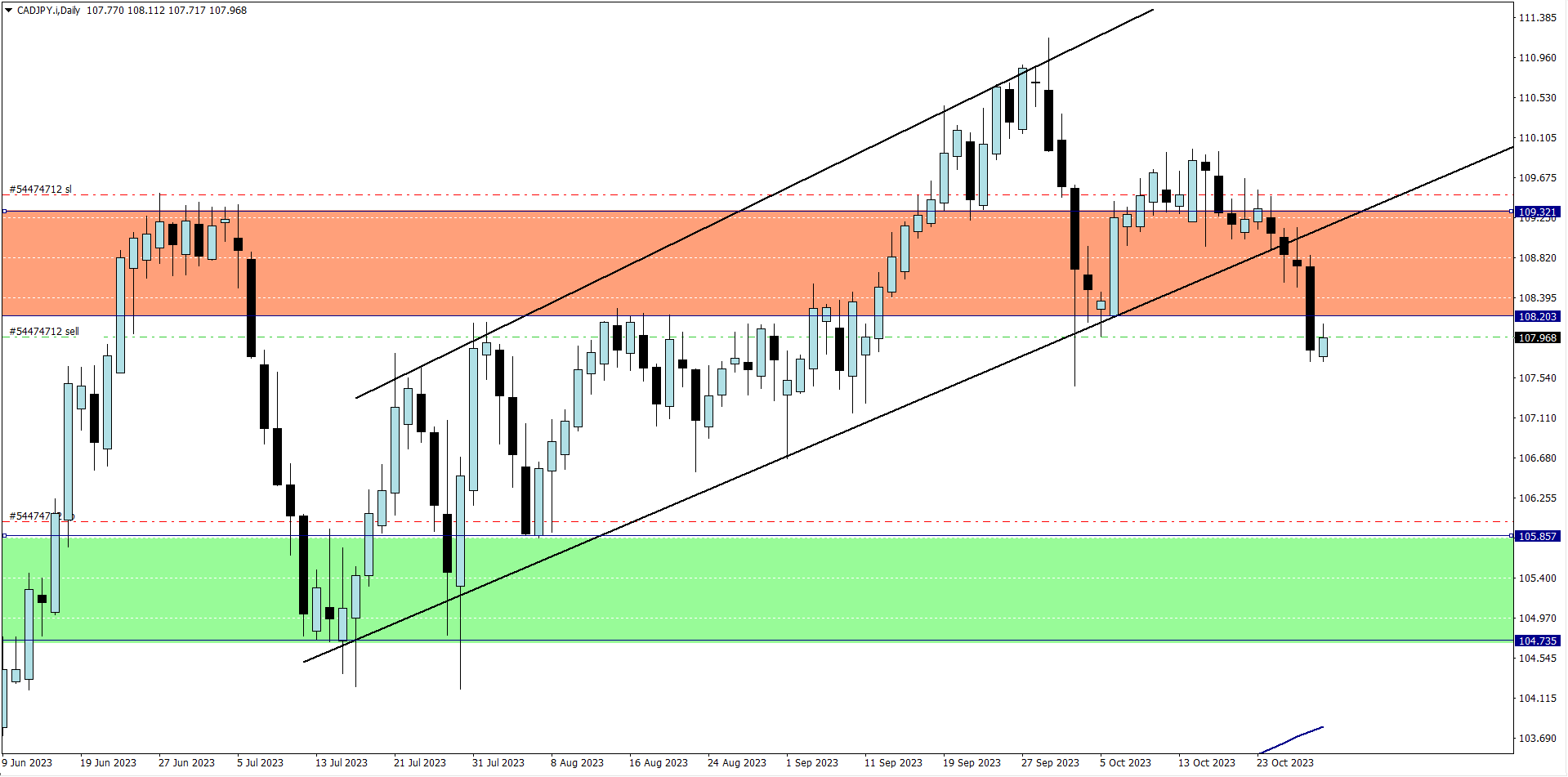

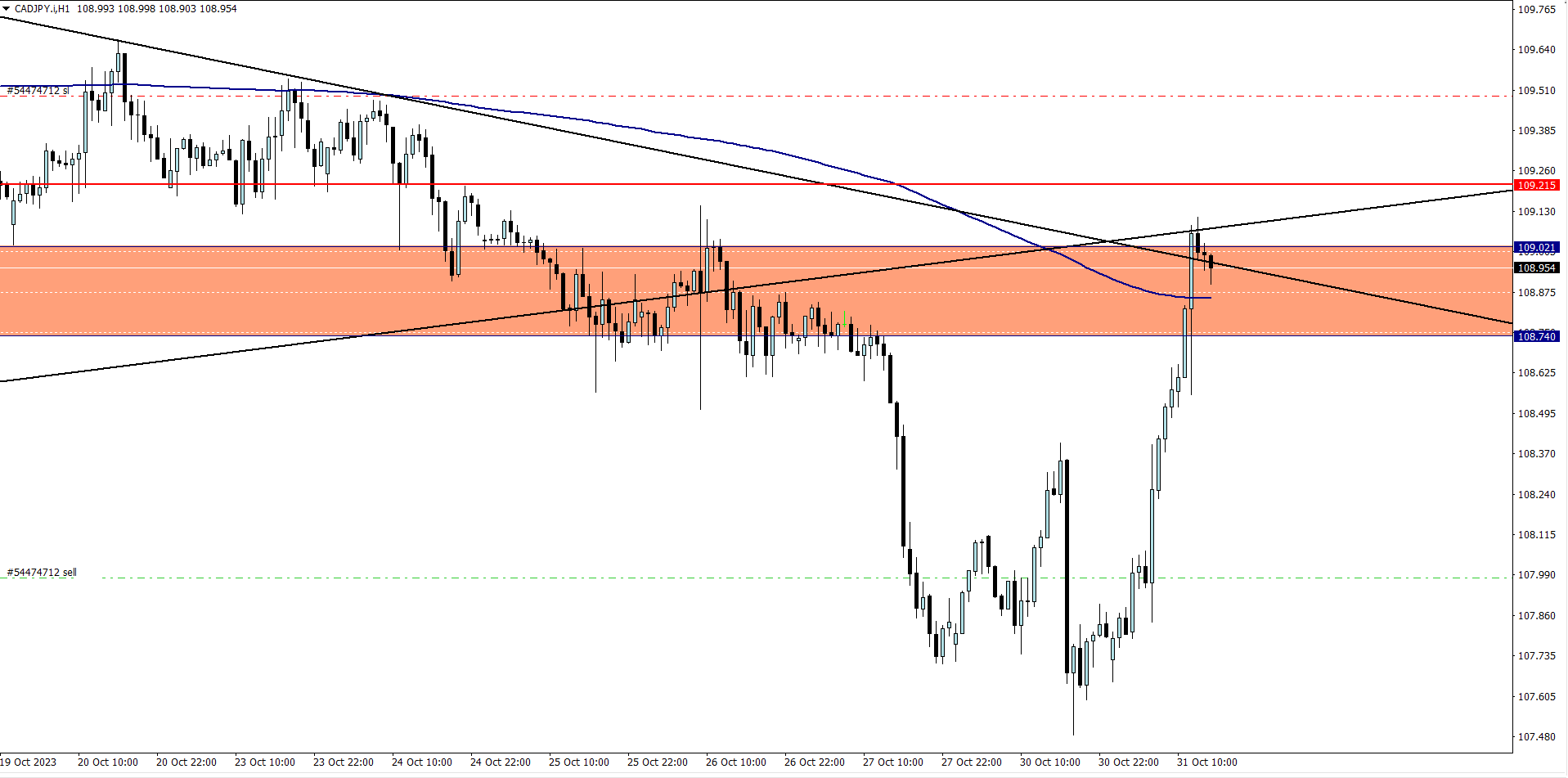

CAD/JPY (8 pm)

Analysis: My reason for selling was shared on our weekly analysis

TUESDAY 31/10/2023

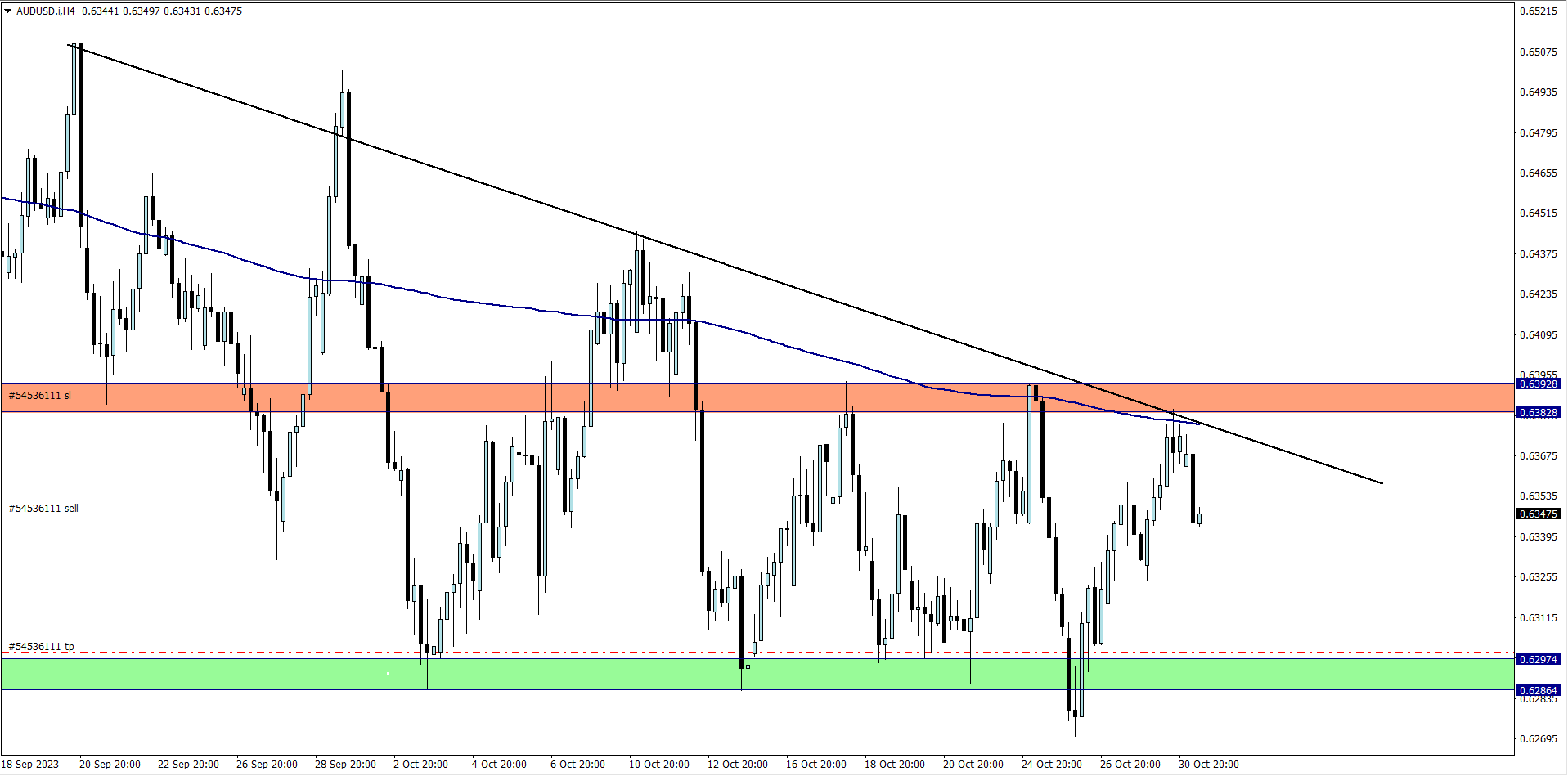

AUD/USD (7.15 am)

Analysis: My reason for selling is multiple rejections of price at a key resistance zone

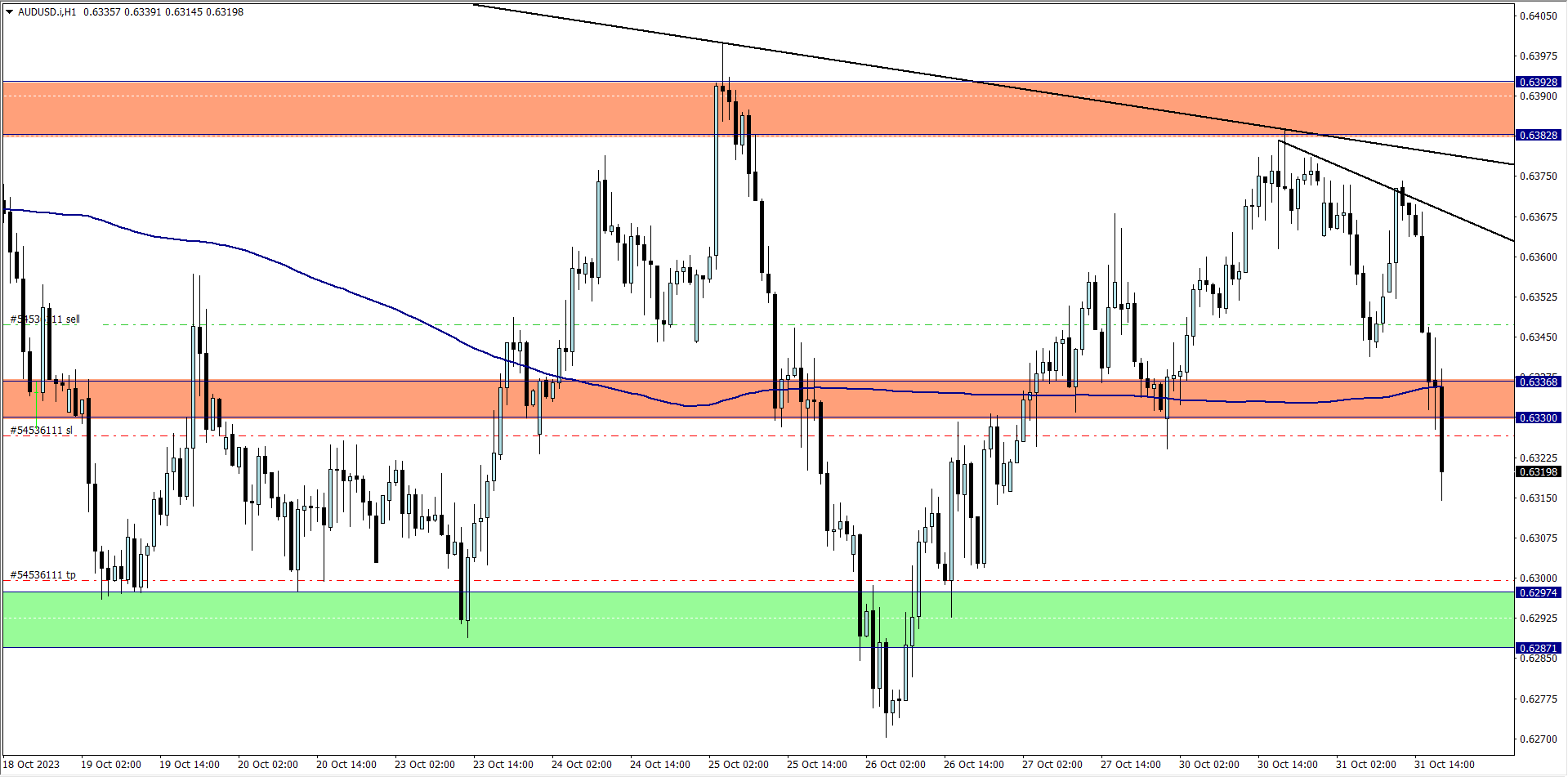

AUD/USD Update (6 pm)

Analysis: Closed trade using trailing SL (+21 pips)

CAD/JPY Update (6.30 pm)

Analysis: I closed this trade manually with a -125 pips loss

Trade activity summary for the week

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST |

| MON (30/10/2023) | CAD/JPY | SELL | – 125 pips |

| TUE (31/10/2023) | AUD/USD | SELL | + 21 pips |

| TOTAL | – 104 pips |

In conclusion:

The only regret I have trading the last two days of the month is:

Managing the CAD/JPY trade. On Tuesday Morning, I was clearly in profits and I should have shifted SL to breakeven, since I planned on selling AUD/USD, but I did not. So this made me lose the CAD/JPY trade

I followed my trading rules on the AUD/USD, and I exited when I had to, so I closed with a win.

Overall, I closed this last few days of the month with a small loss (which could have been averted)

Trade activity summary for the month of October

| 1st TRADING WEEK |

|

|||

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST | |

| MON (02/10/2023) | USD/JPY | BUY | Breakeven | |

| TUE (03/10/2023) | AUD/JPY | BUY | -45 pips | |

| USD/CAD | BUY | +49 pips | ||

| WED (04/10/2023) | GBP/CAD | SELL | Breakeven | |

| TOTAL | + 4 pips | |||

| 2nd TRADING WEEK | ||||

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST | |

| MON (02/10/2023) | CAD/JPY | BUY | Breakeven | |

| TUE (03/10/2023) | GBP/CAD | SELL | + 55 pips | |

| TOTAL | + 55 pips | |||

| 3rd TRADING WEEK |

|

|||

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST | |

| TUE (17/10/2023) | GBP/JPY | SELL | +92 pips | |

| WED (18/10/2023) | USD/JPY | BUY | Breakeven | |

| FRI (20/10/2023) | GBP/CHF | SELL | Pending | |

| TOTAL | + 92 pips | |||

| 4th TRADING WEEK |

|

|||

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST | |

| FRI (20/10/2023) | GBP/CHF | SELL | – 102 pips | |

| TOTAL | – 102 pips | |||

| 5th TRADING WEEK |

|

|||

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST | |

| MON (30/08/2023) | CAD/JPY | SELL | – 125 pips | |

| TUE (31/08/2023) | AUD/USD | SELL | + 21 pips | |

| TOTAL | – 104 pips | |||

| GRAND | TOTAL | – 55 pips |

In conclusion:

The month of October tested not just my discipline but also my money management skills.

Overall, I had:

- 3 losing weeks and

- 2 winning weeks

Ordinarily, it’s supposed to be a losing month for me, but on my major accounts (which I trade every single week), its a winning month. On my minor accounts (which I do not trade every week), I closed with less than -1% or breakeven for the month

The reason for this is because, as a trader, you do not know which week will be profitable or not. So accounts I pick randomly to trade could suffer the most in a struggling month, while accounts I manage every week will most likely thrive

I will share some of my major accounts for educational purposes:

MAJOR ACCOUNTS TRADE STATS

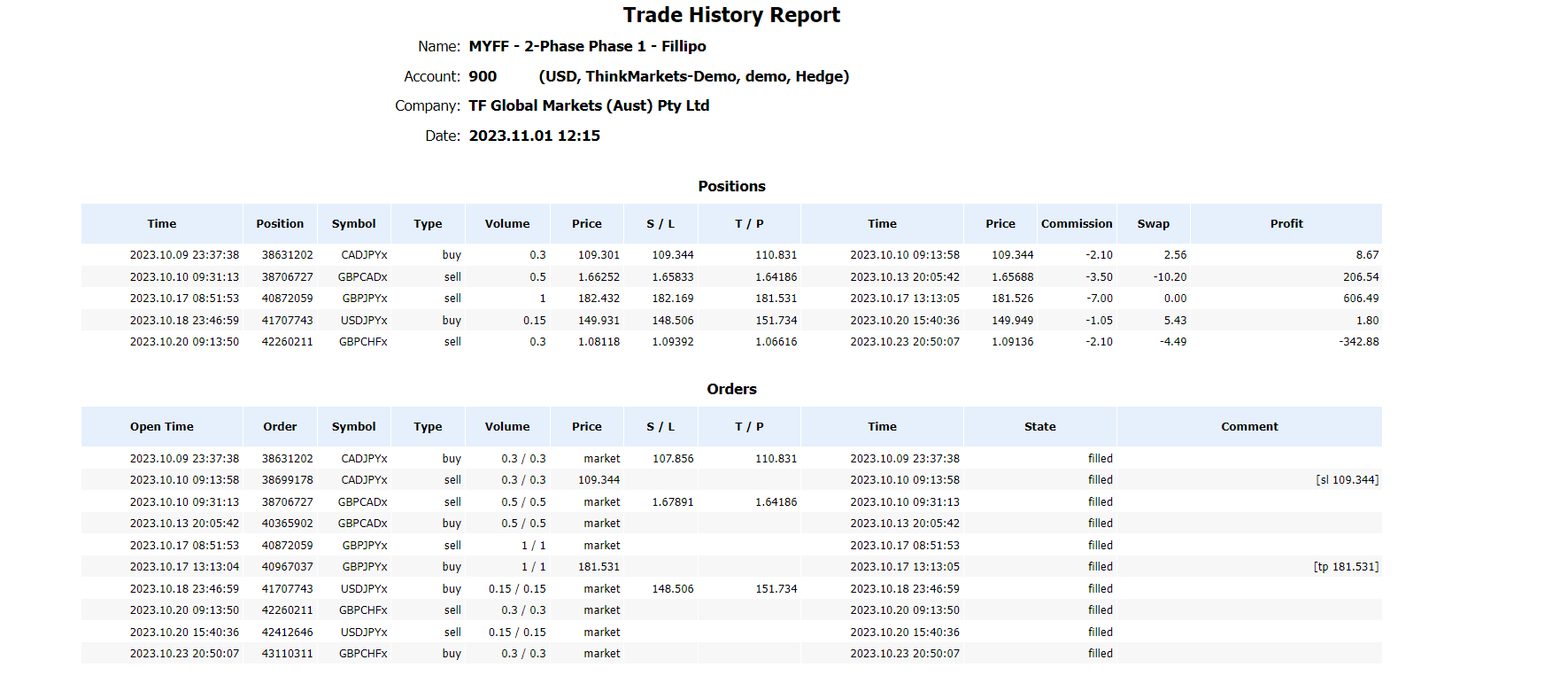

My Flash Funding Trade History (October):

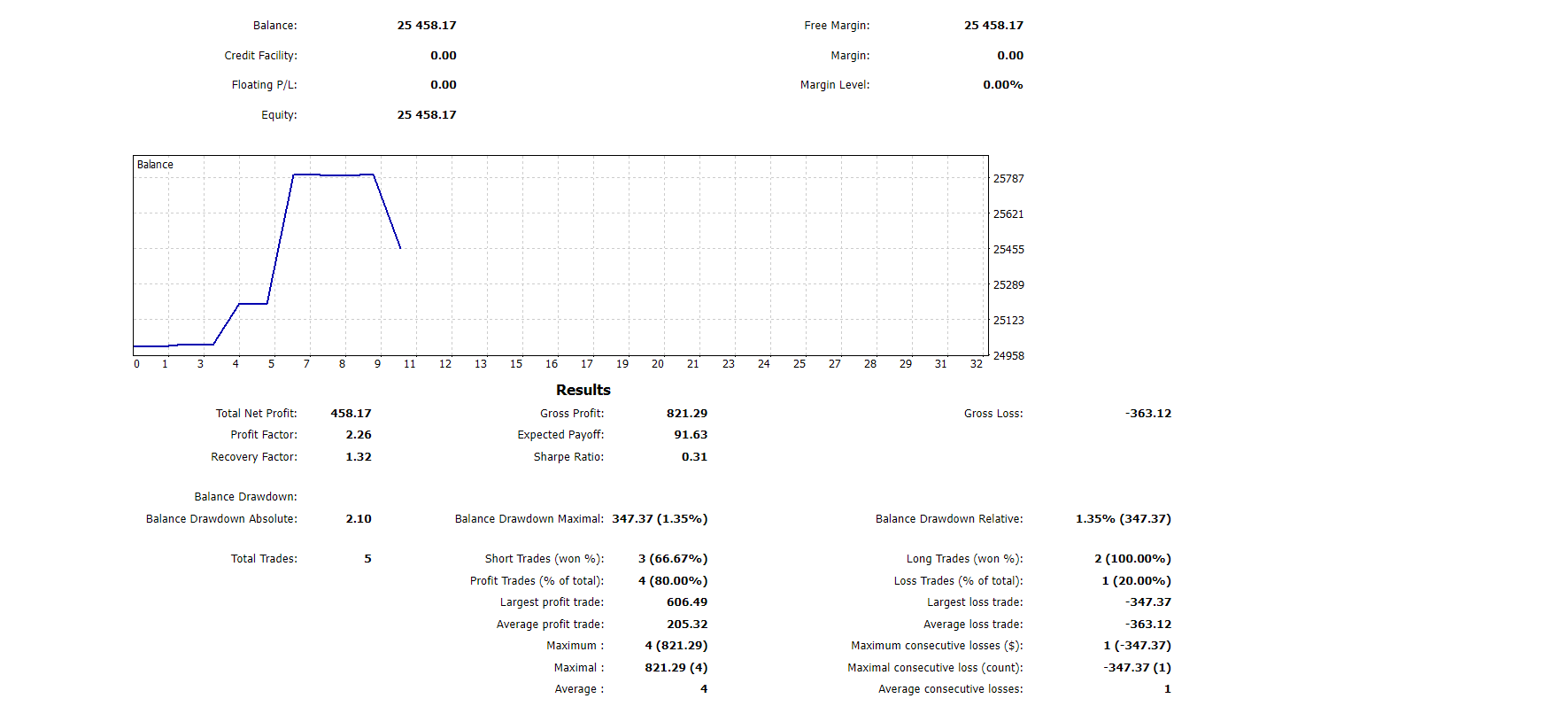

My Flash Funding Stats (October):

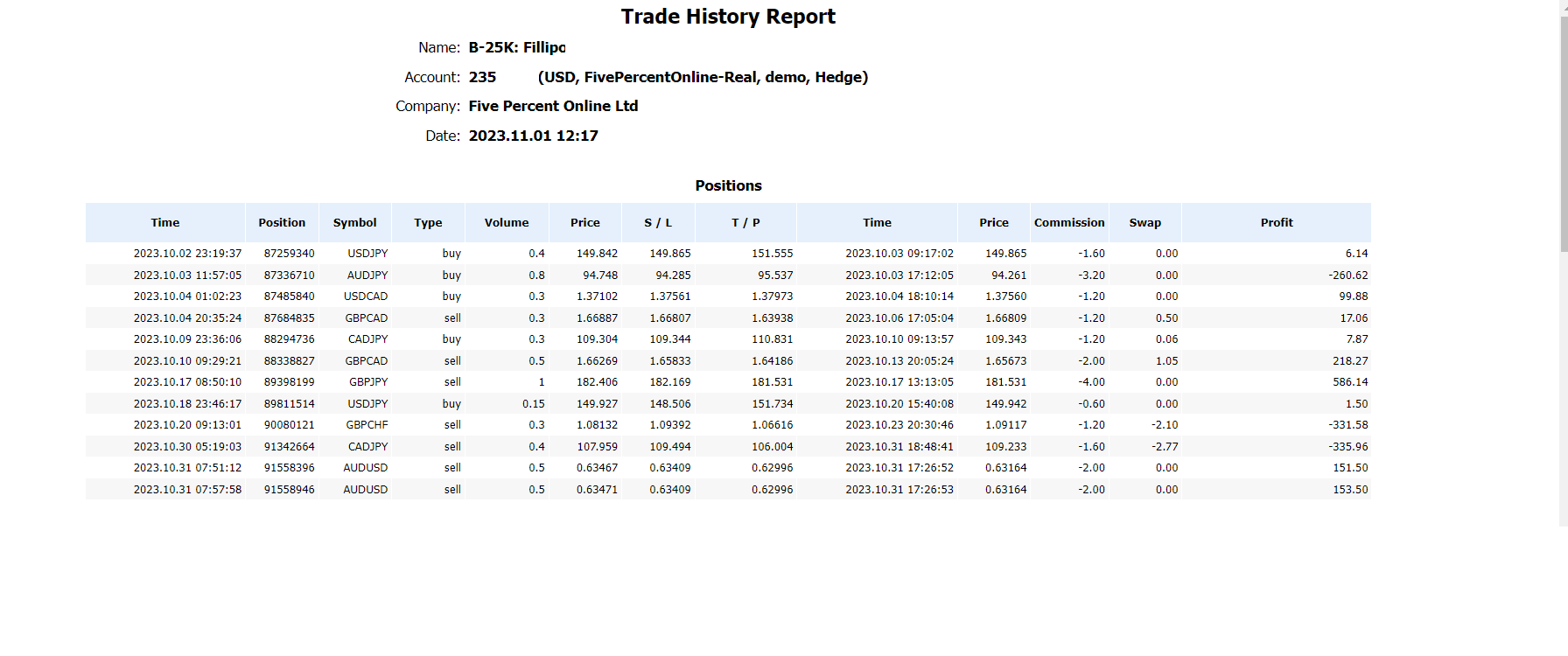

The5ers Bootcamp Trade History (October):

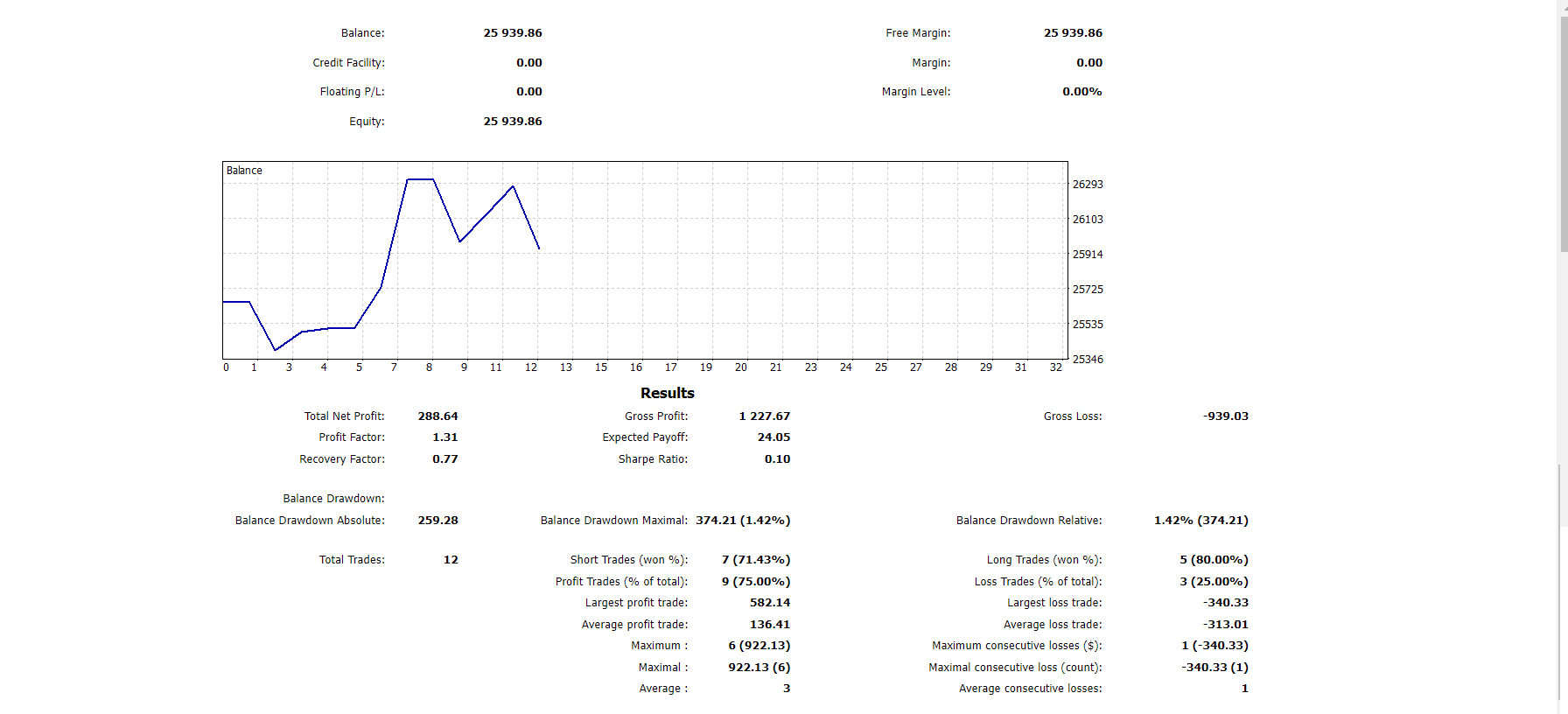

The 5ers Bootcamp Stats (October):

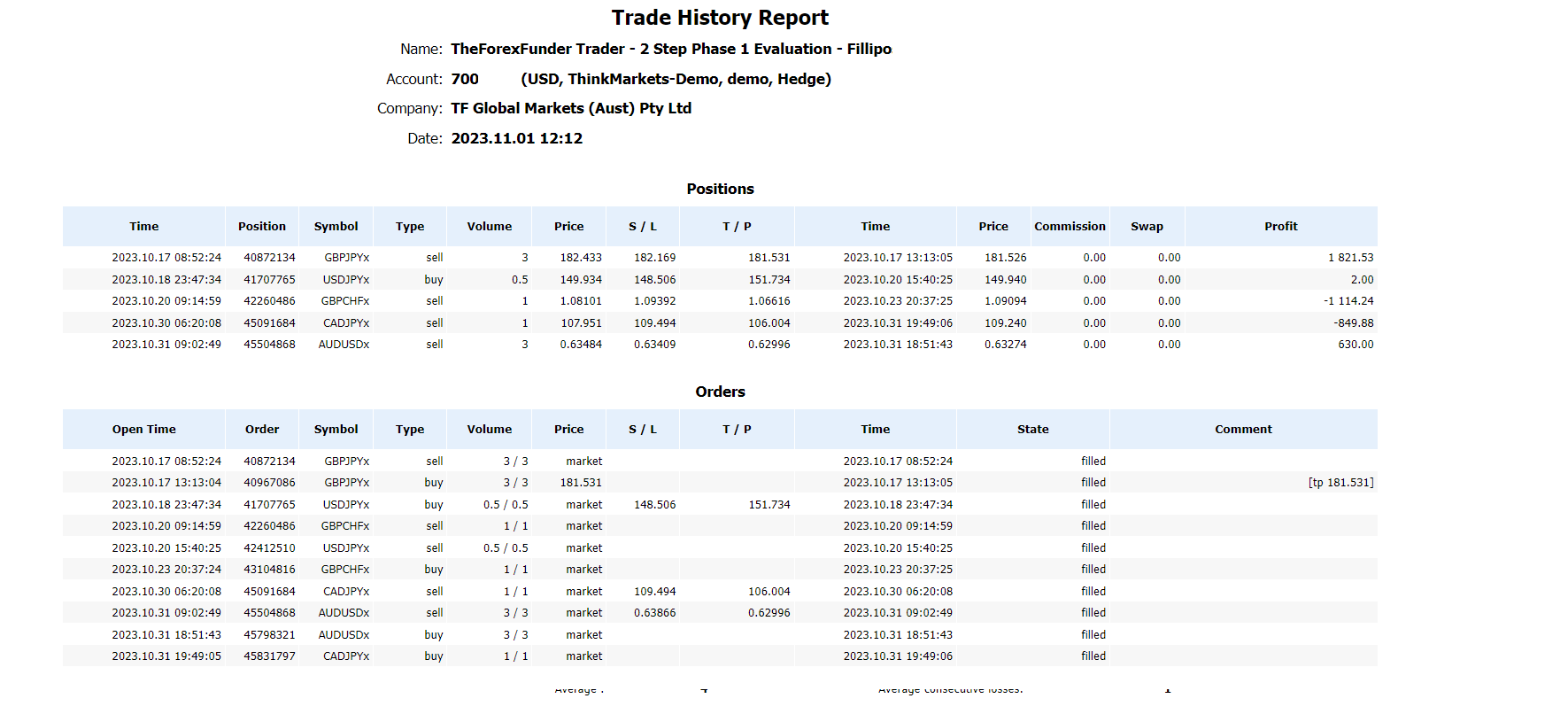

The Forex Funder Trade History (October):

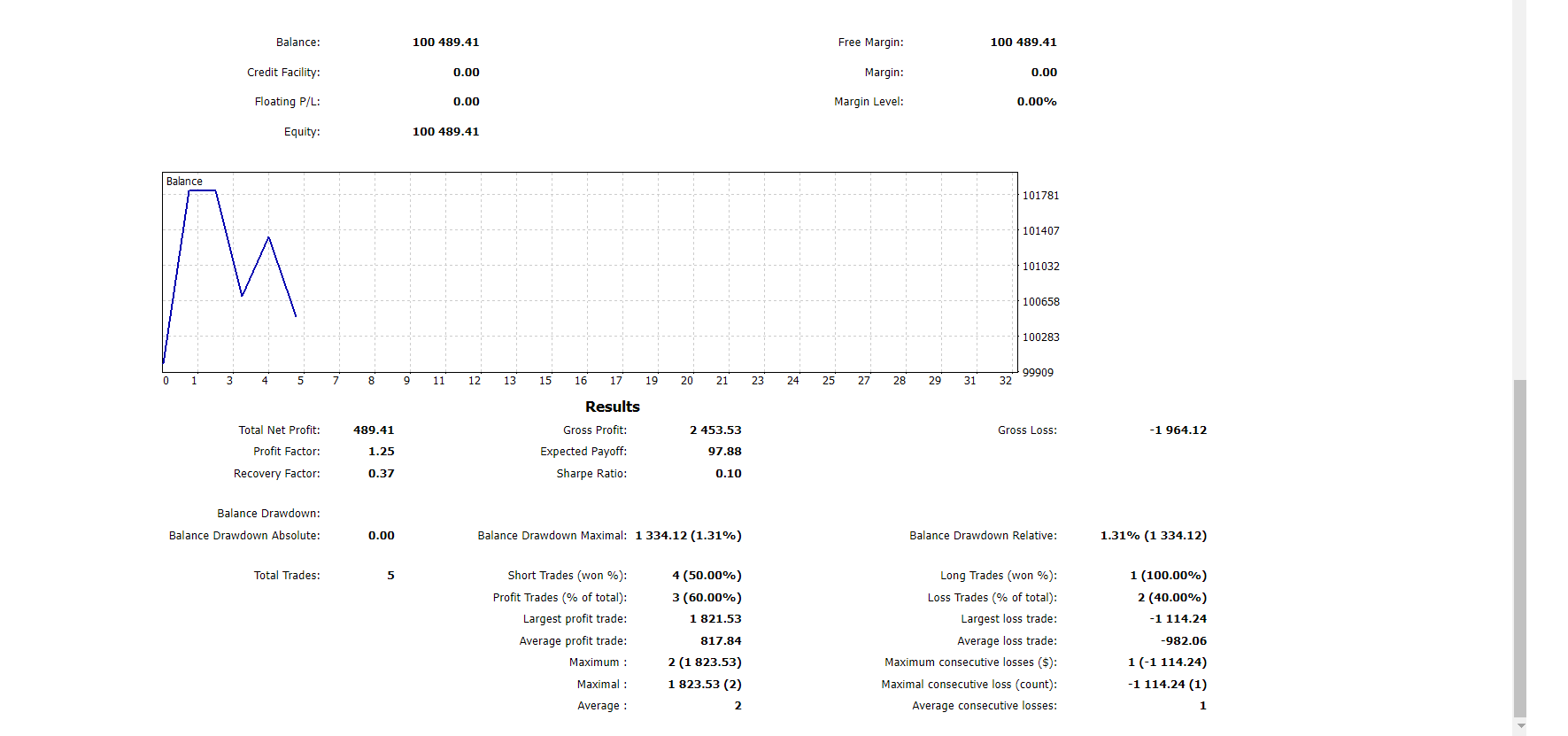

The Forex Funder Stats (October):

MINOR ACCOUNT TRADE STATS

For clarity, I have over 7 minor accounts, but for the purpose of this post, I will be showing one:

Blue Guardian Trade History (October):

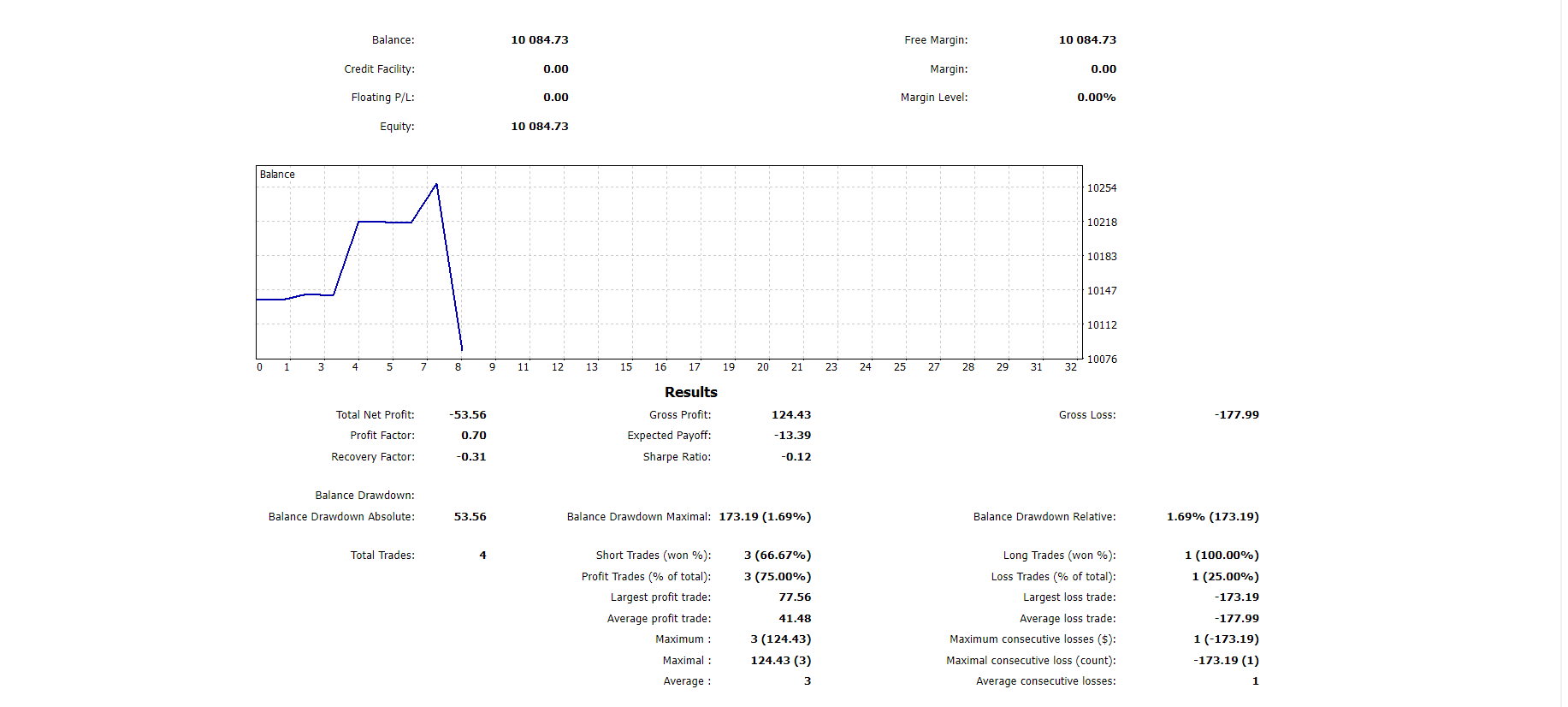

Blue Guardian Stats (October):

How did the month of October go for you?

NOTE:

-

THE FUNDED TRADER: (Use the coupon code: THE0CRAFTER)

- BESPOKE FUNDING PROGRAMME

- FUNDED ENGINEER

- BLUE GUARDIAN (Use the coupon code: CRAFTER)

- GOAT FUNDED

- LARK FUNDING

- SKILLED FUNDED TRADER

- MAVEN TRADING

- MY FLASH FUNDING (Use the coupon code: “FILLIPO” for a -25% discount)

- THE5ERS