My reason for keeping a journal is to encourage traders to also keep one for two major reasons:

- Track weekly trading performance.

- have enough data, in order to be able to work on their trading technique and psychology

Both can only be done when you keep a comprehensive journal, and review it every week.

MONDAY 26/06/2023

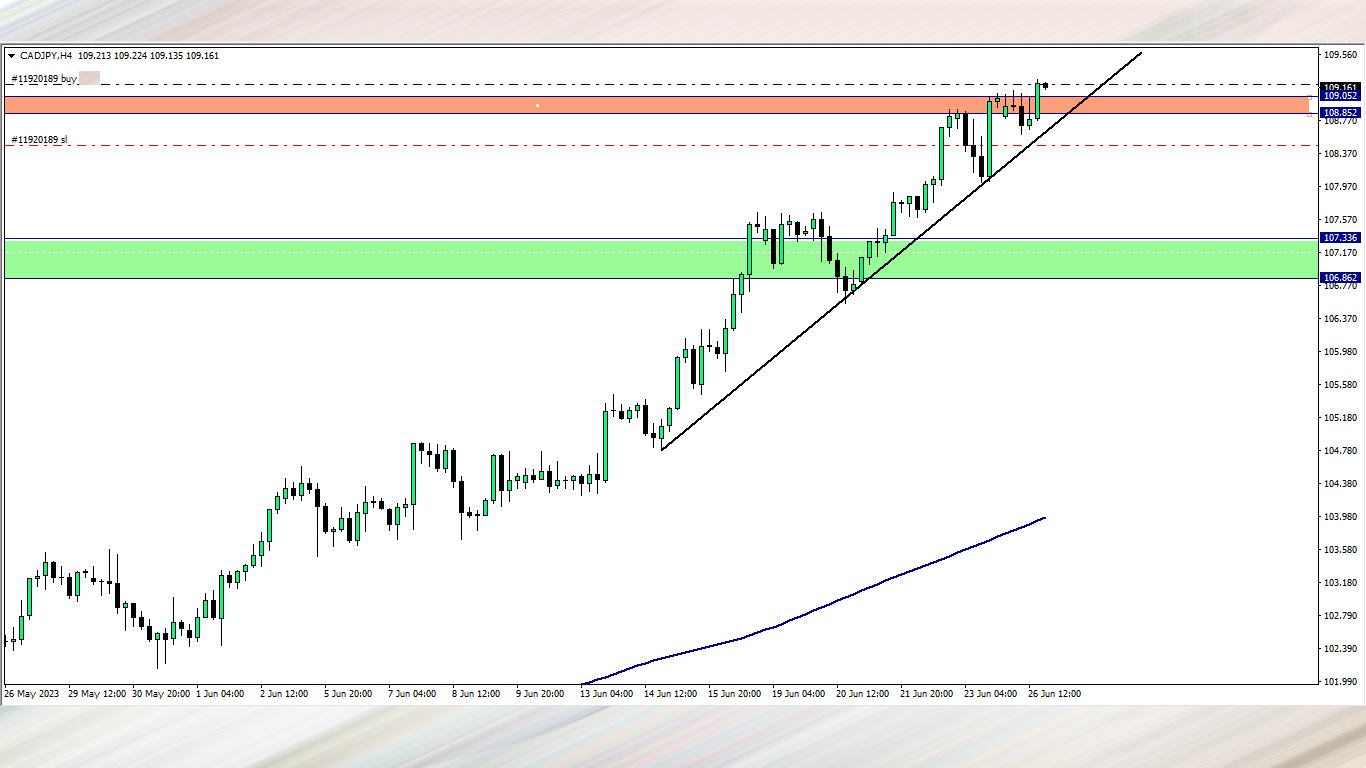

CAD/JPY (6.05 pm)

Analysis: I bought this setup due to our weekly market analysis

TUESDAY 27/06/2023

USD/CAD (6am)

Analysis: The neckline of a head and shoulder formation broke at 6am and I sold immediately, hoping to get out of the trade before CPI news scheduled for 1.30 pm. This setup was also inspired from our weekly market analysis

USD/CAD UPDATE (5 pm)

Analysis: Closed at breakeven

CAD/JPY UPDATE (5.10 pm)

Analysis: I closed this trade with +7 pips while trailing

EUR/CAD (6.30 pm)

Analysis: The sell was inspired by our Wednesday Market Analysis

WEDNESDAY 28/06/2023

EUR/CAD Update (5 pm)

Analysis: trade hit stop loss, and it cost me -54 pips

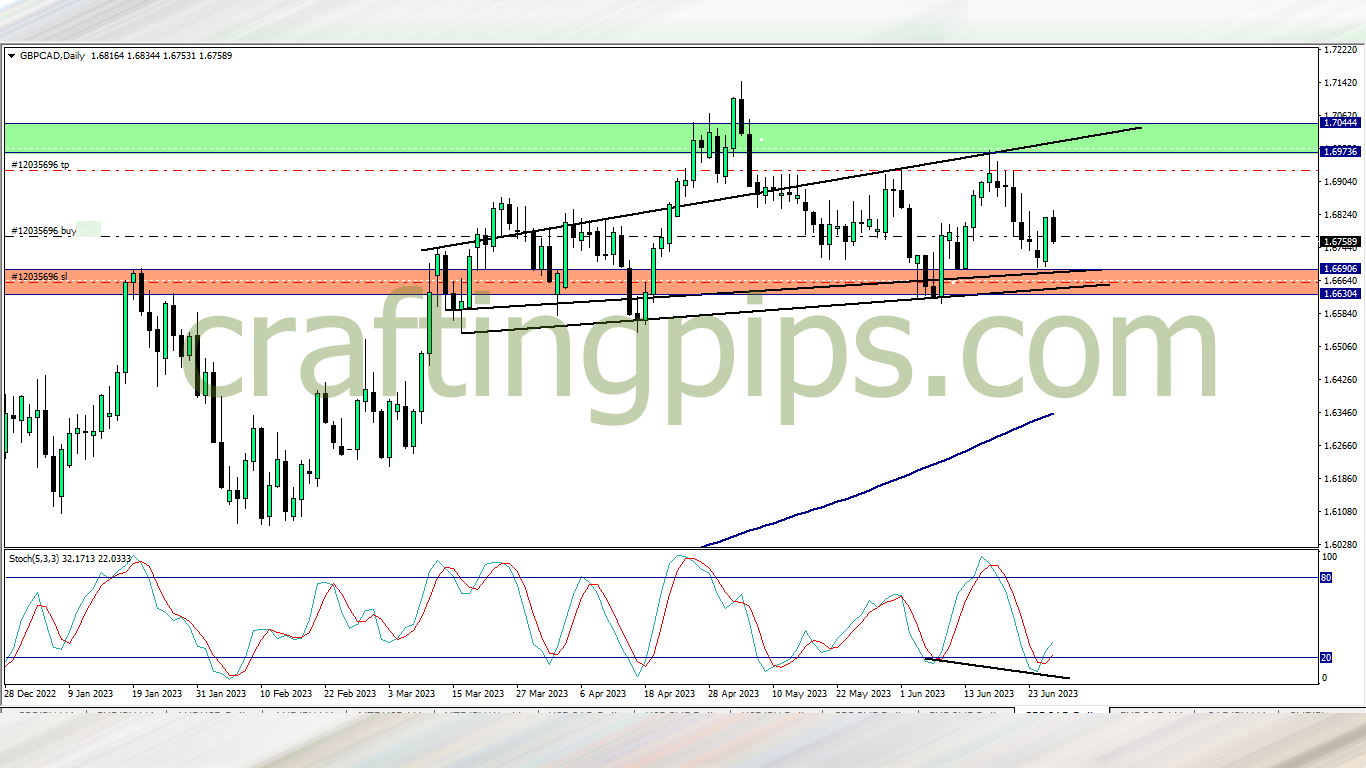

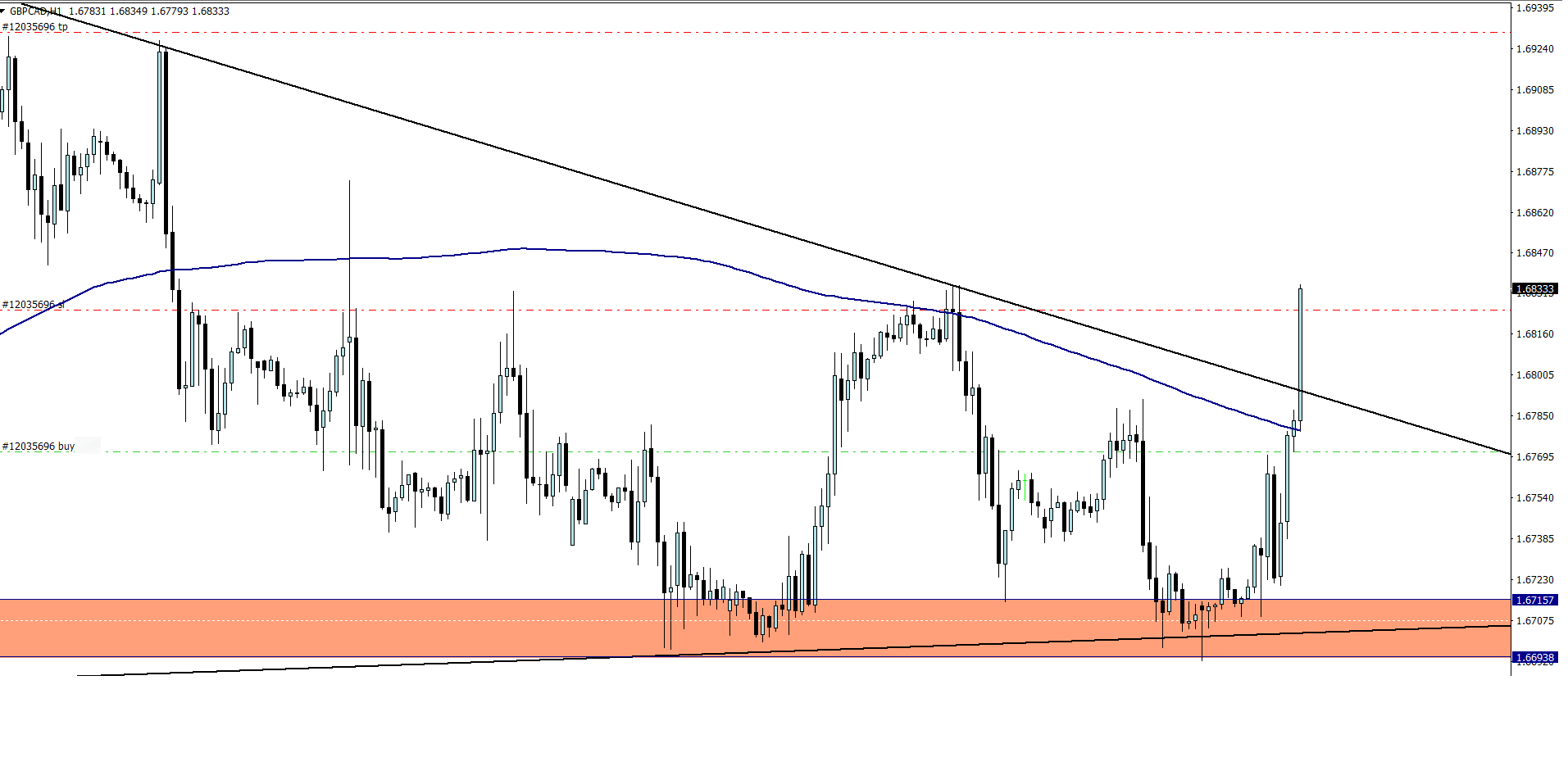

GBP/CAD (7 PM)

Analysis: The sell was inspired by our Wednesday Market Analysis

THURSDAY 29/06/2023

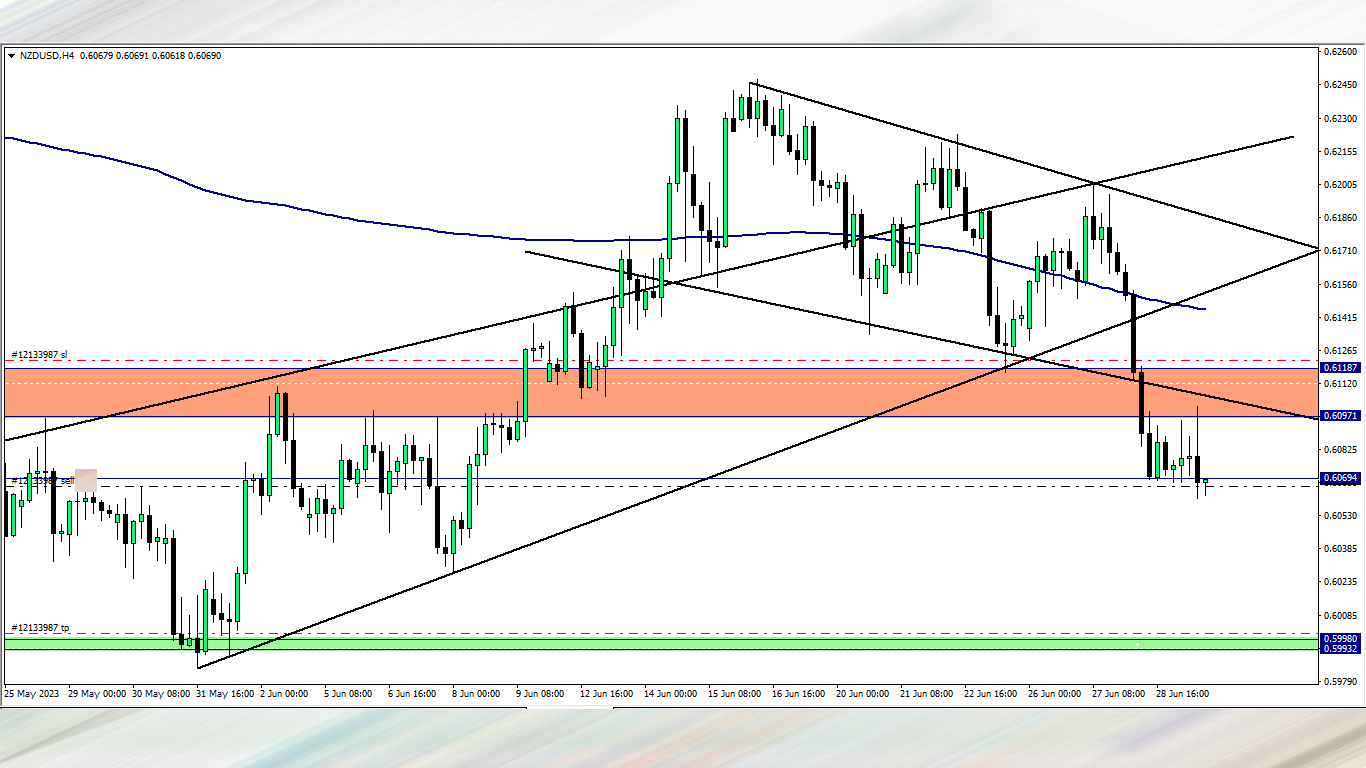

NZD/USD (2pm)

FRIDAY 30/06/2023

GBP/CAD Update (7pm)

Analysis: Manually closed GBP/CAD with +52 pips

NZD/USD Update (7pm)

Analysis: Closed with -54 pips

Trade activity summary for the week

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST |

| MON (26/06/2023) | CAD/JPY | BUY | + 7 pips |

| TUE (27/06/2023) | USD/CAD | SELL | Breakeven |

| EUR/CAD | SELL | – 54 pips | |

| GBP/CAD | BUY | +52 pips | |

| WED (29/06/2023) | NZD/USD | SELL | -54 pips |

| TOTAL | – 49 pips |

Note:

I was not as defensive as I would have loved to be in my last week of the month/quarter, hence my loss on EUR/CAD. Though price went according to our analysis, but it did so after hitting my stop loss.

Overall I would rate my performance this week as fair, as I picked a little loss

How did your week go?

Trade activity summary for the month

| 1st TRADING WEEK |

|

|||

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST | |

| FRI (01/06/2023) | GBP/CHF | SELL | + 93 pips | |

| MON (05/06/2023) | GBP/USD | BUY | – 37 pips | |

| TUE (06/06/2023) | CAD/JPY | BUY | + 17 pips | |

| WED (07/06/2023) | GBP/CHF | BUY | + 14 pips | |

| AUD/JPY | BUY | + 42 pips | ||

| TOTAL | + 129 PIPS | |||

| 2nd TRADING WEEK | ||||

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST | |

| MON (12/06/2023) | NZD/USD | SELL | + 3 pips | |

| TUE (13/06/2023) | GBP/CAD | SELL | + 3 pips | |

| WED (14/06/2023) | NZD/JPY | BUY | + 2 pips | |

| THUS (15/06/2023) | USD/CAD | SELL | + 27 pips | |

| TOTAL | + 35 pips | |||

| 3rd TRADING WEEK | ||||

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST | |

| MON (19/06/2023) | USD/CAD | SELL | + 13 pips | |

| USD/CAD (Re-entry | SELL | – 51 pips | ||

| WED (21/06/2023) | CHF/JPY | BUY | + 74 pips | |

| AUD/USD | SELL | – 41 pips | ||

| CAD/JPY | BUY | + 243 pips | ||

| USD/CAD | SELL | PENDING | ||

| TOTAL | + 238 pips | |||

| 4th TRADING WEEK | ||||

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST | |

| MON (26/06/2023) | CAD/JPY | BUY | + 7 pips | |

| TUE (27/06/2023) | USD/CAD | SELL | Breakeven | |

| EUR/CAD | SELL | – 54 pips | ||

| GBP/CAD | BUY | +52 pips | ||

| WED (29/06/2023) | NZD/USD | SELL | -54 pips | |

| TOTAL | – 49 pips | |||

| GRAND | TOTAL | +353 pips |

NOTE: This quarter was lit.

Being able to trade through rough times (2nd trading week), and come out profitable was the icing on the cake for me. I really wish I played a more defensive game in the final week, but its all good. I will try and do better in the 3rd quarter

2nd QUARTER RESULTS

| APRIL | PIPS MADE/LOST |

| Total Pips won | + 113 pips |

| MAY | PIPS MADE/LOST |

| Total Pips lost | – 199 pips |

| JUNE | PIPS MADE/LOST |

| Total Pips lost | +353 pips |

| Q2 GRAND TOTAL | +267 PIPS |

In conclusion:

Second quarter was great. I was able to recover the losses made in first quarter, and a little profits added to it (+5.5%). The month of July is upon us already. Let’s see what we can make of it

How did your second quarter go?

NOTE:

-

THE FUNDED TRADER: https://dashboard.thefundedtraderprogram.com/purchasechallenge-n/?sl=3322 (use the coupon code: THE0CRAFTER)

-

MY FUNDED FX: https://myfundedfx.tech/purchasechallenge/?sl=758

- BESPOKE FUNDING PROGRAMME: https://www.bespokefundingprogram.com/The_Crafter?ref=The_Crafter