My reason for keeping a journal is to encourage traders to also keep one for two major reasons:

- Track weekly trading performance.

- have enough data, in order to be able to work on their trading technique and psychology

Both can only be done when you keep a comprehensive journal, and review it every week.

MONDAY 31/07/2023

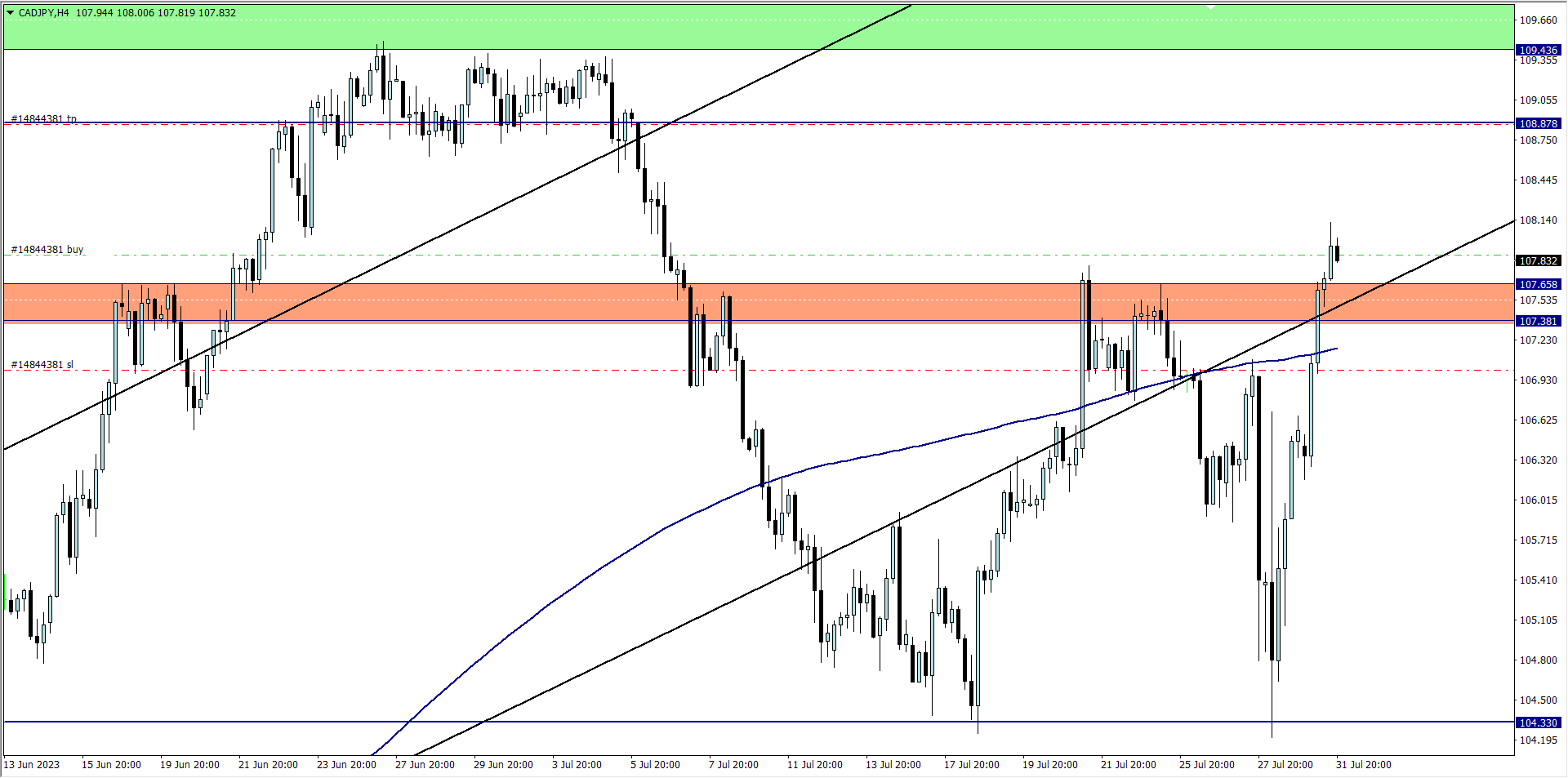

CAD/JPY (9.35 pm)

Analysis: CAD/JPY setup was inspired from our Weekly Market Analysis

WEDNESDAY 02/08/2023

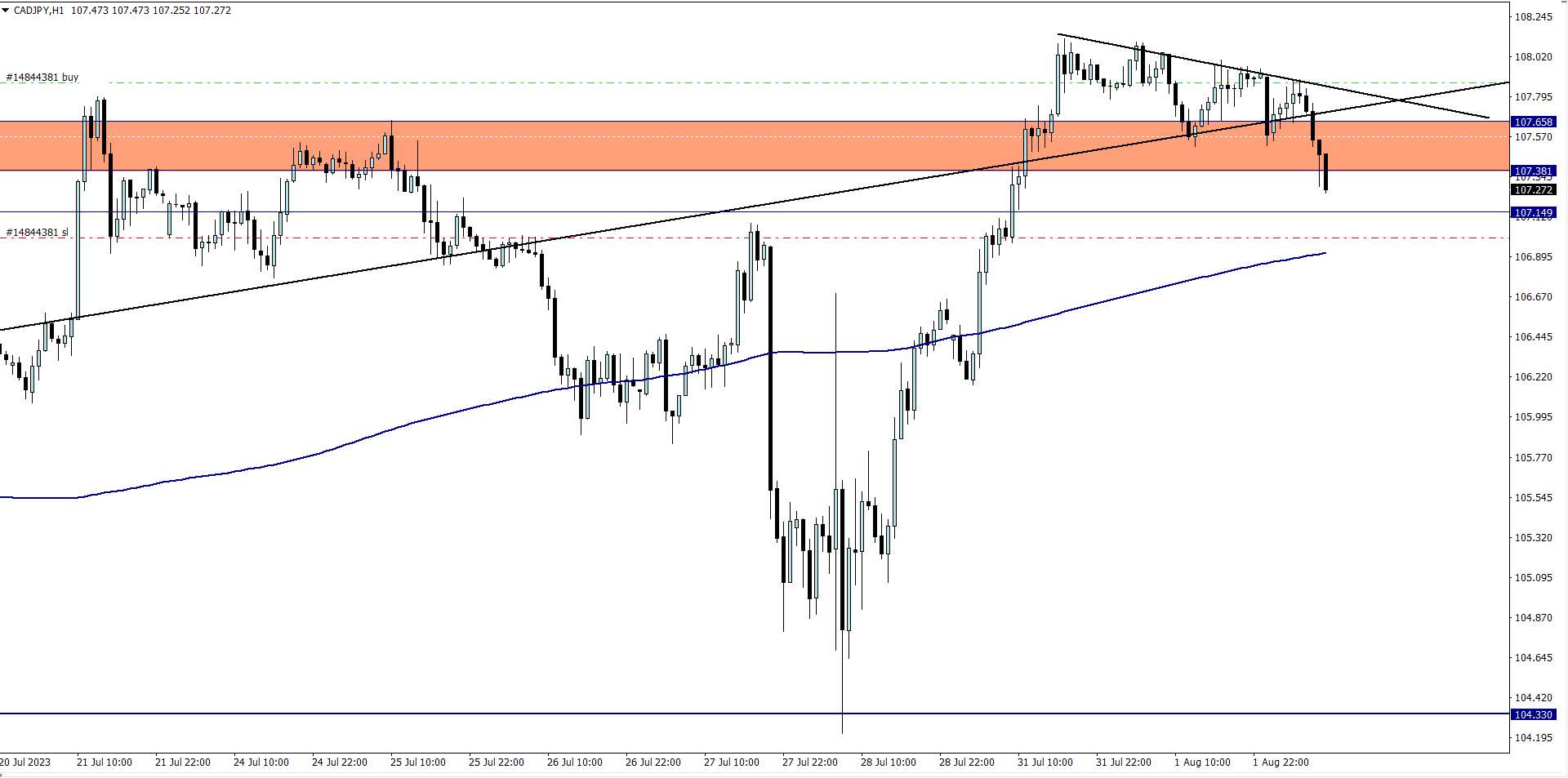

CAD/JPY (7.30 am)

Analysis: I lost -70 pips on this trade, and it was due to negligence on my part, which I will explain in the conclusion of this trade journal

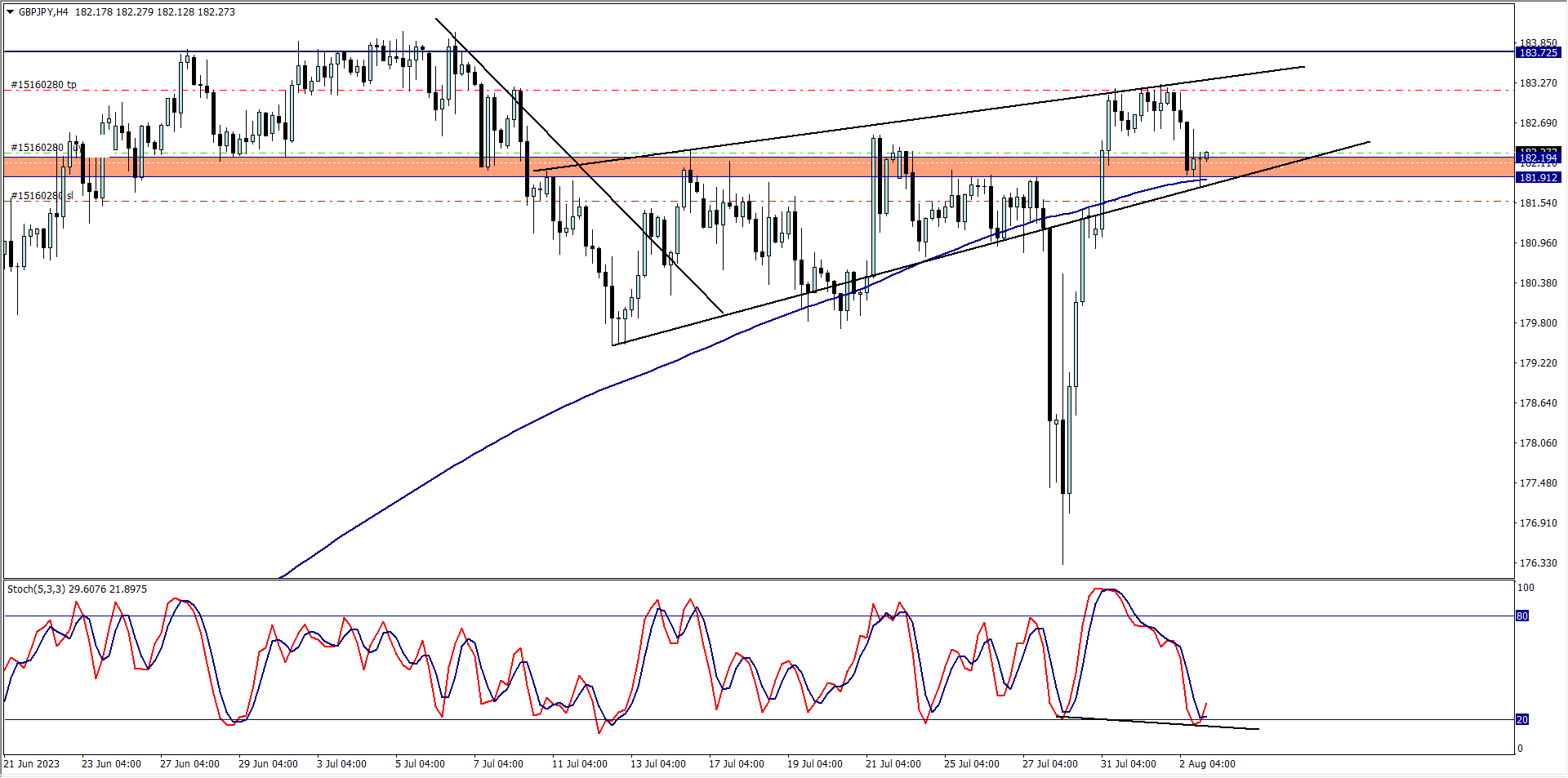

GBP/JPY (6.35 pm)

Analysis: GBP/JPY setup was inspired from our Thursday Market Analysis

THURSDAY 03/08/2023

GBP/JPY Update (6.35 am)

Analysis: I locked +24 pips, and closed with it

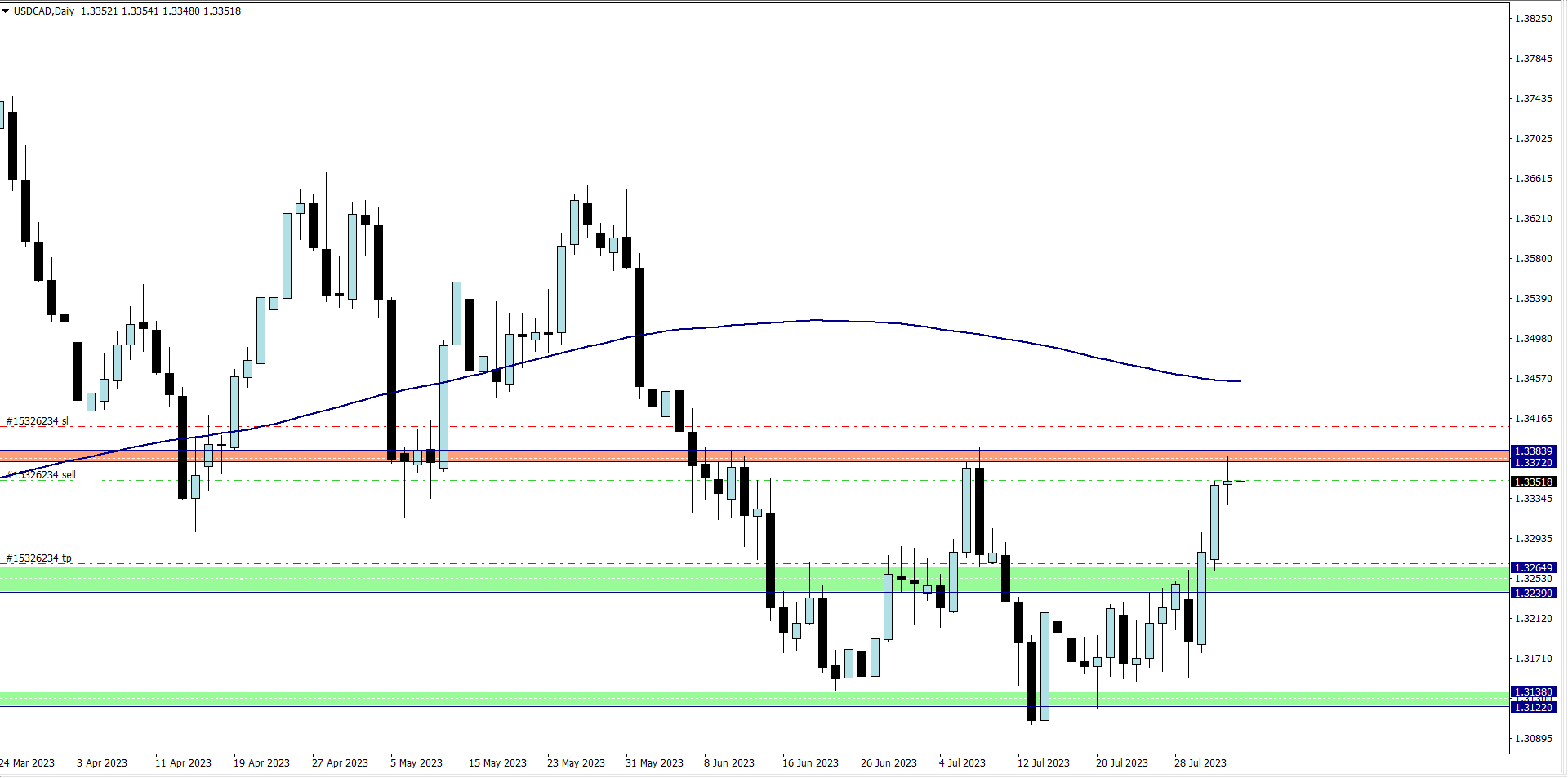

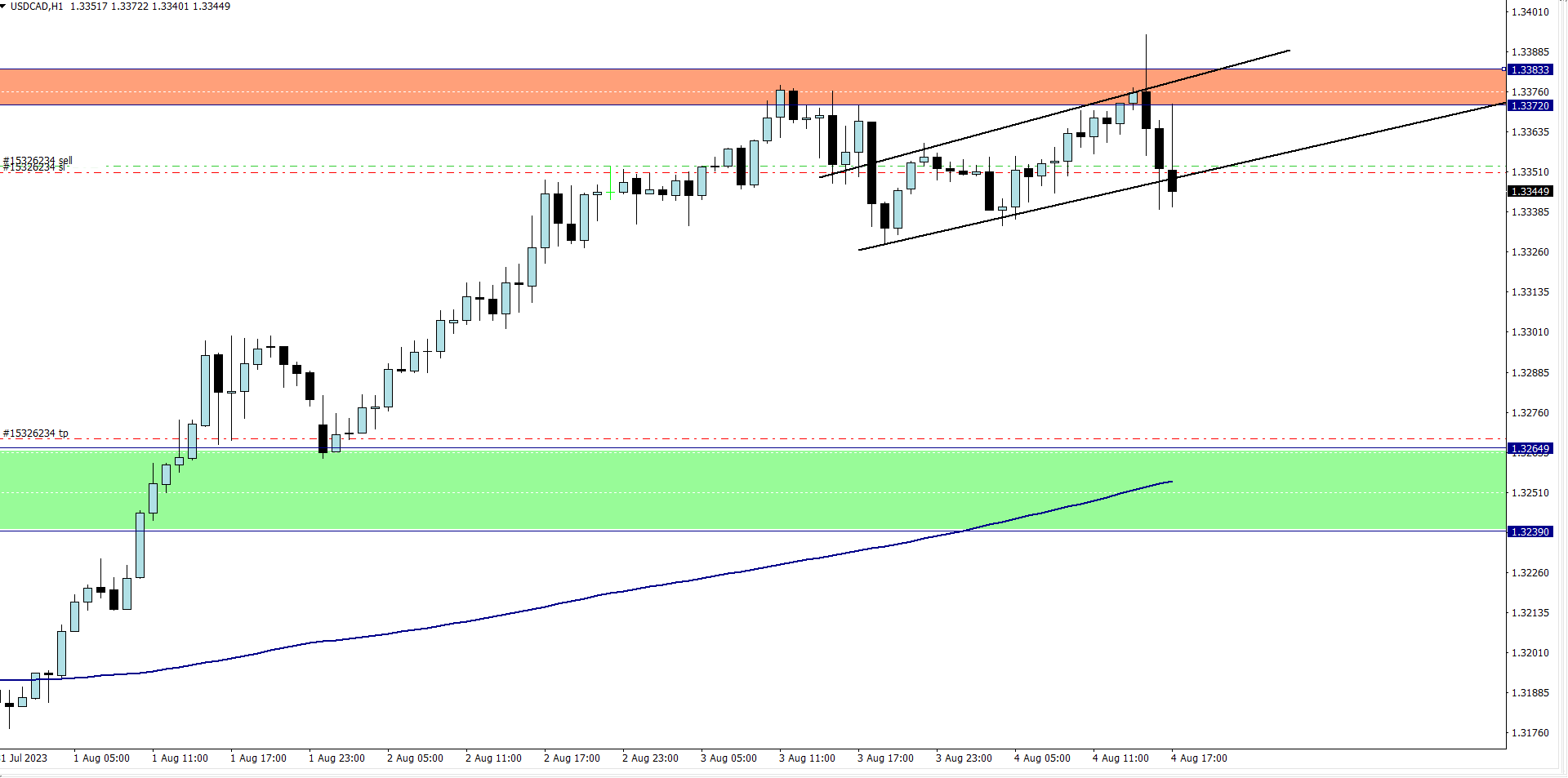

USD/CAD (10.30 pm)

Analysis: USD/CAD setup was inspired from our Friday Market Analysis

FRIDAY 04/08/2023

Analysis: Closed at breakeven

Trade activity summary for the week

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST |

| MON (31/07/2023) | CAD/JPY | BUY | – 70 pips |

| WED (02/08/2023) | GBP/JPY | BUY | +24 pips |

| THUS (03/08/2023) | USD/CAD | SELL | Breakeven |

| TOTAL | -46 pips |

In conclusion:

This week, I took 3 trades which I managed differently.

The least impressive trade was the CAD/JPY, and this has nothing to do with it not going my way, but everything to do with me holding tenaciously to it even after the trade had gone beyond its shelf life, and also giving us a reversal chart pattern formation (forming lower highs after the breakout). If I had cut my loss earlier, I would have closed the trade with less than -15 pips loss

The GBP/JPY trade was perfectly timed. It surpassing it’s shelf life, and the consolidation formed, already gave me an insight to a possible reversal, so I locked profits, and price fully reversed

The USD/CAD trade was an out of character trade. Why do I say so?

Well, I do not hold trades through high impact news, but on this one, I did, and also gave a generous stop loss. The large stop loss saved me from taking a loss, but I closed with breakeven, after price reversed and I engaged my trailing stop loss.

Two major reason why I held on to USD/CAD was because:

- My risk was low (my Friday trades and very conservative)

- My stop loss was generous

- I planned on closing the loss gap on CAD/JPY trade

Overall, I would rate myself 100% on execution, 100% on money management and 50% on trade management. Although I lost a total of -0.4% of my trade capital, I could have done better on managing the CAD/JPY loss

That said, I am hoping next week bring better setups

NOTE:

-

THE FUNDED TRADER: https://dashboard.thefundedtraderprogram.com/purchasechallenge-n/?sl=3322 (use the coupon code: THE0CRAFTER)

-

MY FUNDED FX: https://myfundedfx.tech/purchasechallenge/?sl=758

- BESPOKE FUNDING PROGRAMME: https://www.bespokefundingprogram.com/The_Crafter?ref=The_Crafter