My reason for keeping a journal is to encourage traders to also keep one for two major reasons:

- Track weekly trading performance.

- have enough data, in order to be able to work on their trading technique and psychology

Both can only be done when you keep a comprehensive journal, and review it every week.

MONDAY (08/05/2023)

CAD/CHF (2 pm)

Analysis: Reason for buying CAD/CHF was shared in our weekly analysis

Analysis: Reason for buying CAD/CHF was shared in our weekly analysis

WEDNESDAY (10/05/2023)

CAD/CHF (2 .05 am)

Analysis: Added a second position on Tuesday after price broke the 200 ma the second time, further strengthening our bullish bias… Sadly I manuall closed this trade with -40 pips as price fell flat a few hours into Thursday

THURSDAY (11/05/2023)

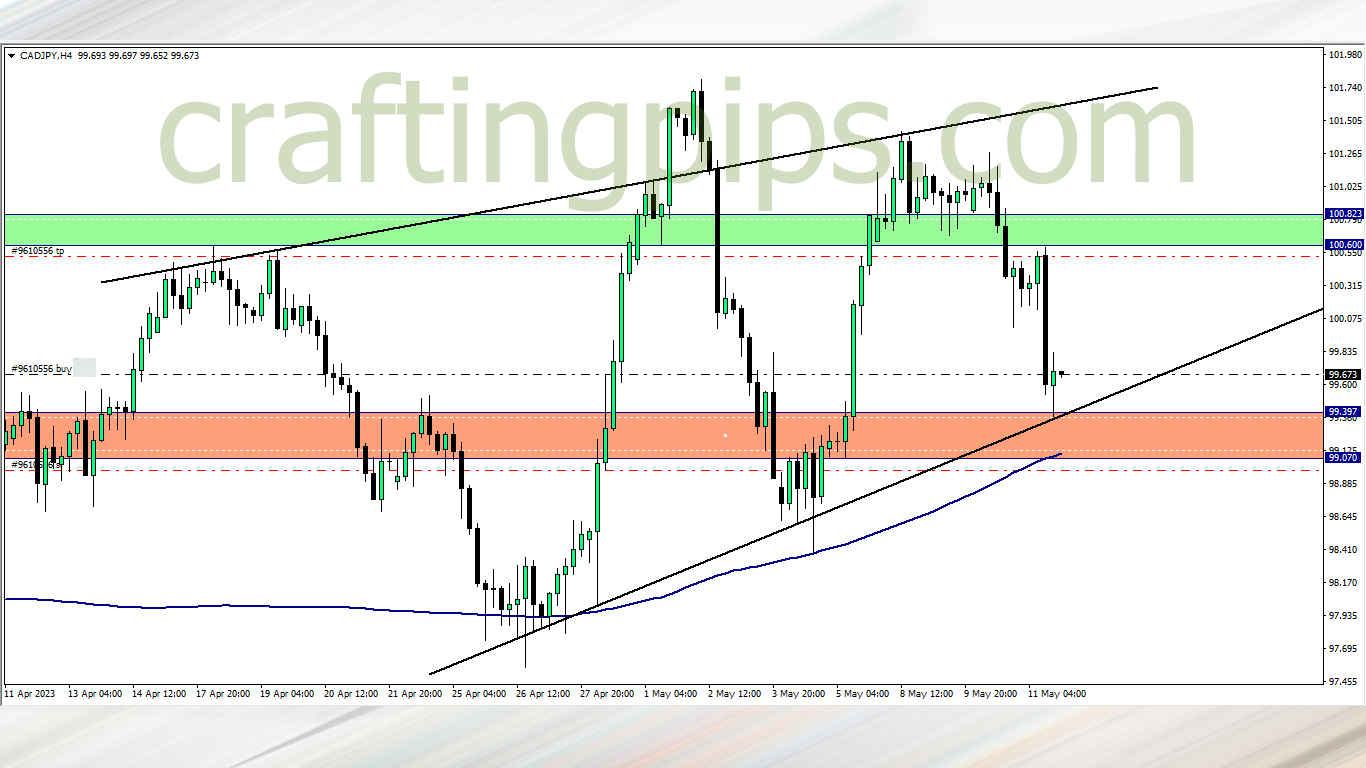

CAD/JPY (6.30 pm)

Analysis: My reason for buying can be seen on our Friday market analysis

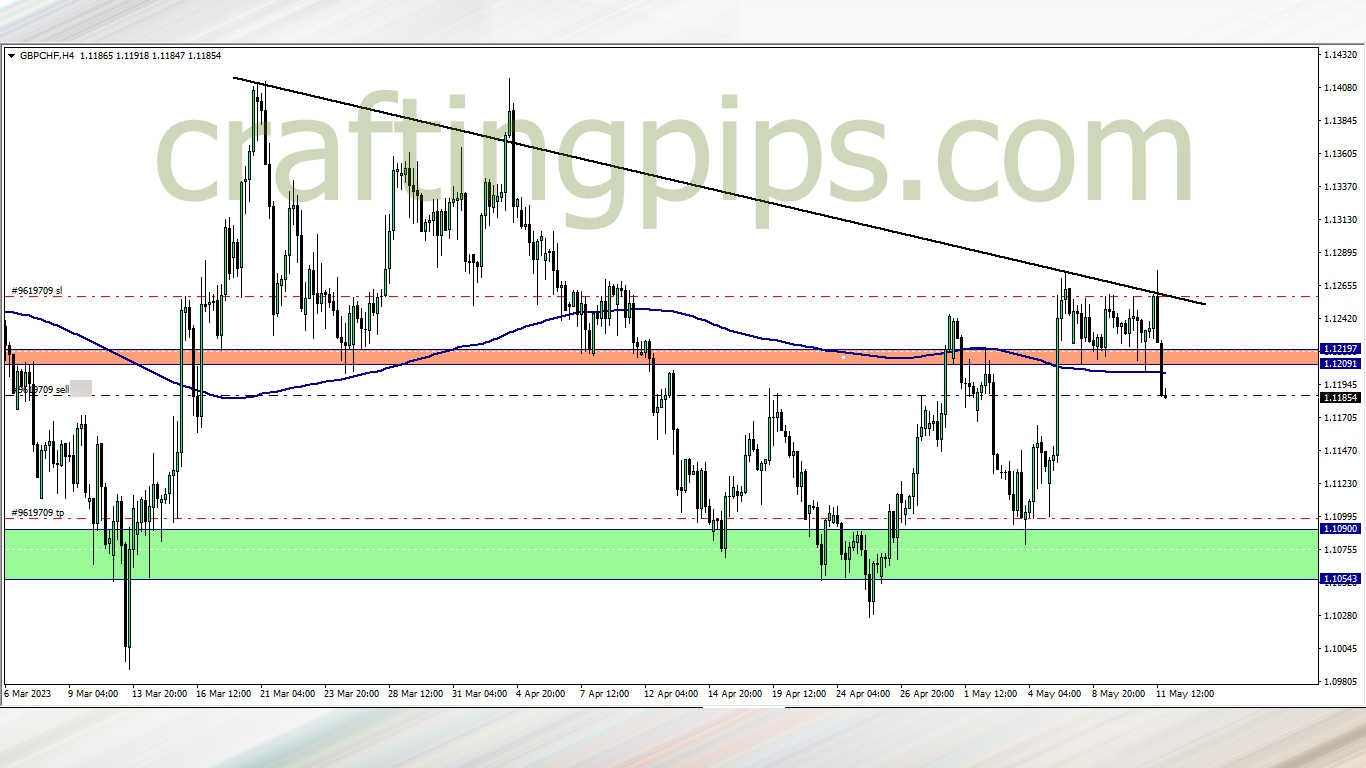

GBP/CHF (9.30 pm)

Analysis: My reason for buying can be seen on our Friday market analysis

FRIDAY (12/05/2023)

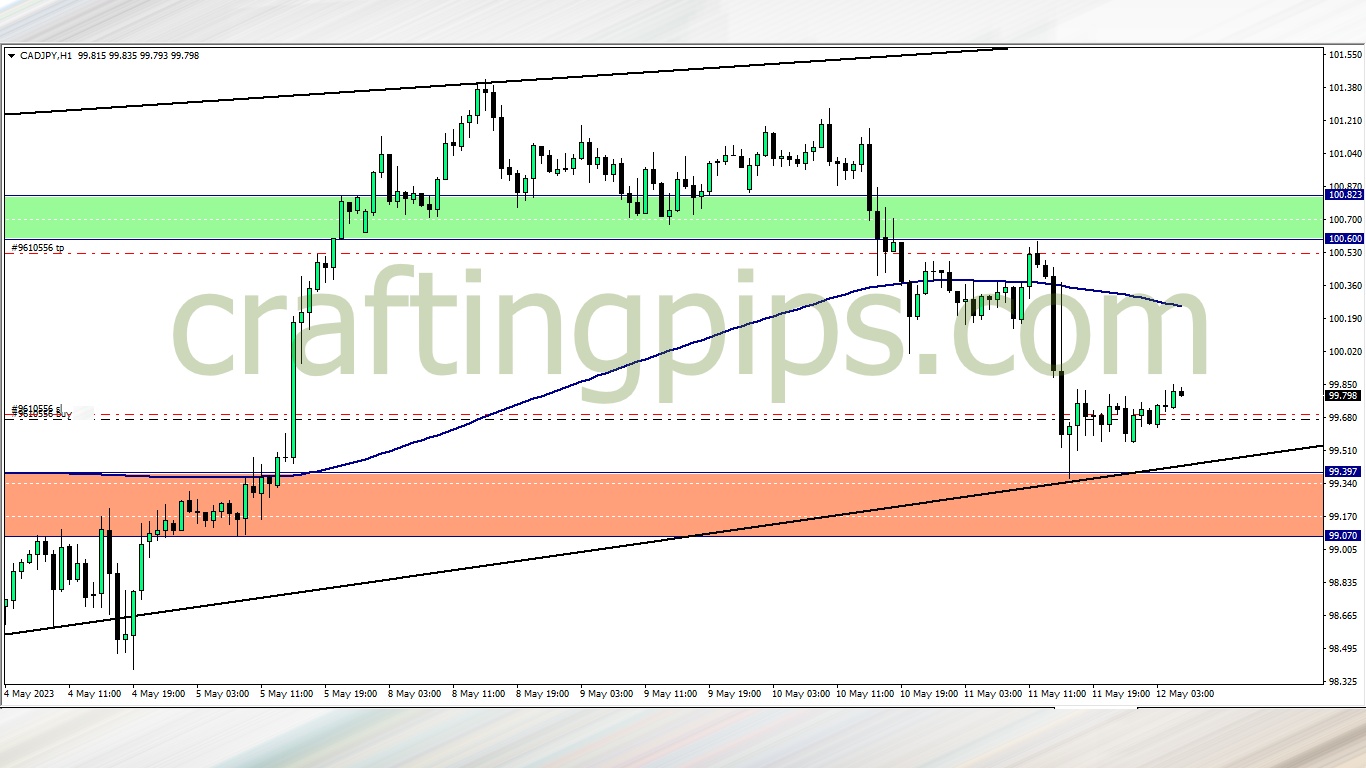

CAD/JPY Update (5am)

Analysis: Closed with +17 pips with a trailing SL

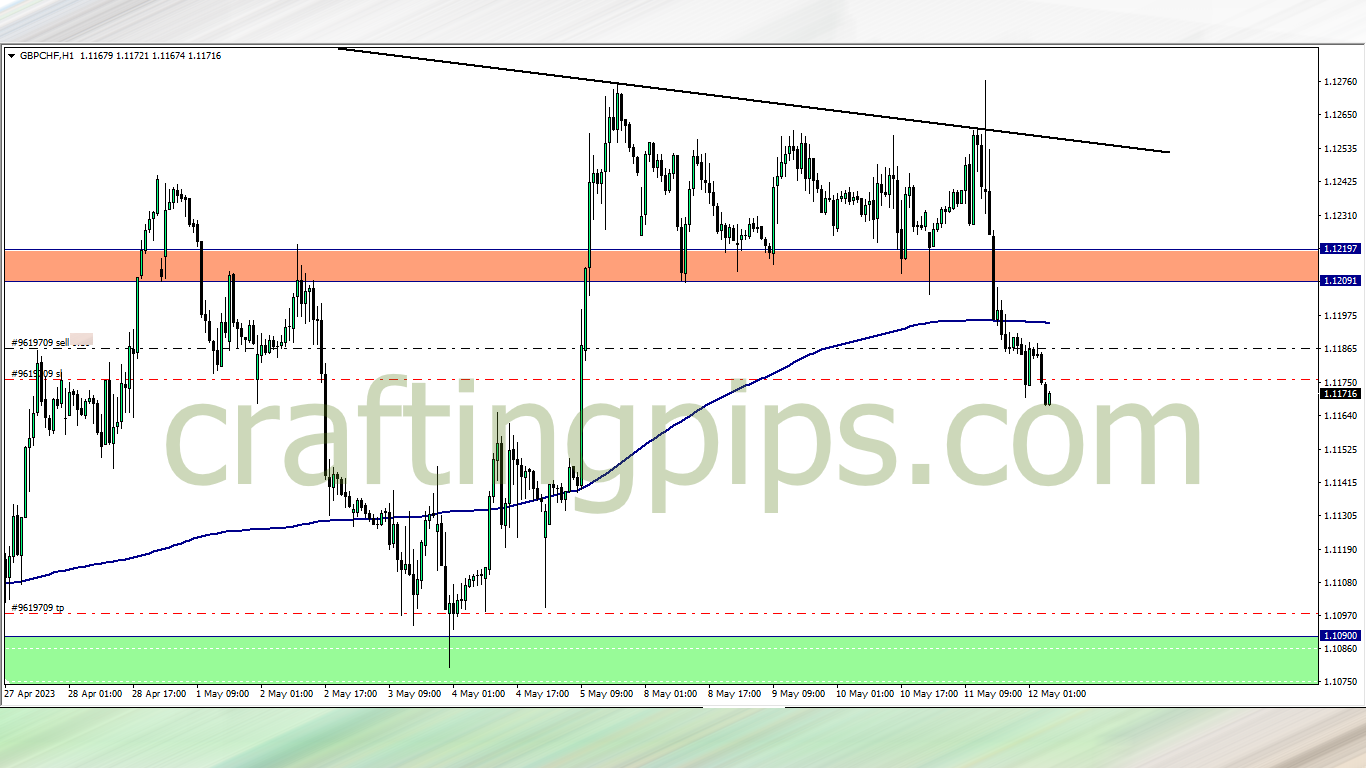

GBP/CHF Update (5am)

Analysis: Closed with +11 pips with a trailing SL

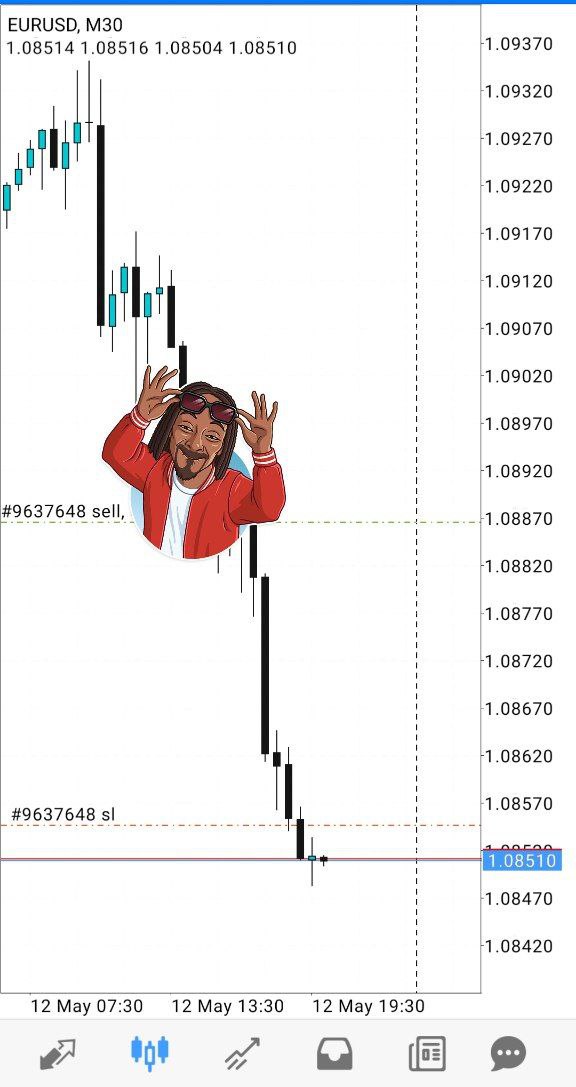

EUR/USD (2 pm)

Analysis: This was one setup I felt won’t materialize until 2 pm today when The bears returned to the market with a convincing breakout below the key support zone and 200 ma.

EUR/USD Update (7pm)

Analysis: I kept on trailing EU till I got hit at +31 pips. I was away from my work station so I am sharing a screenshot of my device which I shared with my trading community

Trade activity summary for the week

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST |

| MON (08/05/2023) | CAD/CHF | BUY | – 40 pips |

| THUS (11/05/2023) | CAD/JPY | BUY | + 17 pips |

| GBP/CHF | SELL | + 11 pips | |

| FRI (12/05/2023) | EUR/USD | SELL | + 31 pips |

| TOTAL | +19 PIPS |

In conclusion:

Trading this week was slow for me due to the fact that the news calendar was stuffed with red folders.

I closed the week with positive pips but I am down by -0.20%. Reason for this is:

I played defensively trading the CAD/JPY & GBP/CHF, so I risked little. I also had a very good setup on the EUR/USD, but again I risked little because there was a red folder on USD, just an hour after I sold EU.

After my first trade went bad, I worked towards risking little and also tightening my trailing SL. Hopefully this coming week will be light on news and also present ace setups for us to feast on

How did your trading week go?

NOTE:

-

THE FUNDED TRADER: https://dashboard.thefundedtraderprogram.com/purchasechallenge-n/?sl=3322 (use the coupon code: THE0CRAFTER)

-

MY FUNDED FX: https://myfundedfx.tech/purchasechallenge/?sl=758

- BESPOKE FUNDING PROGRAMME: https://www.bespokefundingprogram.com/The_Crafter?ref=The_Crafter