My reason for sharing my trade journal is to encourage traders to also keep one for two major reasons:

- Track weekly trading performance.

- Build a better psychology, which will sharpen your trading intuition

Both can only be done when you keep a comprehensive journal, and review it every week.

MONDAY 25/09/2023

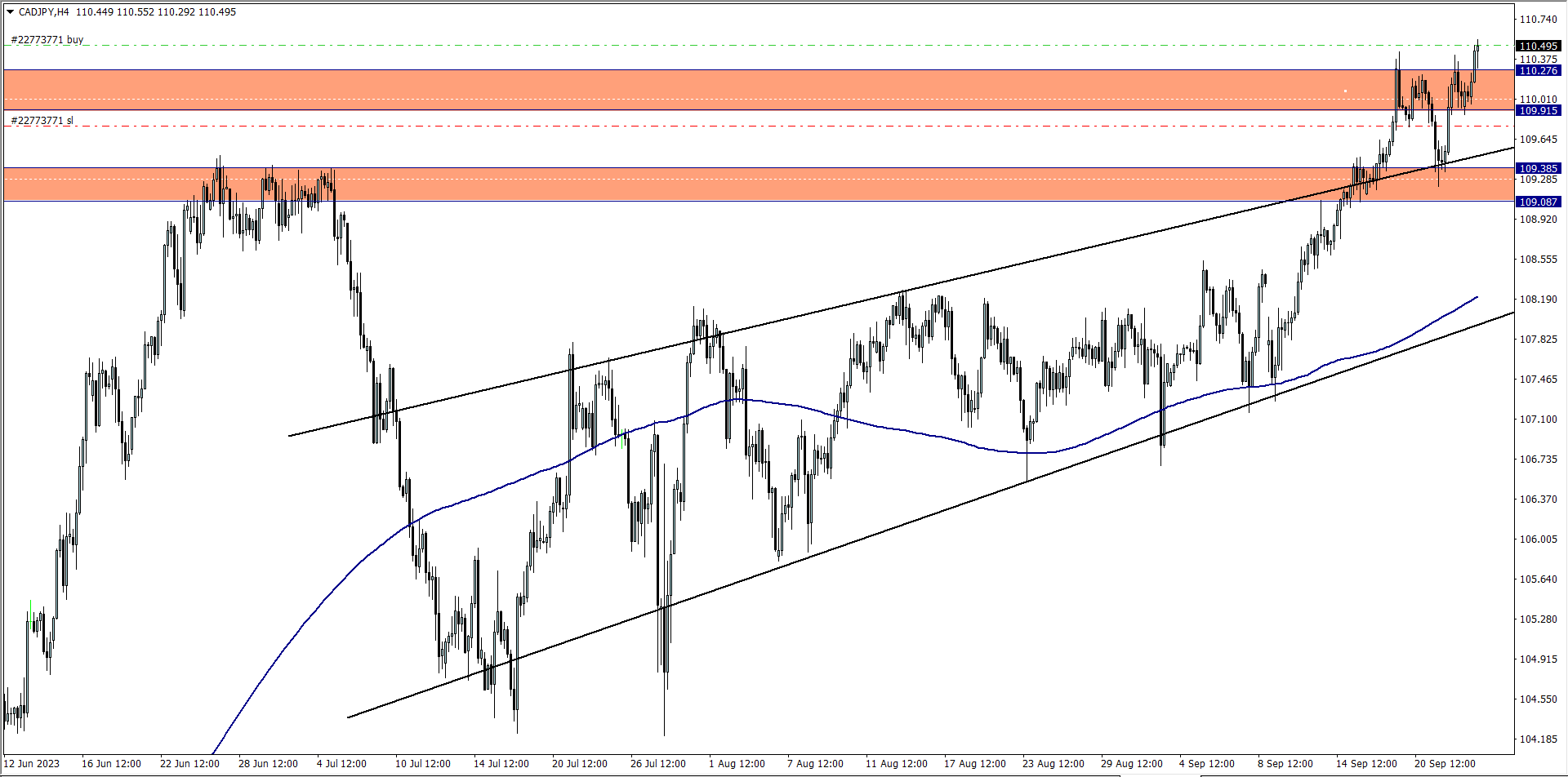

CAD/JPY (6pm)

Analysis: Bought CAD/JPY based on our Tuesday Market Analysis

TUESDAY 26/09/2023

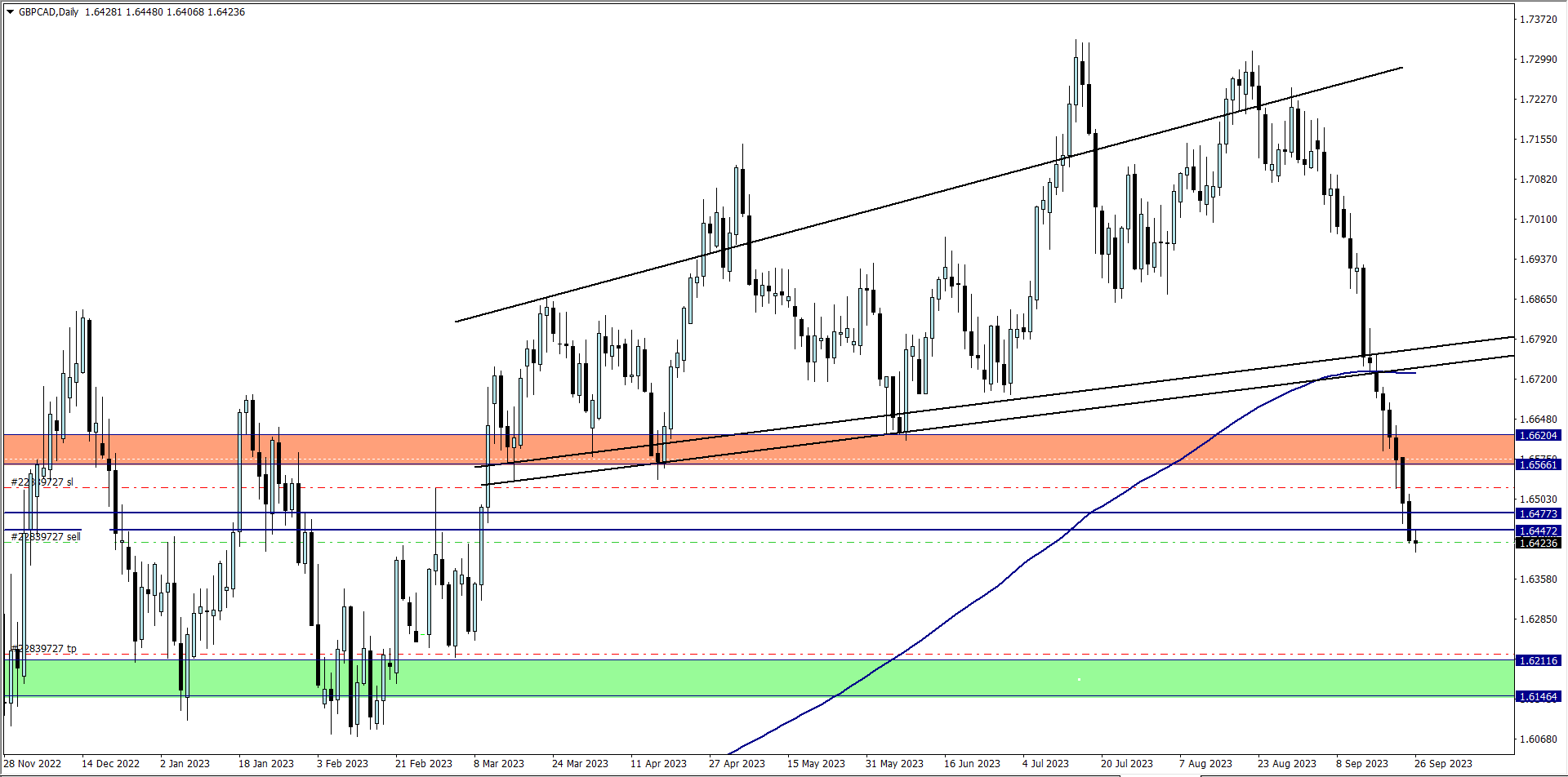

GBP/CAD (9am)

Analysis: I am selling this pair based on the analysis I shared on Weekly Market Analysis

THURSDAY 28/09/2023

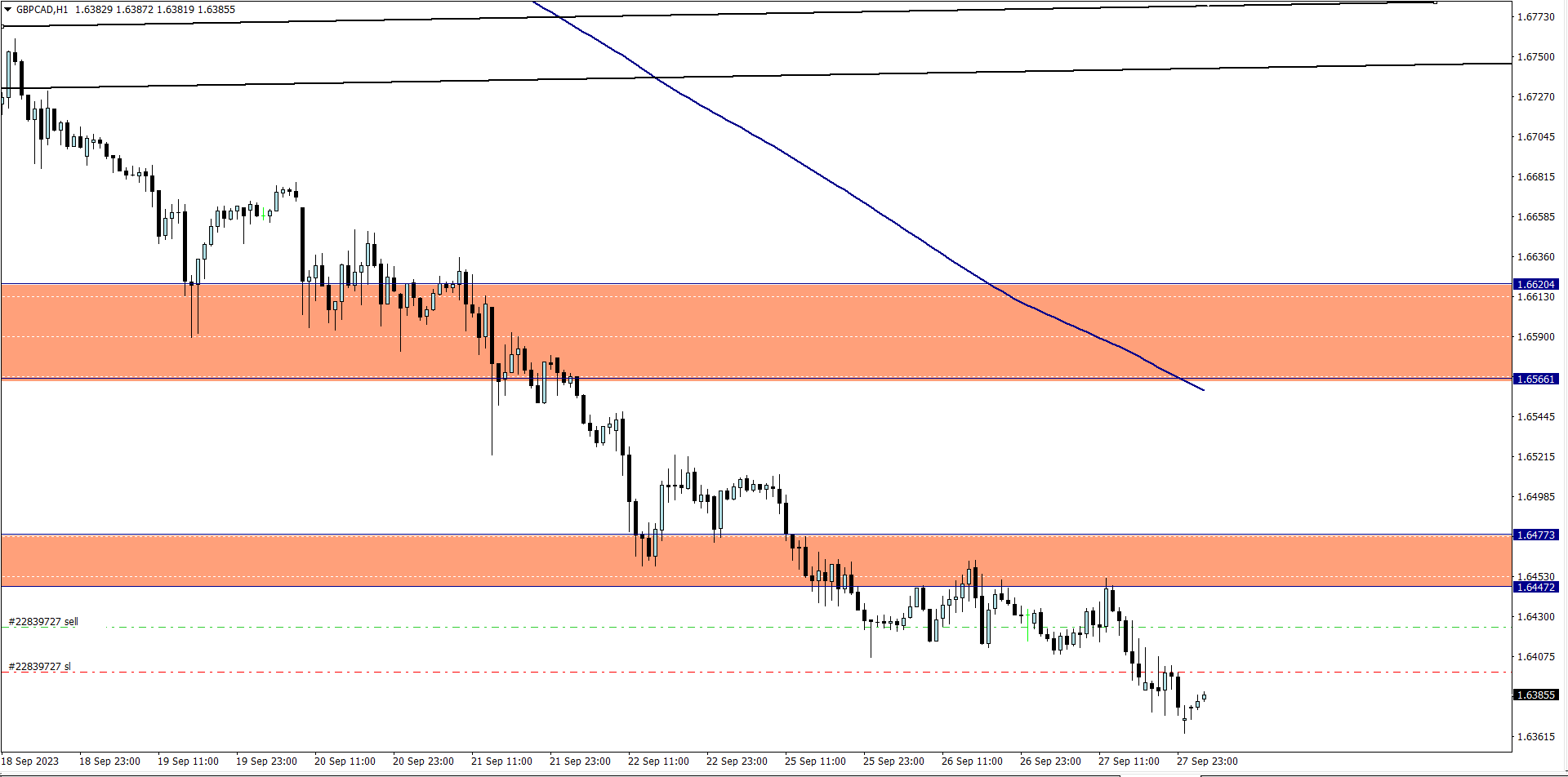

GBP/CAD Update (9am)

Analysis: I engaged my trailing SL and manually closed this trade with +45 pips

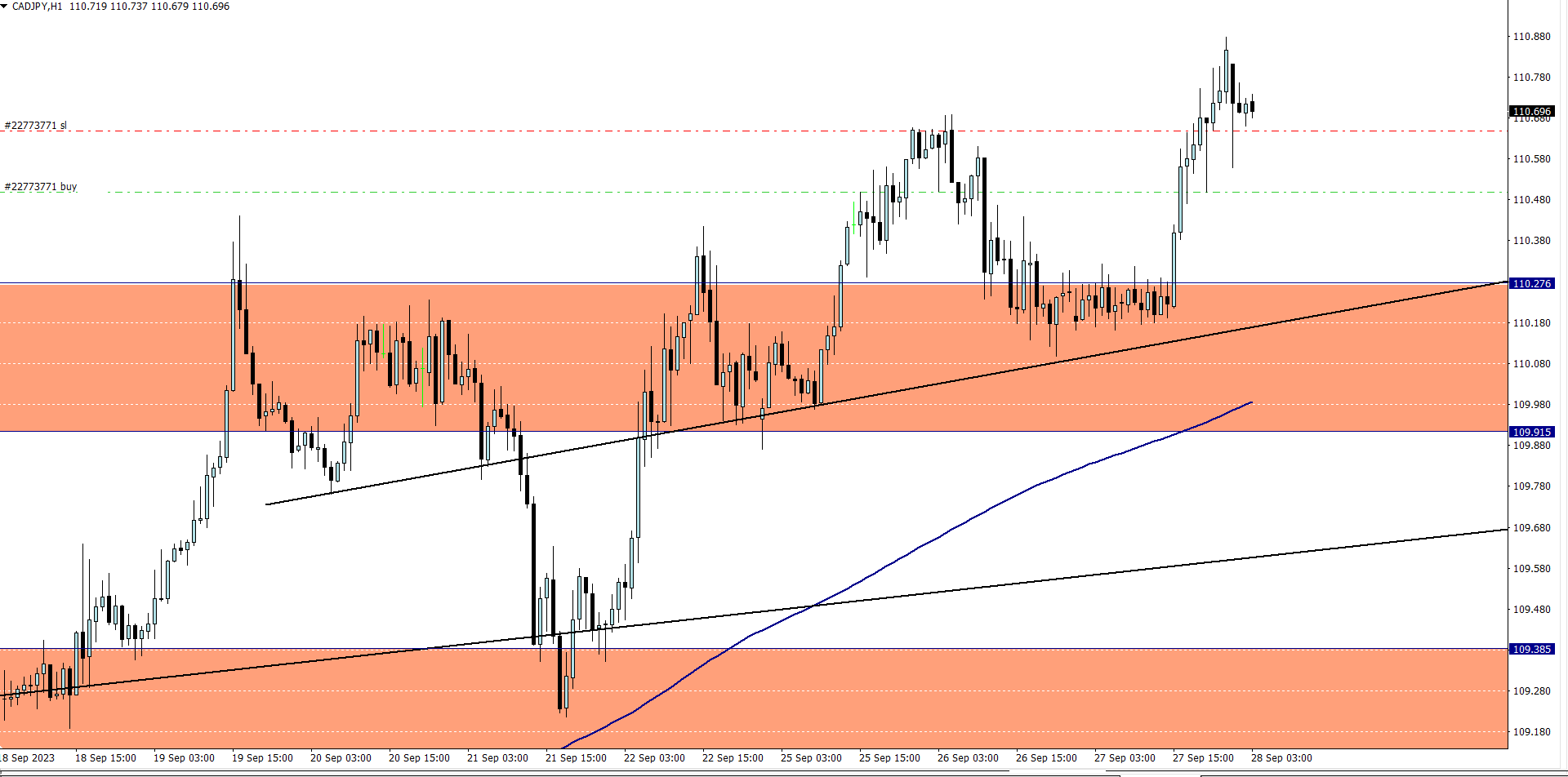

CAD/JPY Update (9am)

Analysis: I engaged my trailing SL and manually closed this trade with +16 pips

FRIDAY 29/09/2023

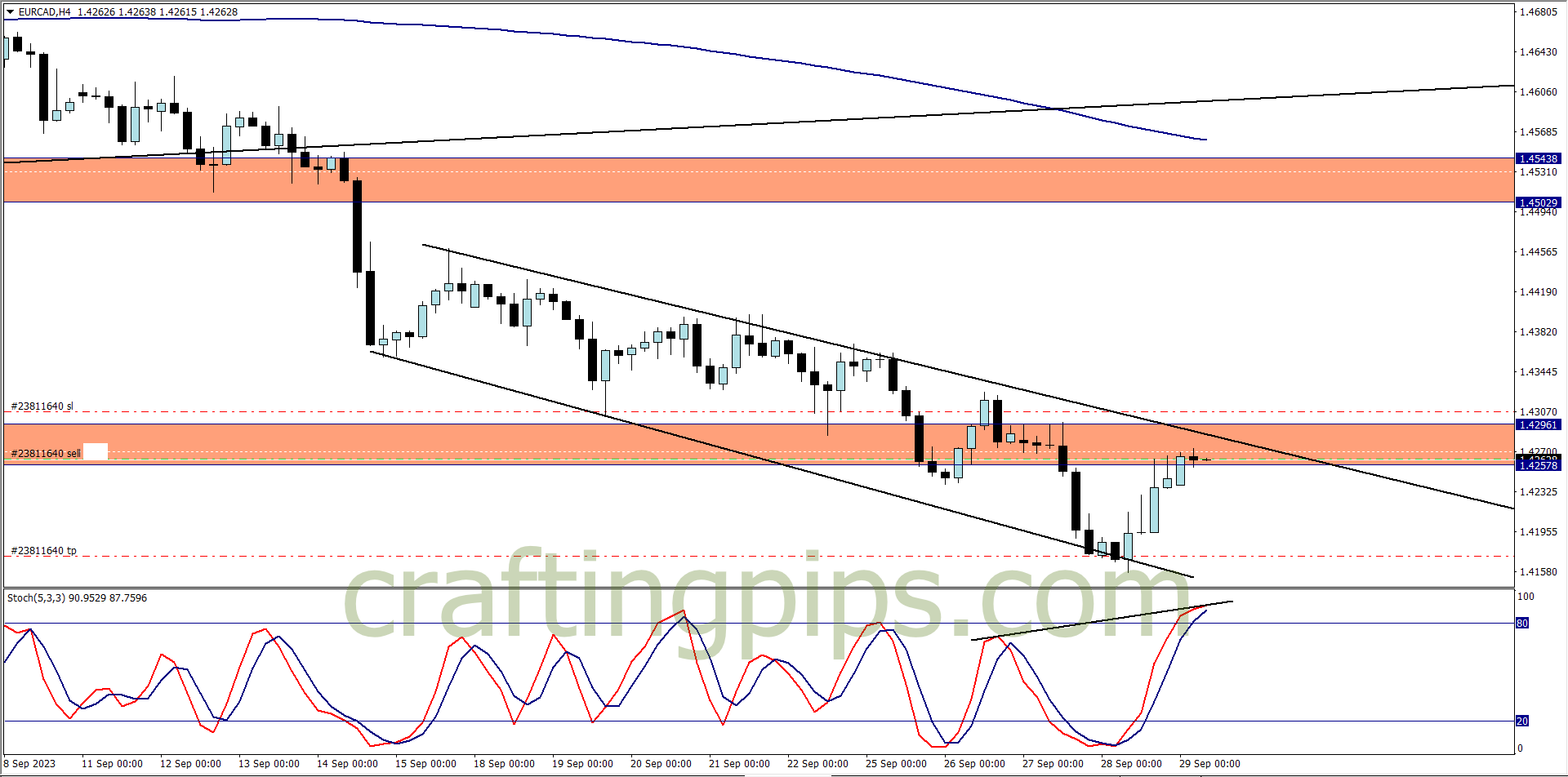

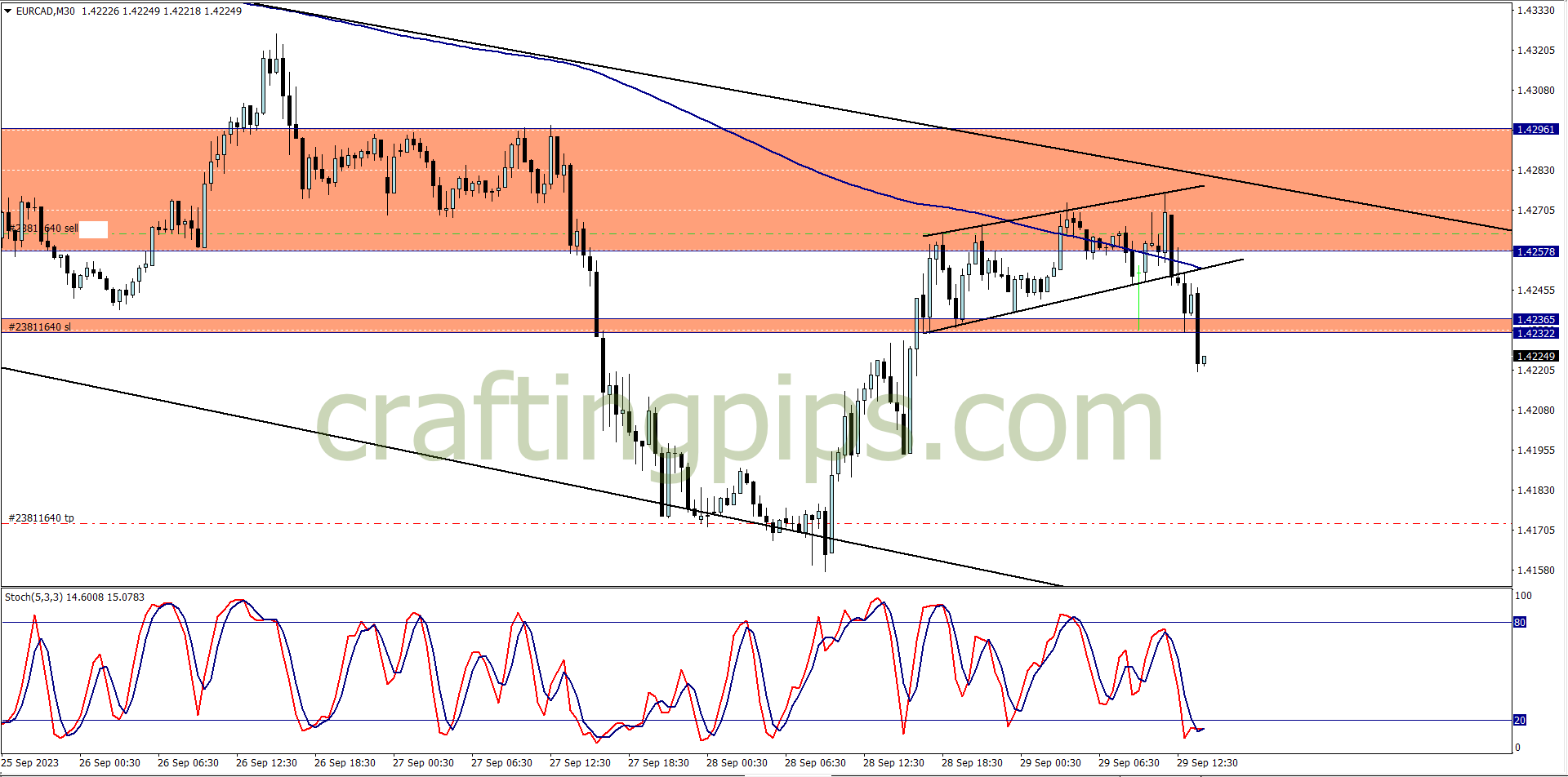

EUR/CAD (6am)

Analysis: Hidden bullish divergence spotted on the EUR/CAD, and though I do not trade most Friday’s, I have decided to break that little rule today.

EUR/CAD update (12.55 pm)

Analysis: Trailing SL activated and closed this trade with +30 pips

Trade activity summary for the week

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST |

| MON (25/09/2023) | CAD/JPY | BUY | + 16 pips |

| TUE (26/09/2023) | GBP/CAD | SELL | + 45 pips |

| FRI (29/09/2023) | EUR/CAD | SELL | + 30 pips |

| TOTAL | + 91 pips |

In conclusion:

This week I had no trade hit my target profit. All were closed manually using my “setup expiration” concept.

If I had not used the setup expiration concept, guess what would have happened?

ALL my trades would have hit stop loss.

Mind you, this technique does not necessarily mean that:

You exiting trades that have expired DOES NOT necessarily mean that some trades won’t hit your supposed TP in some cases. It just means that:

If you sample a hundred random trades you exited using this technique, you will notice that, you saved time, money, and all the emotional roller coaster associated with you holding on to a stubborn trade

I closed this week with +1.5% ROI. Not bad for a week that no trade hit TP

Trade activity summary for the month of September

| 1st TRADING WEEK |

|

|||

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST | |

| MON (04/09/2023) | EUR/JPY | BUY | – 68 pips | |

| TUE (05/09/2023) | EUR/USD | SELL | + 6 pips | |

| WED (06/09/2023) | NZD/USD | SELL | Pending | |

| GBP/CAD | SELL | + 38 pips | ||

| TOTAL | – 24 PIPS | |||

| 2nd TRADING WEEK | ||||

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST | |

| MON (11/09/2023) | GBP/CAD | SELL | +50 pips | |

| TUE (12/09/2023) | NZD/USD | SELL | -12 pips | |

| THUS (14/09/2023) | CAD/JPY | BUY | Breakeven | |

| GBP/CAD | BUY | +32 pips | ||

| FRI (15/09/2023) | GOLD | SELL | – 57 pips | |

| TOTAL | +13 pips | |||

| 3rd TRADING WEEK | ||||

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST | |

| MON (18/09/2023) | CAD/JPY | BUY | + 29 pips | |

| TUE (19/09/2023) | USD/JPY | BUY | – 40 pips | |

| THUS (21/09/2023) | AUD/JPY | BUY | +55 pips | |

| TOTAL | +44 pips | |||

| 4th TRADING WEEK | ||||

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST | |

| MON (25/09/2023) | CAD/JPY | BUY | + 16 pips | |

| TUE (26/09/2023) | GBP/CAD | SELL | + 45 pips | |

| FRI (29/09/2023) | EUR/CAD | SELL | + 30 pips | |

| TOTAL | + 91 pips | |||

| GRAND | TOTAL | + 124 pips |

Note: I closed the month of September with about +2.9% ROI. With a fairly decent month of one bad trading week and 3 profitable weeks

3rd QUARTER RESULTS

| JULY | PIPS MADE/LOST |

| Total Pips won | +397 pips |

| AUGUST | PIPS MADE/LOST |

| Total Pips lost | – 148 pips |

| SEPTEMBER | PIPS MADE/LOST |

| Total Pips lost | + 124 pips |

| Q3 GRAND TOTAL | +516 PIPS |

In conclusion:

The month of August was the most challenging month for me. I closed the month in negative pips, but still managed to squeeze out lil profits.

I managed to close the most difficult quarter of the year with almost +6% ROI. I am looking forward to profitable 4th quarter

How did 3rd quarter go for you?

NOTE:

-

THE FUNDED TRADER: (Use the coupon code: THE0CRAFTER)

- BESPOKE FUNDING PROGRAMME

- FUNDED ENGINEER

- BLUE GUARDIAN (Use the coupon code: CRAFTER)

- GOAT FUNDED

- LARK FUNDING

- SKILLED FUNDED TRADER

- MAVEN TRADING

- MY FLASH FUNDING (Use the coupon code: “FILLIPO” for a -25% discount)

- THE5ERS