Hey traders,

Welcome to 2023… Pipsmanship will be used as one of my trading journals going forward.

The reason for this is to encourage traders to keep one for two major reasons:

- Track their weekly trading performance.

- Work on their trading technique and psychology

Both can only be done when you keep a comprehensive journal, and review it every week.

MONDAY 16/01/2023

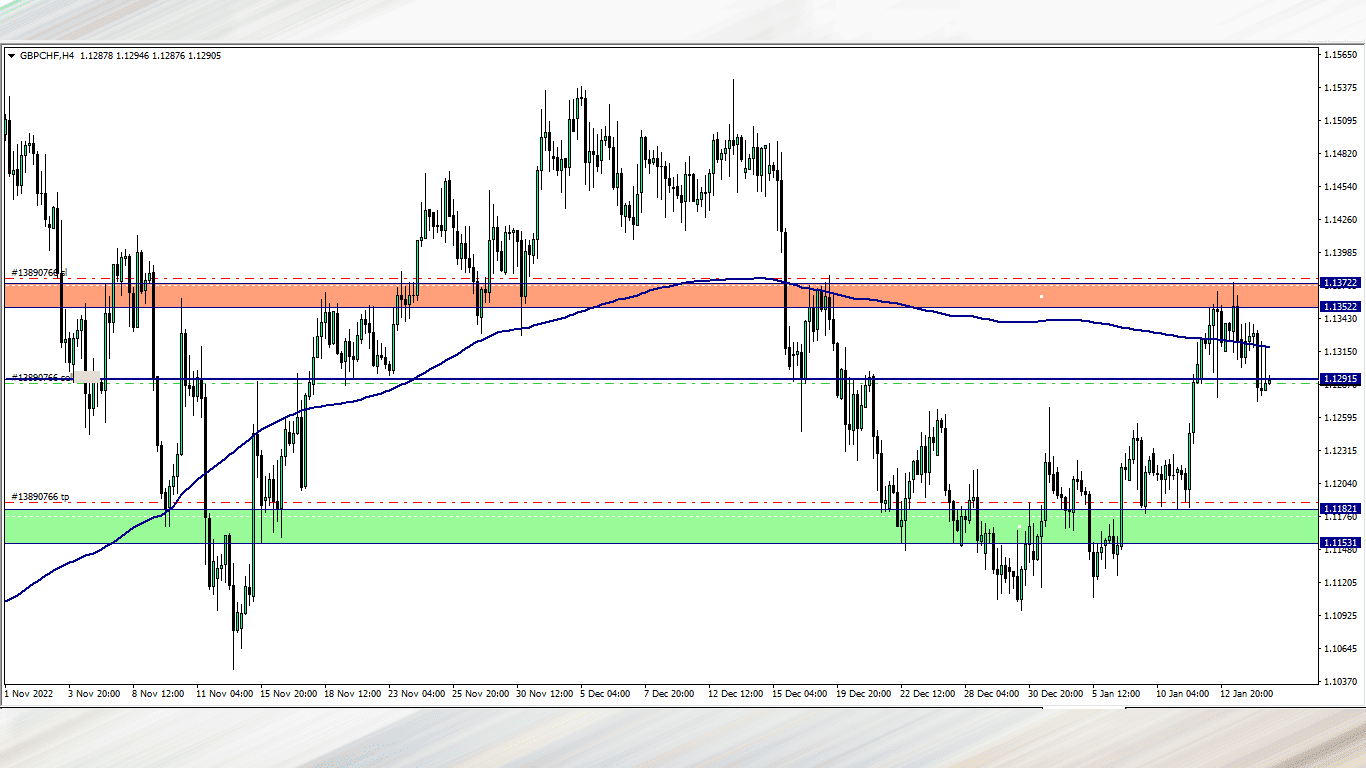

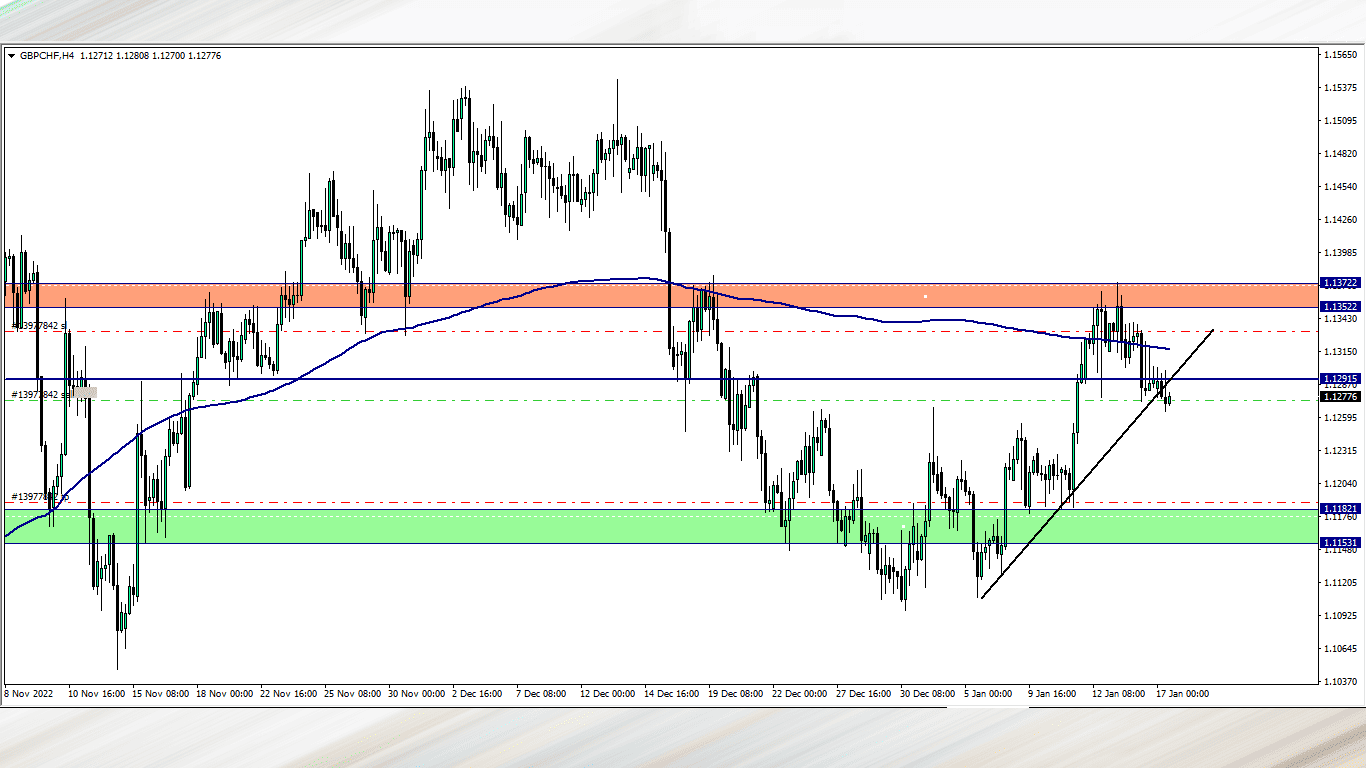

GBP/CHF (7.10 pm)

Reason for selling is because price has been rejected twice by 200 ma

Price broke a key support level

On the daily tf, we have price rejected a couple of time around the red zone

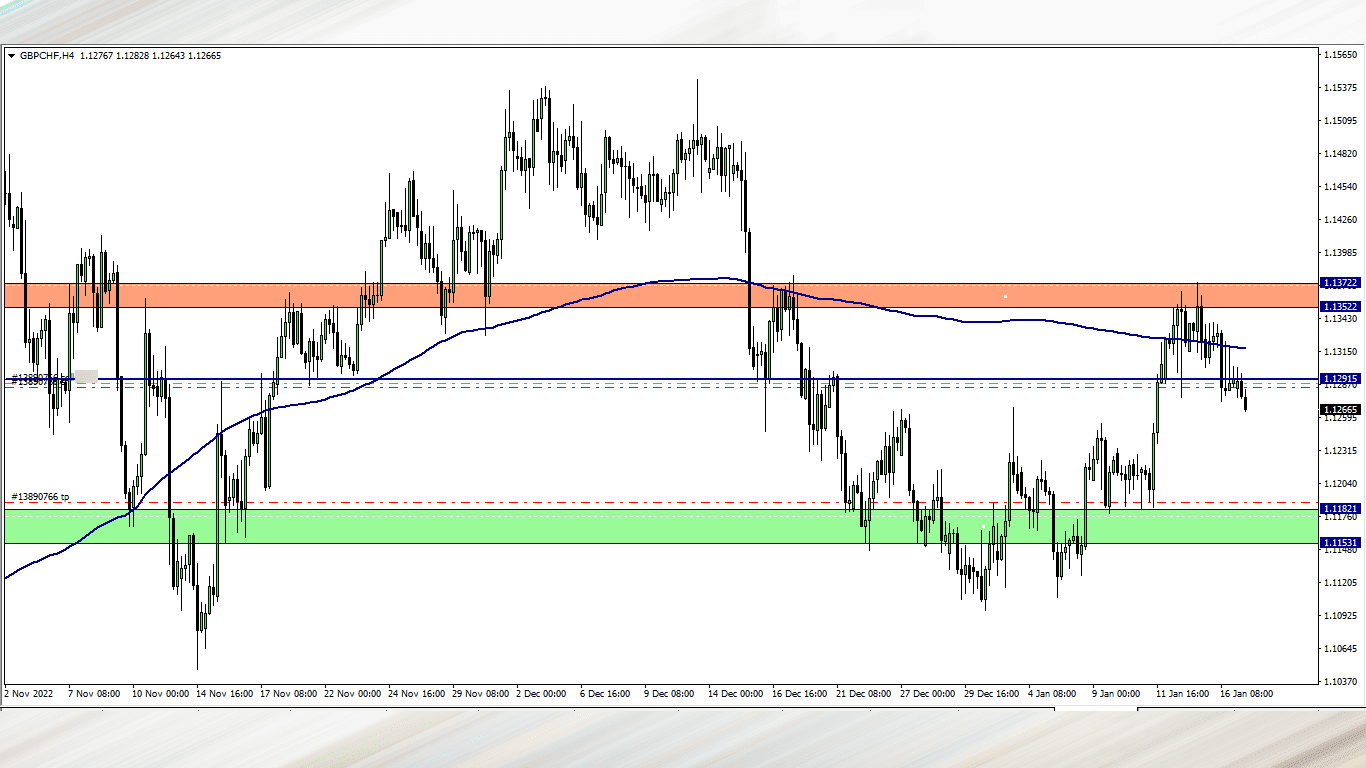

GBP/CHF UPDATE (7.45 am)

We are clearly in profits on the GBPCHF trade but I will be locking +3 pips because of the high impact GBP news coming up by 8am

GBP/CHF UPDATE (11 am)

Stop loss got hit, lost -56 pips

THURSDAY 19/01/2023

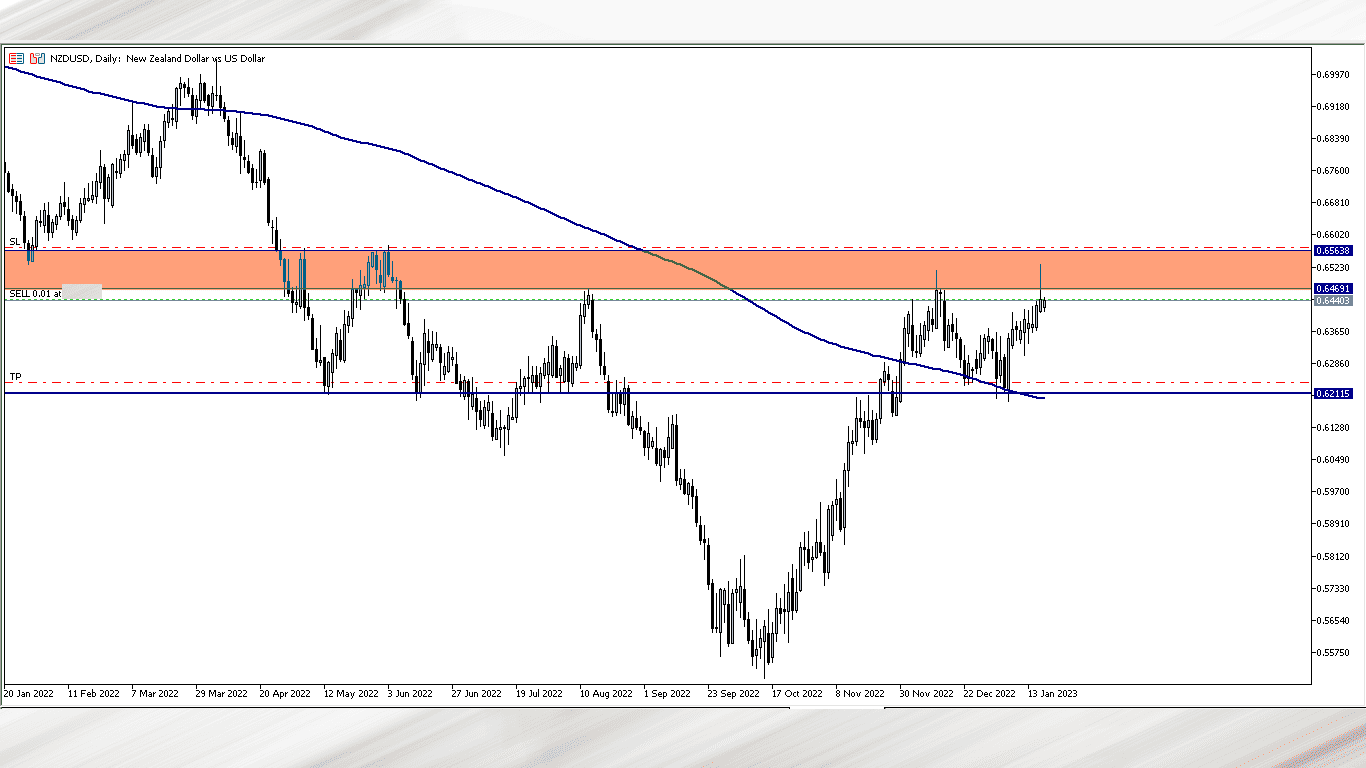

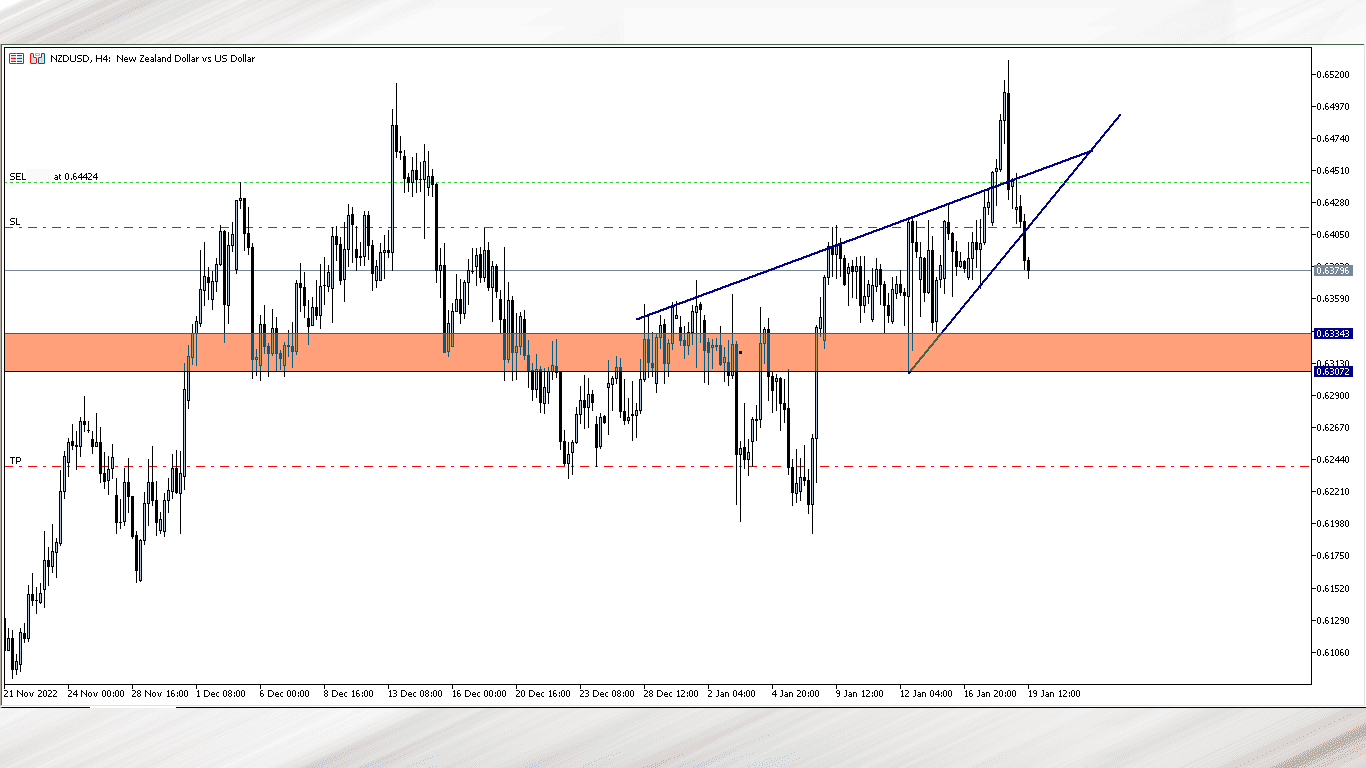

NZD/USD 12.30AM

The reason for me buying is based on our Thursday market analysis

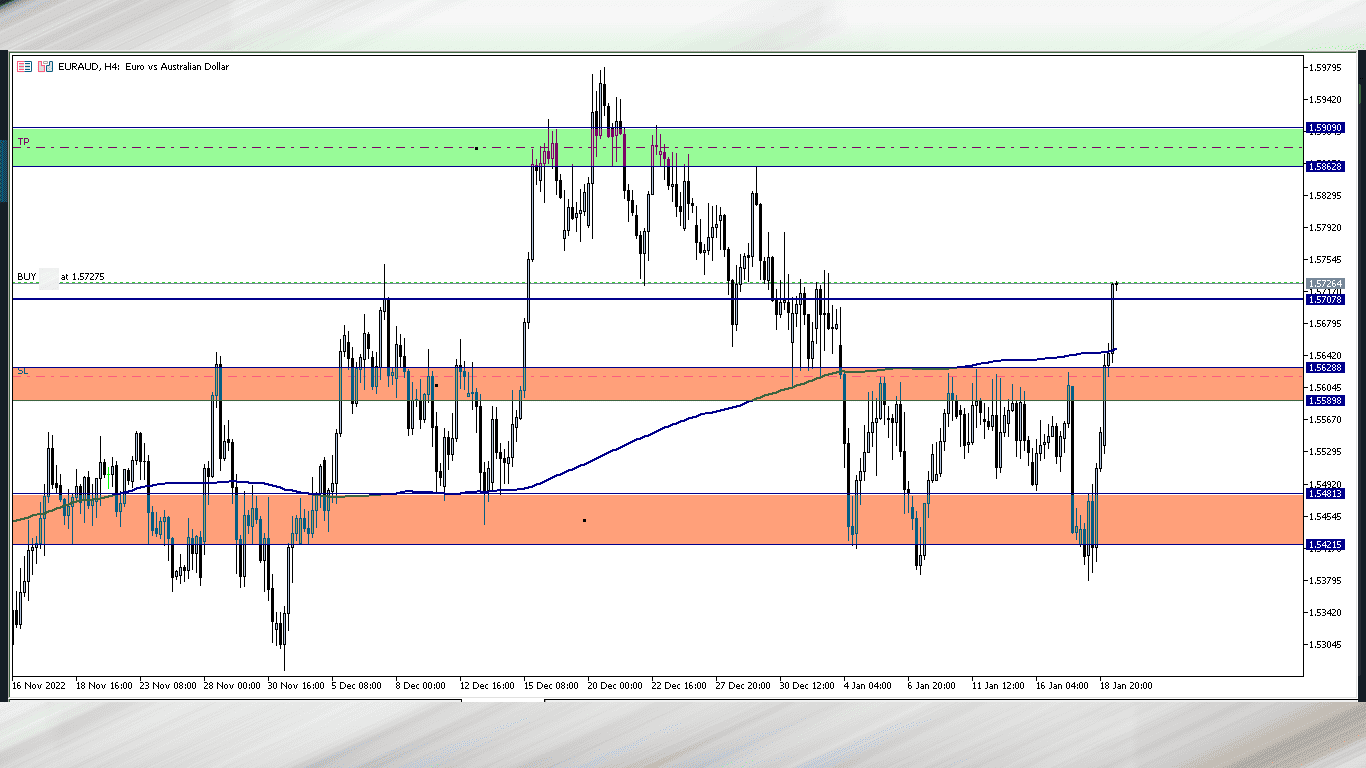

EUR/AUD 11.05am

Analysis:

A strong bullish candlestick breakout of resistance level 1.57058 and the 200 ma signifies that the bulls are currently on steroid. On the daily time frame the candlestick already looks over stretched, and its the reason for my huge stop loss (below the 200ma)

I am not planning to hold this trade for long, but if it presents an opportunity to, then we will

NZD/USD update (1.05 pm)

Locked +32 pips on the NZD/USD trade.

Reason: It’s Thursday, and already past mid day, I won’t want to carry a bad trade into Friday or next week, so I will be trailing profits and posting updates. The brown zone will be my first target profit where I may take profits

NZD/USD update (2.25 pm)

Trailing SL hit (+56 pips)

FRIDAY 19/01/2023

EUR/AUD Update (7.38am)

Closed manually with a -90 pips loss

Trade activity summary for the week

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST |

| MON (16/01/2023) | GBP/CHF | SELL | – 53 pips |

| THUS (19/01/2023) | NZD/USD | SELL | +56 pips |

| THUS (19/01/2023) | EUR/AUD | BUY | -90 pips |

| TOTAL | -87 pips |

In conclusion:

My only regret this week is that I should not have taken the EUR/AUD trade. The daily candlestick was already over extended as I rightly stated in the analysis, so there was no point taking it. The good part is that I exited manually so I closed this week with a little overall loss.

The GBP/CHF re-entry caused me a loss also but no regrets taking it because the coast was clear (no high impact news), and I followed standard re-entry procedures.

That’s it with my trading journal this week… Looking forward to next week

NOTE:

Hey traders,

If you are into trading for proprietary firm which I believe you should due to the huge advantages involved, look no further

You will enjoy a 5% discount if you buy any of their plan using my coupon code.

The funded trader needs no introduction, as they are currently becoming one of the most sorted proprietary firms in the industry due to their flexible challenge rules which consist of you being able to use an EA (expert advisory or trading robot) on one of their packages.

Also their packages are pretty affordable, which also comes with unlimited trials even if you fail to hit the set target within the 35 days period. If you are interested in getting a 5% discount upon purchase, hit THE FUNDED TRADER and use THE0CRAFTER as the coupon code