My reason for sharing my trade journal is to encourage traders to also keep one for two major reasons:

- Track weekly trading performance.

- Build a better psychology, which will sharpen your trading intuition

Both can only be done when you keep a comprehensive journal, and review it every week.

MONDAY 02/10/2023

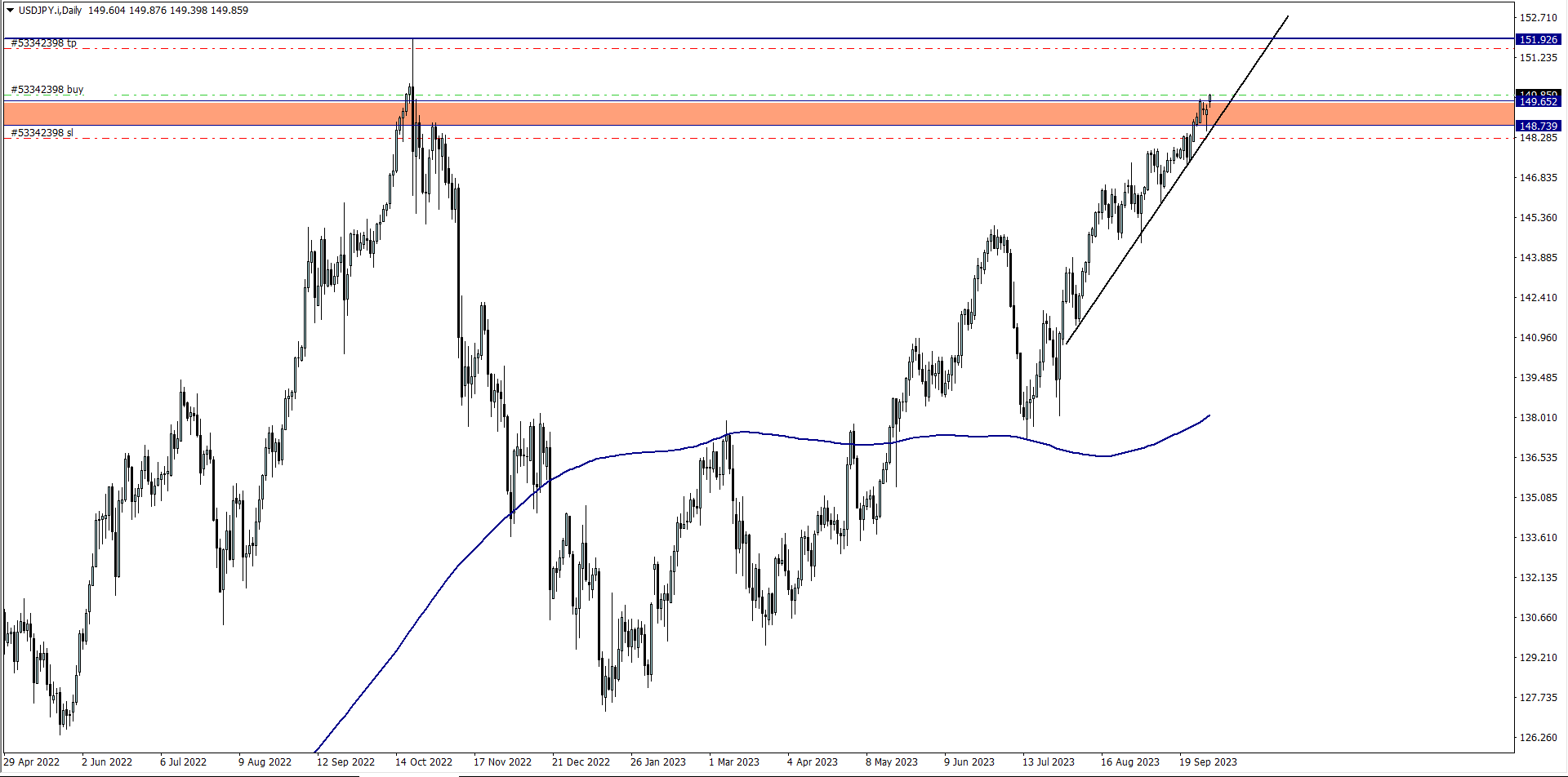

USD/JPY (9.30 pm)

Analysis: The USD/JPY buy was inspired by our Weekly Market Analysis

TUESDAY 03/10/2023

USD/JPY Update (9:11 am)

Analysis: Closed at breakeven

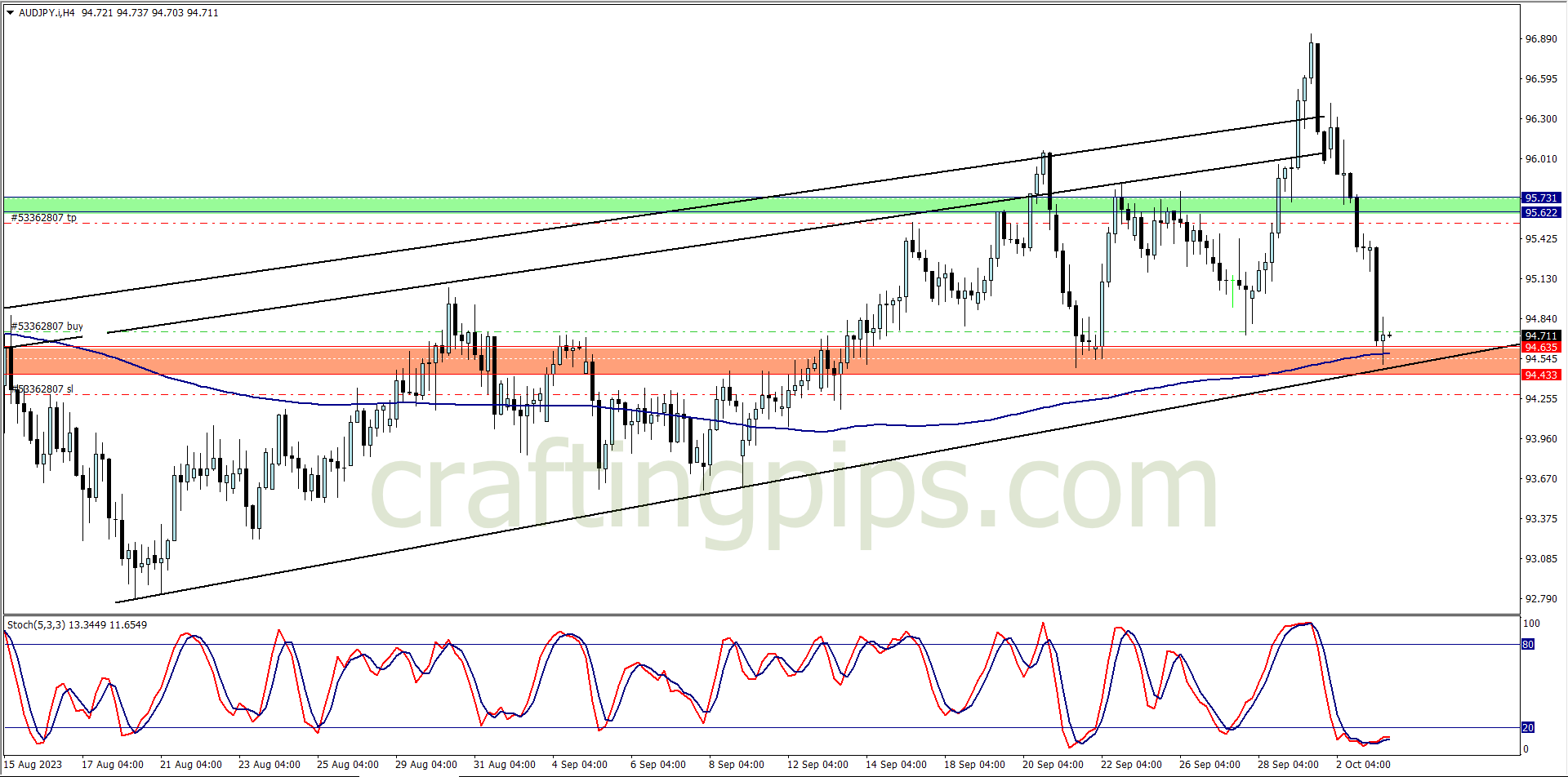

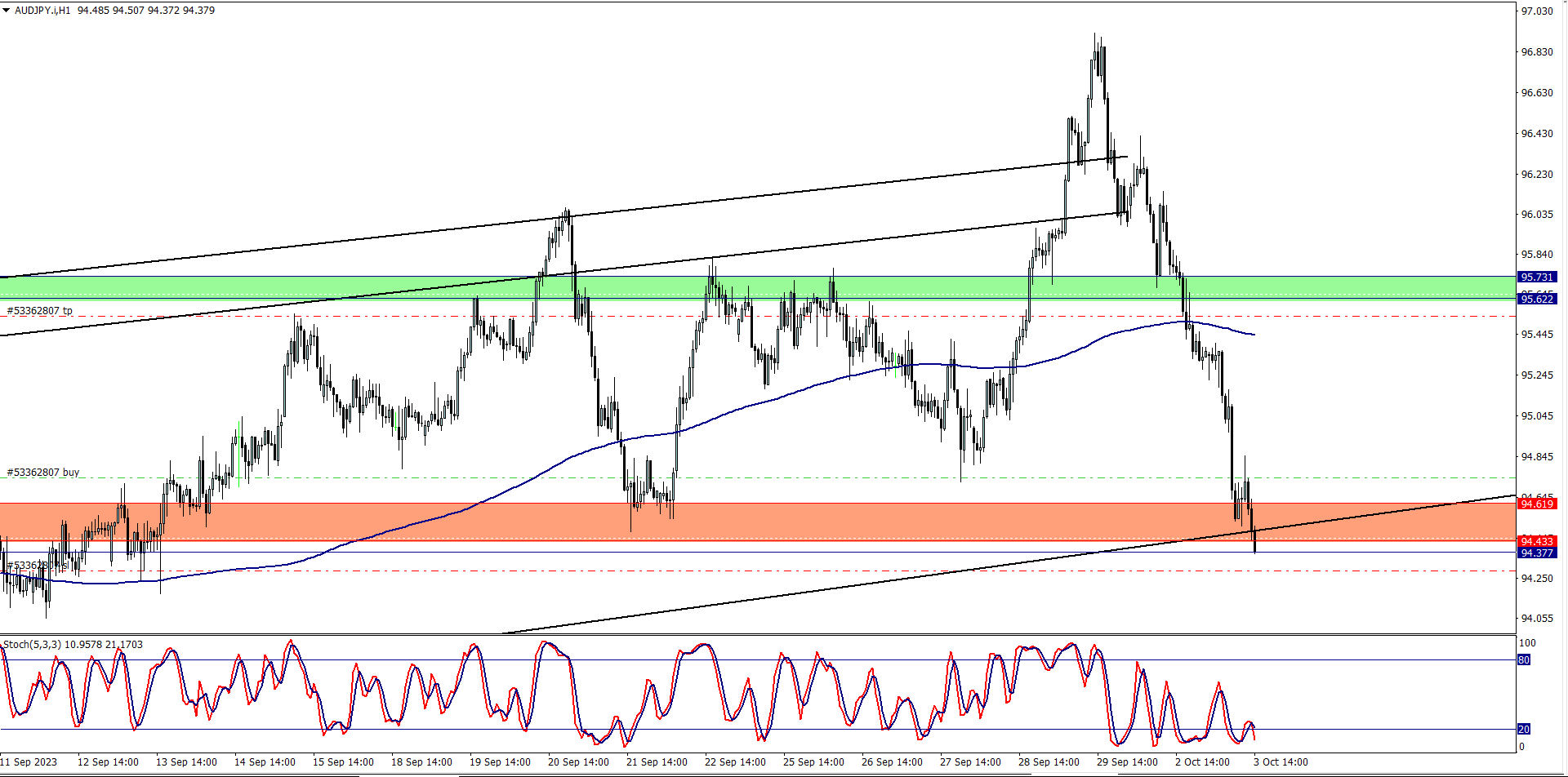

AUD/JPY (10.05 am)

Analysis: The AUD/JPY buy was inspired by our Tuesday Market Analysis

AUD/JPY Update (4:00 pm)

Analysis: No news events, but price fell like a falling star. I closed with -45 pips

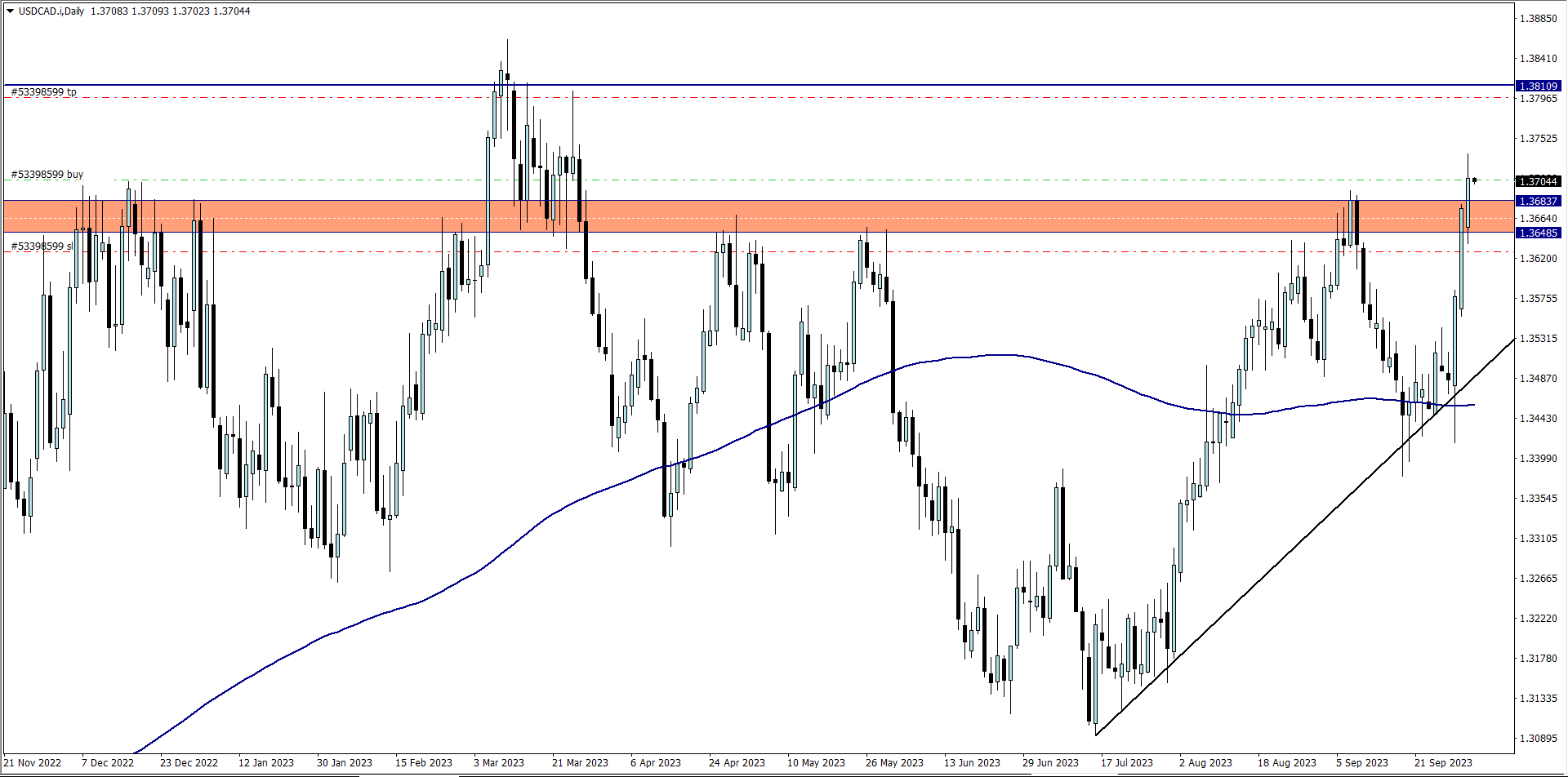

USD/CAD (11:30 pm)

Analysis: The USD/CAD buy was inspired by our Weekly Market Analysis

WEDNESDAY 04/10/2023

USD/CAD (4.35 pm)

Analysis: Manually closed the trade with +49 pips

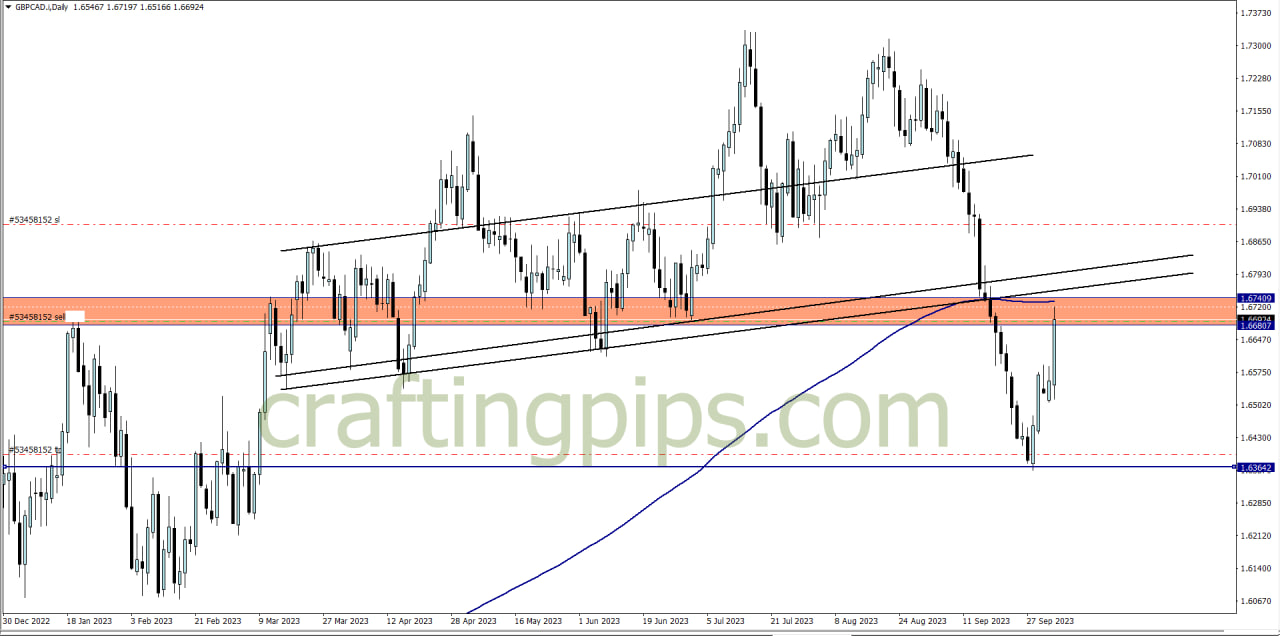

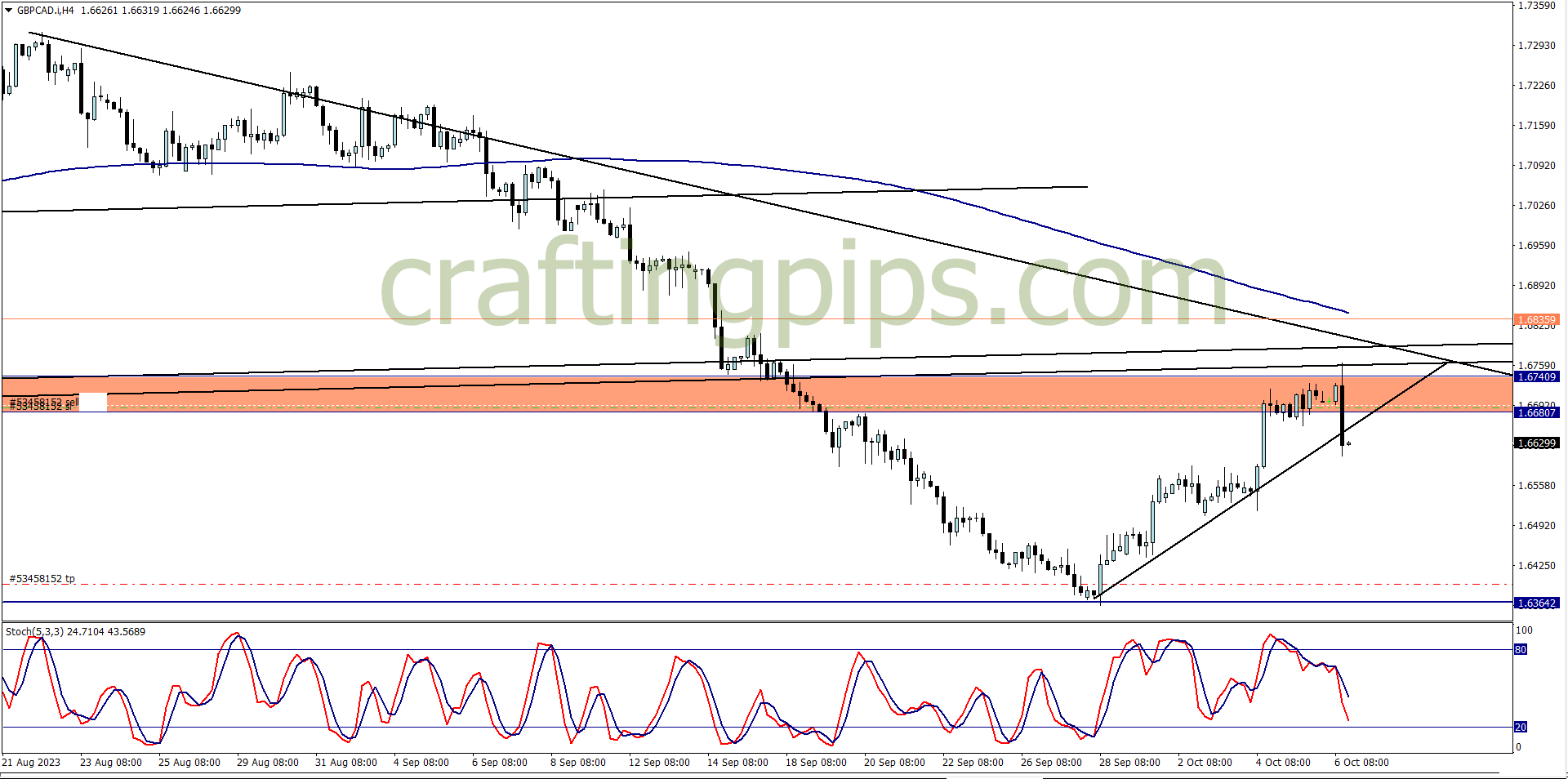

GBP/CAD (7.40 pm)

Analysis: The GBP/CAD sell was inspired by our Thursday Market Analysis

FRIDAY 06/10/2023

GBP/CAD Update (2.30 pm)

Analysis: The GBP/CAD drop only happened after the high impact news on CAD occurred on Friday. All I did was secure my capital afterwards by shifting my SL to BE.

Price reversed and hit my SL, closing the trade in breakeven

Trade activity summary for the week

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST |

| MON (02/10/2023) | USD/JPY | BUY | Breakeven |

| TUE (03/10/2023) | AUD/JPY | BUY | -45 pips |

| USD/CAD | BUY | +49 pips | |

| WED (04/10/2023) | GBP/CAD | SELL | Breakeven |

| TOTAL | + 4 pips |

In conclusion:

Yes I closed with positive pips, but -0.6% on my P&L

I had high hopes on AUD/JPY, and was on a winning streak from last week, so I risked a lil more than I would normally risk. I had to reduce my risk when trading the USD/CAD, hence I could not clear the loss made by the AUD/JPY.

I am impressed the way I handled my trades this week. Discipline and risk management was on point. I am closing the week with -0.6% loss. Looking forward to next week

How did your trading week go?

NOTE:

-

THE FUNDED TRADER: (Use the coupon code: THE0CRAFTER)

- BESPOKE FUNDING PROGRAMME

- FUNDED ENGINEER

- BLUE GUARDIAN (Use the coupon code: CRAFTER)

- GOAT FUNDED

- LARK FUNDING

- SKILLED FUNDED TRADER

- MAVEN TRADING

- MY FLASH FUNDING (Use the coupon code: “FILLIPO” for a -25% discount)

- THE5ERS