My reason for keeping a journal is to encourage traders to also keep one for two major reasons:

- Track weekly trading performance.

- have enough data, in order to be able to work on their trading technique and psychology

Both can only be done when you keep a comprehensive journal, and review it every week.

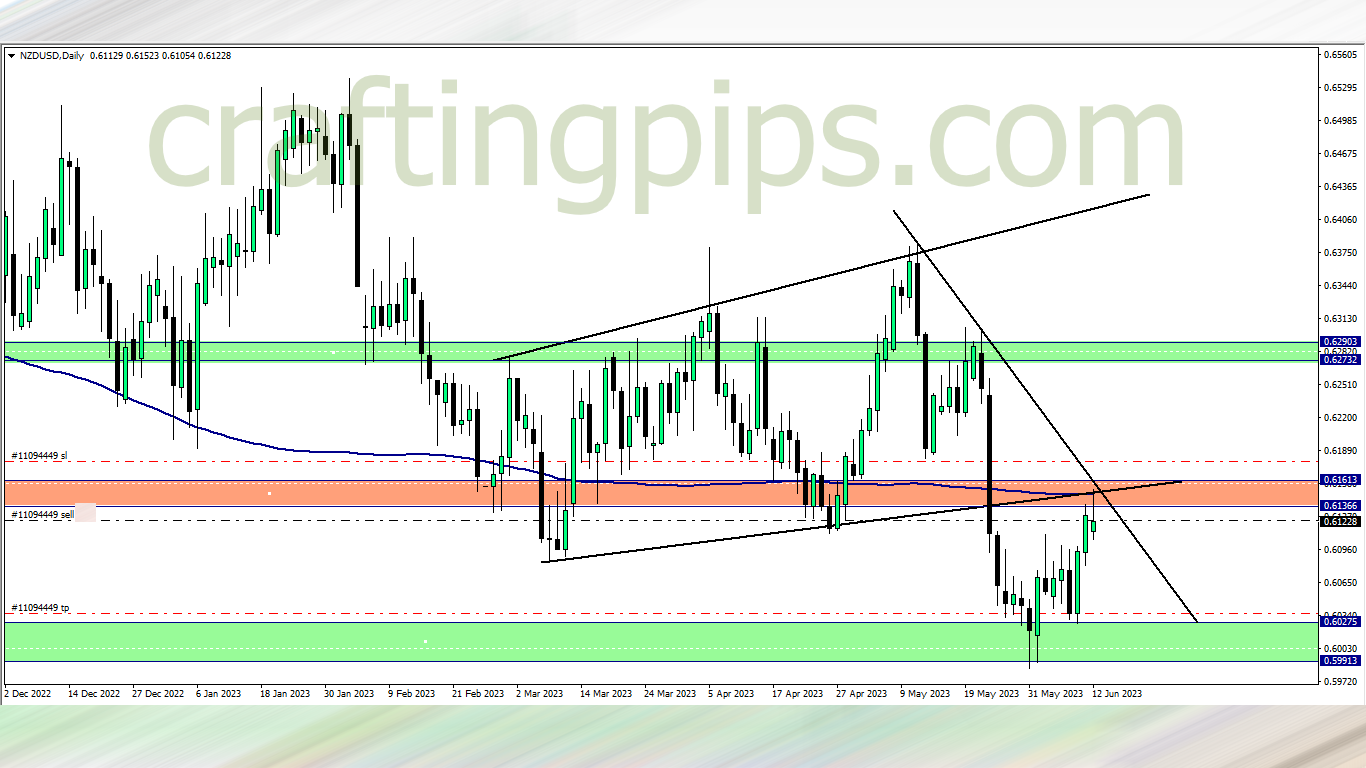

MONDAY (12/06/2023)

NZD/USD (9.45 pm)

Analysis: The sell was inspired from our weekly market analysis

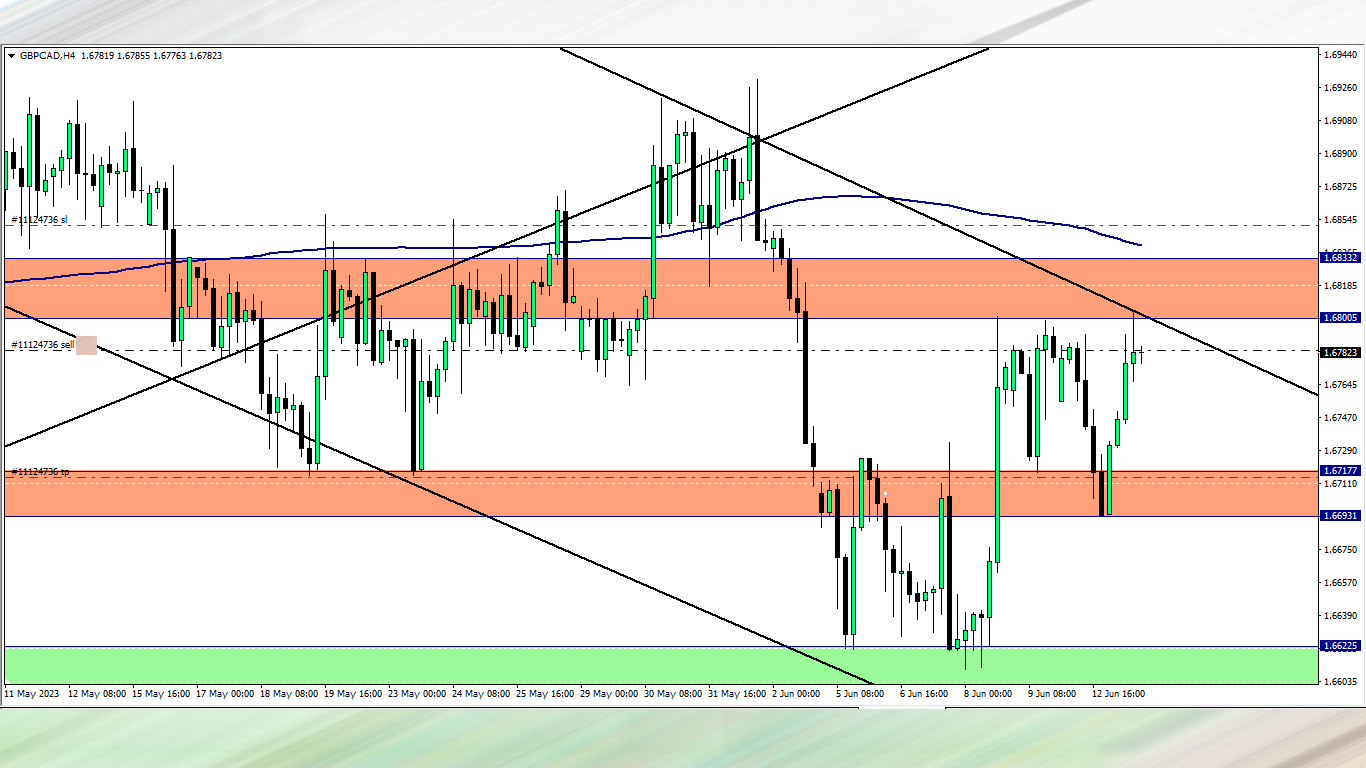

TUESDAY (13/06/2023)

GBP/CAD (2.05 pm)

Analysis: My reason for selling is because price is at a key resistance zone, and also below the 200 ma. Note that there is a high impact GBP news (Gov Bailey speaks) scheduled for 3 pm.

So We have less than an hour to either make profits and move on, or decide if we are to hold the position through the news

GBP/CAD Update(2.48 pm)

+3 pips and out

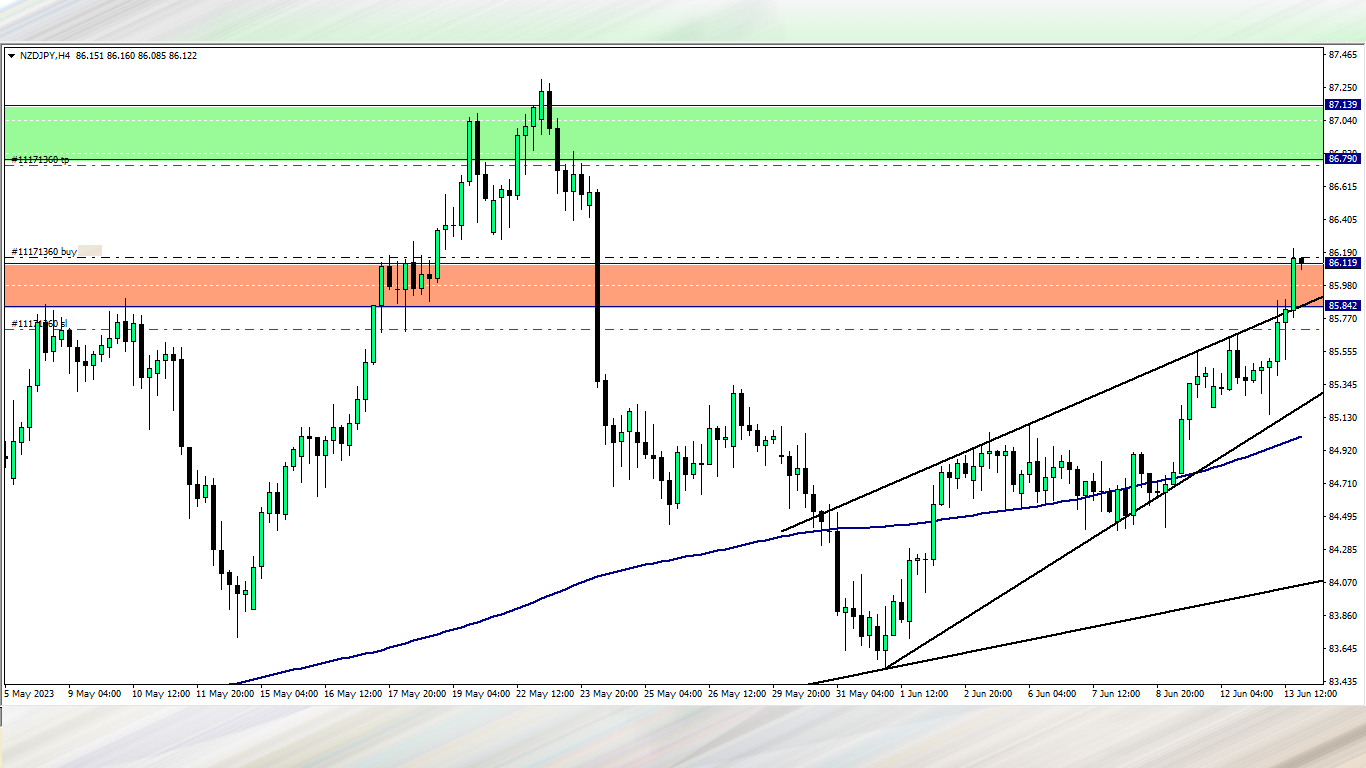

NZD/JPY (6.05 pm)

Analysis: The buy was inspired from our Wednesday market analysis

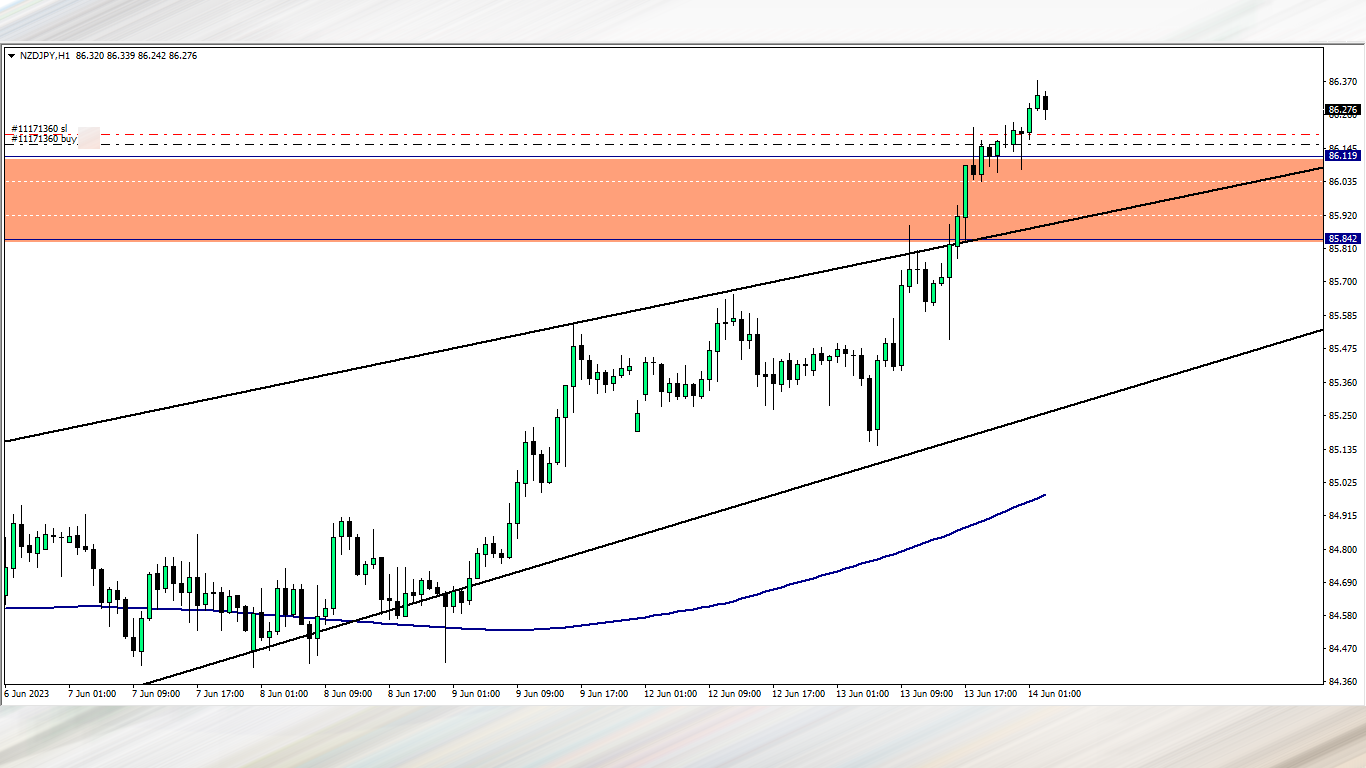

WEDNESDAY (14/06/2023)

NZD/JPY Update

Analysis: Closed with +2pips

THURSDAY (15/06/2023)

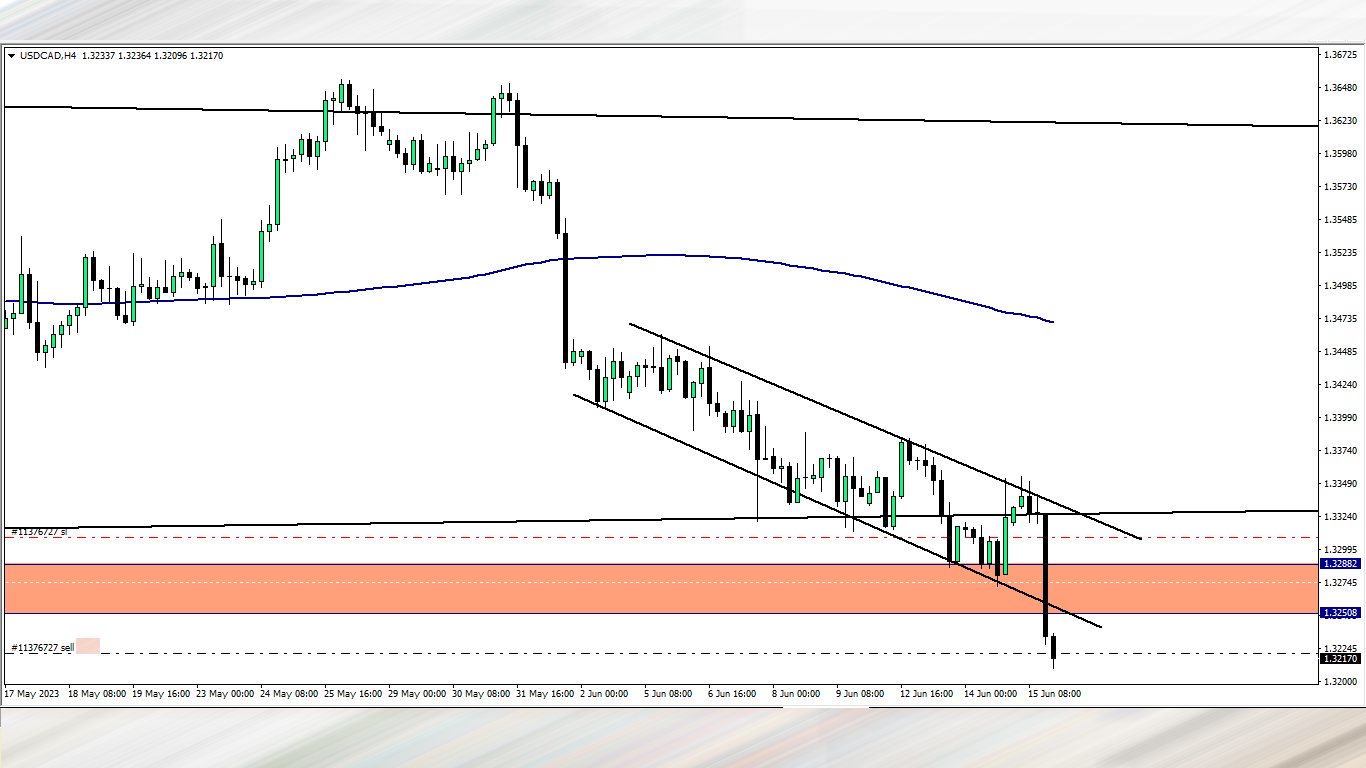

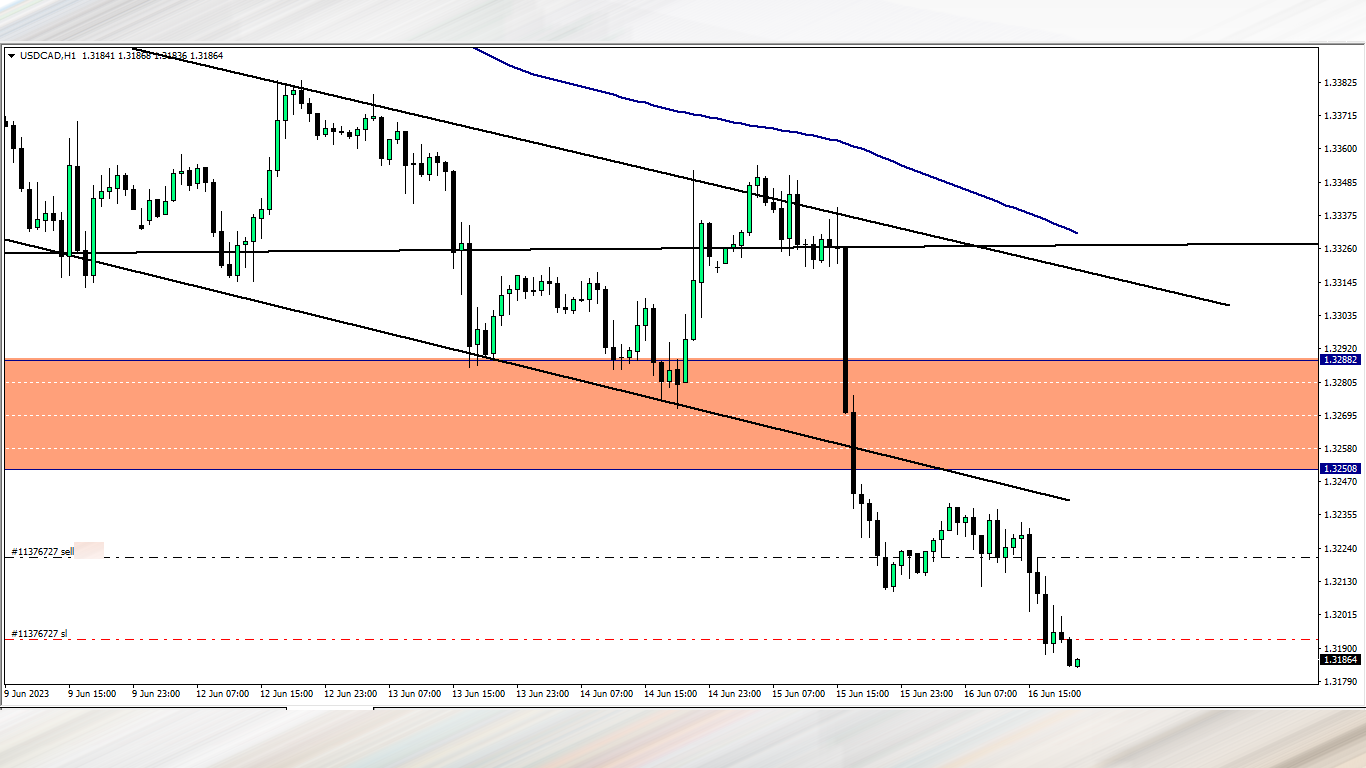

USD/CAD (9.30 pm)

Analysis: This setups was first sighted on our weekly market analysis, but materialised on Thursday

FRIDAY (16/06/2023)

USD/CAD Update (10 pm)

Analysis: Finally locked +27 pips with my trailing stop loss, and am done for the week

Trade activity summary for the week

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST |

| MON (12/06/2023) | NZD/USD | SELL | + 3 pips |

| TUE (13/06/2023) | GBP/CAD | SELL | + 3 pips |

| WED (14/06/2023) | NZD/JPY | BUY | + 2 pips |

| THUS (15/06/2023) | USD/CAD | SELL | + 27 pips |

| TOTAL | + 35 pips |

In conclusion:

This week ought to have been an inactive week for me because of the loaded news calendar with high impact news. There were some A setups which I could not resist, so I was EXTREMELY conservative pushing tight stop loss on my trades, hence the few pips gained on my winning trades.

NZD/JPY would have fetched me over 200 pips as it moved so well. I had to also exit the USD/CAD despite it being bearish. Hopefully we continue selling next week.

How did your trading week go?

NOTE:

-

THE FUNDED TRADER: https://dashboard.thefundedtraderprogram.com/purchasechallenge-n/?sl=3322 (use the coupon code: THE0CRAFTER)

-

MY FUNDED FX: https://myfundedfx.tech/purchasechallenge/?sl=758

- BESPOKE FUNDING PROGRAMME: https://www.bespokefundingprogram.com/The_Crafter?ref=The_Crafter