My reason for sharing my trade journal is to encourage traders to also keep one for two major reasons:

- Track your weekly trading performance.

- Build a better psychology, which will sharpen your trading intuition

Both can only be done when you keep a comprehensive journal, and review it every week.

MONDAY 20/05/2024

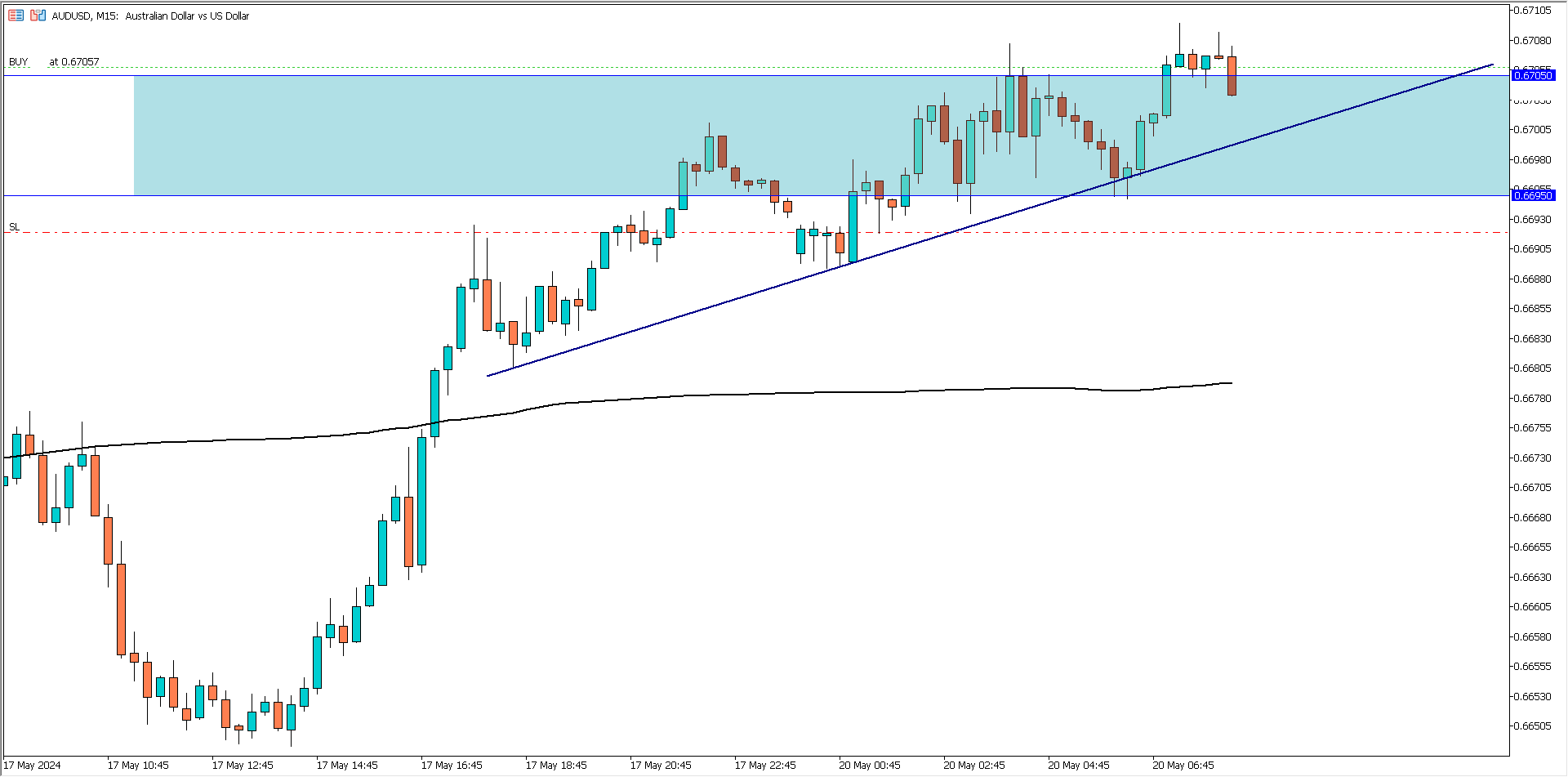

AUD/USD (6.30 am)

Analysis: My buy was inspired by our Weekly Market Analysis

AUD/USD Update (7.22 am)

Manually closed with -13 pips

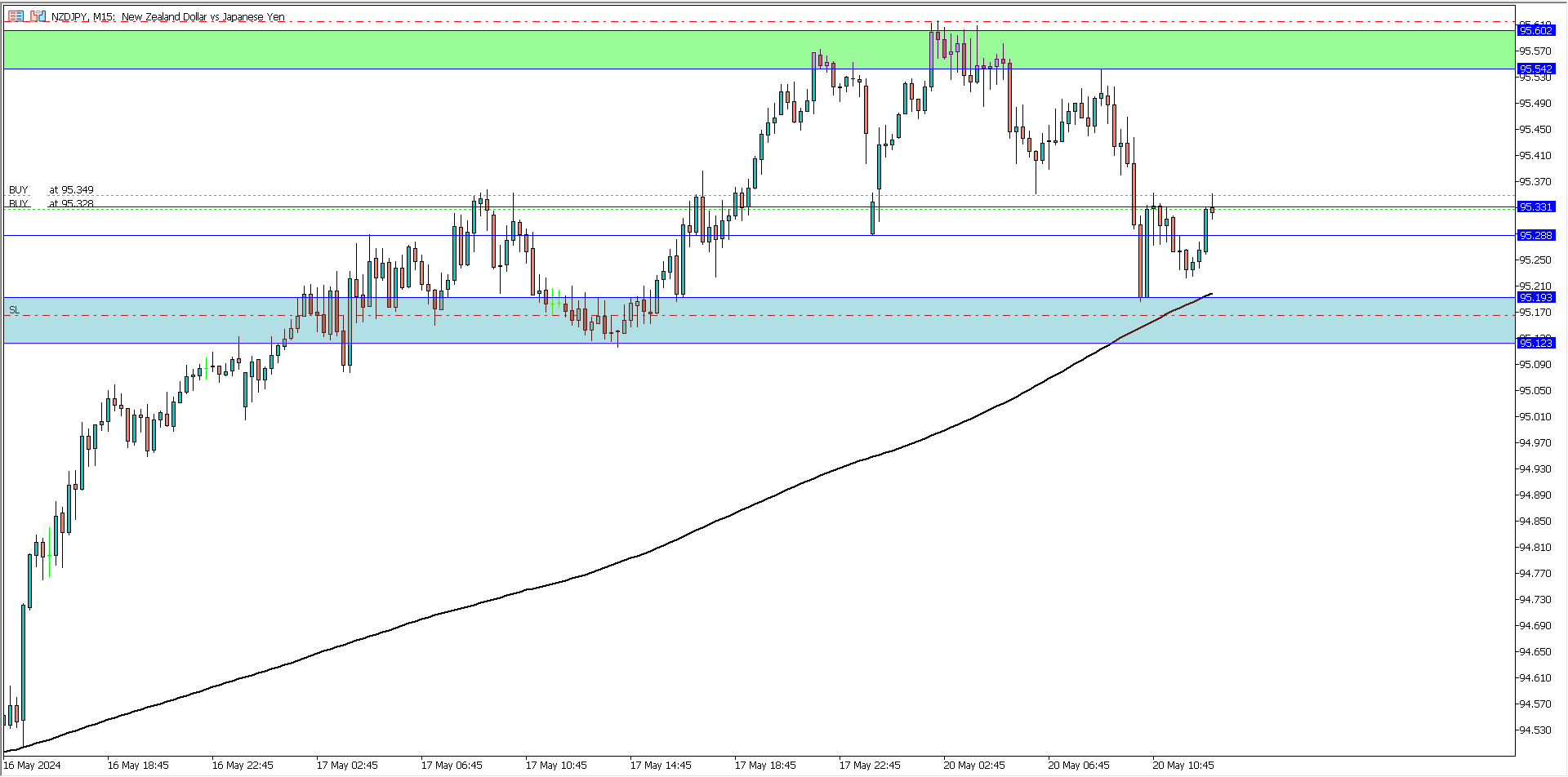

NZD/JPY (11.05 am)

Analysis: My buy was inspired by our Weekly Market Analysis

NZD/JPY Update (1.33 pm)

SL hit (- 34 pips)

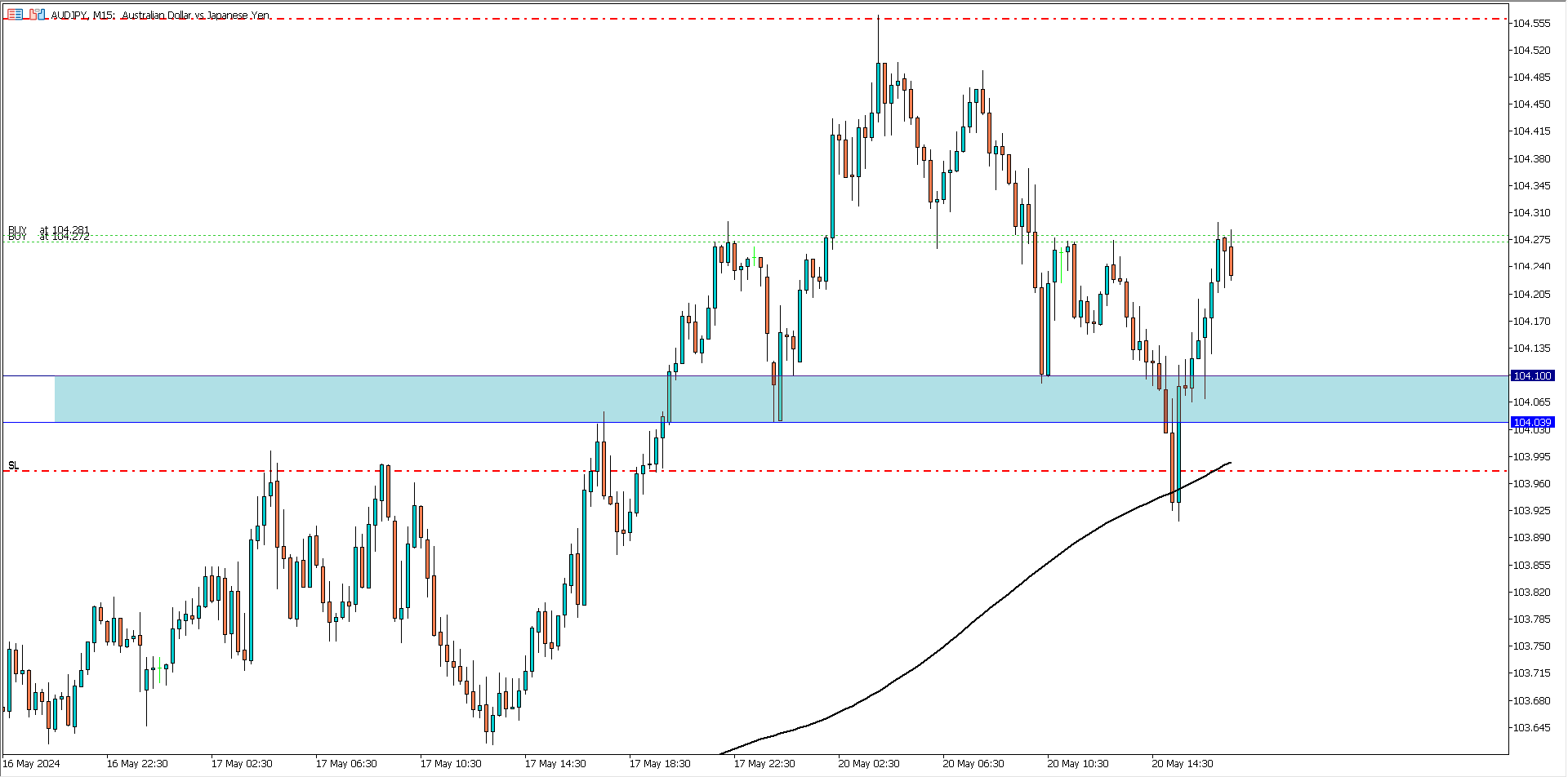

AUD/JPY (3.41 pm)

Analysis: A strong bullish bias on the larger time frame inspired the buy on the 15 minutes time frame.

TUESDAY 21/05/2024

AUD/JPY Update (2.53 am)

Manually closed with +12 pips

GBP/JPY (11.30 am)

Analysis: Break of key resistance zone on the 15 min. time frame and a bullish bias on the daily and 4 hour tf

NZD/USD (12.15 pm)

Analysis: Break of key support zone on the 15 min. time frame and a bearish bias on the daily and 4 hour tf

GBP/JPY Update (2.15 pm)

SL hit -25 pips

NZD/USD Update (2.15 pm)

Closed manually with +8 pips

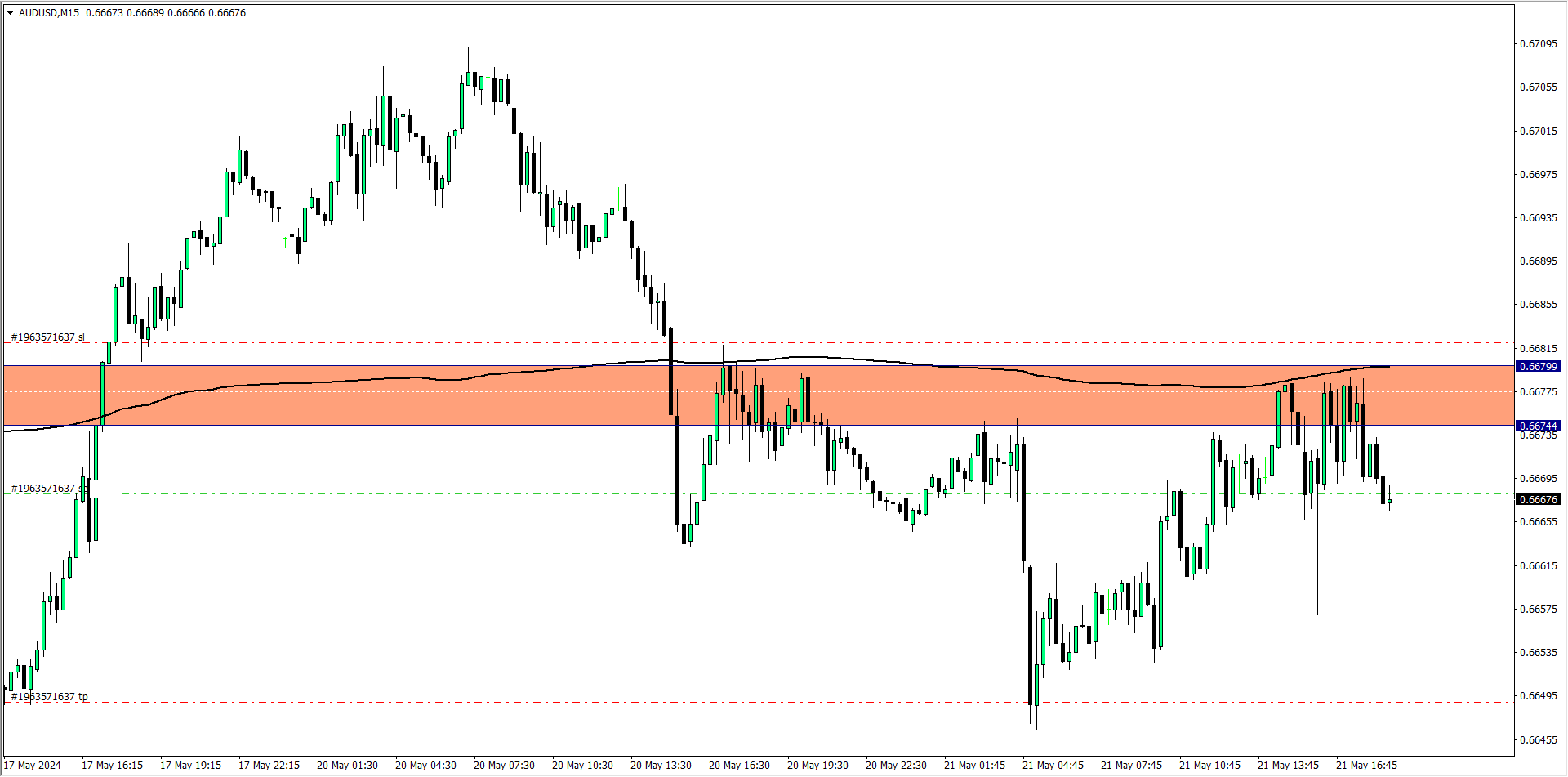

AUD/USD (5.02 pm)

Analysis: Bearish bias on the daily and 4hr tf and a break of a key support zone on the 15 mins tf inspired the sell

WEDNESDAY 22/05/2024

AUD/USD Update (4.42 am)

Manually closed -13 pips

THURSDAY 23/05/2024

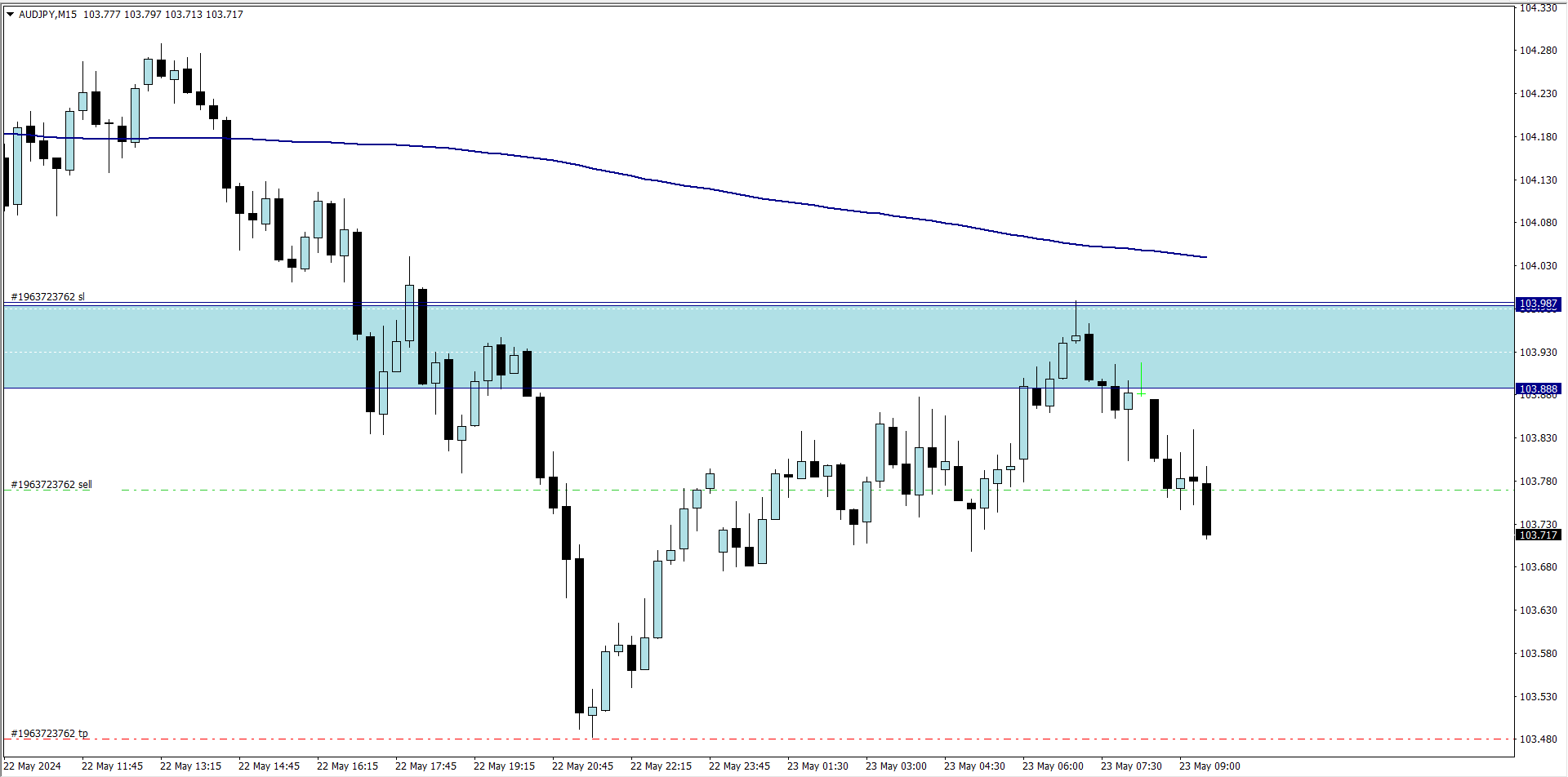

AUD/JPY (7.30 am)

Analysis: Bearish bias on the daily and 4hr tf and a break of a key support zone on the 15 mins tf inspired the sell

AUD/JPY Update (11 am)

Manually closed -21 pips

Trade activity summary for the week

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST |

| MON (20/05/2024) | AUDUSD | BUY | -13 pips |

| NZDJPY | BUY | -34 pips | |

| AUDJPY | BUY | +12 pips | |

| TUE (21/05/2024) | GBPJPY | BUY | -25 pips |

| NZDUSD | SELL | +8 pips | |

| AUD/USD | SELL | – 13 pips | |

| THUS (23/05/2024) | AUD/JPY | SELL | -21 pips |

| TOTAL | -86 pips |

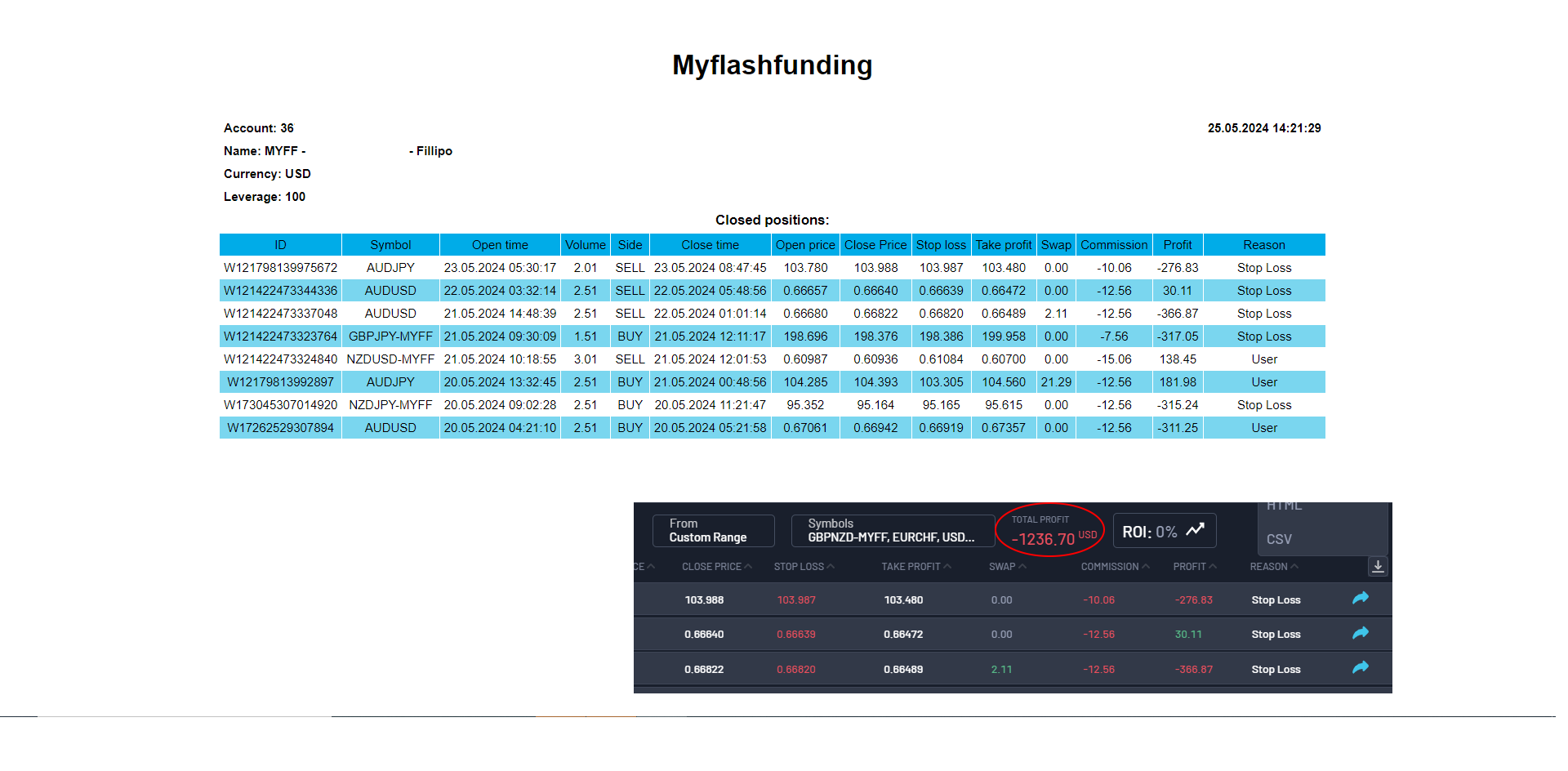

MYFF prop account trading summary (20th to 24th of May)

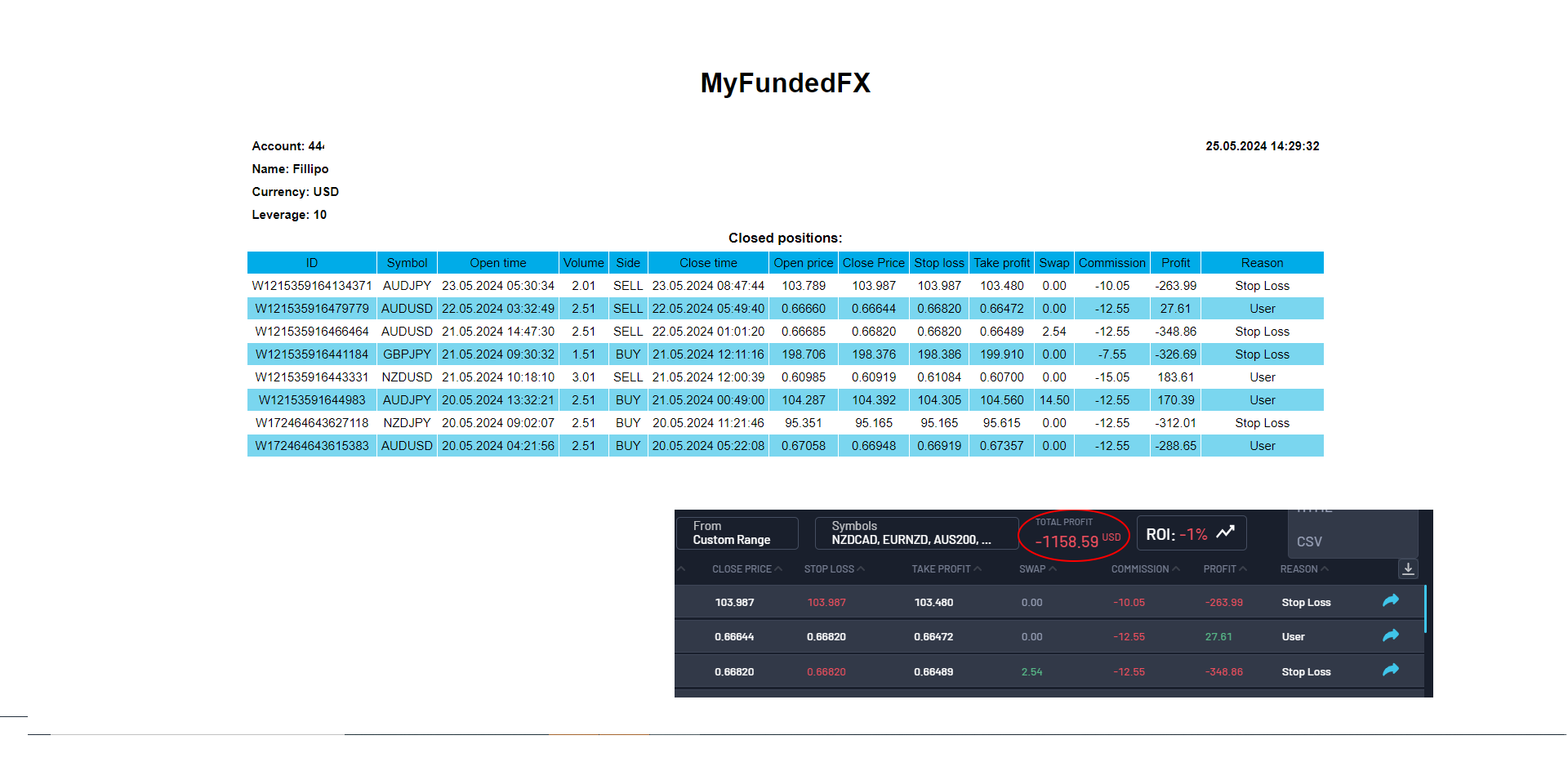

MFFX prop account trading summary (20th to 24th of May)

In conclusion:

Last week was my worst trading week for the year. I lost -4.2 to -5% of my prop account because of a couple of reasons

- I was not in tune with the market because I was also handling a lot of mental pressure

- I was in a hurry to hit some payouts, and also push some accounts into payout phase

This weekend I spent more time reflecting on my last week’s trading activities, and I found out that even if I had to close with a losing position, I could have done a better job by losing less (-2% to 3%)

This week, I will be sticking to the basics and I will be building from the ground up.

How did your trading week go?

Note:

- BESPOKE FUNDING PROGRAMME

- FUNDED ENGINEER

- BLUE GUARDIAN (Use the coupon code: CRAFTER)

- GOAT FUNDED

- LARK FUNDING

- SKILLED FUNDED TRADER

- MAVEN TRADING

- MY FLASH FUNDING (Use the coupon code: “FILLIPO” for a -25% discount)

- THE5ERS