On social media today, I can pick twenty scalpers showing off their skills, yet struggle to find just one swing trader.

Do you ever ask why?

Let me tell you why.

Scalping or day trading looks more marketable when compared to a trader who struggles to show you just one or two trades he has taken the entire week.

While the marketability of high-frequency trading has never been in doubt, the struggles most traders undergo trying to become like one of these social media gurus is far worse than having lime or bitter leaf juice for breakfast

I am not here to market swing trading to you, but to remind of you of the benefits of swing trading, just in case you have forgotten

1. TIME

Aside from the monetary gains, another reason why most people get lured into the world of trading is because you are the master of your time.

Meaning you have the privilege to hold a trade for days and sometimes you could also stay away from the market for days/weeks, because your setups are not ready to trade.

While most traders may frown at being less active in the market, they forget the potentials of having spare time each day.

Being a swing trader (the trader who holds trades for more than a day) gives you time to pursue other interests or hobbies.

Some swing traders have multiple streams of income that is not related to trading, and even if they told you they traded you will find it hard to believe because they enjoy the free time created by being a swing trader

Being a scalper may seem cool, especially after binge-watching other gurus online, posting mind-blowing profits, but soon you will begin to suffer burnout in your trading career, and what you seem to love will gradually begin to feel like the 9 – 5 job you thought you escaped.

Now your only excuse to become a high-frequency trader is:

You believe that scalpers or day traders make more money than swing traders. Your reason for this is because high-frequency traders enjoy more setups than swing traders

Isn’t it?

I will explain further using the 1-hour time frame (which could be used when day trading) and the 4-hour time frame (which is used by swing traders)

2. FREQUENCY Vs PROFITABILITY

One question that will continue to cause endless wars amongst traders probably till the end of time would be:

“Does the frequency of times you trade the market equal profitability“?

Most new traders and some intermediate traders strongly believe that being a scalper or an intraday trader automatically makes you financially better than a swing or position trader.

Why not?…

However, upon close scrutiny, this question is no different from questions like:

If there was a duel between Spiderman and Batman, who would be the last man standing?

In trading, such comparisons are a lot more tricky to answer, and the answer also depends on so many factors which will be discussed extensively some other time.

But to settle the argument of why high-frequency trading does not necessarily equate to more profitability, and what you are missing out on when you frequently engage the market.

I will use a trading system to buttress my point, and in this example, I will be using the 1 and 4-hour time frames. My reason for this is that:

Some day traders do use the 1-hour time frame, and some swing traders use the 4-hour time frame to trade. The only difference is that the day traders close their trades within 24 hours, while the swing trader could hold their trade for days.

So let’s head to the lad.

Trading system:

It comprises of 3 moving averages:

- 9 moving average

- 21 moving average

- 200 moving average

How it works:

The 200 MA

Basically, we will use the 200 ma to judge if the market is bullish or bearish.

If price is below the 200 MA, then all we will be looking out for is bearish signals

If price is above the 200 MA, then all we will be looking out for is bullish signals

The 9 & 21 MA

Bearish entry: If the 9 MA crosses the 21 moving average from the top, then it’s a sell signal

Bullish entry: If the 9 MA crosses the 21 moving average from below, then it’s a sell signal

Placing stop losses

There are two different ways of placing your stop loss when using this trading system:

1st method: After taking a bullish or bearish trade, you can place your stop loss below the last swing low or swing high (which is what we will use in our tests)

2nd method: After taking a bullish or bearish trade, you can place your stop loss below the last hump created by the 9 and 21 moving average.

Take profits

There are two different ways of taking profits when using this trading system:

1st method: You either wait for both moving averages (9 & 21) cross in the opposite direction (which is what we will use in our tests) or

2nd method: You use price structure to close trades. Meaning key support or resistance levels will be your target profits

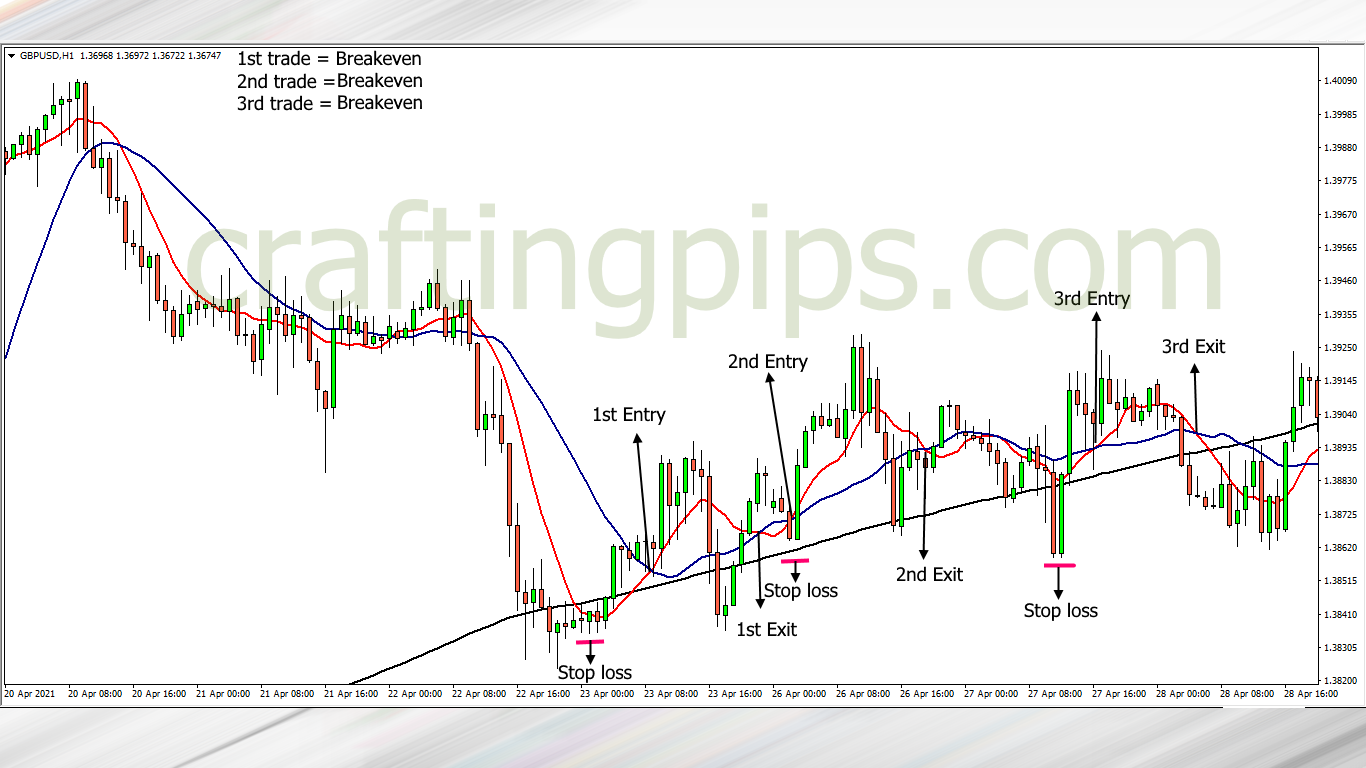

1- hour time frame test

The first week in the market using the 1- hour time frame, we can see 3 breakeven trades, and the market was choppy, so all the hassles trading the GBP/USD proved futile

The second week was filled with invalid entries, hence no trades

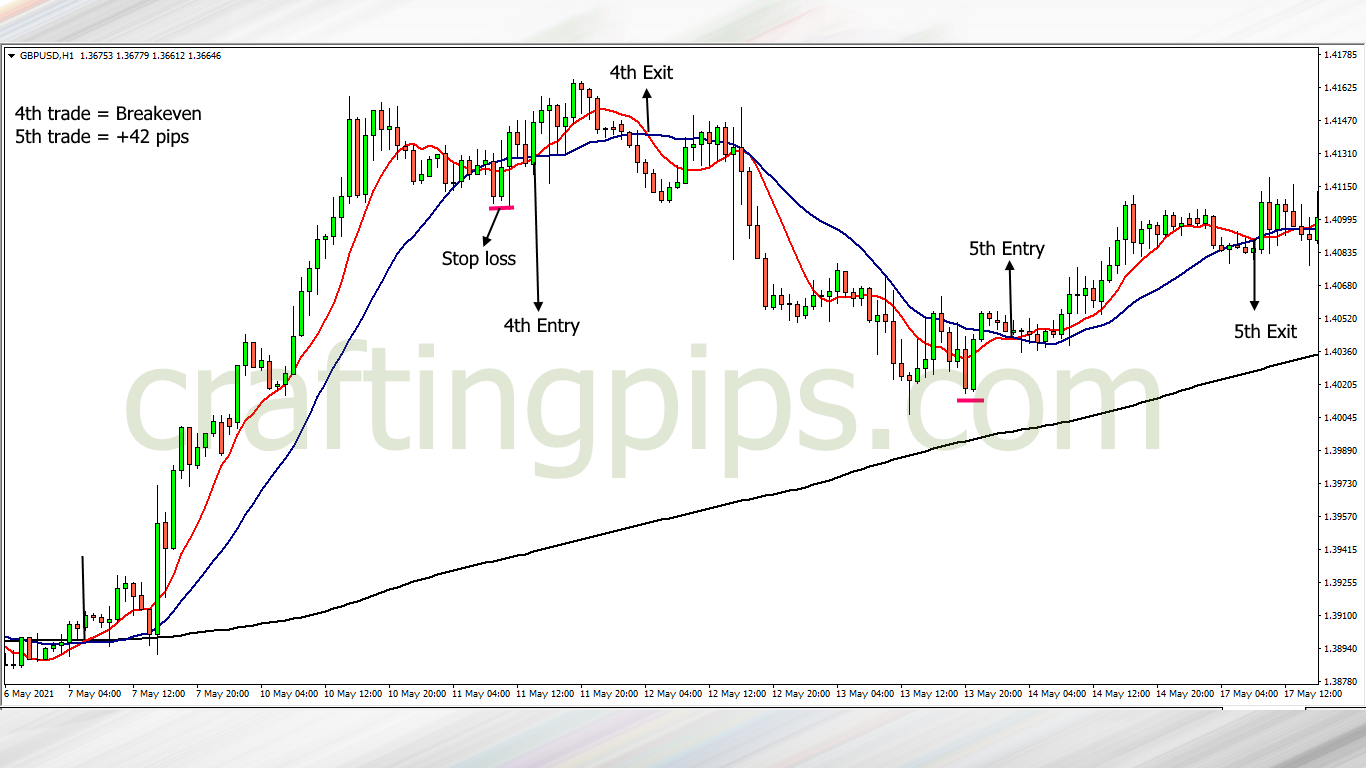

On the third week we can see that only one trade went our way, the other was a breakeven

The fourth week was where the magic happened. There were three good trades and we closed a one month trading period with +187 pips profit.

Analysis of what went down on the 1 hour time frame

- A total of 8 trades were taken within a one month trading period using the 1 hour time frame

- The first week was a waste of time trading because our entire trades taken hit breakeven

- Our second was filled with inactivity in the market as all trades given were invalid

- On our third week we can see that just one trade earned us pips, the other trade closed as breakeven

- The last week was where the magic happened. All three trades made us pips

Conclusion

The third and fourth week were the only productive weeks in a span of 4 trading weeks. The first two weeks was a waste of time and effort which could have been spent doing something productive else where

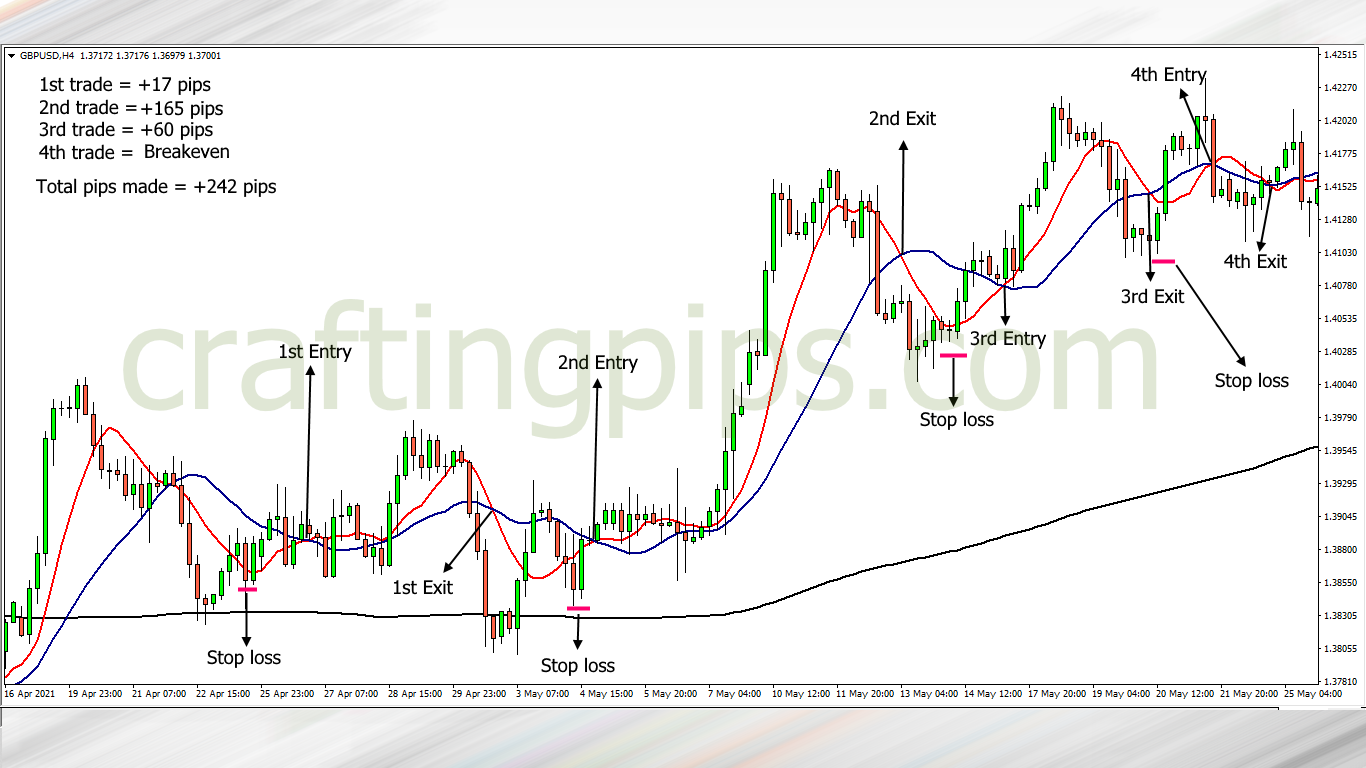

4- hour time frame test

On the 4-hour time frame you can see that we used the same month that was used on the 1 hour time frame, and the results speek for themselves.

Analysis of what went down on the 4 hour time frame

- A total of four trades were taken in an entire 4 weeks trading period on the 4 hour time frame

- Each week was profitable apart from the last week which closed with a breakeven

Conclusion

If a trader placed just 4 trades in an entire month trading the GBP/USD, it means he enjoyed more productive time working on other projects or simply studying other pairs.

Such a trader will also enjoy less mental stress trying to monitor setups in the market.

Note

So you would agree with me that:

Higher frequency trading has got nothing on being more profitable than another trader who engages the market at a lower frequency.

If you notice, there was a whooping +55 pips difference between both time frames, which further gives credance to trading less is actually more.

3. ATARAXIA

Most high frequency traders suffer mood swings all through the day. It amuses me sometimes when I think of how a scalper’s daily P&L is directly proportional to their mood.

It’s not easy taking 10 to 100 trades every single day and not feel the pressure.

There are very few traders who won’t crack under such circumstances. Not forgetting that In the midst of all the chaos the market presents daily to scalpers, a trader also has his personal life and issues to deal with.

The most under rated trading tool every trader needs to perform optimally is: “THE MIND”

For the mind to function optimally when trading the market, the mind has to be in a calm state, traquility, or in other words ataraxia.

Trading the larger time frames does not mean you won’t suffer losses, and it certainly does not mean you won’t get bothered by losing streaks.

It only means that:

Because you have fewer setups to trade in an entire month, there is a guarantee that when you return to the market to trade after a previous day/week’s loss, you are less likely to commit to errors due to your emotions.

In conclusion:

How you choose to trade the market and the effect it has on you as a trader is purely a personal experience.

There are traders who can stare at the screen for days and still trade optimally. Their emotions are almost always in tact and they do well as scalpers. But again, such traders are fewer in numbers compared to what the social media shows.

So my advice is:

Just like the famous inscription over the entrance to the temple of the oracle at Delphi which states:

“KNOW THYSELF“

If you are a trader who has a short attention span or easily gets emotional after a few wins or losses in the market, it is better you stick to the larger time frames.

On the contrary, if you have the emotional fortitude to withstand the baggage of being a high-frequency trader, then you can stick to it

Nothing is cast on stone my friends.

If you are interested in joining our FREE trading group on Telegram, where trade ideas and trade-related topics are discussed, which could assist your trading career while being infected by positive vibes

hit us on Pip Crafters