My reason for keeping a journal is to encourage traders to also keep one for two major reasons:

- Track weekly trading performance.

- have enough data, in order to be able to work on their trading technique and psychology

Both can only be done when you keep a comprehensive journal, and review it every week.

TUESDAY 04/07/2023

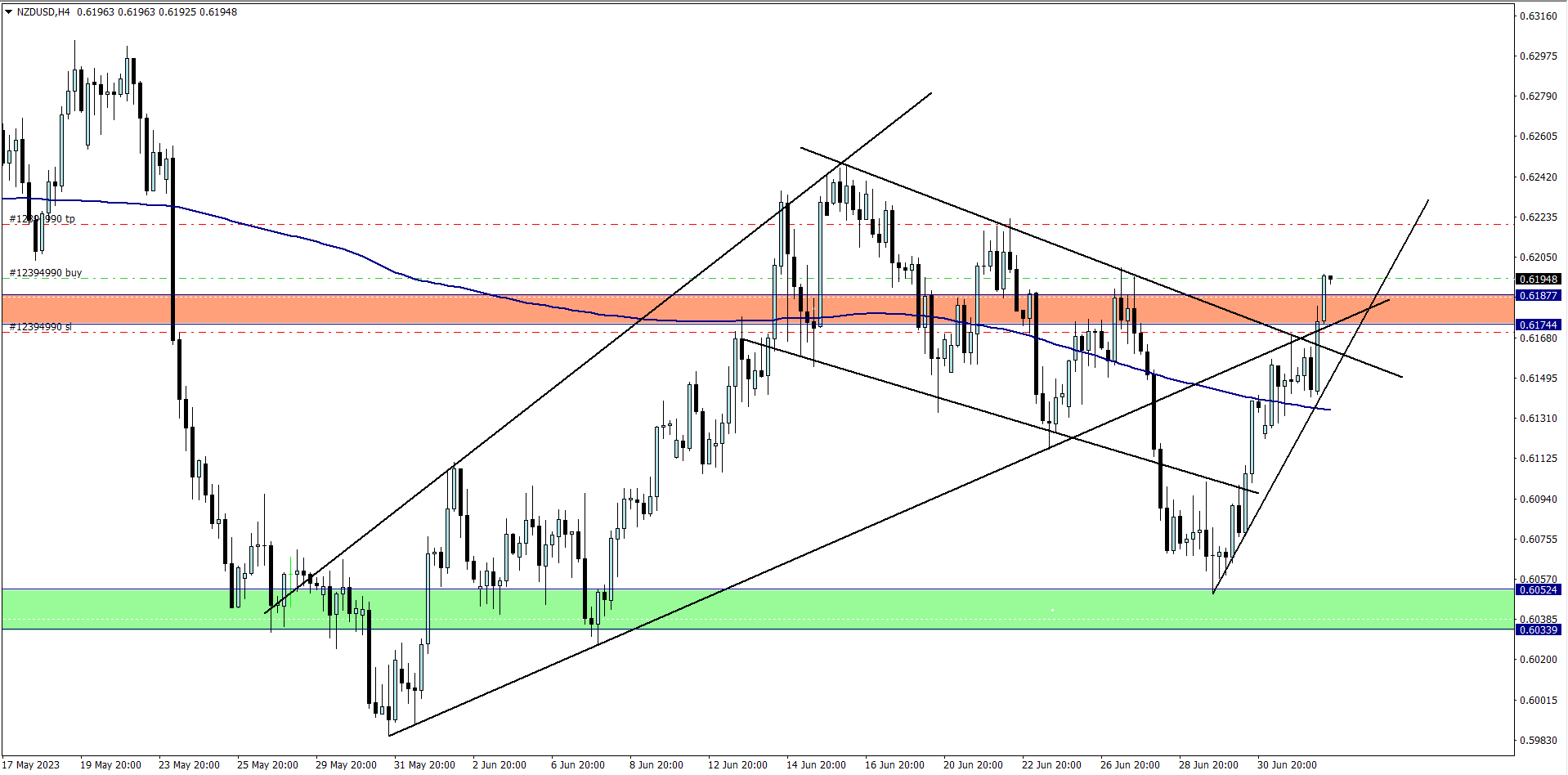

NZD/USD (2 pm)

Analysis: The clean breakout was my reason for buying, that said, I am not expecting too much from it. 15 – 25 pips will do!

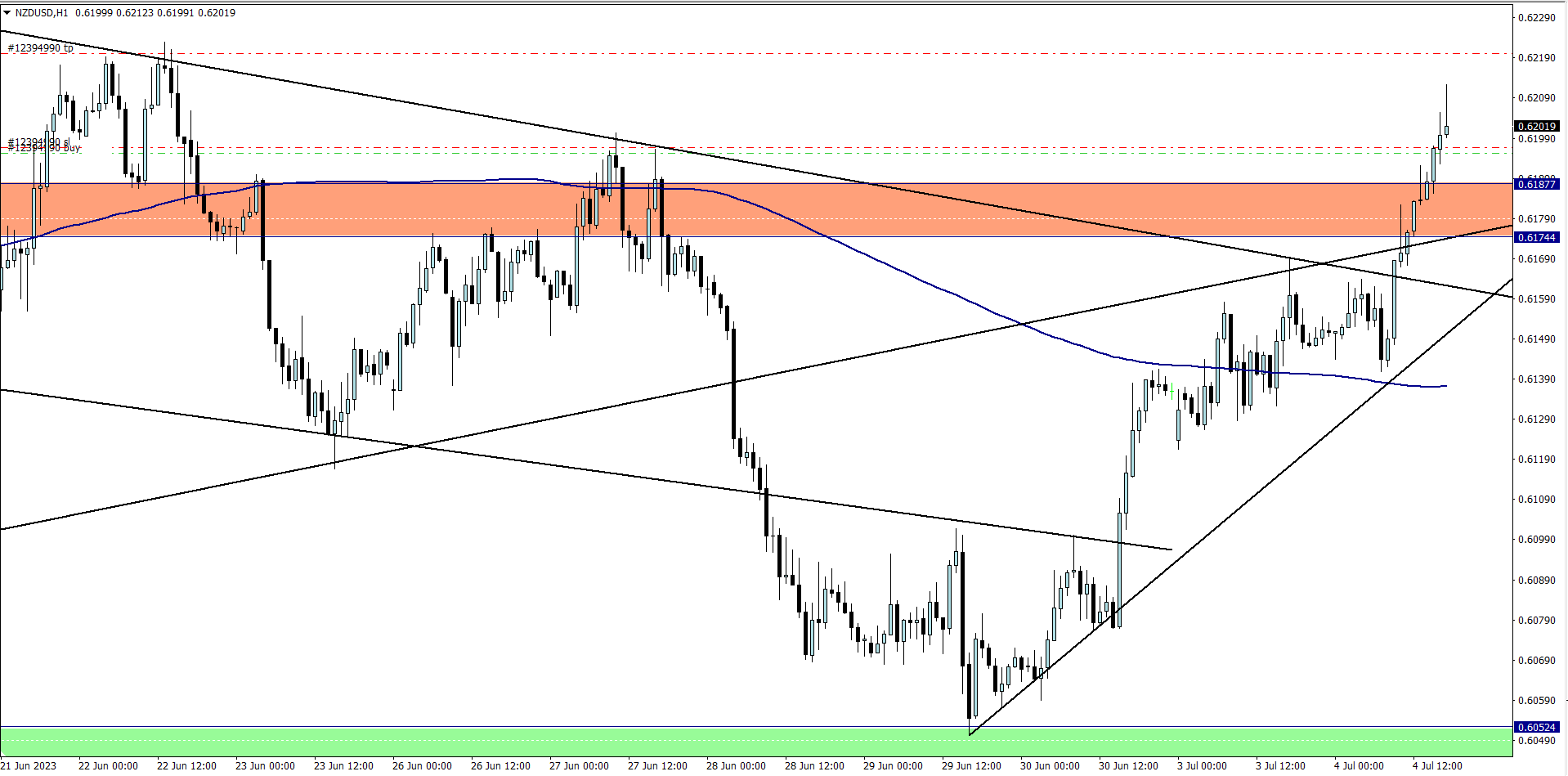

NZD/USD Update (3.30 pm)

Analysis: Closed at breakeven

THURSDAY 06/07/2023

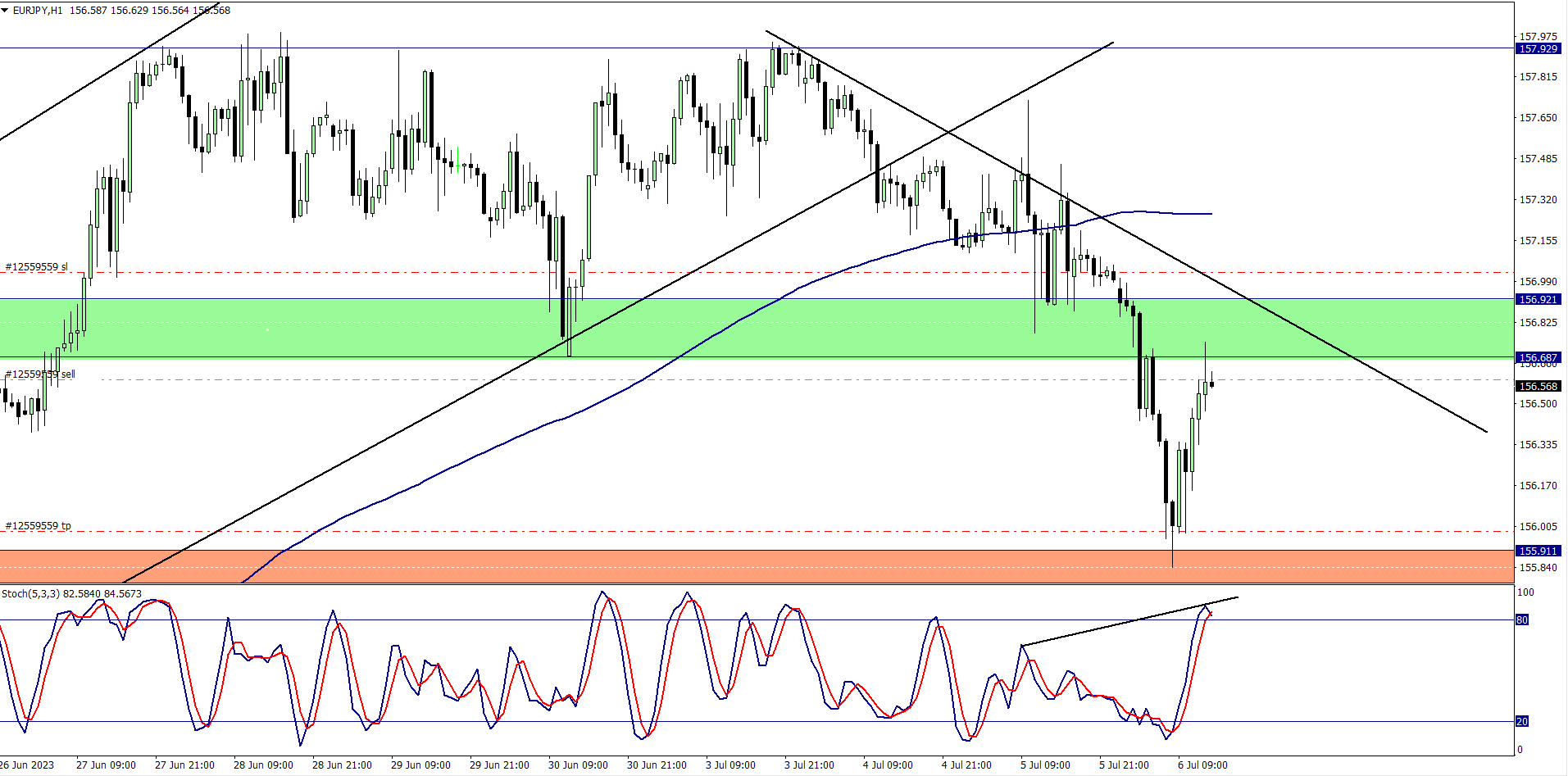

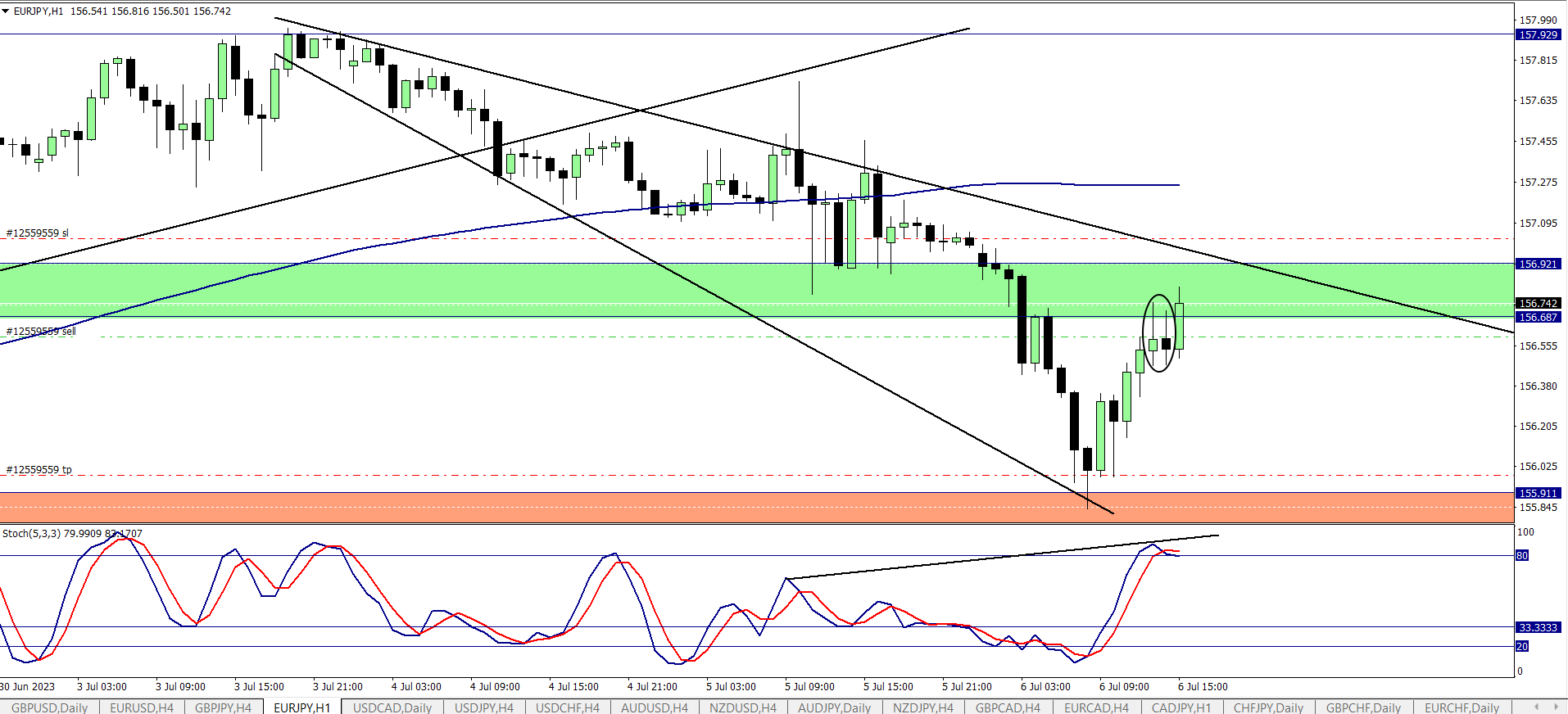

EUR/JPY (12.15 pm)

Analysis: The overall trend is bearish on the EUR/JPY, so this bearish divergence is most likely going to work

EUR/JPY Update (1.30 pm)

Analysis: Tweezer top ought to have been another confirmation for this trade to give us some cheddar, but price still went on to hit our stop loss (-42 pips) before reversing to hit our initial target profit (this is very annoying when it happens)

Trade activity summary for the week

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST |

| TUE (04/07/2023) | NZD/USD | BUY | Breakeven |

| THUS (06/07/2023) | EUR/JPY | SELL | – 42 pips |

| TOTAL | – 42 pips |

In conclusion:

This week was a challenging week for me in the market for two major reasons:

1. The news calendar was filled with high impact news which discouraged me from holding any trade for more than 10 hours

2. I missed the CAD/JPY trade which I planned on trading since the weekend

The first reason I gave is understandable because I can’t help it. No trader has any control over what news events will pop up during the week. When there is a week full of high impact news, all I can do as a trader is become less active, and if at all I do trade, I have to be conservative in my approach

The second reason was 100% my fault. Laxity kicked in after waiting for a few days for the CAD/JPY trade to pan out. Then the EUR/JPY trade reminds me of the EUR/CAD trade I took last week.

The same bearish divergence, the same outcome. The lesson I have learnt from both outcomes is: Next time I will apply a generous stop loss when dealing with bearish/bullish divergence.

That said, I am hopeful that the remaining 3 weeks plus will be a lot better.

How did your trading week go?

NOTE:

-

THE FUNDED TRADER: https://dashboard.thefundedtraderprogram.com/purchasechallenge-n/?sl=3322 (use the coupon code: THE0CRAFTER)

-

MY FUNDED FX: https://myfundedfx.tech/purchasechallenge/?sl=758

- BESPOKE FUNDING PROGRAMME: https://www.bespokefundingprogram.com/The_Crafter?ref=The_Crafter