My reason for keeping a journal is to encourage traders to also keep one for two major reasons:

- Track weekly trading performance.

- have enough data, in order to be able to work on their trading technique and psychology

Both can only be done when you keep a comprehensive journal, and review it every week.

MONDAY 10/07/2023

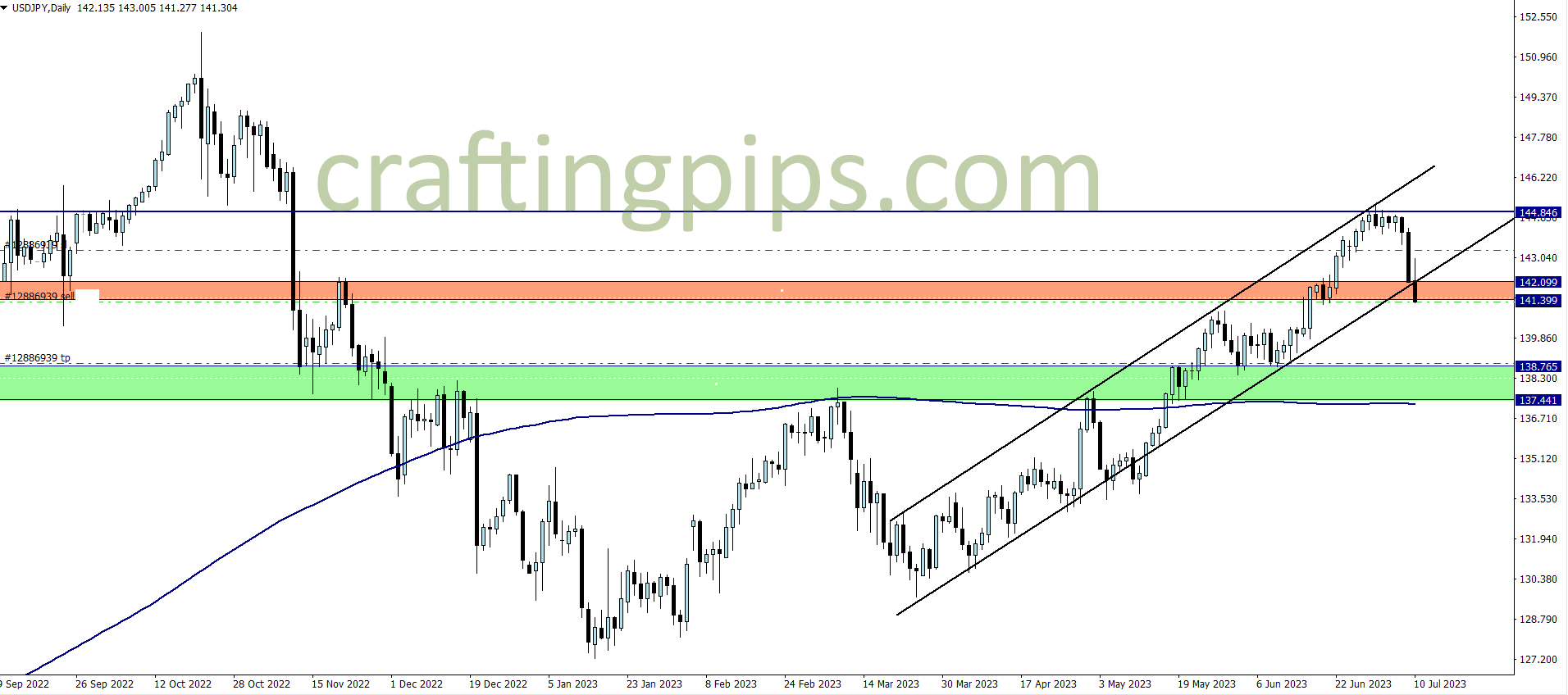

CAD/JPY (9.20 pm)

Analysis: My reason for selling CAD/JPY is because of our Weekly Market Analysis

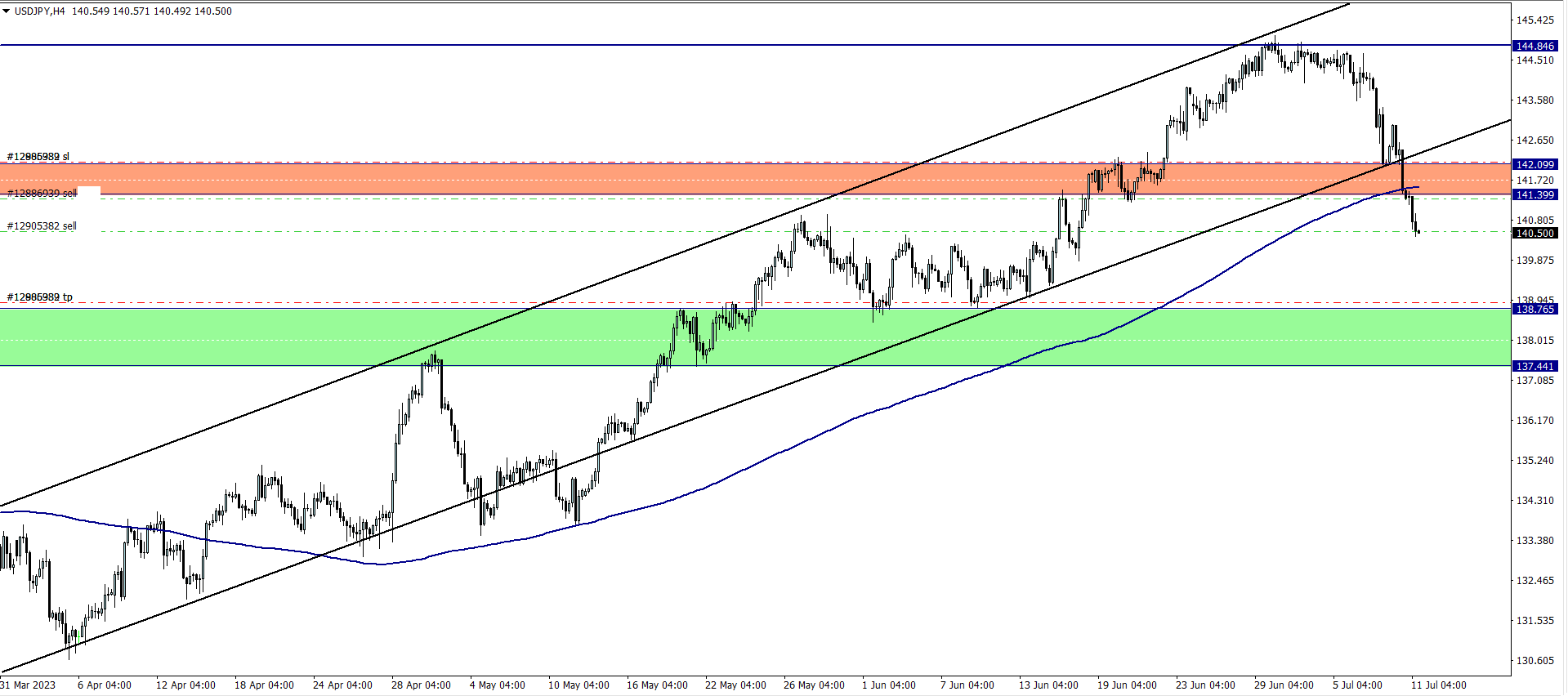

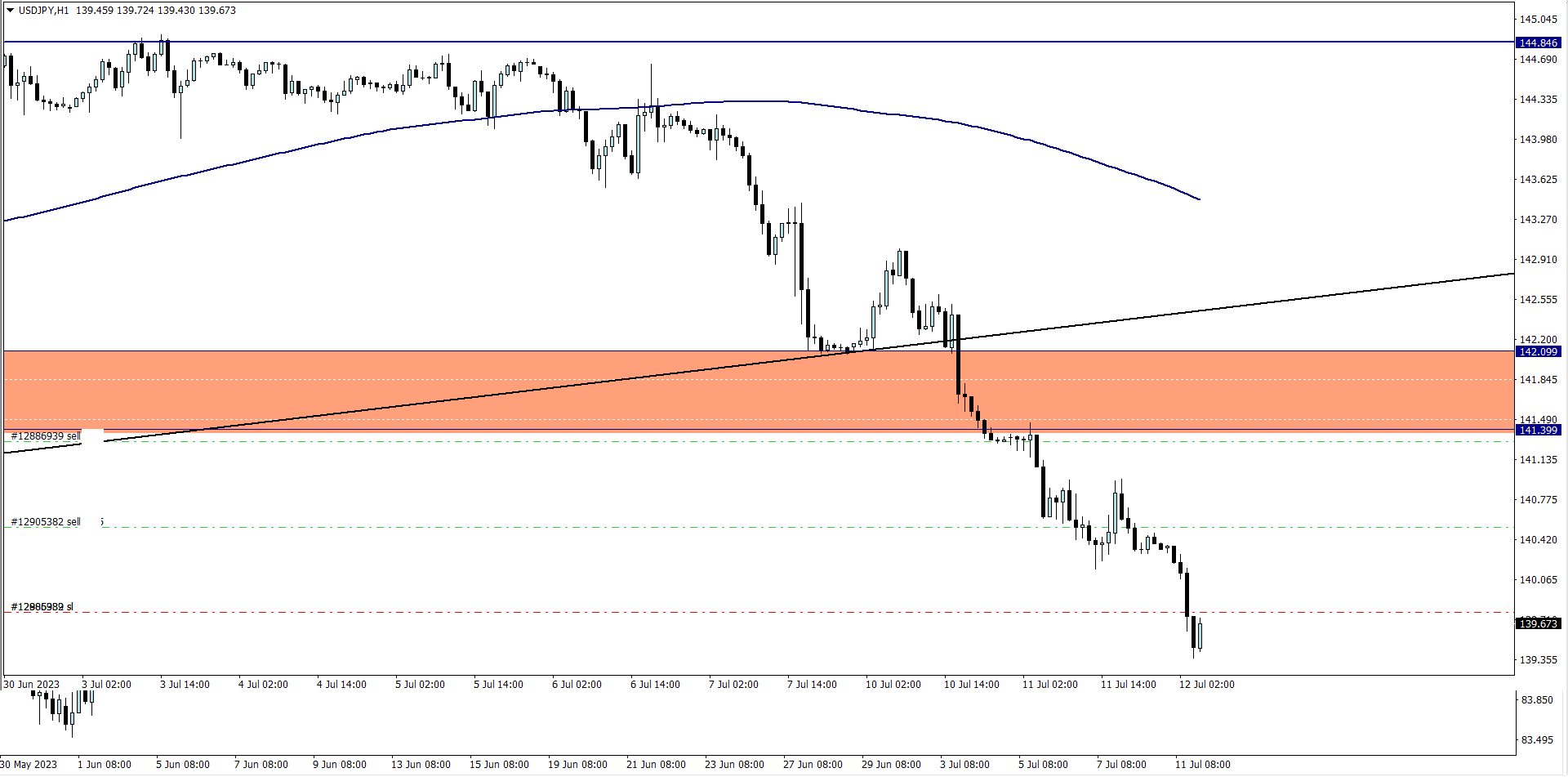

USD/JPY (9.20 pm)

Analysis: My reason for selling CAD/JPY is because of our Weekly Market Analysis

TUESDAY 11/07/2023

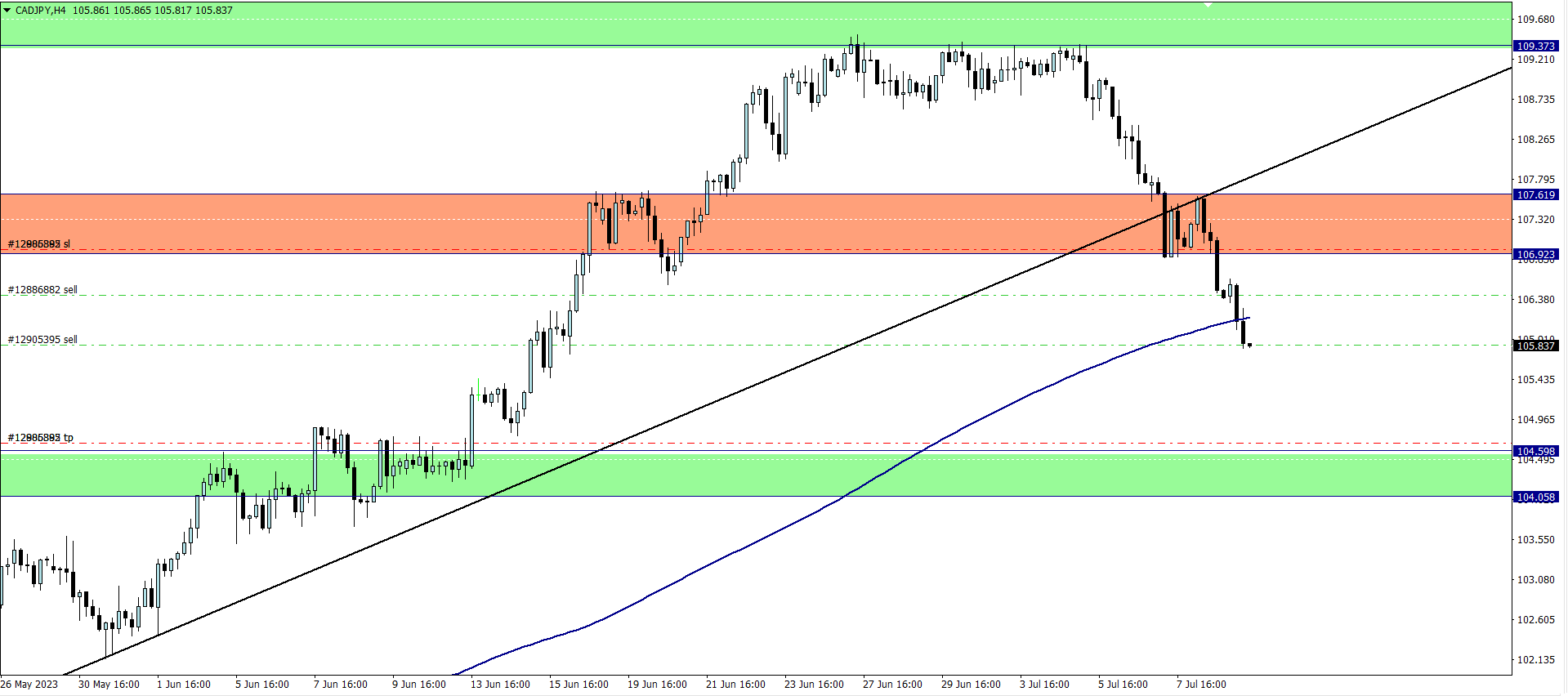

CAD/JPY (2 am)

Analysis: Added to positions

USD/JPY (2 am)

Analysis: Added to positions

WEDNESDAY 12/07/2023

CAD/JPY (3.30pm)

Analysis: trailing SL hit both positions (+64 pips)

USD/JPY (3.30pm)

Analysis: trailing SL hit both positions (+231 pips)

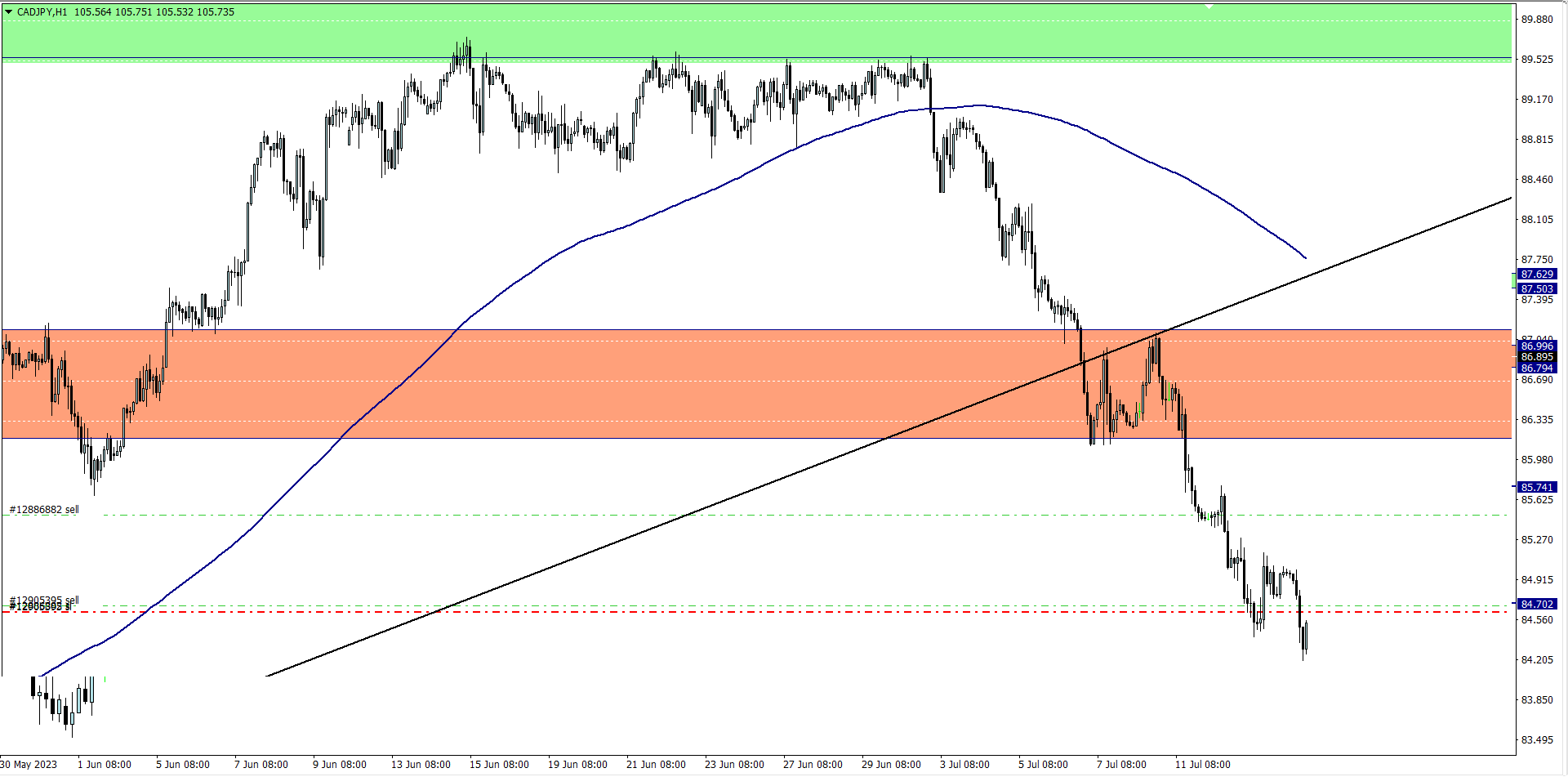

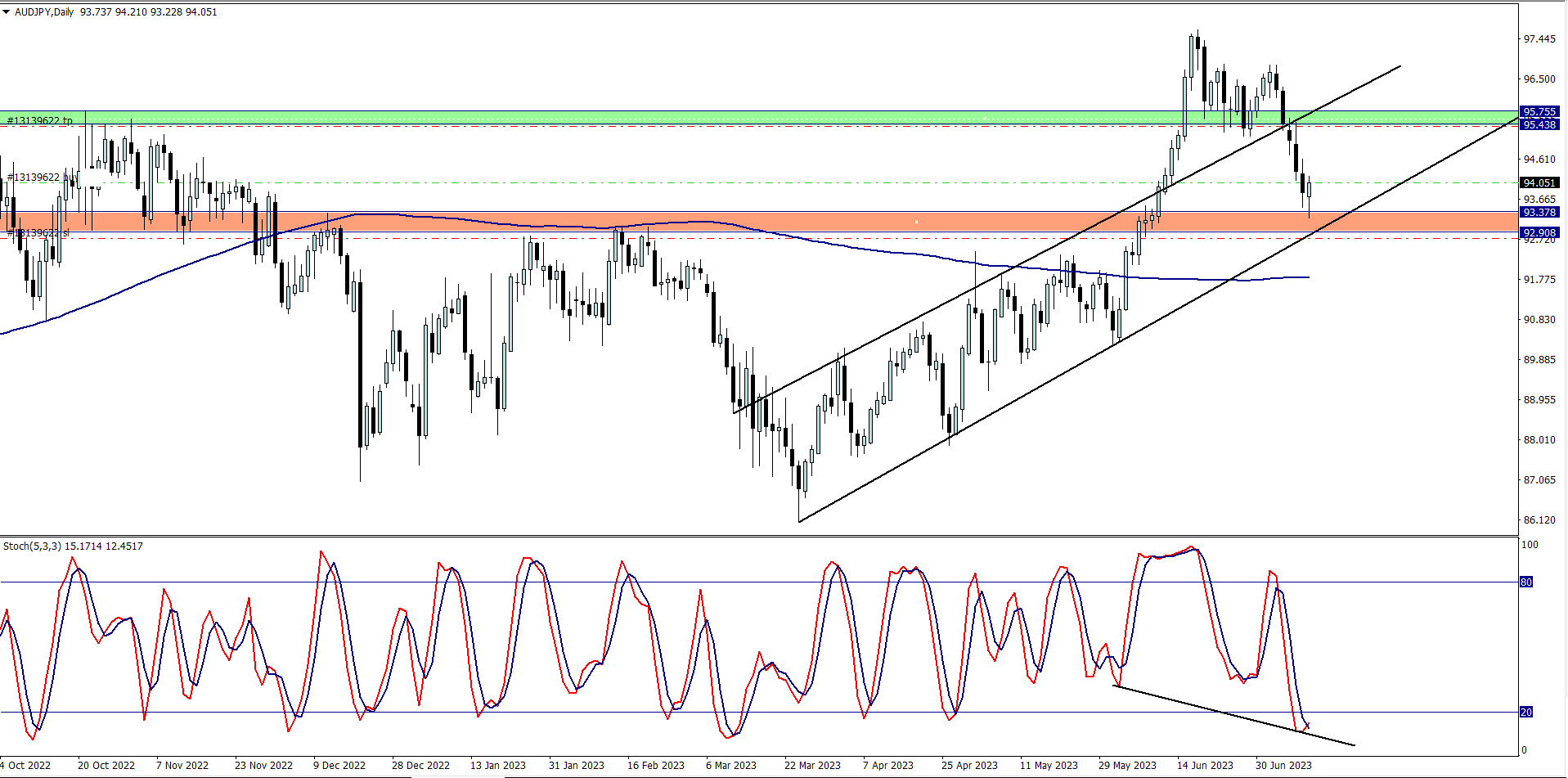

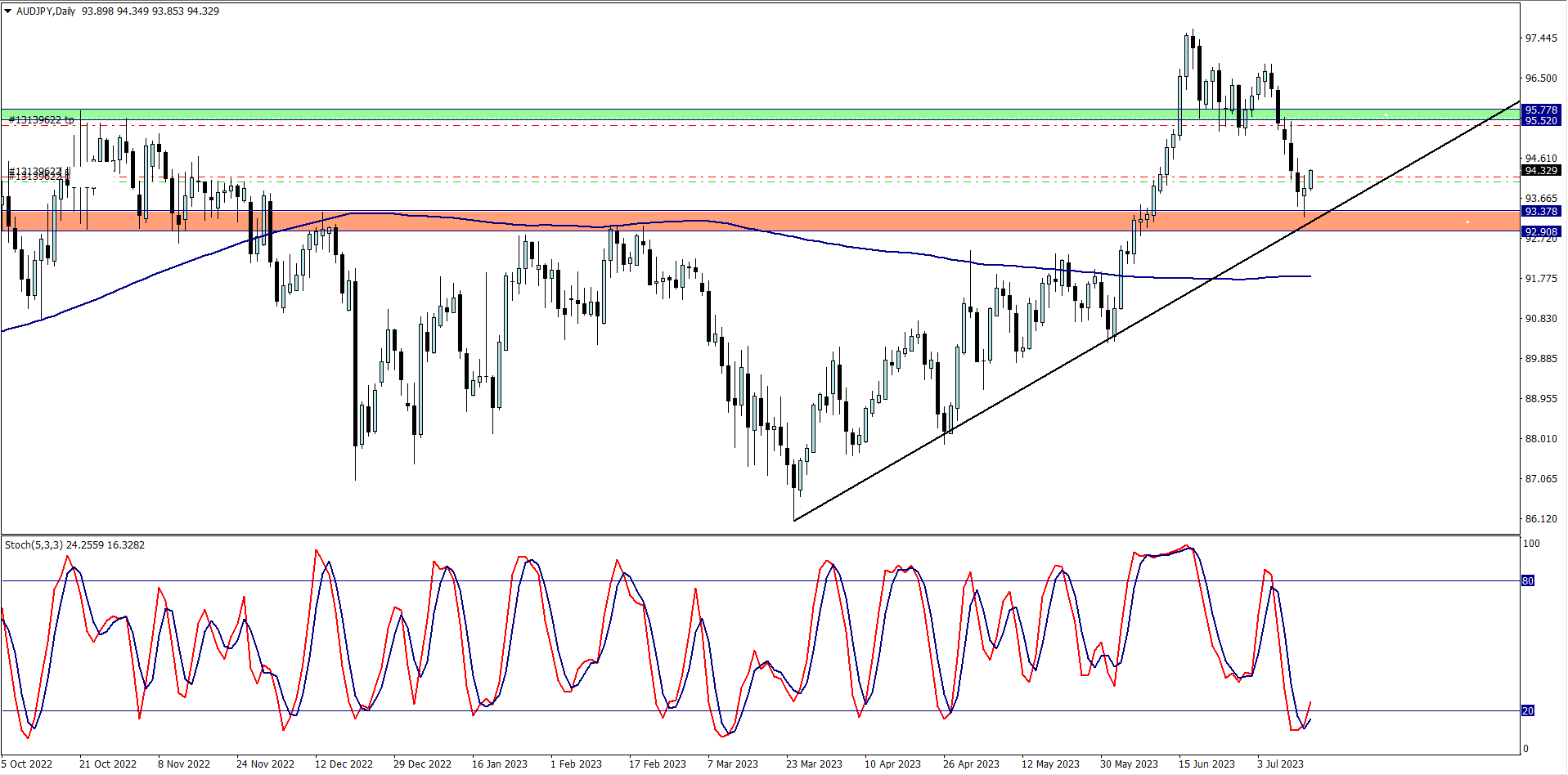

AUD/JPY (9.40 pm)

Analysis: My reason for buying AUD/JPY was because of our Thursday Market Analysis

THURSDAY 13/07/2023

AUD/JPY Update (9.40 pm)

Analysis: I closed the trade with +46 pips (price hit my trailing SL)

Trade activity summary for the week

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST |

| MON (10/07/2023) | CAD/JPY | SELL | + 64 pips |

| USD/JPY | SELL | + 231 pips | |

| WED (13/07/2023) | AUD/JPY | BUY | +46 pips |

| TOTAL | + 341 pips |

In conclusion:

The week was a challenging week for my regular USD pairs due high impact news events, so I had no choice but to dump all my “A setups” with USD currency. This made me stick to my JPY pairs since there was less noise during the Asian session this week.

I would have made more pips if I allowed all the trades I took to run their course, but I decided to play it safe and maximize the opportunities the market presented by working on my risk management.

It was a flawless trading week for me, and looking back, I would not have traded it any better.

How did your week in the market go?

NOTE:

-

THE FUNDED TRADER: https://dashboard.thefundedtraderprogram.com/purchasechallenge-n/?sl=3322 (use the coupon code: THE0CRAFTER)

-

MY FUNDED FX: https://myfundedfx.tech/purchasechallenge/?sl=758

- BESPOKE FUNDING PROGRAMME: https://www.bespokefundingprogram.com/The_Crafter?ref=The_Crafter