My reason for sharing my trade journal is to encourage traders to also keep one for two major reasons:

- Track your weekly trading performance.

- Build a better psychology, which will sharpen your trading intuition

Both can only be done when you keep a comprehensive journal, and review it every week.

MONDAY 06/05/2024

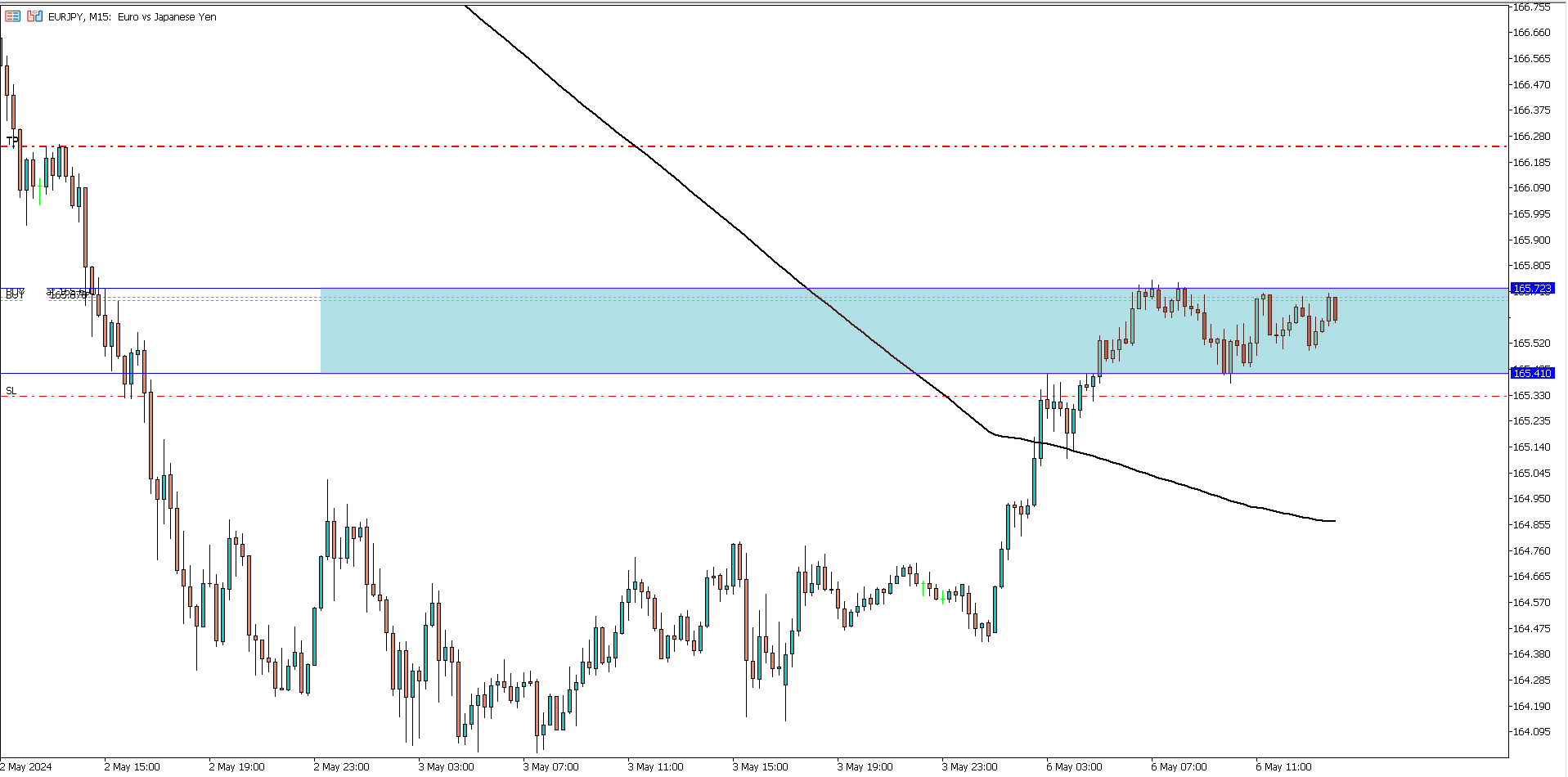

EUR/JPY (12:05 pm)

Analysis: My reason for buying was due to my bias formed from our weekly market analysis

EUR/JPY Update (6:03 pm)

I manually closed with +20 pips

TUESDAY 07/05/2024

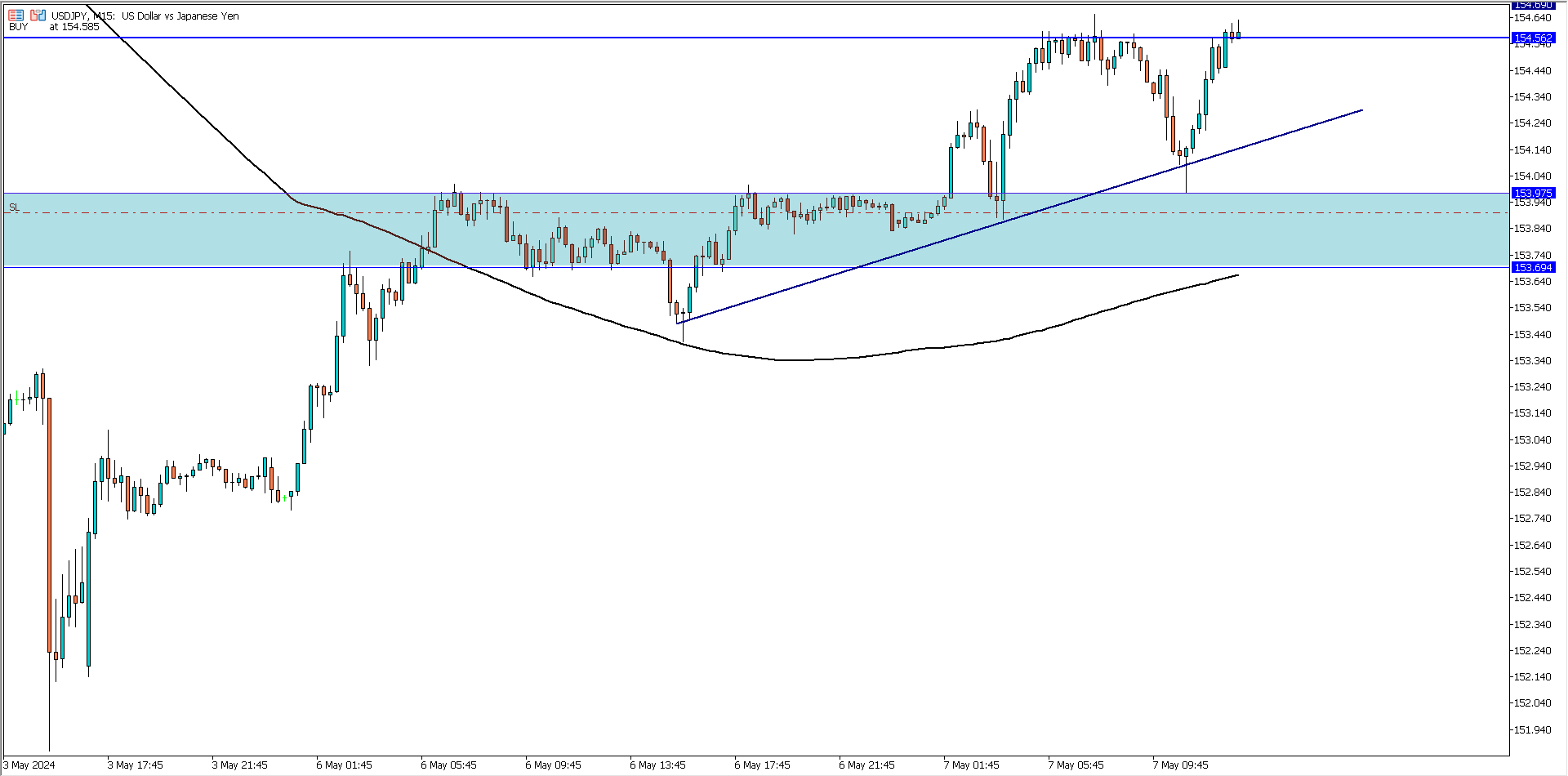

USD/JPY (11:05 AM)

Analysis: My reason for buying was due to my bias formed from our weekly market analysis

AUD/USD (5:30 PM)

Analysis: I sold due to break in structure

AUD/USD Update (6:30 pm)

Manually closed with +8 pips

WEDNESDAY 08/05/2024

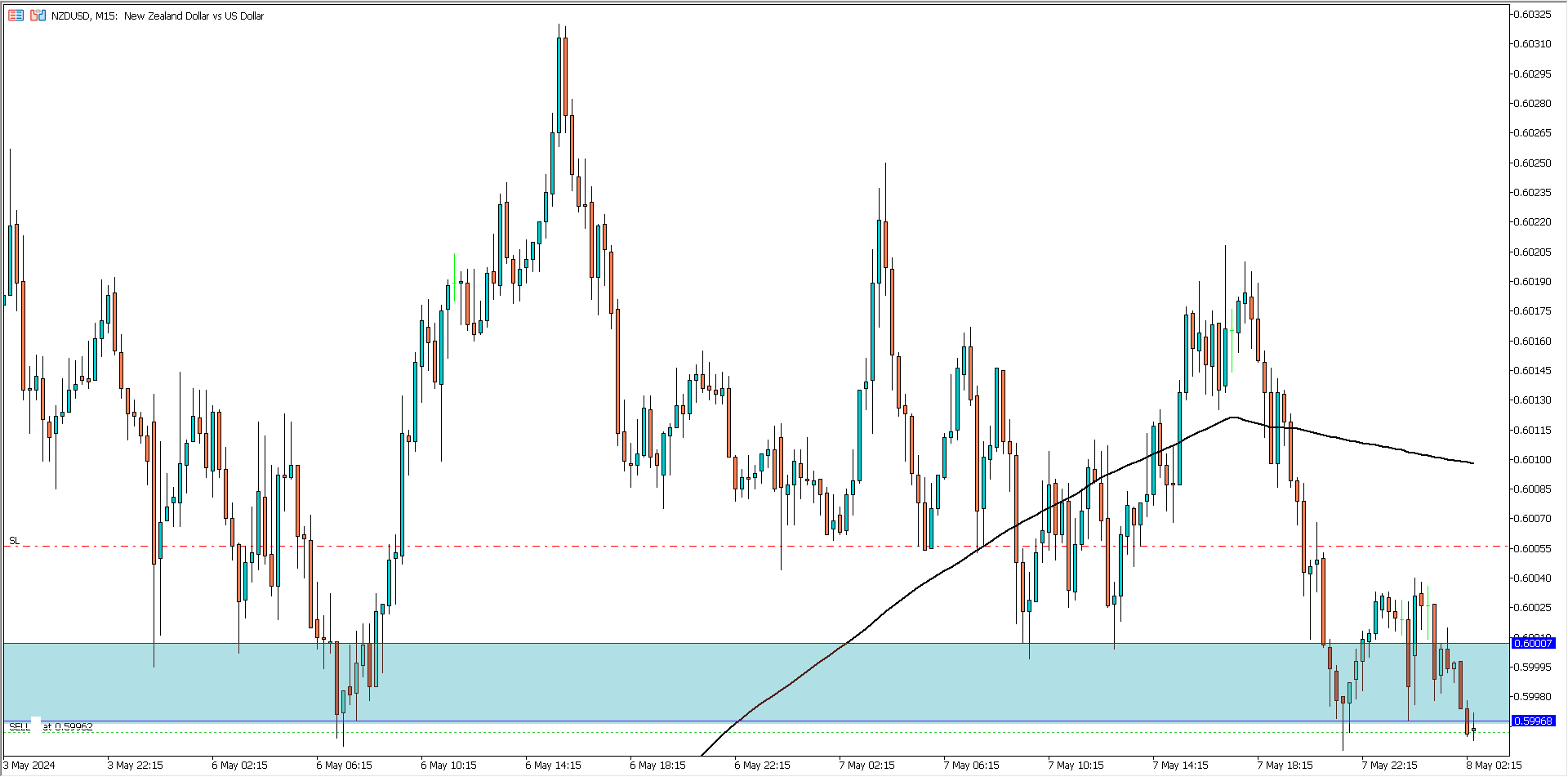

NZD/USD (12:35 am)

Analysis: My reason for selling was due to our Wednesday Market Analysis

USD/JPY Update (12:53 AM)

Manually closed with +18 pips

NZD/USD Update (3:08 am)

Manually closed with +9 pips

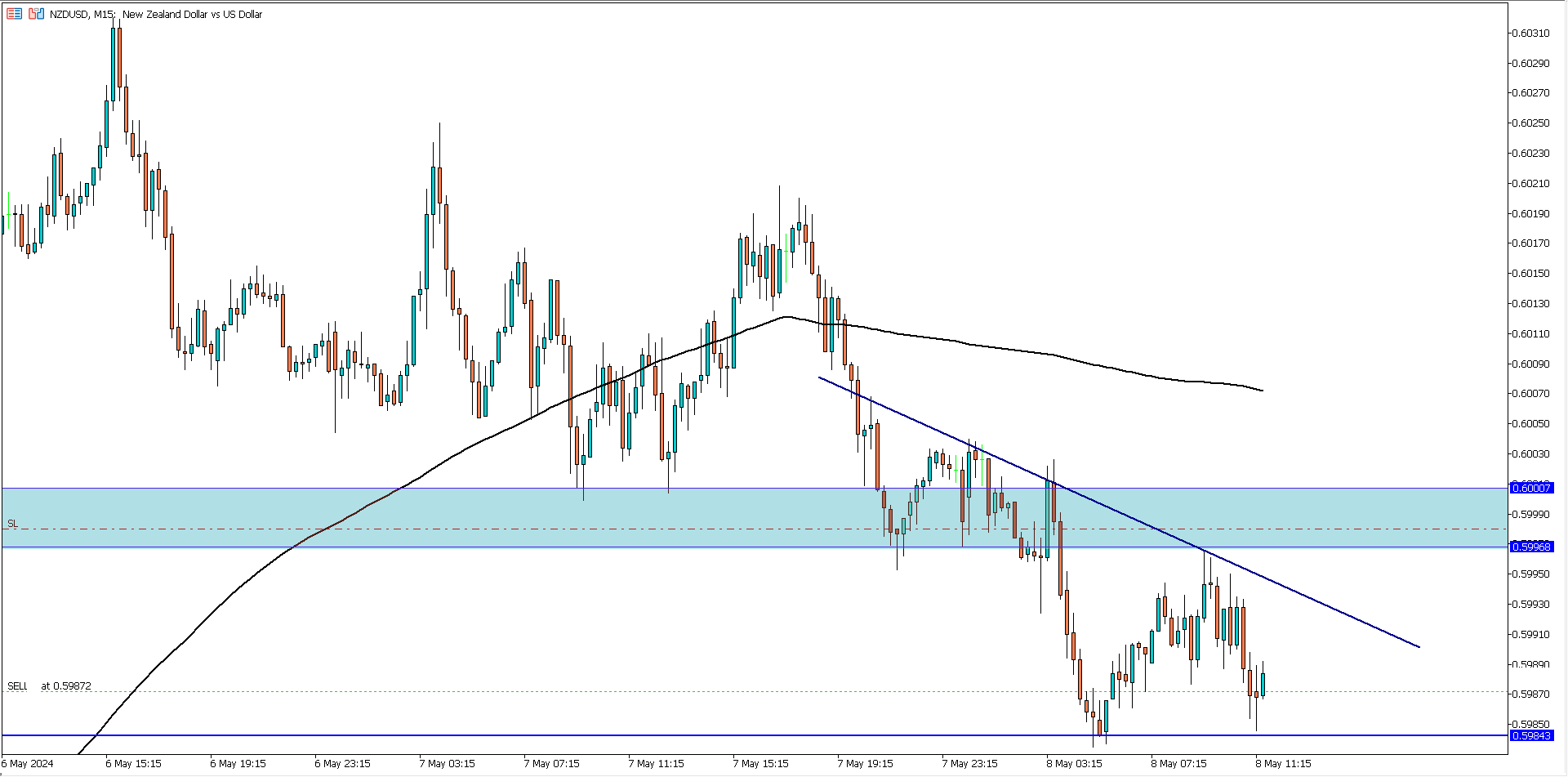

NZD/USD Re-selling (09:39 am)

Analysis: My reason for re-selling was due to our Wednesday Market Analysis

NZD/USD reselling Update (6 pm)

Closed at breakeven

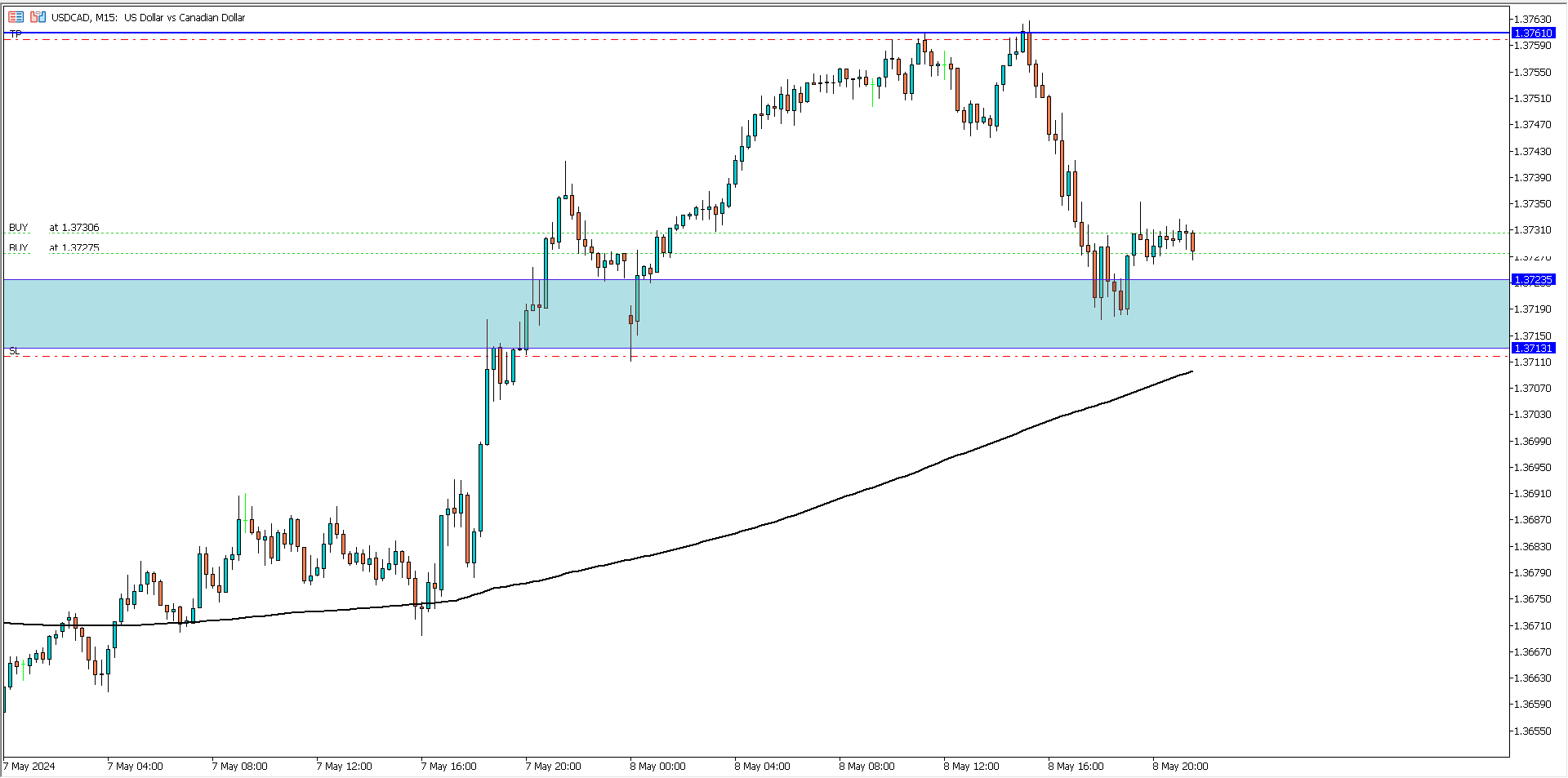

USD/CAD (7.40 pm)

Analysis: A strong bullish outlook on the higher time frame and price bouncing on a key support zone and 200 ma inspired the buy

THURSDAY 09/05/2024

USD/CAD Update (9.30 am)

Closed at breakeven

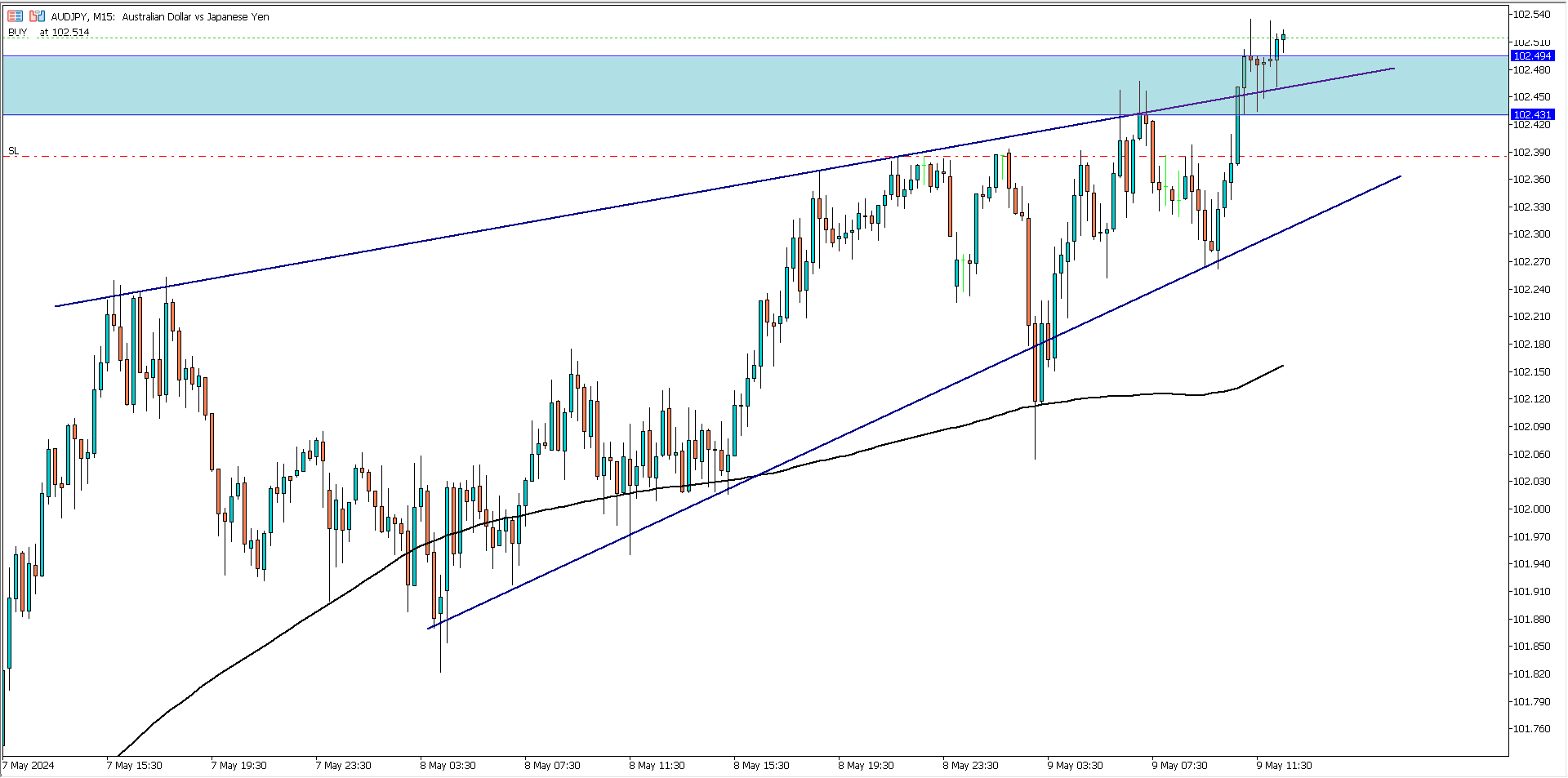

AUD/JPY (10:40 am)

Analysis: A strong bullish outlook on the daily and 4 hour time frame and multiple rejections on the 15 mins timeframe after a bullish breakout inspired me to buy

AUD/JPY Update (12:30 pm)

Closed at breakeven

FRIDAY 10/05/2024

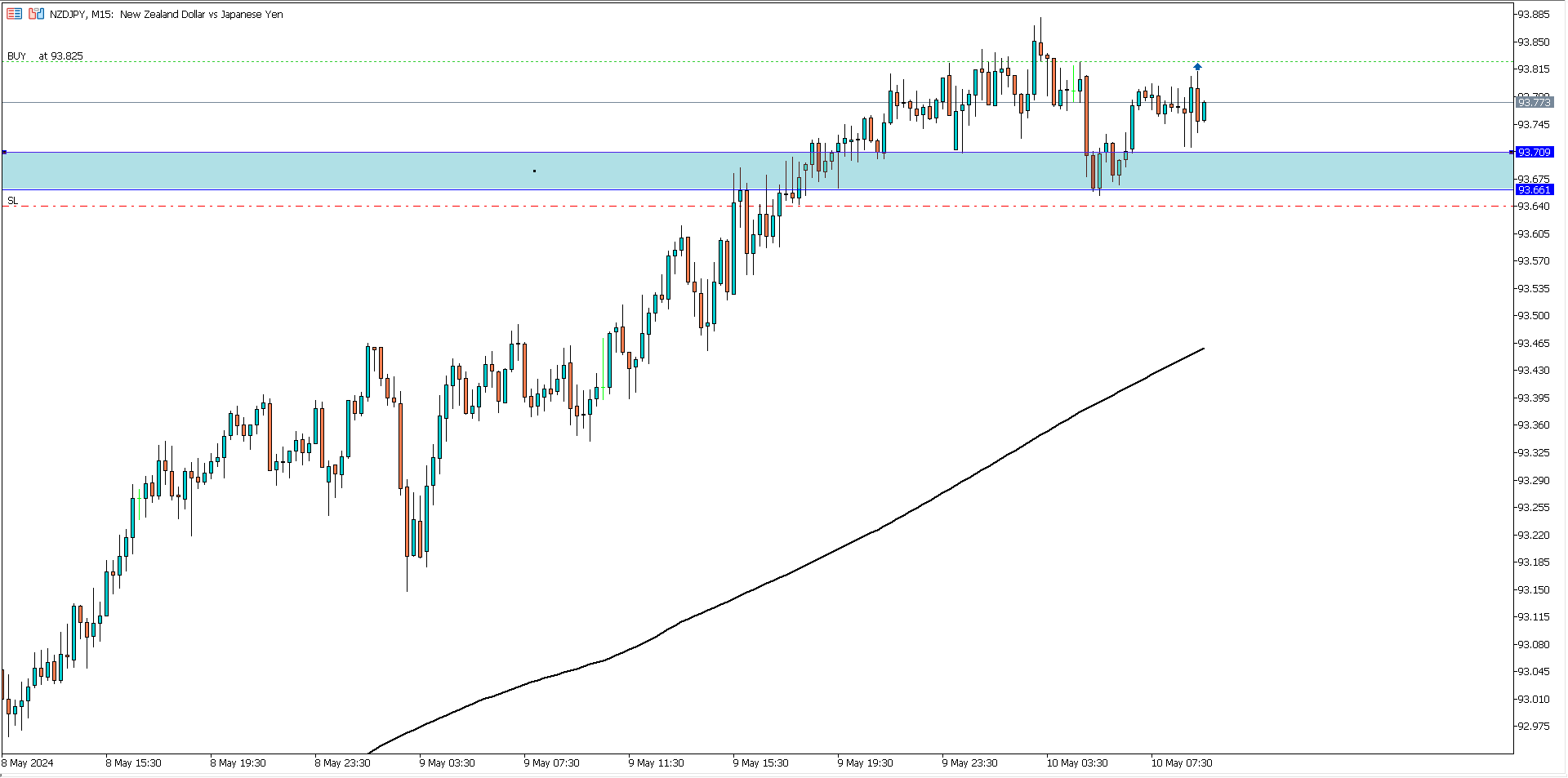

NZD/JPY (7:30am)

Analysis: On the daily and 4 hour time frame, NJ has a strong bullish outlook

NZD/JPY Update (3:31 pm)

SL hit, and I lost -18 pips

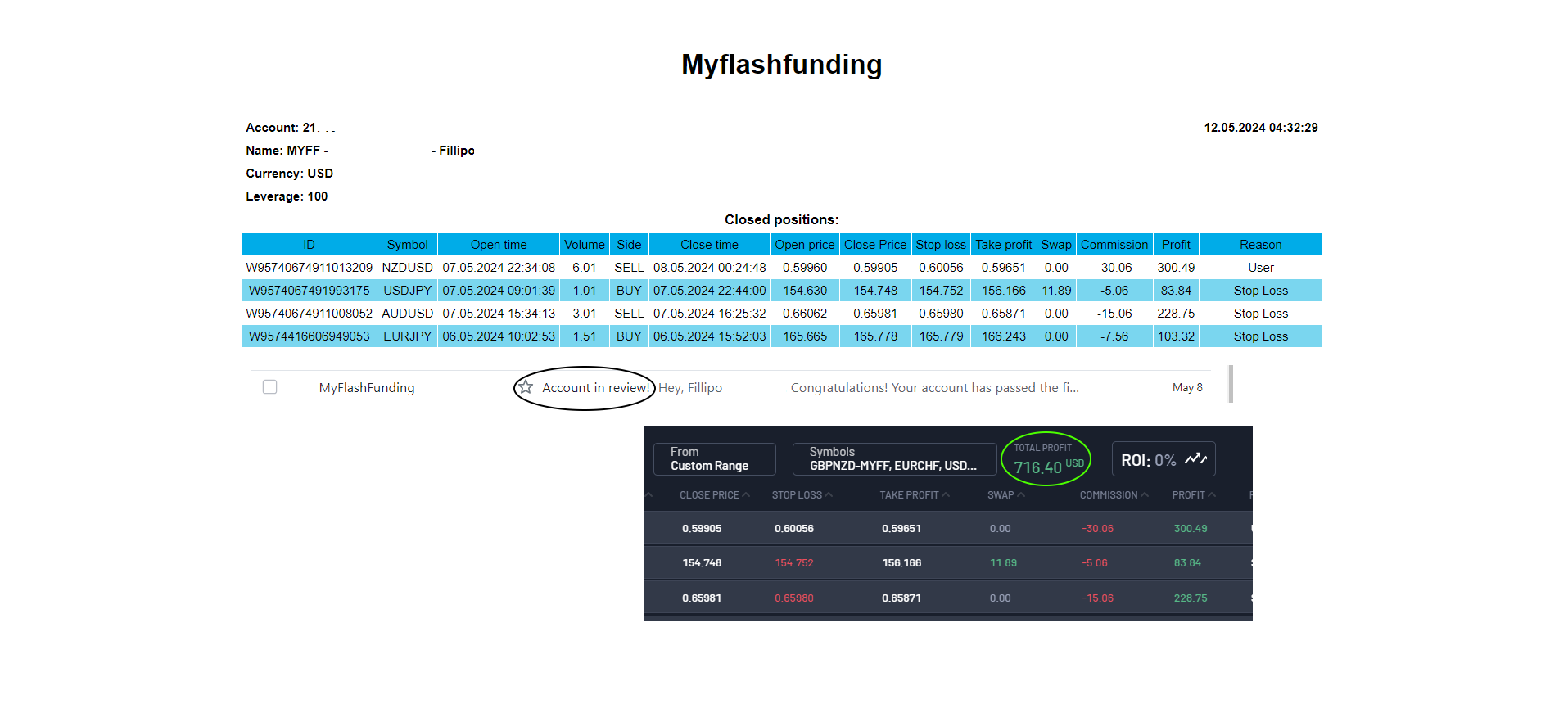

Trade activity summary for the week

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST |

| MON (06/05/2024) | EUR/JPY | BUY | +20 pips |

| TUE (07/05/2024) | USD/JPY | BUY | +18 pips |

| AUD/USD | SELL | + 8 pips | |

| WED (08/05/2024) | NZD/USD | SELL | +9 pips |

| NZD/USD | RE- SELL | Breakeven | |

| USD/CAD | BUY | Breakeven | |

| THUS (09/05/2024) | AUD/JPY | BUY | Breakeven |

| FRI (10/05/2024) | NZD/JPY | BUY | -18 pips |

| TOTAL | +37 pips |

In conclusion:

With 8 trades executed, last week has the be my busiest trading week this year.

From Monday to Wednesday I was able to secure almost +3% ROI. I also added another account to payout phase (currently under review), and secured some payments.

Afterwards, I just could not remove my foot from the pedal, as I traded every available viable setup that popped up on my screen, which I believe was as a result of me wanting to take more accounts to the next phase (phase 2 and payout)

My super power last week was me been able to close most of my trades in breakeven. But again my breakeven is not what most traders know as breakeven (smiling)

My breakeven accommodate commissions on each trade and also yields +0.2 to +0.5 ROI per trade. So over time, multiple breakeven trades accumulate to decent profits

Lastly I goofed on my Friday trade….

I could have easily not participated in the market, but I did. But even when I did, I had an opportunity to close the trade as breakeven and secure some decent profits, but again… I did not. So I lost over -1% of the profits I made.

Overall it was a difficult week to trade, so I give myself a tap on the back for managing to close the week in profits.

Looking forward to the week ahead

How did your trading week go?

Monday to Wednesday trading activities with MyFlashFunding account:

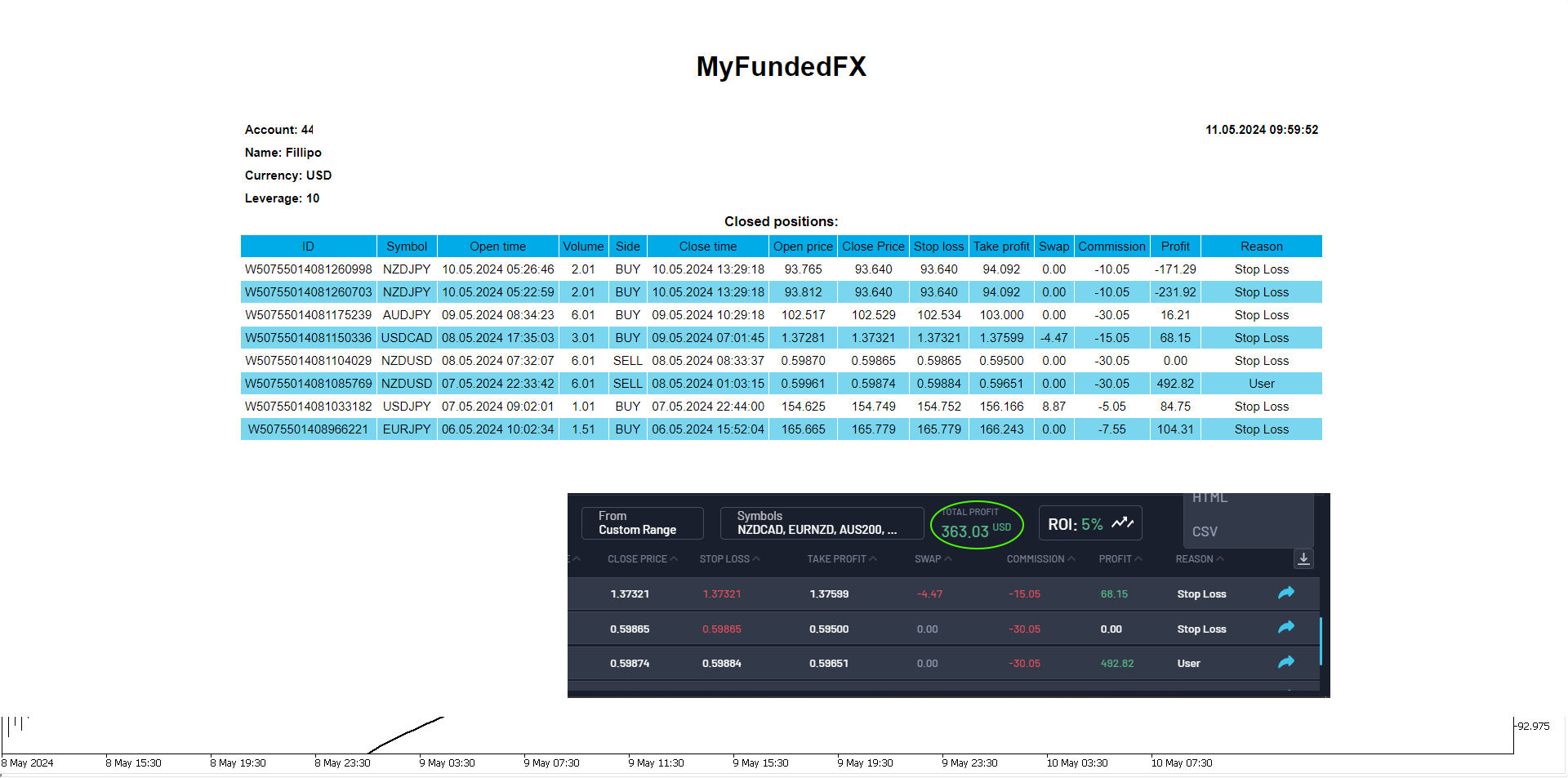

Monday to Friday trading activities with MyFundedFX account:

NOTE:

- BESPOKE FUNDING PROGRAMME

- FUNDED ENGINEER

- BLUE GUARDIAN (Use the coupon code: CRAFTER)

- GOAT FUNDED

- LARK FUNDING

- SKILLED FUNDED TRADER

- MAVEN TRADING

- MY FLASH FUNDING (Use the coupon code: “FILLIPO” for a -25% discount)

- THE5ERS