My reason for sharing my trade journal is to encourage traders to also keep one for two major reasons:

- Track your weekly trading performance.

- Build a better psychology, which will sharpen your trading intuition

Both can only be done when you keep a comprehensive journal, and review it every week.

WEDNESDAY 01/05/2024

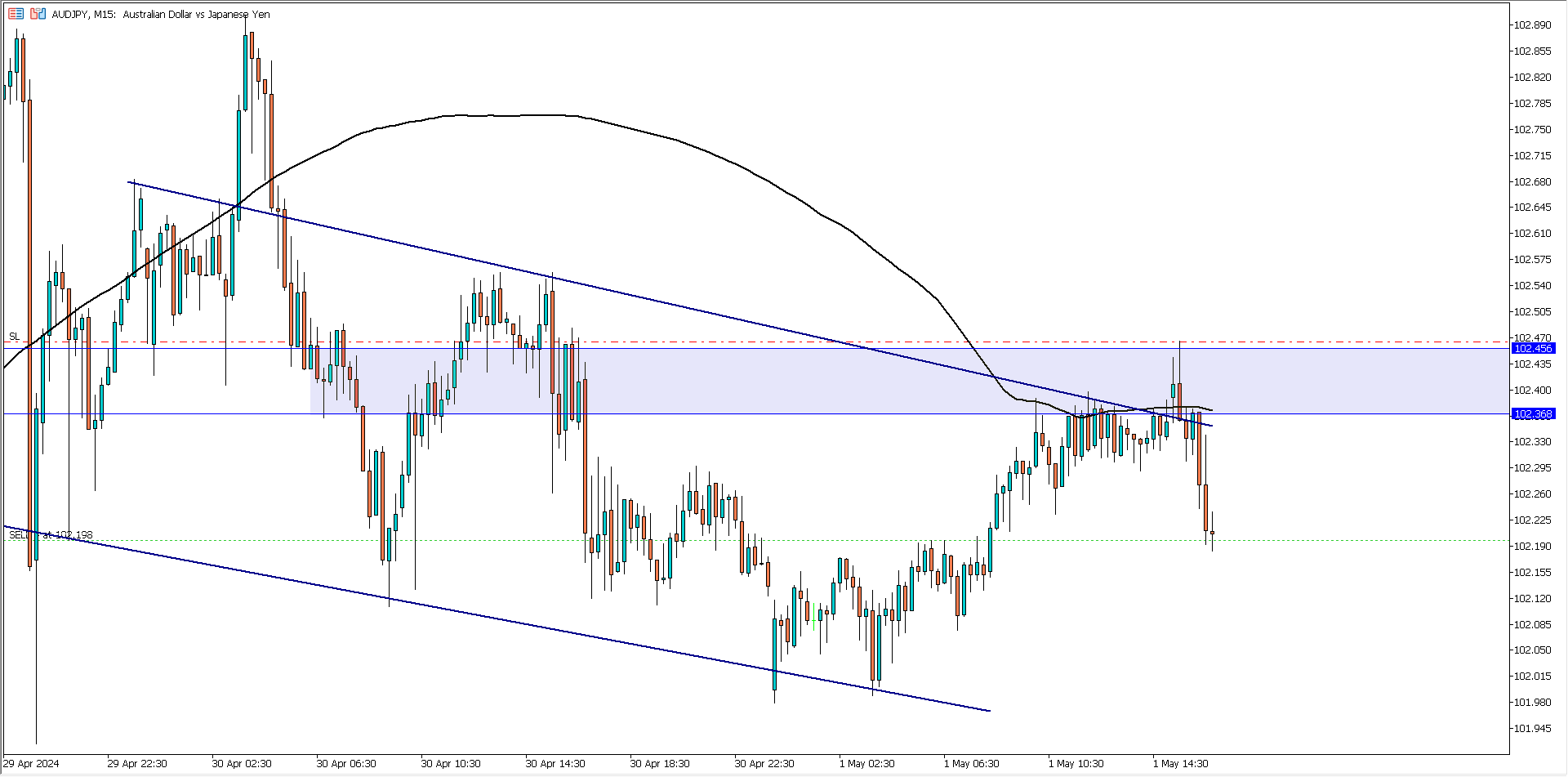

AUD/JPY (2:51 pm)

Analysis: Rejection on the higher time frame and multiple rejections and a breakout encouraged the sell of AUD/JPY

AUD/JPY Update (7:44 pm)

Trade hit SL, and I closed with -26 pips

THURSDAY 02/05/2024

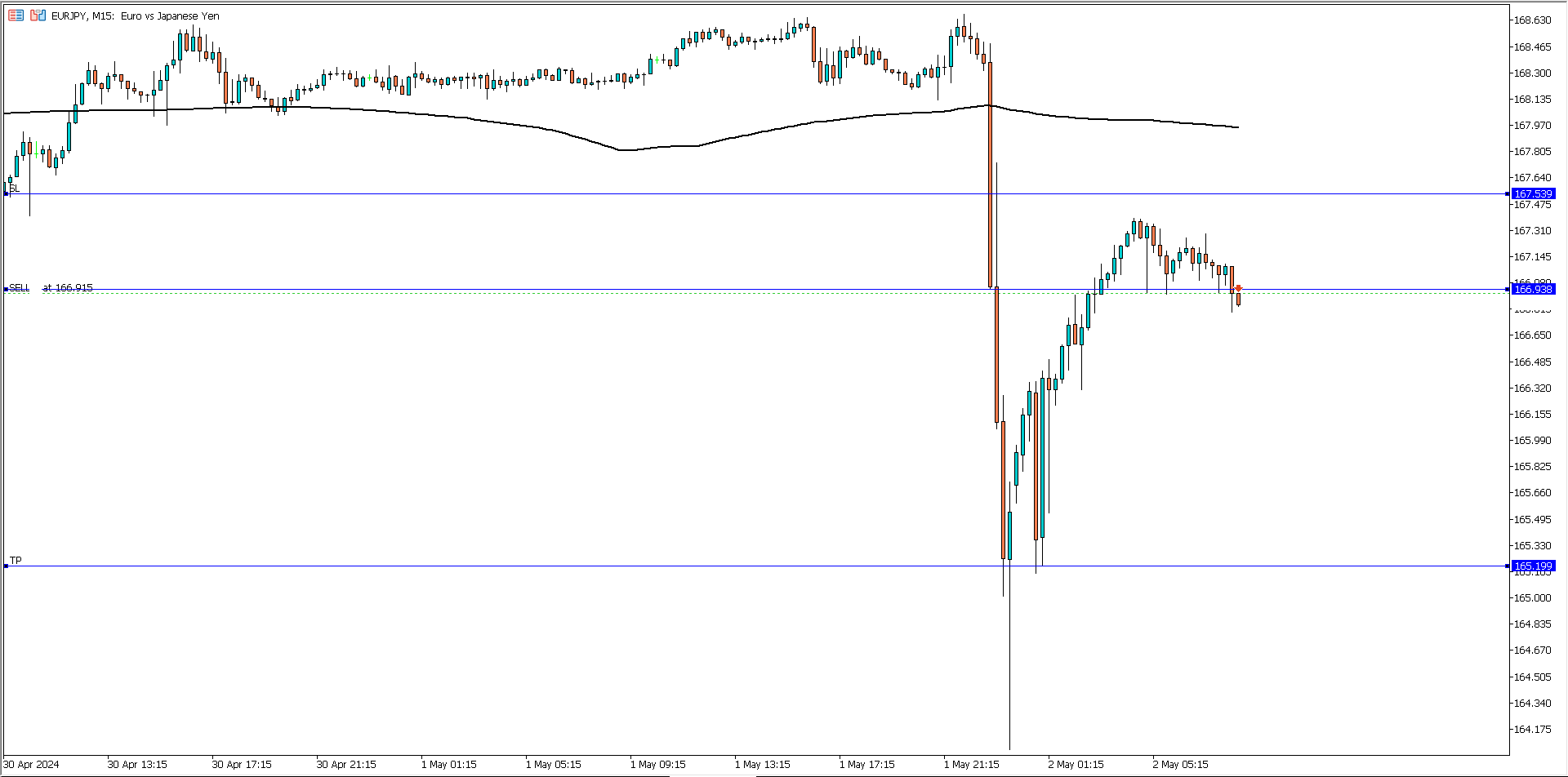

EUR/JPY (6.31 am)

Analysis: This sell trade was inspired by a rejection on the daily time frame

EUR/JPY Update (8:51 am)

I manually closed with +23 pips (Trailing SL)

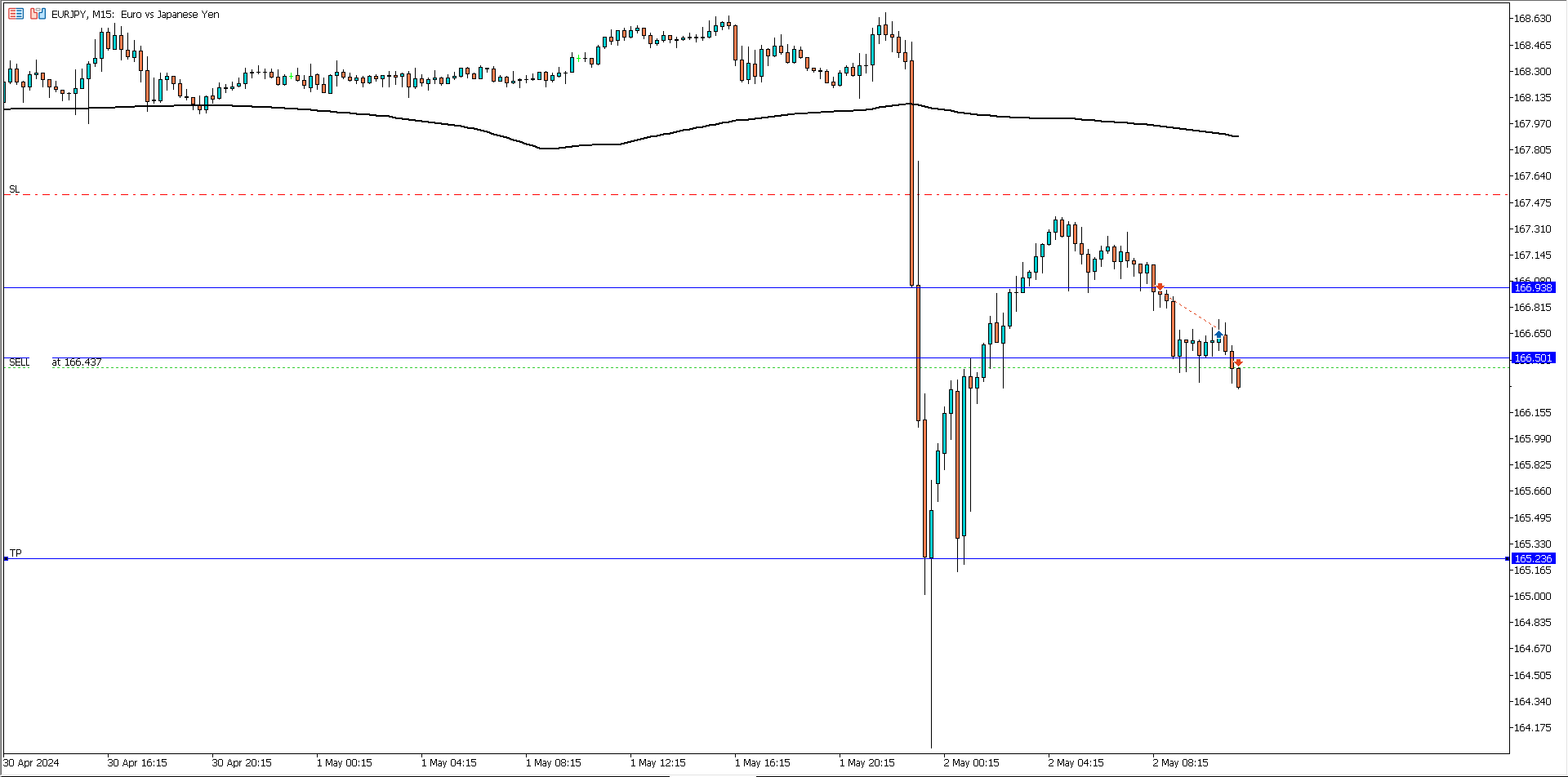

EUR/JPY Re-entry (9:33 am)

Analysis: A little over 30 mins after I closed my first trade, I noticed a bearish breakout on the EUR/JPY, so I joined the sellers

EUR/JPY Update (12.37 pm)

I manually closed with +76 pips (Trailing SL)

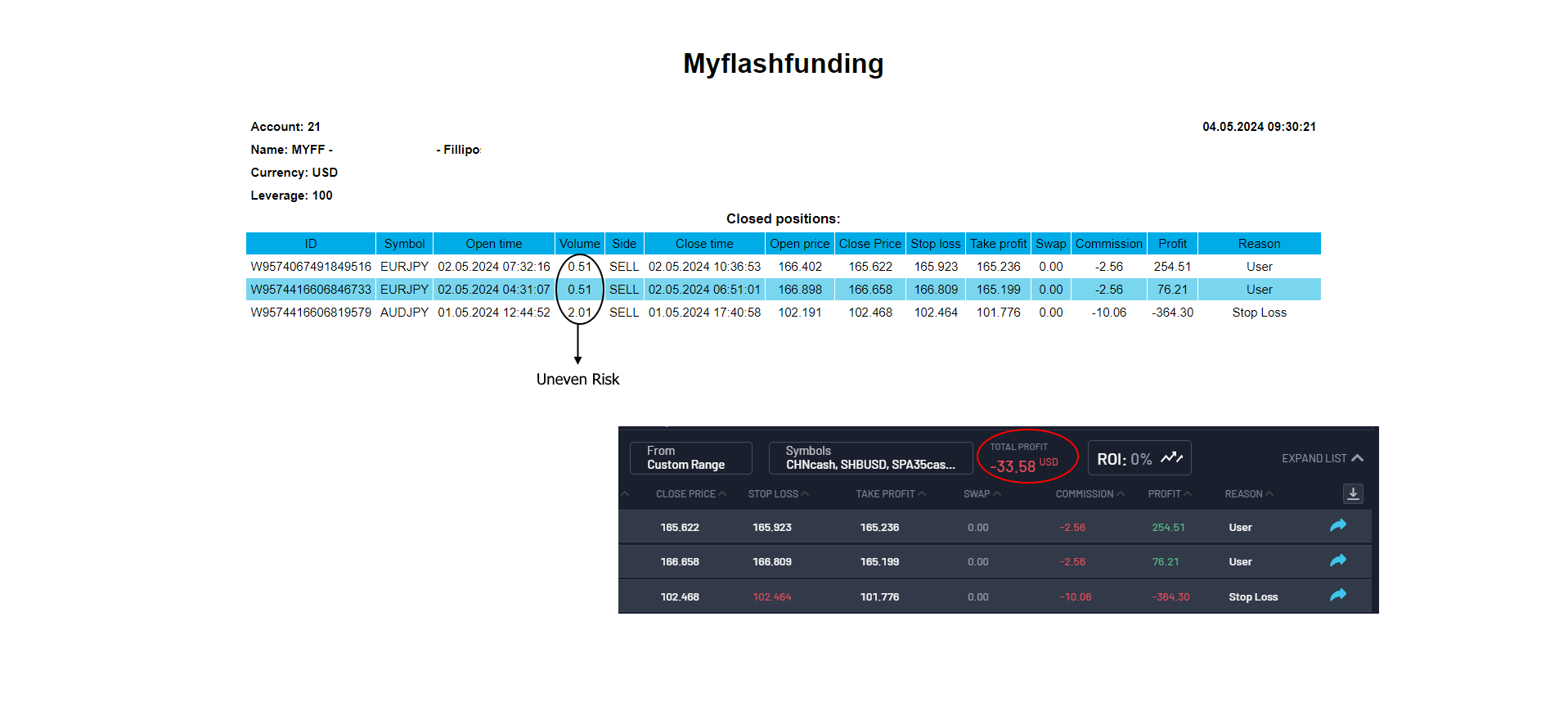

Trade activity summary for the week

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST |

| WED (01/05/2024) | AUD/JPY | SELL | -26 pips |

| THUS (02/05/2024) | EUR/JPY | SELL | +23 pips |

| EUR/JPY | SELL | +76 pips | |

| TOTAL | + 73 pips |

In conclusion:

This week proper risk management kept me at breakeven. Closing with a high positive pip value but having a -0.05% loss, speaks how much I value risk management.

My reason for the risk management was because the trades I took were not A+ setups, and I was also on the negative with my first trade of the month (AUD/JPY)

Overall it was a poor performance, but discipline-wise I would rate myself 100%.

Looking forward to a better week

How did yours go?

NOTE:

- BESPOKE FUNDING PROGRAMME

- FUNDED ENGINEER

- BLUE GUARDIAN (Use the coupon code: CRAFTER)

- GOAT FUNDED

- LARK FUNDING

- SKILLED FUNDED TRADER

- MAVEN TRADING

- MY FLASH FUNDING (Use the coupon code: “FILLIPO” for a -25% discount)

- THE5ERS