Hey traders,

Welcome to 2023… Pipsmanship will be used as one of my trading journals going forward.

The reason for this is to encourage traders to keep one for two major reasons:

- Track their weekly trading performance.

- Work on their trading technique and psychology

Both can only be done when you keep a comprehensive journal, and review it every week.

Welcome to 2023

MONDAY 09/01/2023

Last week was not good. I had two bad trades and one winning trade. The winning trade was not even a proper winning trade because it was a trailing stop loss that got hit (which I was thankful for)

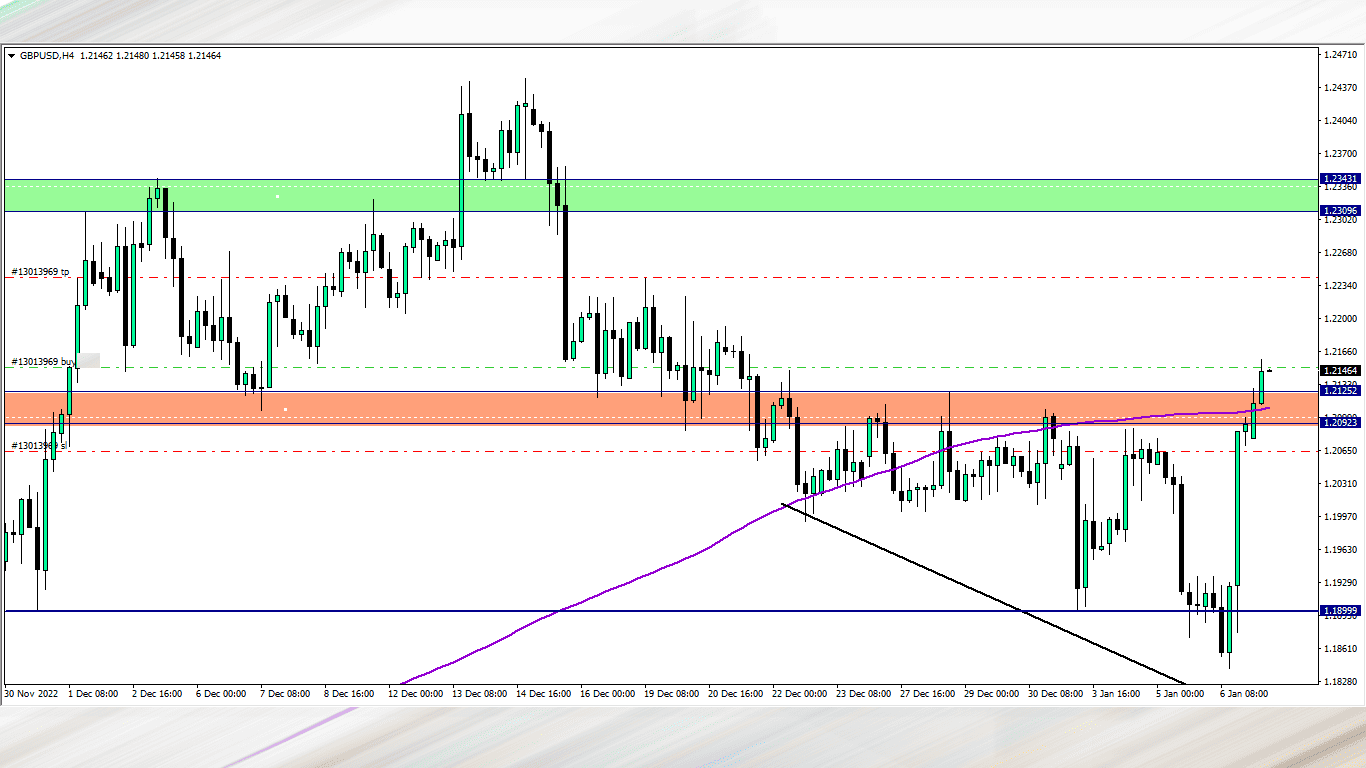

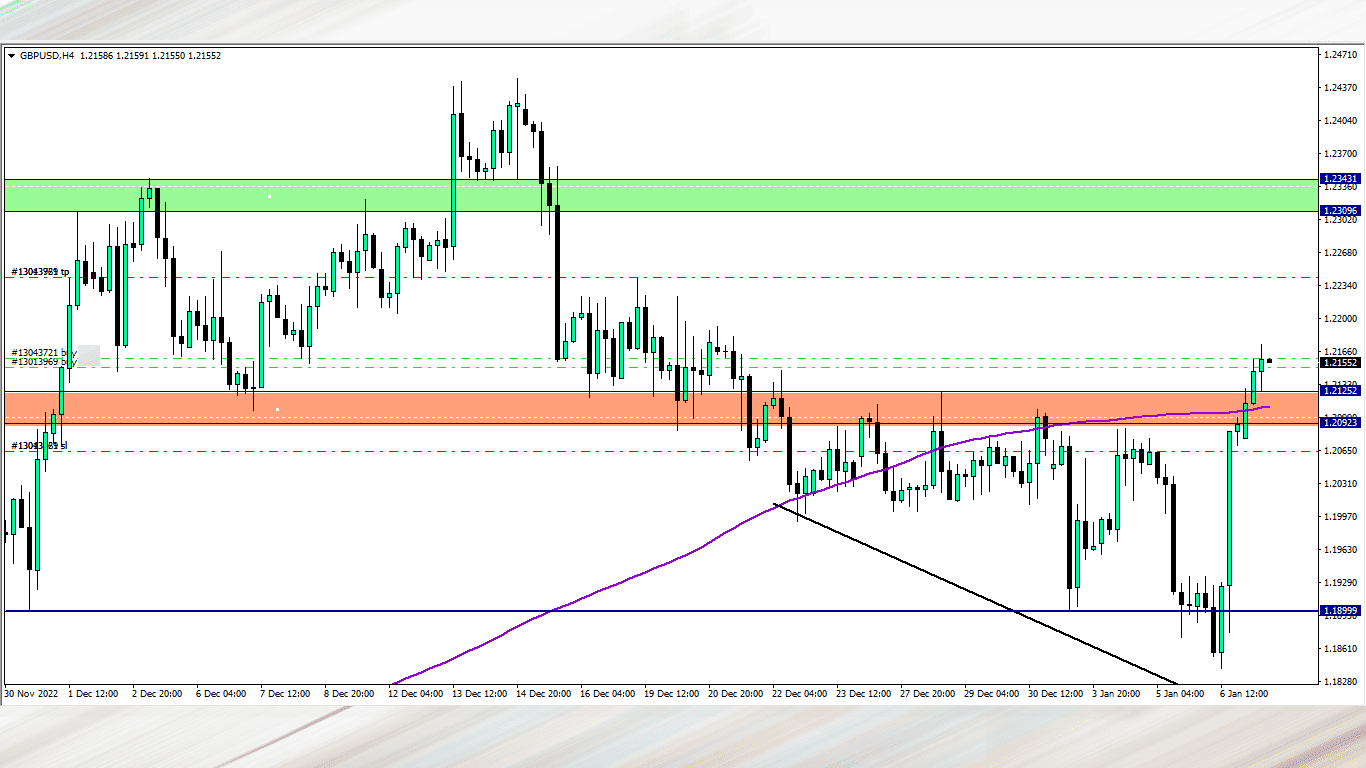

Starting the week by selling GBP/USD at 7am after the close of the 4hr candlestick based on our weekly analysis

GBP/USD update (11 am)

I have added to the GBP/USD trade at the close of the 7am candlestick…. This is where money management comes in. I have not yet exceeded my total risk for today and this trade.

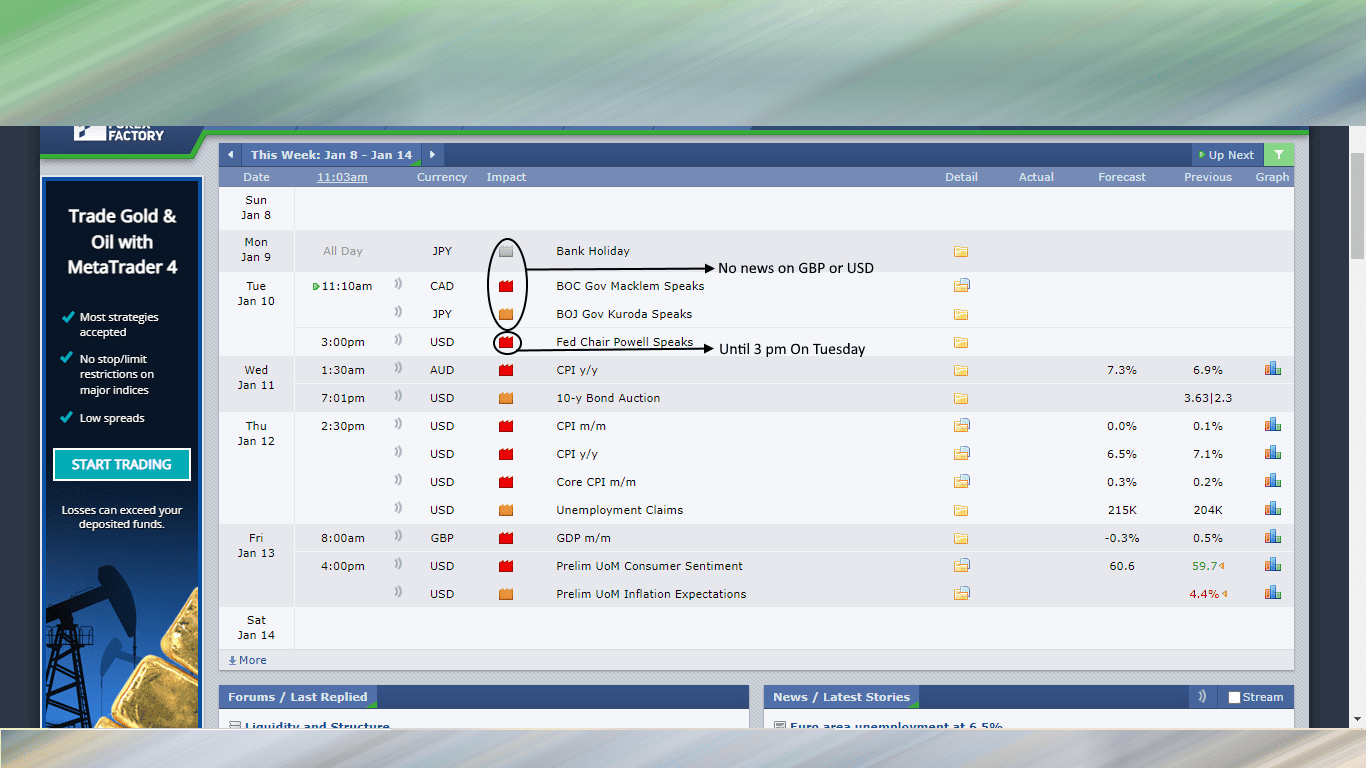

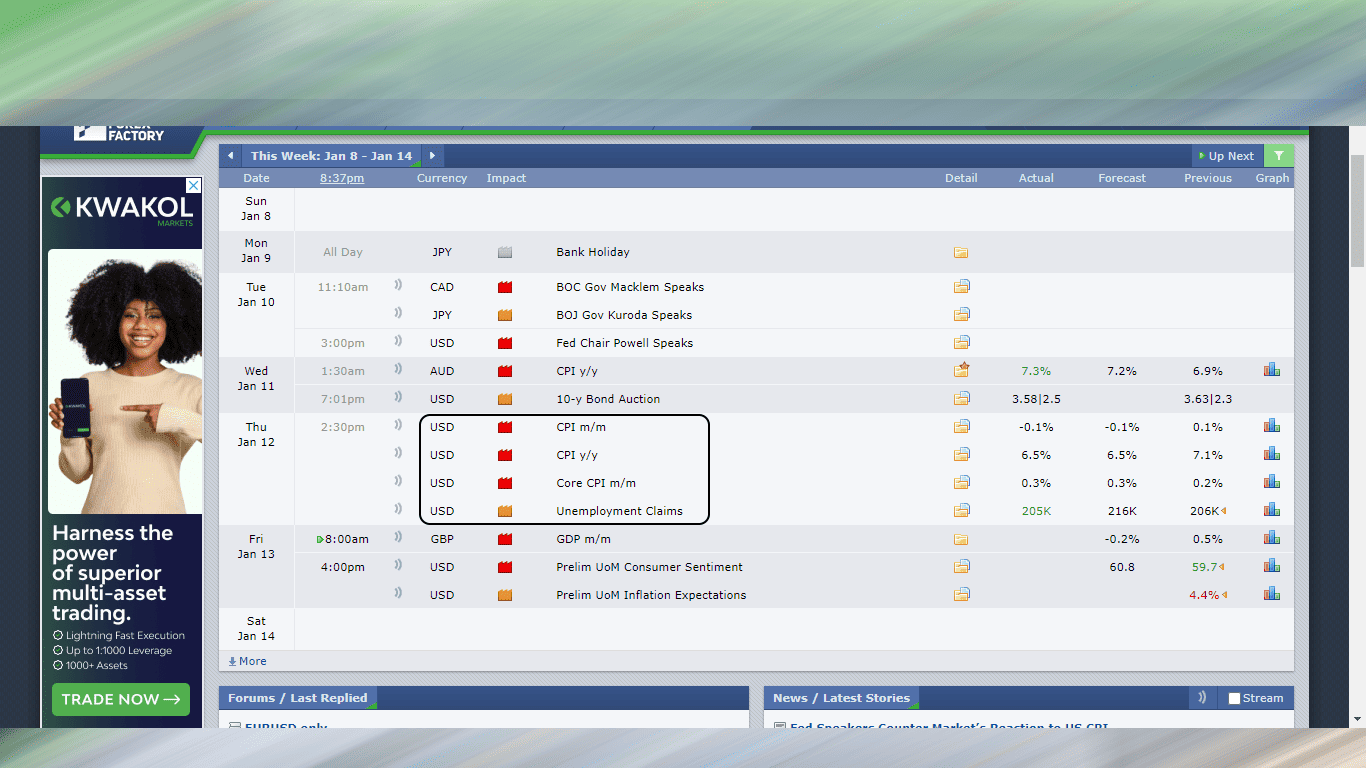

Also taking such risks entails you watching out for any high impact news not popping up any time soon:

Judging from our news desk, we still have over 24 hours to keep this trade

Judging from our news desk, we still have over 24 hours to keep this trade

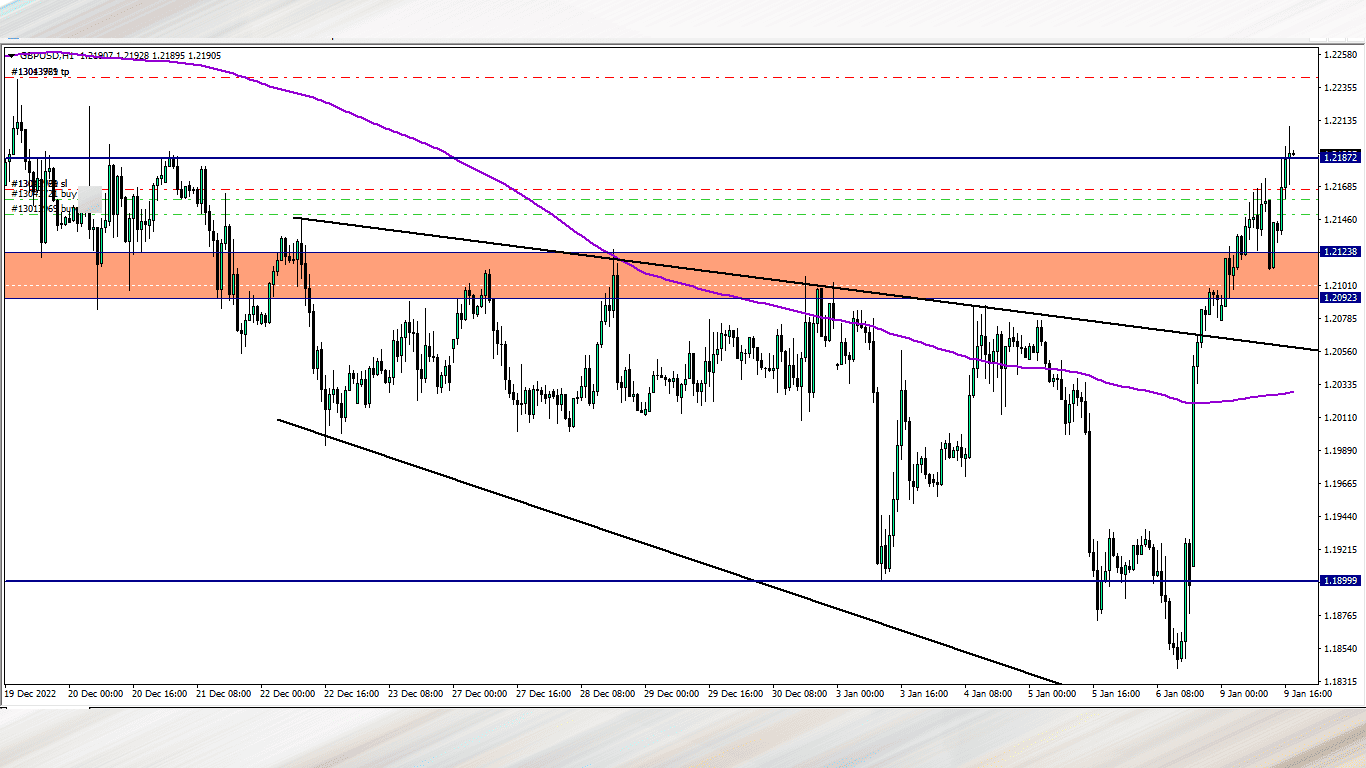

GBP/USD update (5 pm)

Locked some profits below a minor resistance level. We may still see the GBP/USD hit its target profit, but from here onward, I would trail till price hits tp of takes me out

GBP/USD UPDATE (6.20PM)

Trailing SL took me out and both of my positions closed profitably (+64 pips)

I will not be trading today due to market conditions. Once I do during the week, I will update

WEDNESDAY (11/01/2023)

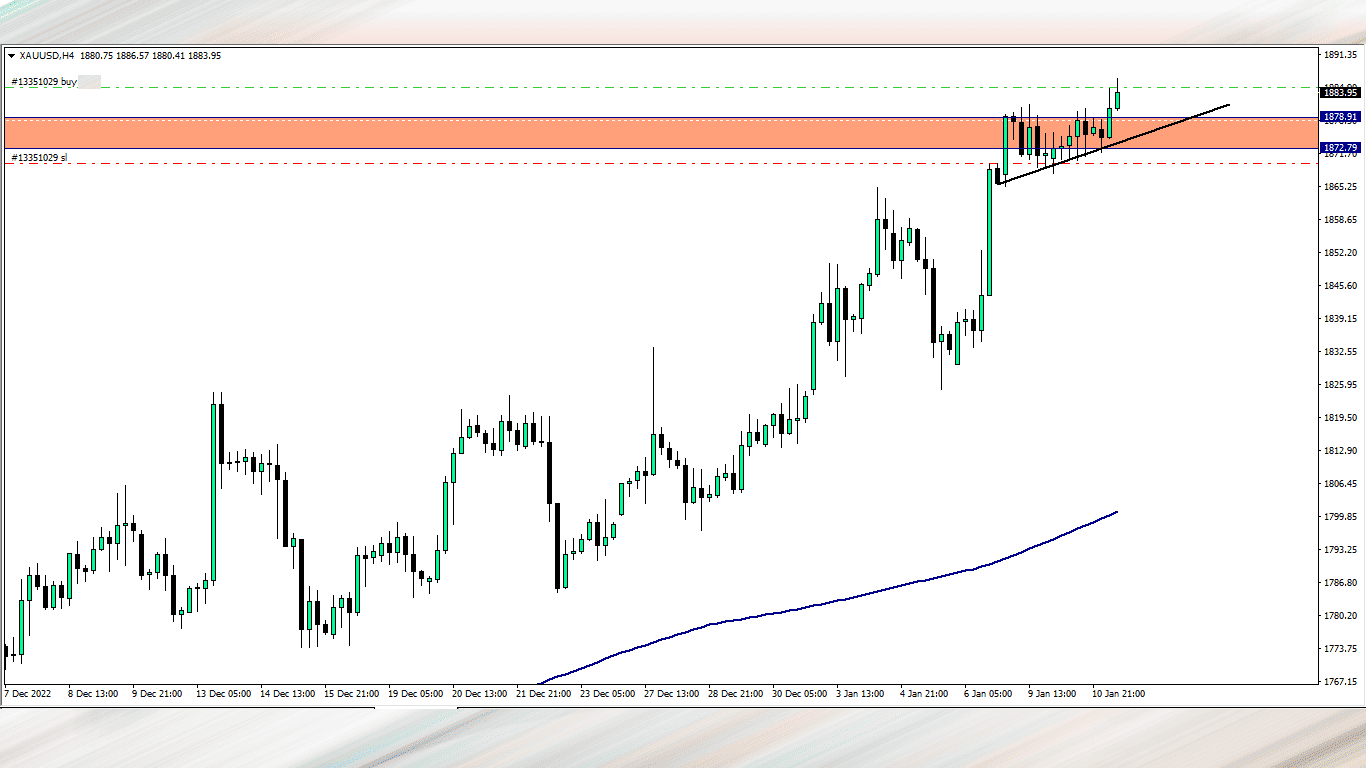

Gold (11am)

Selling Gold due to the analysis I dropped today

let’s see how it plays out

Gold update (4pm)

Gold did a deep pullback and took out my SL (-148 pips)

THURSDAY (12/01/2023)

No trades today for me due to CPI which can be seen in our news calendar

THURSDAY (10.30 pm)

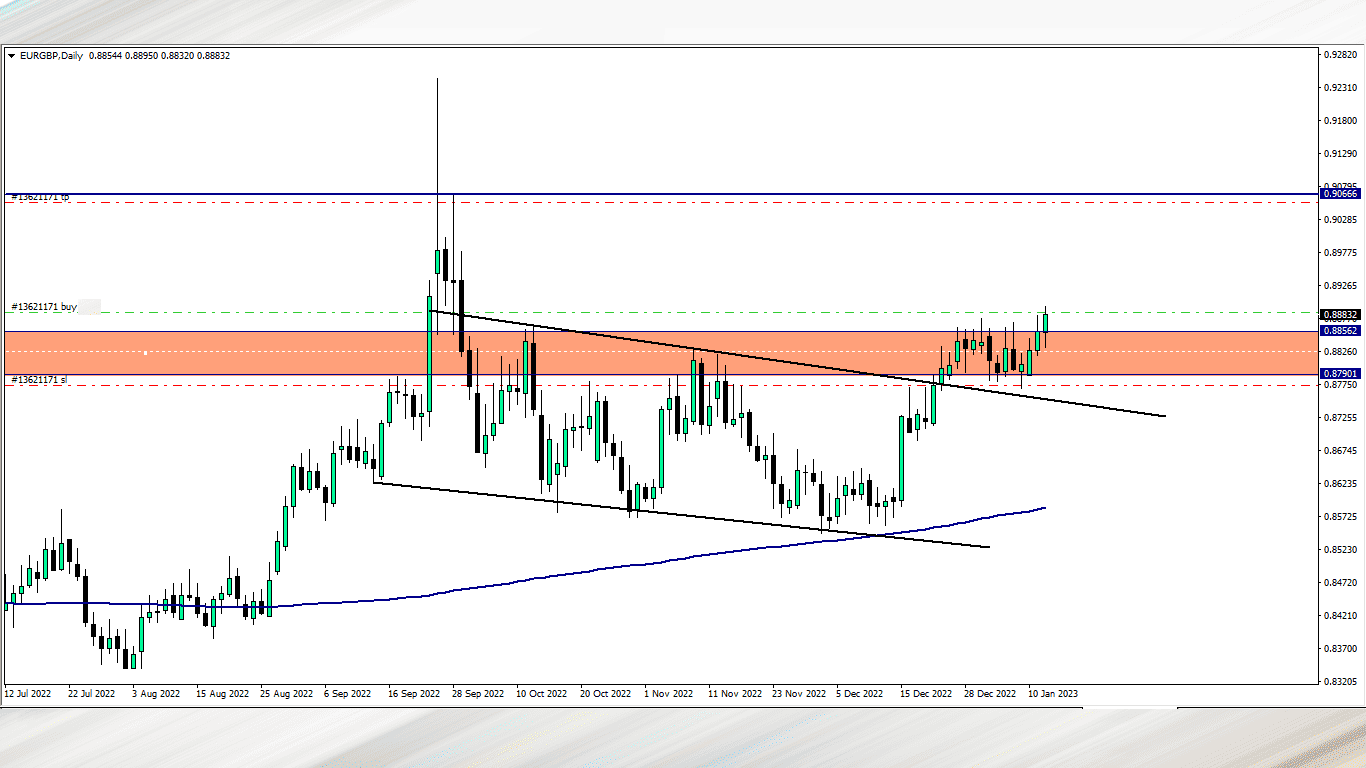

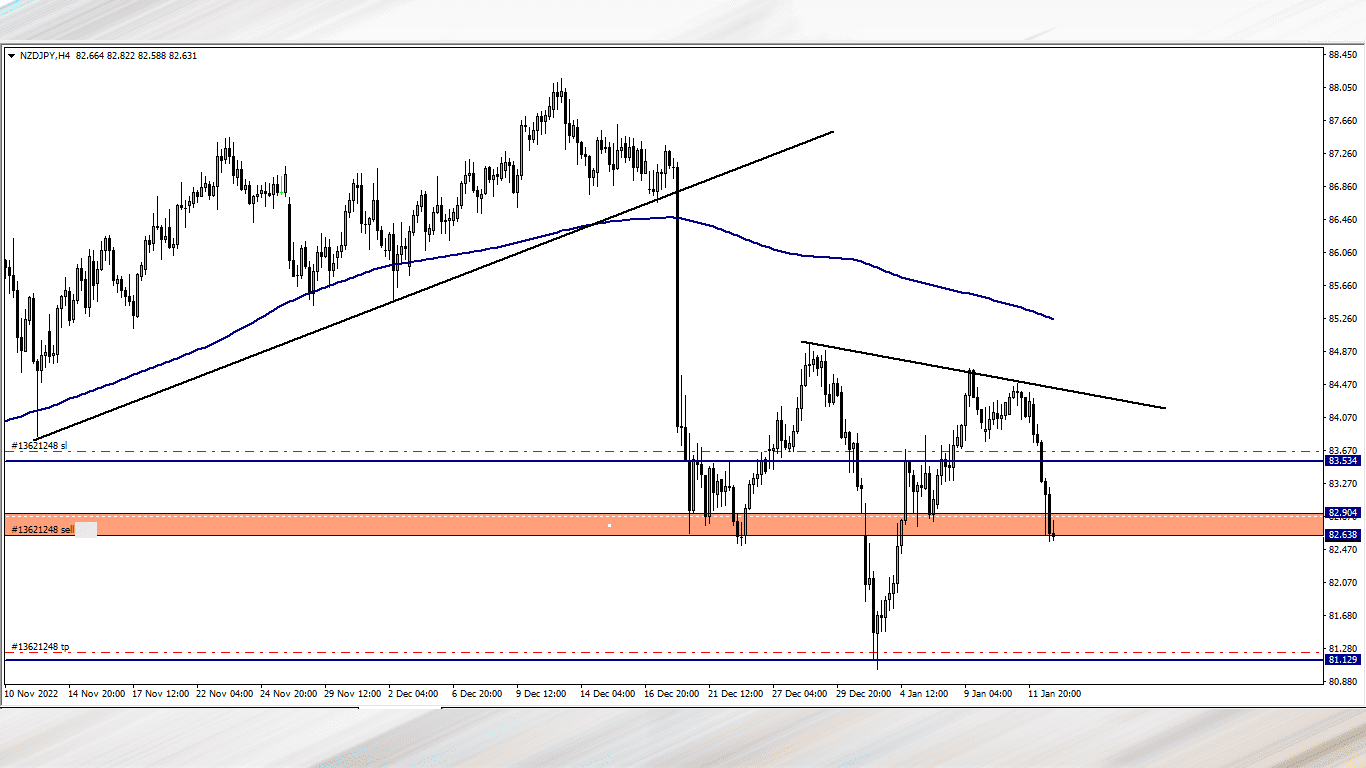

I bought EUR/GBP and sold NZD/JPY

EUR/GBP

Analysis on the EUR/GBP was explained on our Friday setups

Plans: I will be holding the EUR/GBP trade through the weekend and into next week

NZD/JPY

Analysis on the NZD/JPY was explained on our Friday setups

FRIDAY (13/01/2023)

Update on NZD/JPY & EUR/GBP (2 pm)

NZD/JPY – Trade earned us +56 pips, and if I had not trailed it it would have probably hit our intended target profit, but no problems, its allpart of the plan

EUR/GBP – This is a swing trade I am still holding on to. I will post updates as the trade progresses

Trade activity summary for the week

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST |

| 09/01/2022 (MON) | GBP/USD | BUY | +64 pips |

| 11/01/2022 (WED) | XAU/USD | BUY | -148 pips |

| 12/01/2022 (THUS) | NZD/JPY | SELL | +56 pips |

| EUR/GBP | BUY | -96 pips | |

| TOTAL | -124 PIPS | ||

In conclusion:

Gold was my only bad trade for the week, and the reason for this was due to a huge pull back before the bulls came in. There is nothing I would have done better if I were to go back into the past and take this trade again because my stop loss was rule based.

I am closing with a little loss this week and its simply because am still waiting on the EUR/GBP trade which shows great potential. As we hit next week, the trade’s progress will be updated

WEDNESDAY 18/01/2023

EUR/GBP Update

I manually had to close the trade as it went against our analysis.. Closed with -96 pips

NOTE:

Hey traders,

If you are into trading for proprietary firm which I believe you should due to the huge advantages involved, look no further

You will enjoy a 5% discount if you use any of these two proprietary firms:

The funded trader needs no introduction, as they are currently becoming one of the most sorted proprietary firms in the industry due to their flexible challenge rules which consist of you being able to use an EA (expert advisory or trading robot) on one of their packages.

Also their packages are pretty affordable, which also comes with unlimited trials even if you fail to hit the set target within the 35 days period. If you are interested in getting a 5% discount upon purchase, hit THE FUNDED TRADER and use THE0CRAFTER as the coupon code

2. fundyourfx

Fundyourfx are a prop firm that caters for those traders who are not interested in sitting for any challenges. They have the cheapest direct funded account in the industry.

Once you purchase any of their packages, all you have to do is stick to their trading rules and get paid every time you hit +10% ROI, while your account is automatically increased by +50% of initial capital. If you are interested in getting a 5% discount upon purchase, hit FUNDYOURFX and use THE_CRAFTER as the coupon code