My reason for sharing my trade journal is to encourage traders to also keep one for two major reasons:

- Track your weekly trading performance.

- Build a better psychology, which will sharpen your trading intuition

Both can only be done when you keep a comprehensive journal, and review it every week.

MONDAY 17/06/2024

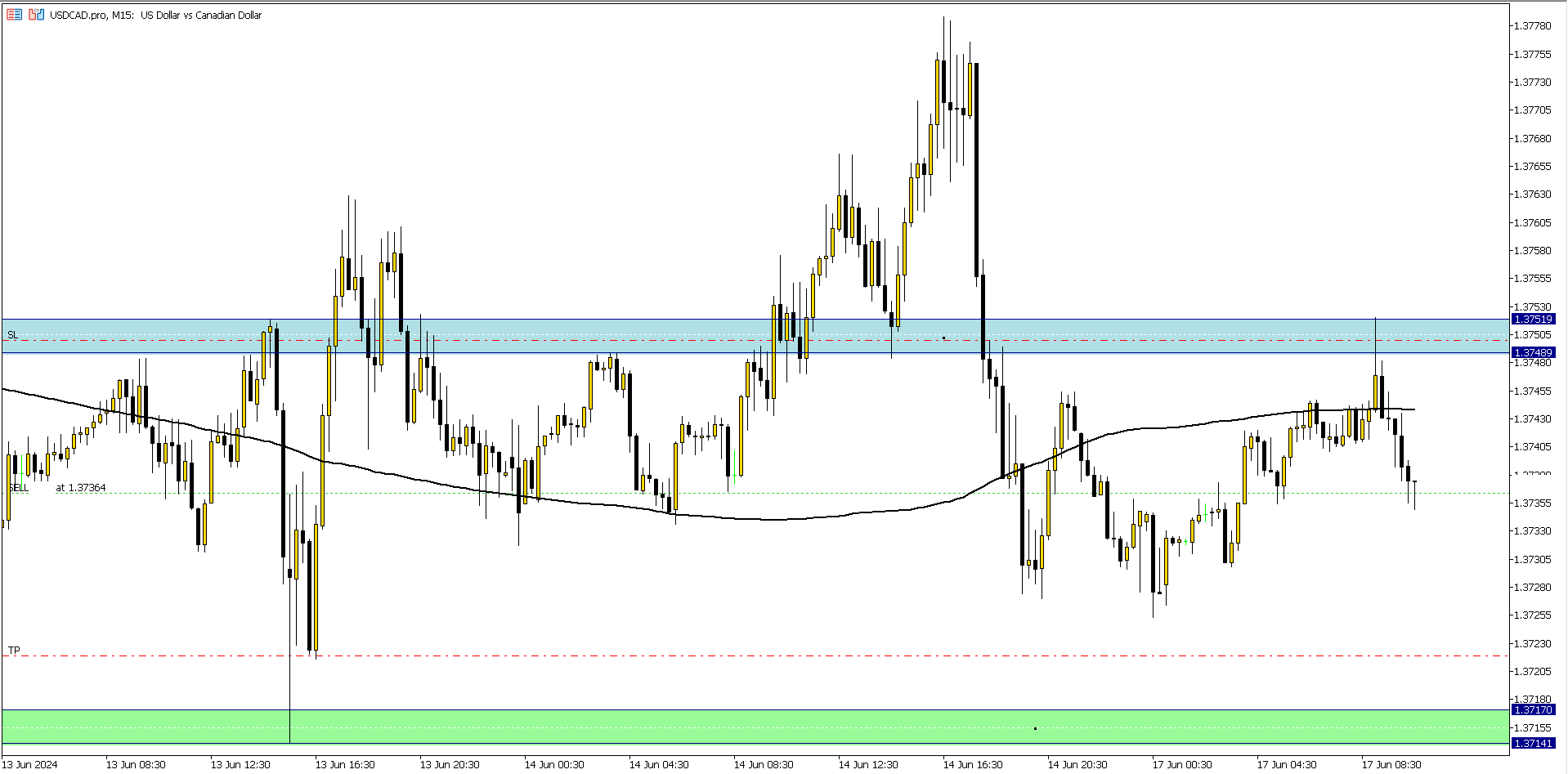

USD/CAD (12.45 pm)

Analysis: An overall bearish outlook on the higher timeframe, and a bounce off a key resistance zone on the 15 min time frame encourage the sell

USD/CAD update (2 pm)

SL hit (+13 pips)

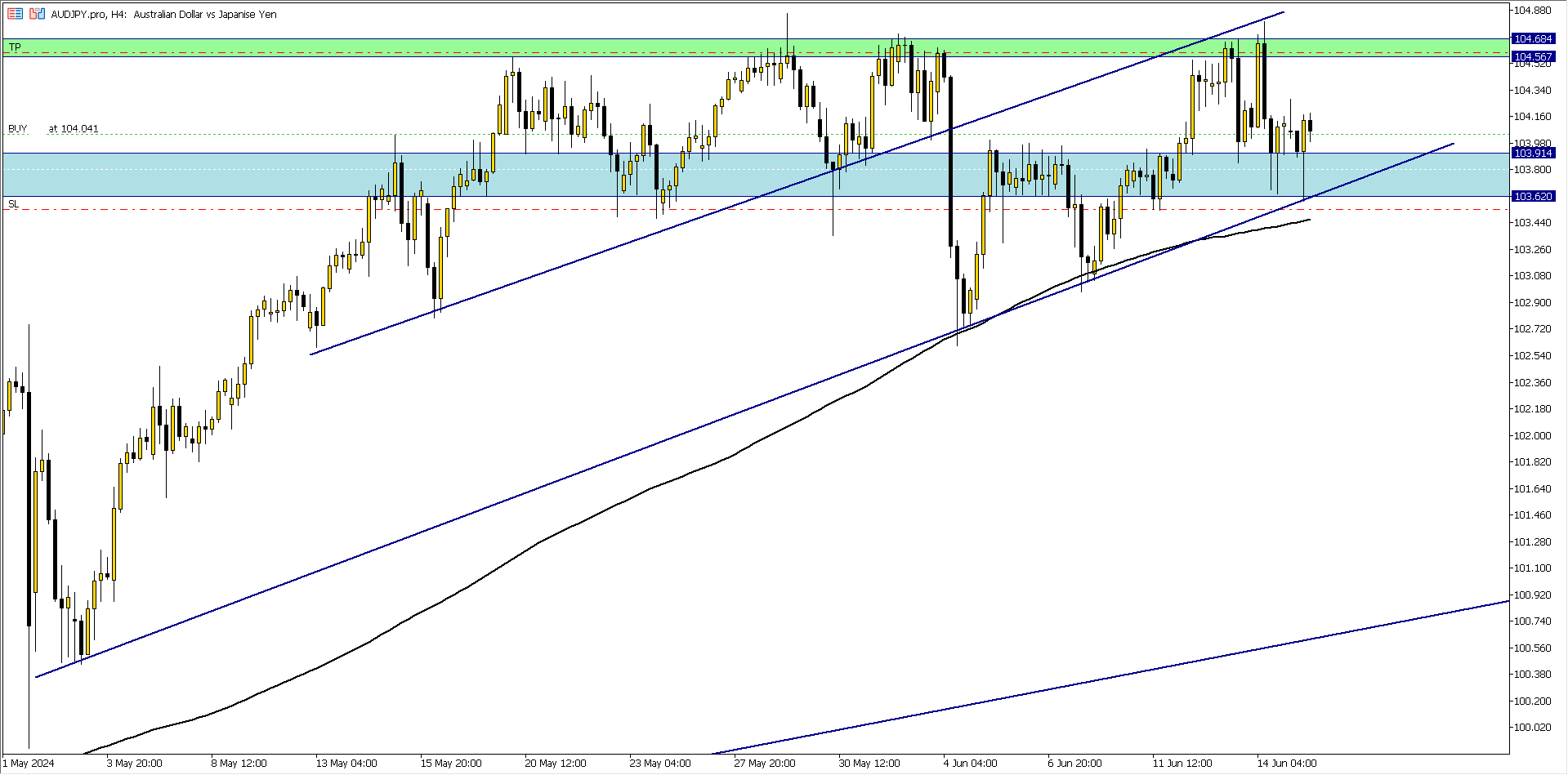

AUD/JPY (2 pm)

Analysis: A decent bounce on a key support zone and 200 moving average supports our need to buy

TUESDAY 18/06/2024

AUD/JPY Update (3.20 am)

Manually closed at +16 pips

USD/CAD (7.30 am)

Analysis: Selling USD/CAD due to the reversal candlestick pattern formed on the daily time frame, on a key resistance zone

USD/CAD Update (8.42 am)

SL hit (-13 pips hit)

WEDNESDAY 19/06/2024

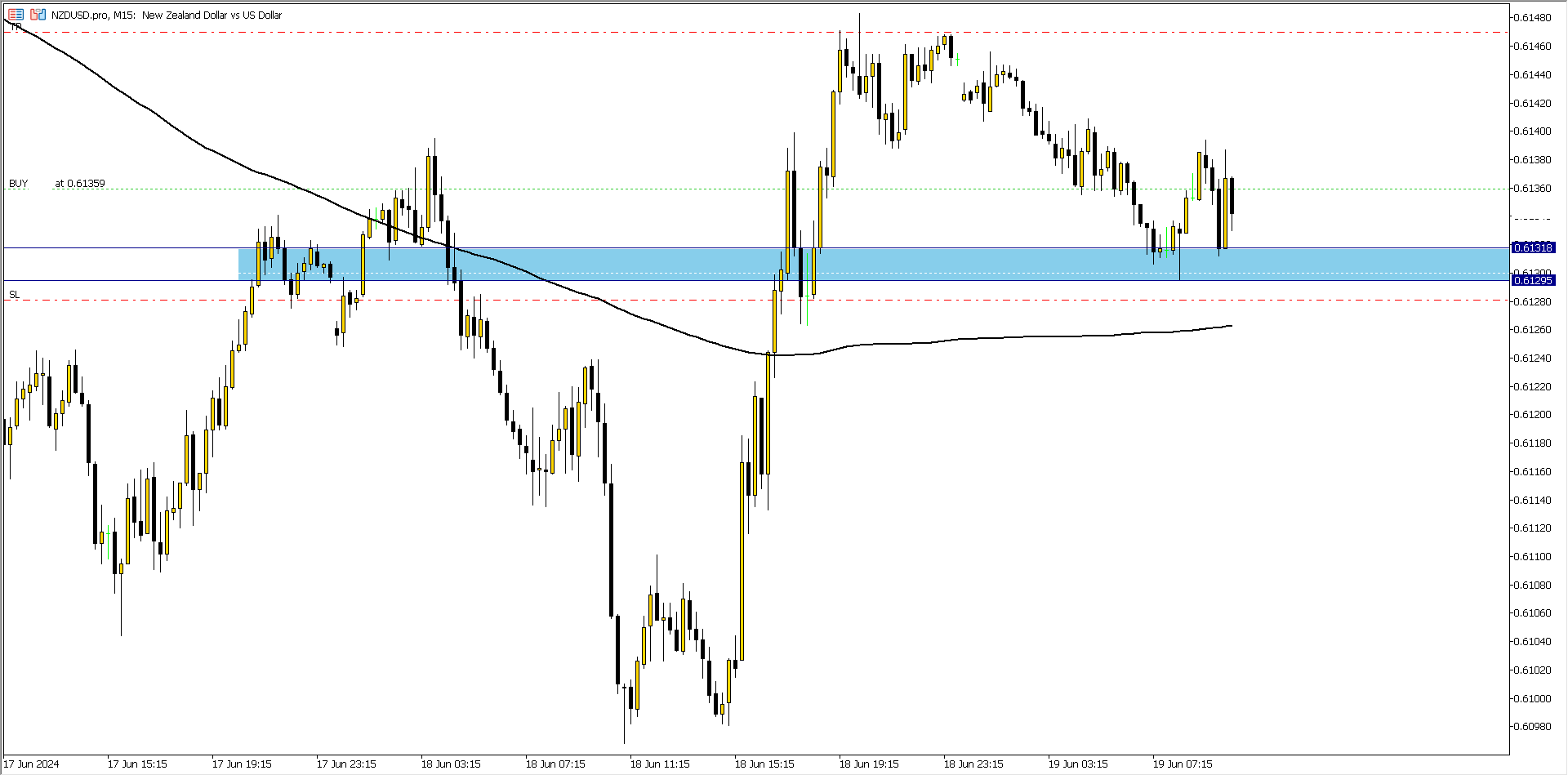

NZD/USD (8.15 am)

An overall bullish bias on the NZD/USD, and a bounce on a key support zone inspired a buy

NZD/USD Update (10.47 am)

Closed at breakeven

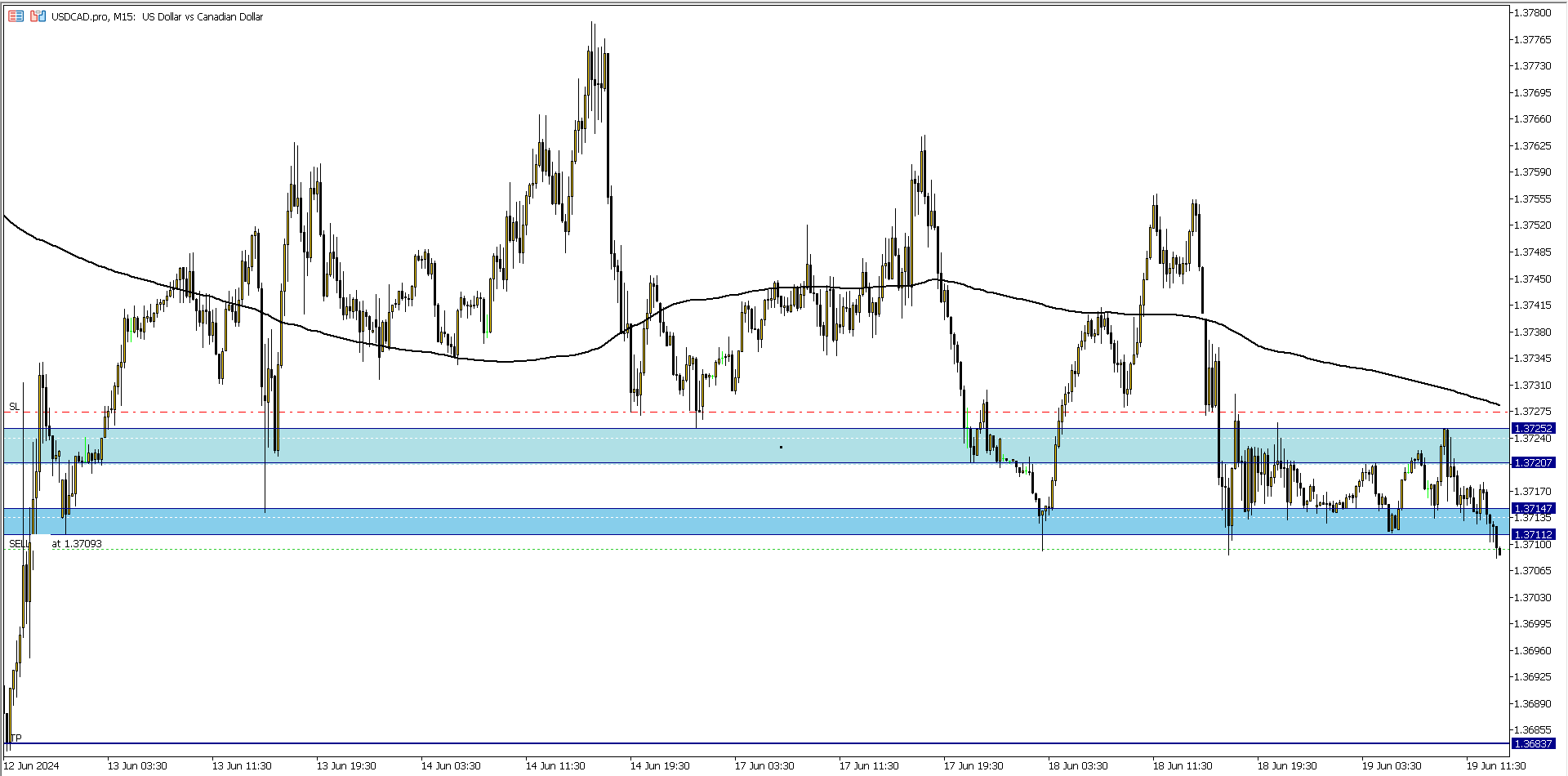

USD/CAD (12.03 pm)

Analysis: A bearish overall outlook, and price bearish breakout through a key support zone on the motivated the sell

USD/CAD (3.45 pm)

Manually closed the trade with +9 pips

THURSDAY 20/06/2024

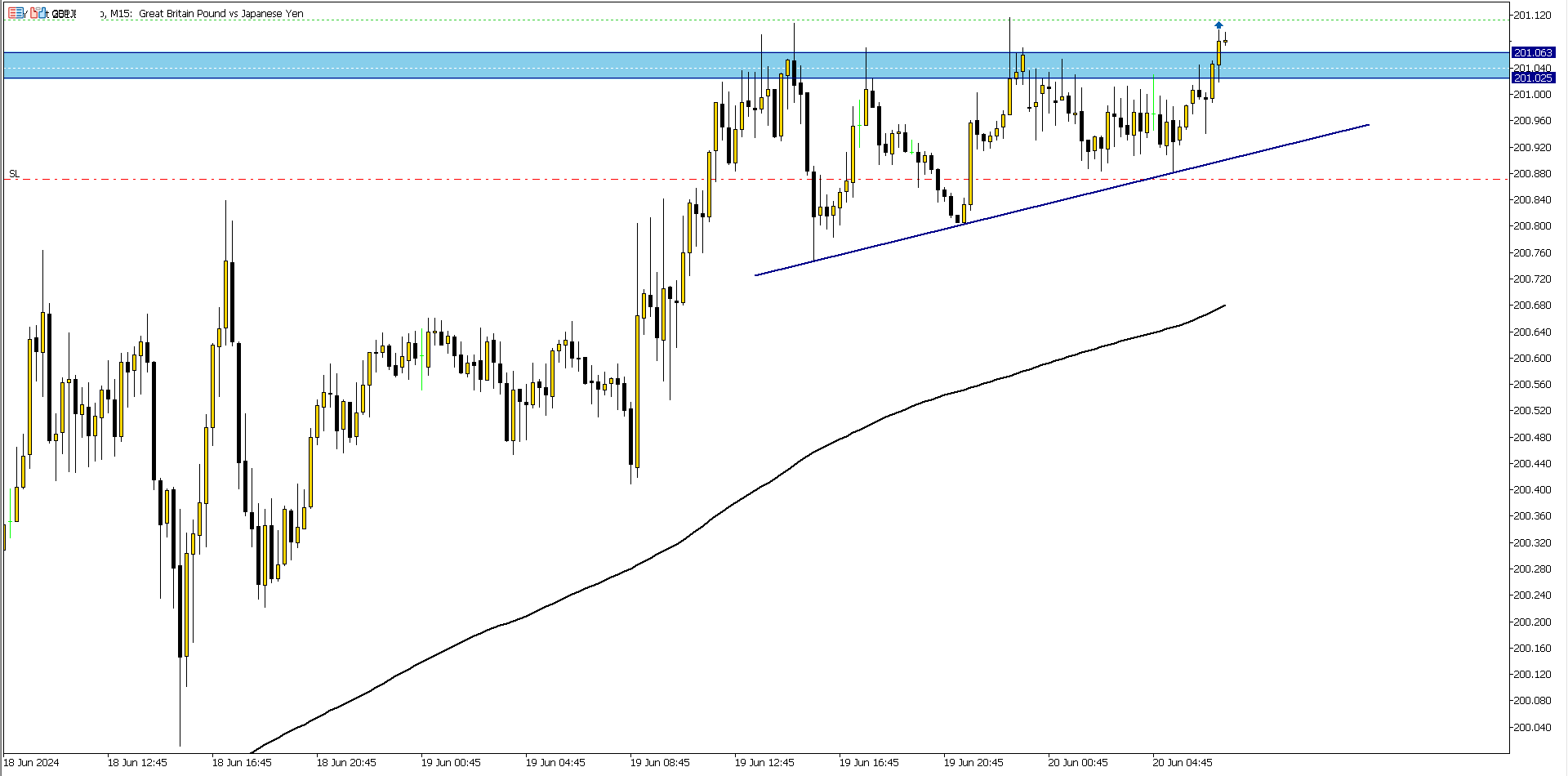

GBP/JPY (5.36 am)

Analysis: A bullish breakout on the 15 mins time frame and a bullish bias on the daily time frame inspired a buy

GBP/JPY Update (7.57 am)

SL got hit (-24 pips)

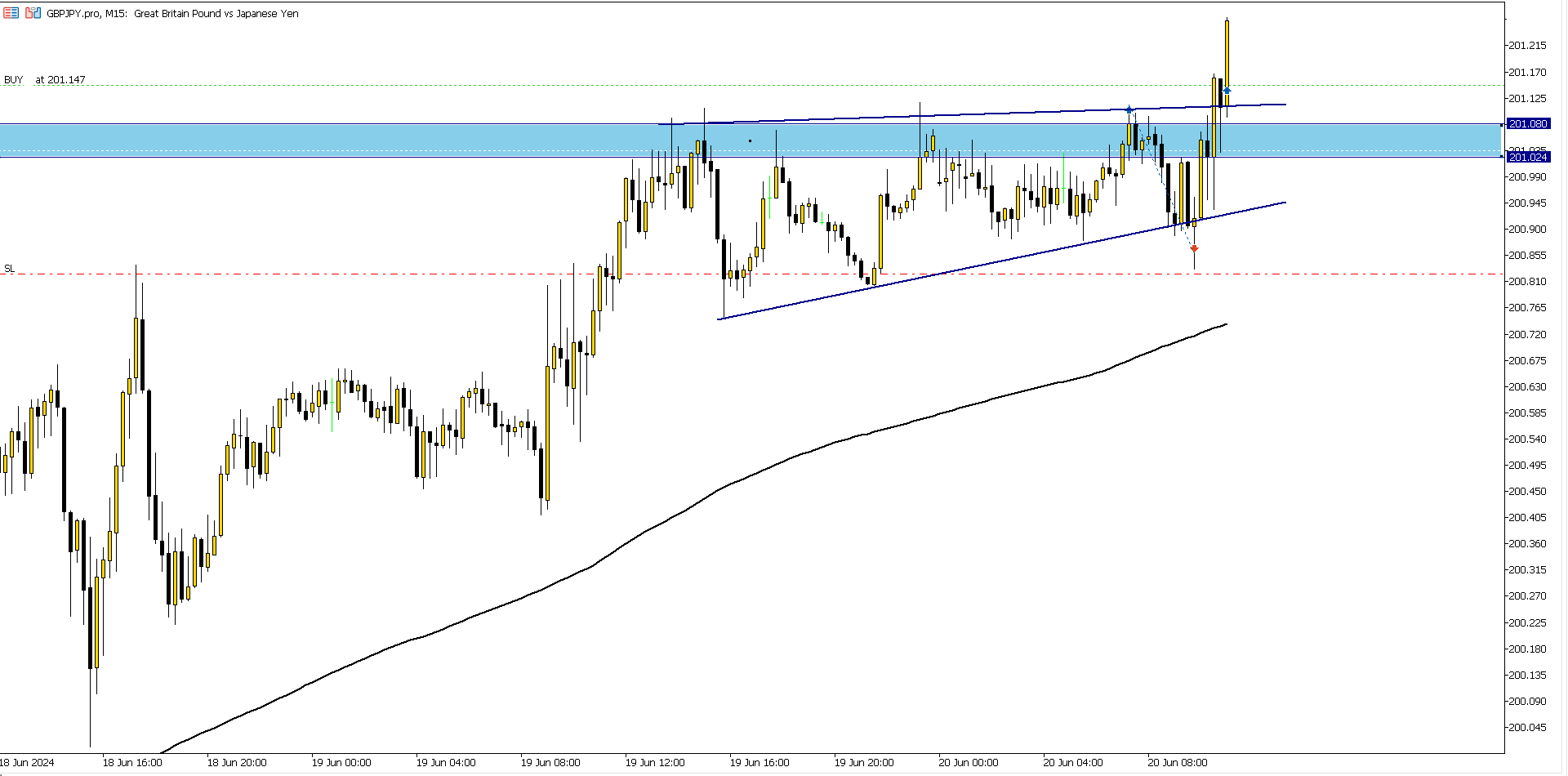

GBP/JPY Re-entering (9 am)

Analysis: After price hit my SL, it continued the initial bullish move, and I bought

GBP/JPY Update (11.57 am)

Manually closed with +15 pips

Trade activity summary for the week

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST |

| MON (17/06/2024) | USD/CAD | SELL | – 13 pips |

| AUD/JPY | BUY | +16 | |

| TUE (18/06/2024) | USD/CAD | SELL | – 13 pips |

| WED (19/06/2024) | NZD/USD | SELL | Breakeven |

| USD/CAD | SELL | +9 pips | |

| THUS (20/06/2024) | GBP/JPY | BUY | -24 pips |

| GBP/JPY | BUY | +15 pips | |

| TOTAL | -10 pips |

In Conclusion:

USD/CAD milked me last week.

I lost -2.7% to the market, and the major reason was because USD/CAD was full of fish bones. So on every USD/CAD trade I took on the 15 minutes time frame, price cleared my SL before heading to TP.

The same thing happened with the GBP/JPY, which I had to re-take, but the reduced risk, had no significant impact on my drawdown. So far I have had 3 losing weeks, and a little above -5% loss on my trading capital

I would rate my execution 90%, but the outcome was way below par. The market had the final say

That said, I look forward to a profitable week

How did your trading week go?

NOTE:

Our telegram group: https://t.me/+UujC4KoBe1AN0fnK

-

AXE TRADER: (Use the coupon code: THECRAFTER for a -20% discount)

- BESPOKE FUNDING PROGRAMME

- FUNDED ENGINEER

- BLUE GUARDIAN (Use the coupon code: CRAFTER)

- GOAT FUNDED

- LARK FUNDING

- SKILLED FUNDED TRADER

- MAVEN TRADING

- MY FLASH FUNDING (Use the coupon code: “FILLIPO” for a -25% discount)

- THE5ERS