My reason for keeping a journal is to encourage traders to also keep one for two major reasons:

- Track weekly trading performance.

- have enough data, in order to be able to work on their trading technique and psychology

Both can only be done when you keep a comprehensive journal, and review it every week.

MONDAY (01/05/2023)

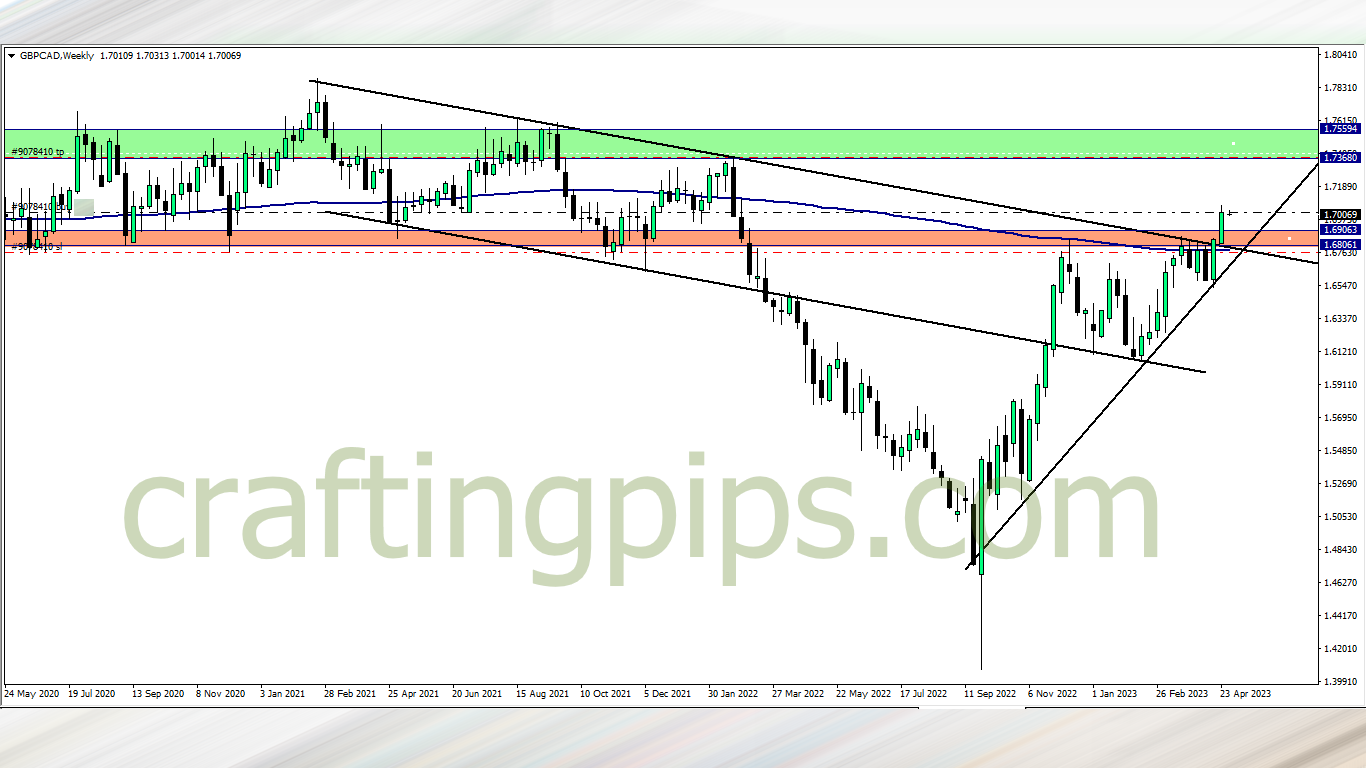

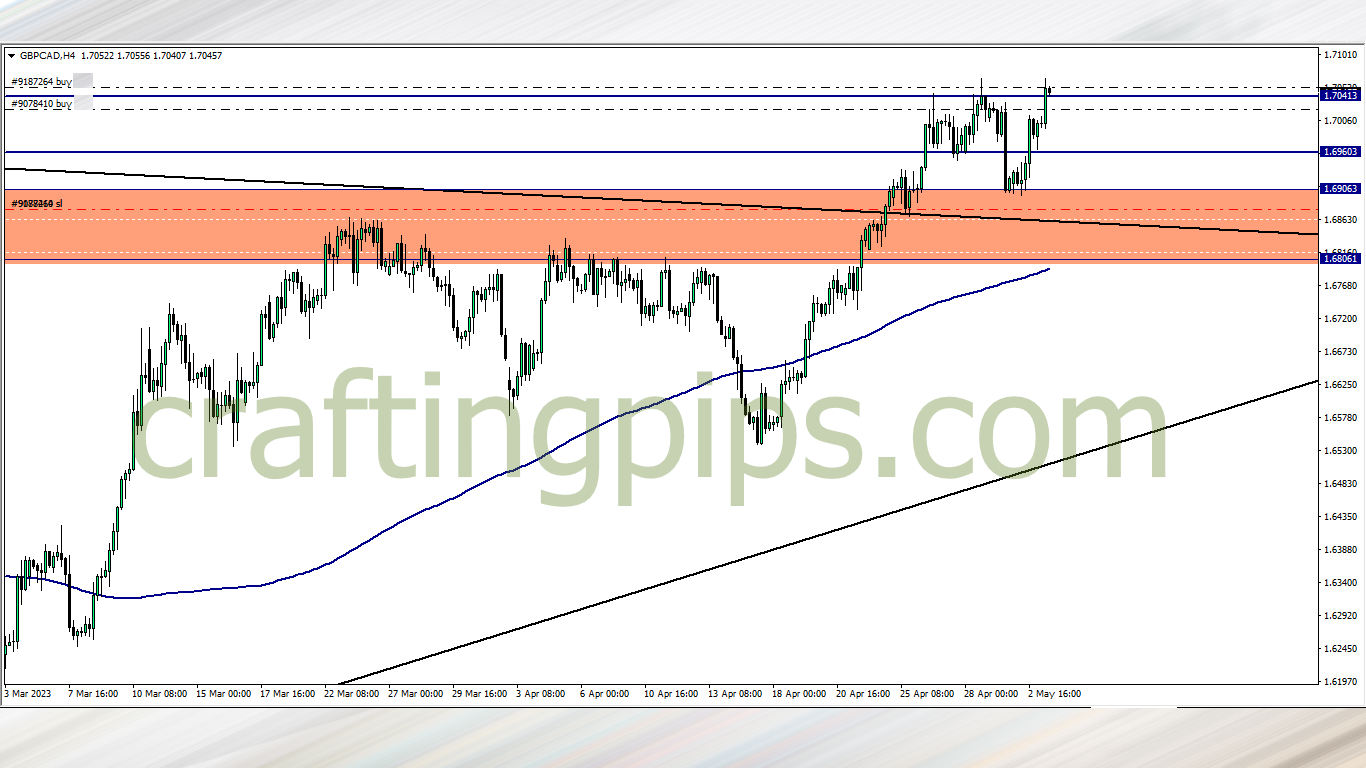

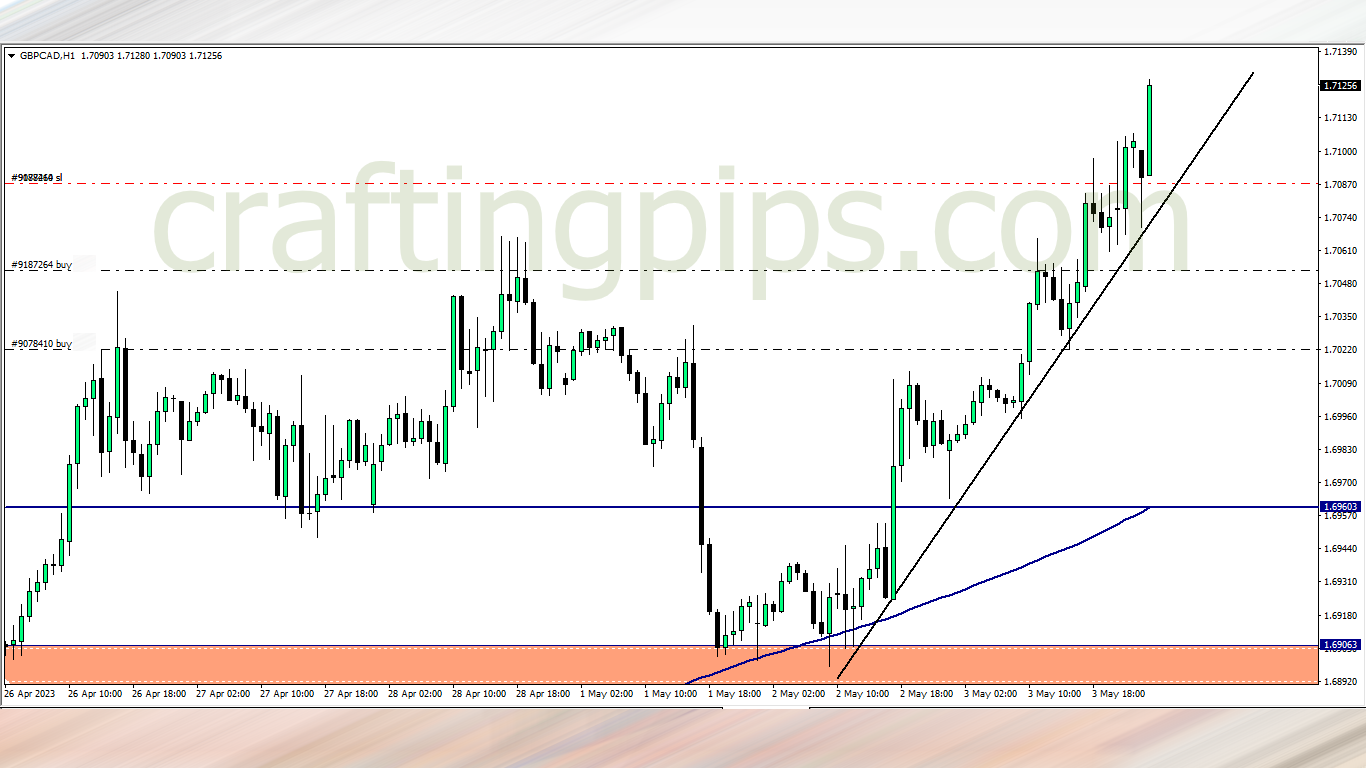

GBP/CAD (2.30 am)

Analysis: My reason for buying was shared on our weekly market analysis

TUESDAY (02/05/2023)

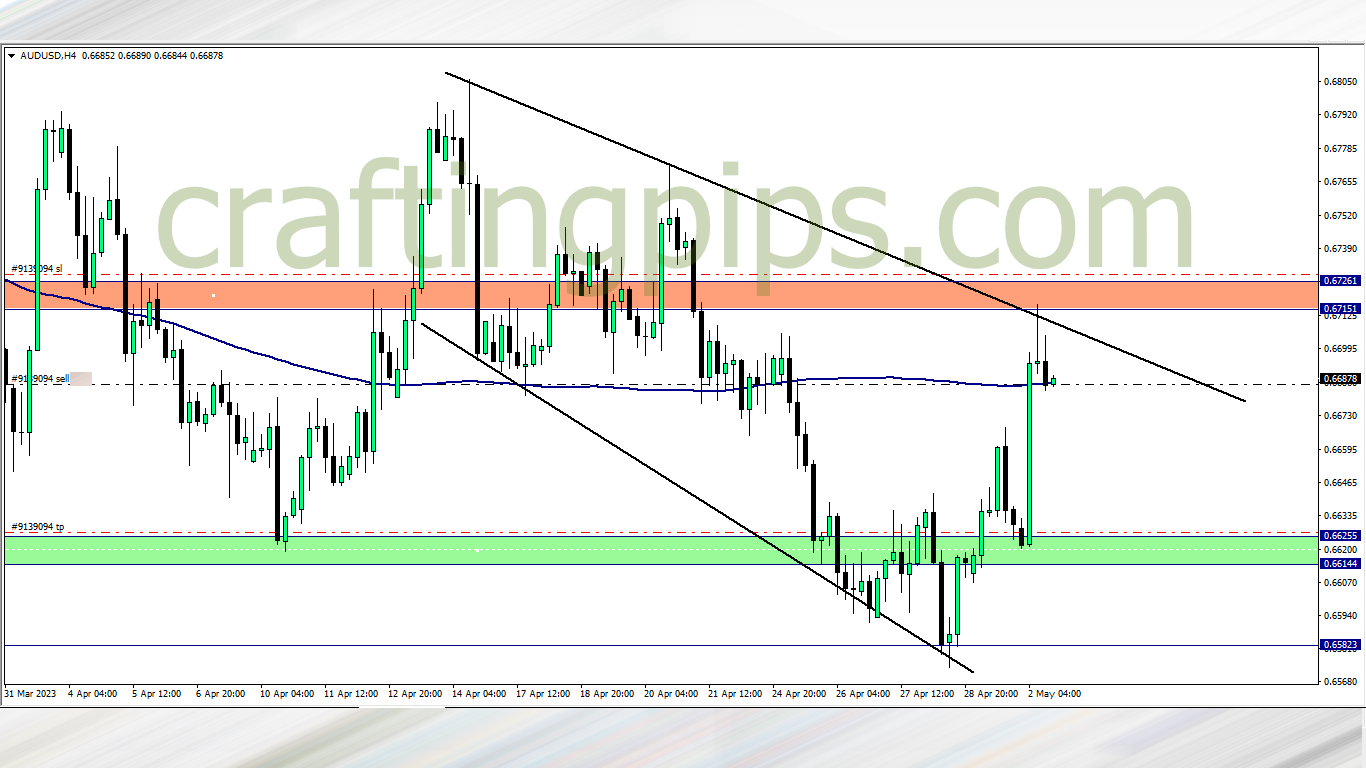

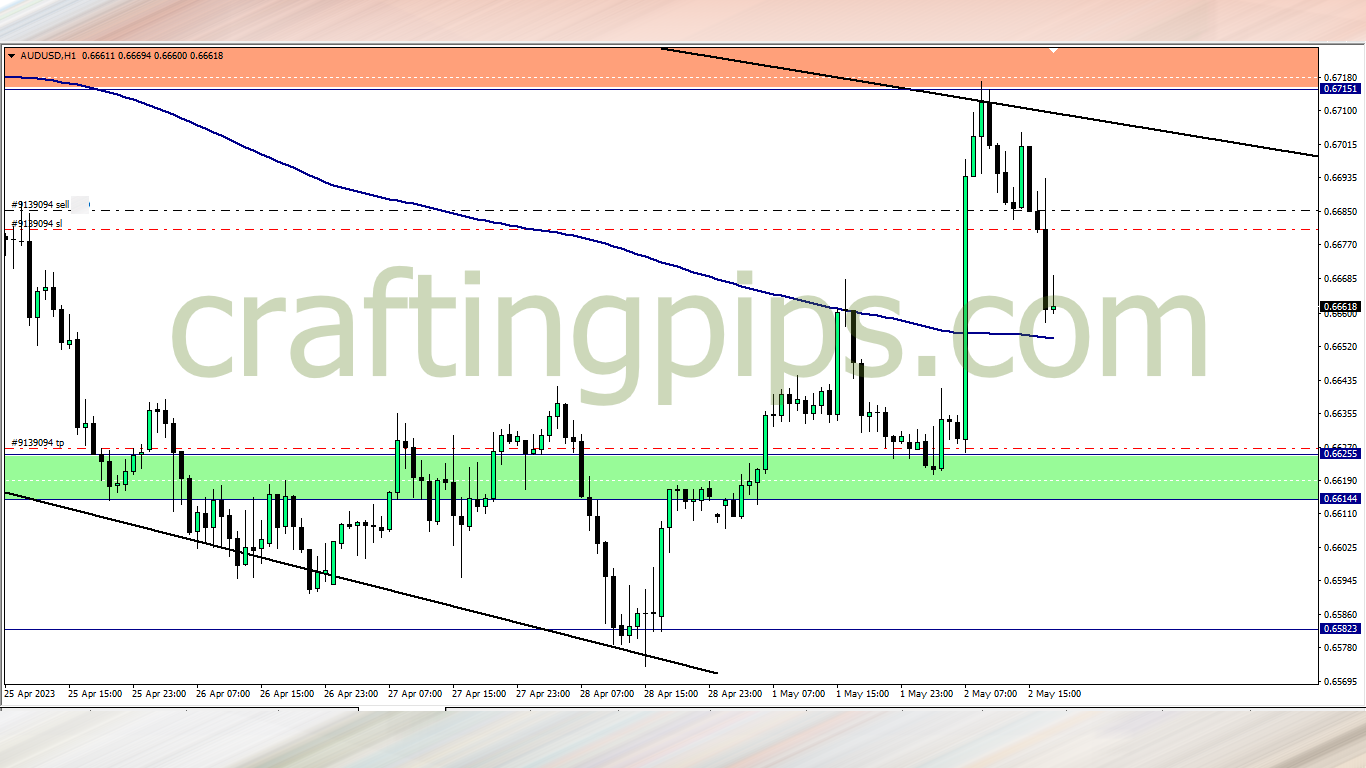

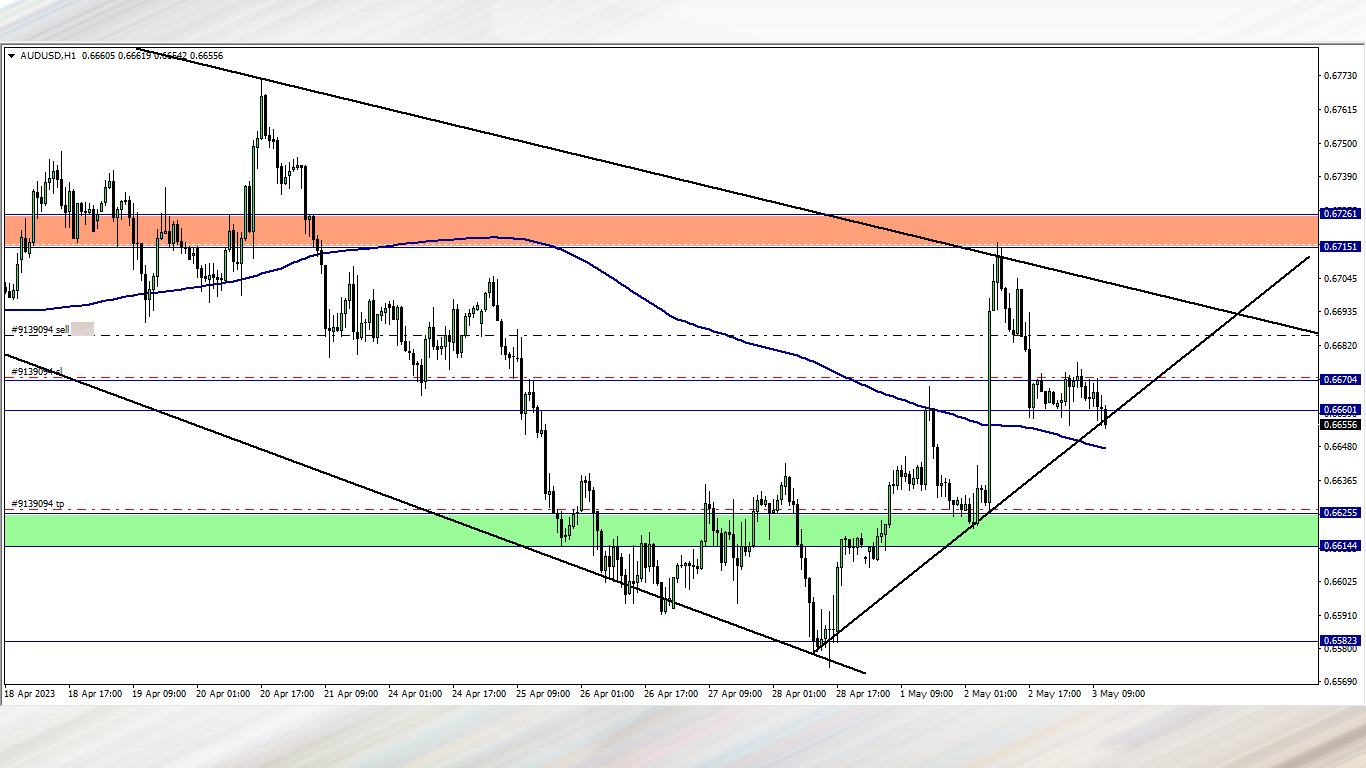

AUD/USD (2.05 pm)

Analysis: My reason for selling was because price began to stall after hitting a key resistance zone on the 4 hour time frame, which also coincides with the 200 ma acting as a resistance zone. On the daily time frame, price it touching the 200 ma, so I expect a pullback.

AUD/USD Update (4.35 pm)

Analysis: Locked +5 pips

WEDNESDAY (03/05/2023)

AUD/USD Update (10.50 am)

Analysis: Locked +14 pips and may exit this trade before 1.15 pm. Reason is because of the stacked economic calendar with high impact news on the USD

AUD/JPY Update (10.50 am)

Analysis: Scaled in on this trade. If it meets all my criteria, will hopefully ride it to TP

GBP/CAD Update (10.50 am)

Analysis: Scaled in on this trade. If it meets all my criteria, will hopefully ride it to TP

AUD/JPY Update (7.20 pm)

Analysis: Trailing stop loss closed the AUD/JPY trade with +76 pips

GBP/CAD Update (11 pm)

Analysis: Trailing stop activated, +100 pips locked

THURSDAY (04/05/2023)

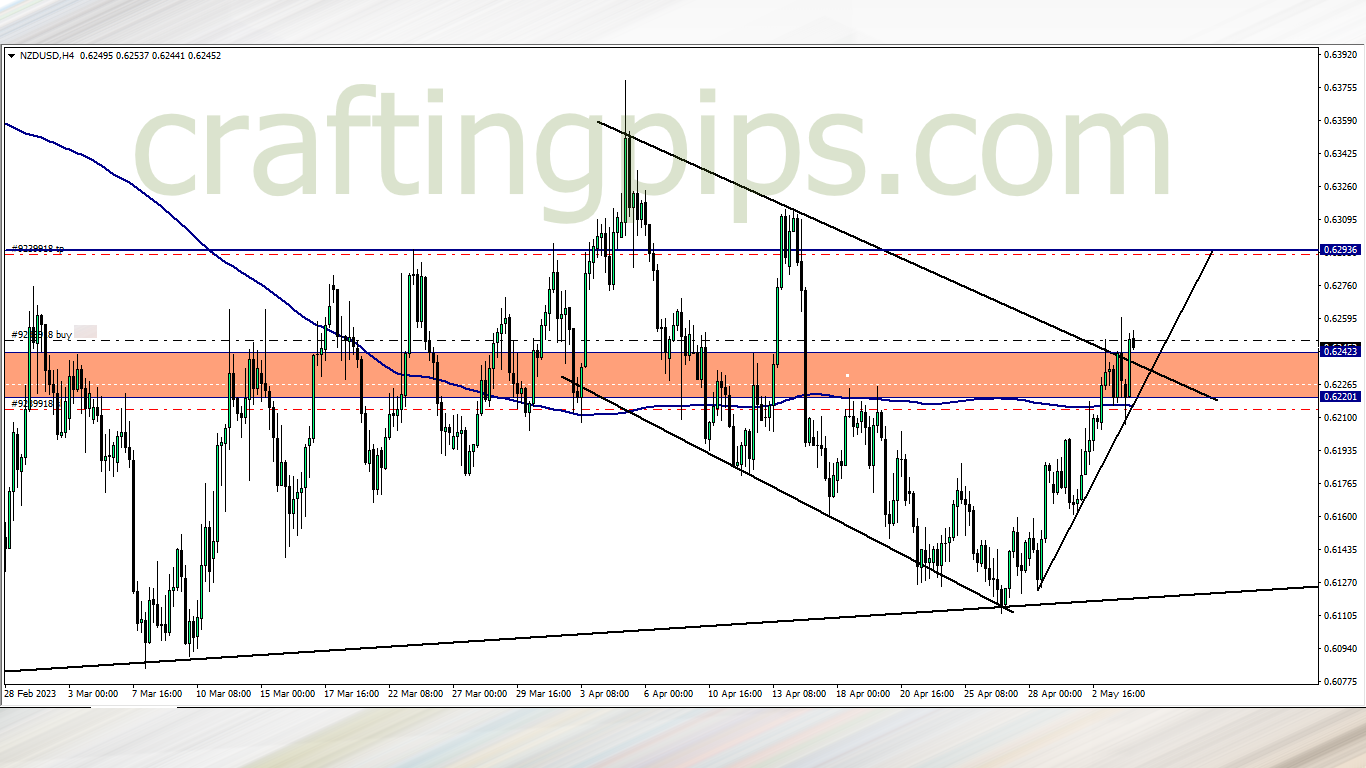

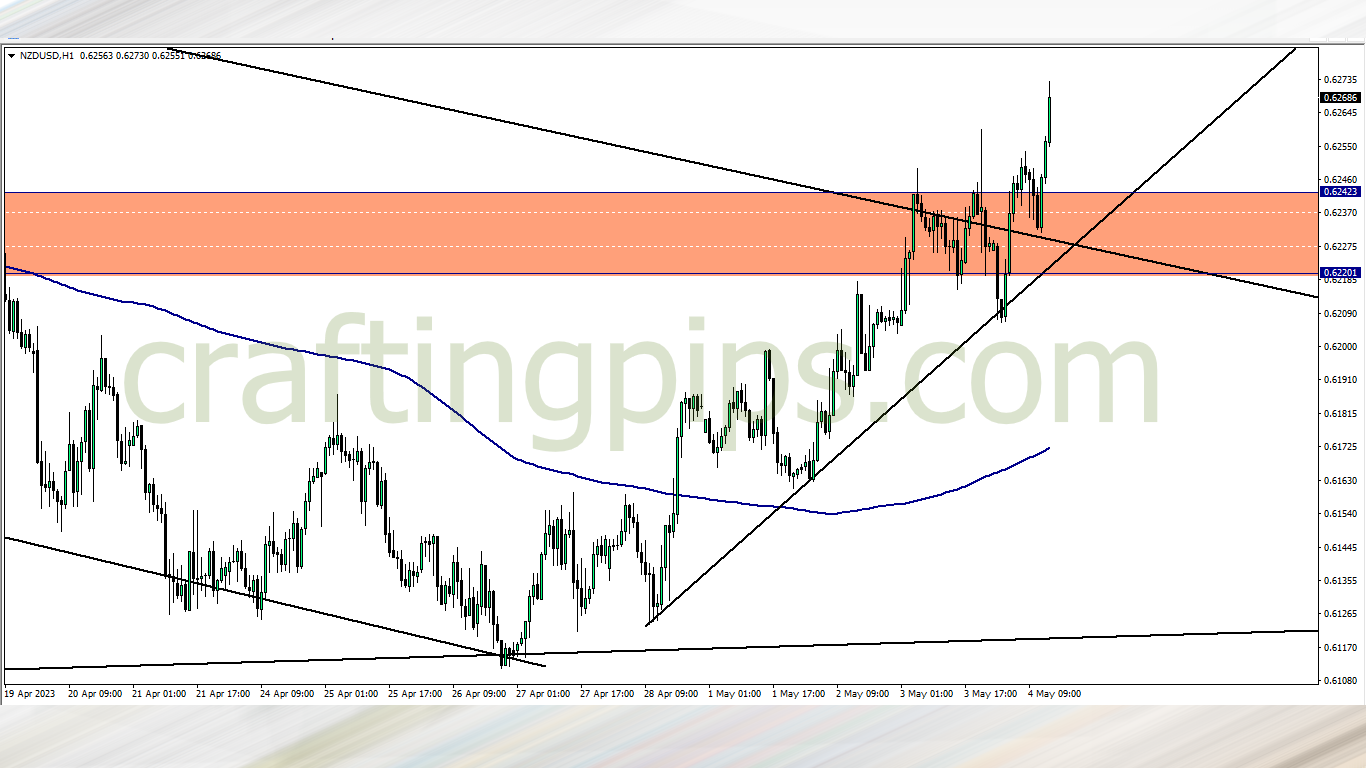

NZD/USD (7.05 am)

Analysis: Multiple rejections of price by the 200 ma & key support zone gives us further bullish bias Hoping to get 15 to 30 pips on this setup before 1.30 pm (unemployment claims ) What are you trading this London session?

GBP/CAD Update (9.00 am)

Closed the trade with +100 pips

NZD/USD Update (7.05 am)

Analysis: +18 pips and out. I was too fast in closing this trade that I forgot to screen grab it

Trade activity summary for the week

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST |

| MON (01/05/2023) | GBP/CAD | BUY | + 100 pips |

| TUE (02/05/2023) | AUD/USD | SELL | + 14 pips |

| WED (03/05/2023) | AUD/JPY | SELL | + 76 pips |

| THUS (04/05/2023) | NZD/USD | BUY | + 18 pips |

| TOTAL | + 208 PIPS |

In conclusion:

This week was FLAWLESS VICTORY for me. Not a single losing trade. This only means that my trading system was in sync with the market, nothing more. If I were to have any regret, it would be the NZD/USD trade I took on Thursday.

If I had used my trailing stop loss, I could have closed the trade with over +35 pips, but I manually closed because we were approaching a high impact news event, and I just did not want to deal with slippage.

My trading rule cost me money this time, but I am fine with it. Trading rules do get expensive sometimes, but on the long run they are well worth it.

Trading rules are like you paying for insurance every year. It seems like a waste until when you need it

How did your trading week go?

NOTE:

-

THE FUNDED TRADER: https://dashboard.thefundedtraderprogram.com/purchasechallenge-n/?sl=3322 (use the coupon code: THE0CRAFTER)

-

MY FUNDED FX: https://myfundedfx.tech/purchasechallenge/?sl=758

- BESPOKE FUNDING PROGRAMME: https://www.bespokefundingprogram.com/The_Crafter?ref=The_Crafter