My reason for keeping a journal is to encourage traders to also keep one for two major reasons:

- Track weekly trading performance.

- have enough data, in order to be able to work on their trading technique and psychology

Both can only be done when you keep a comprehensive journal, and review it every week.

MONDAY (24/10/2023)

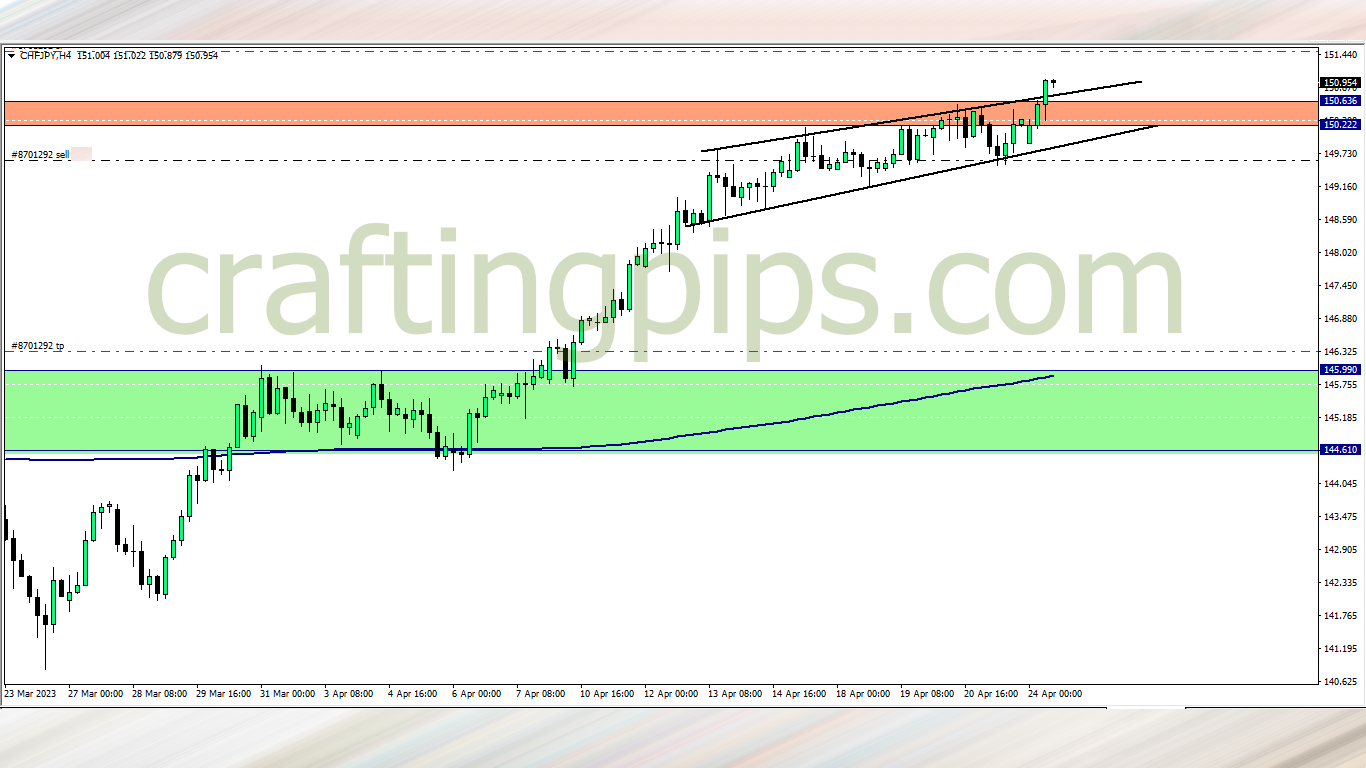

CHF/JPY (10 am)

Analysis: Manually closed with -140 pips loss

CHF/JPY (9.30 pm)

Analysis: My reason for buying was shared on Tuesday market analysis

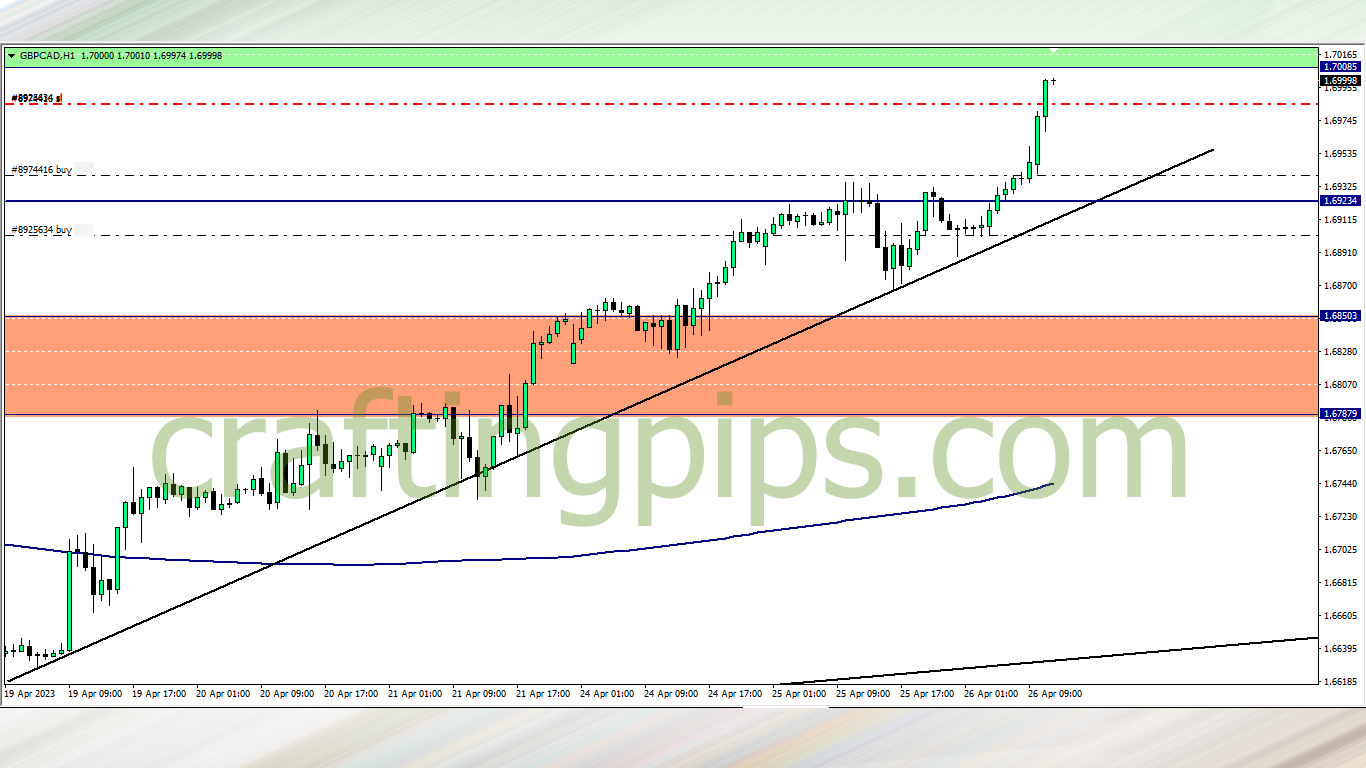

GBP/CAD (9.30 pm)

Analysis: My reason for buying was shared on Tuesday market analysis

TUESDAY (25/04/2023)

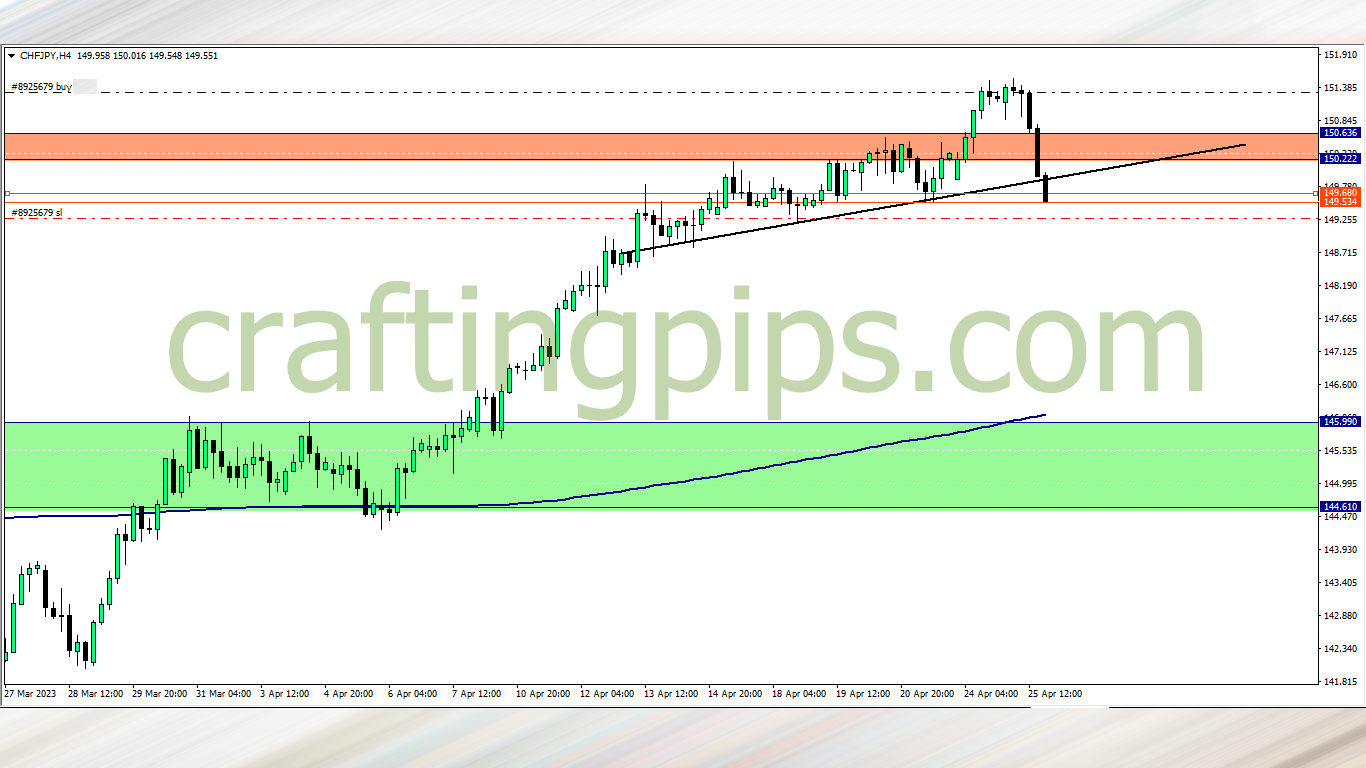

CHF/JPY UPDATE (10 am)

Analysis: Closed manually with -174 pips

WEDNESDAY (26/04/2023)

GBP/CAD Update (10.05 am)

Analysis: I scaled in nice on GBP/CAD and I closed manually using the trailing stop loss. This trade fetched me +165 pips on both positions

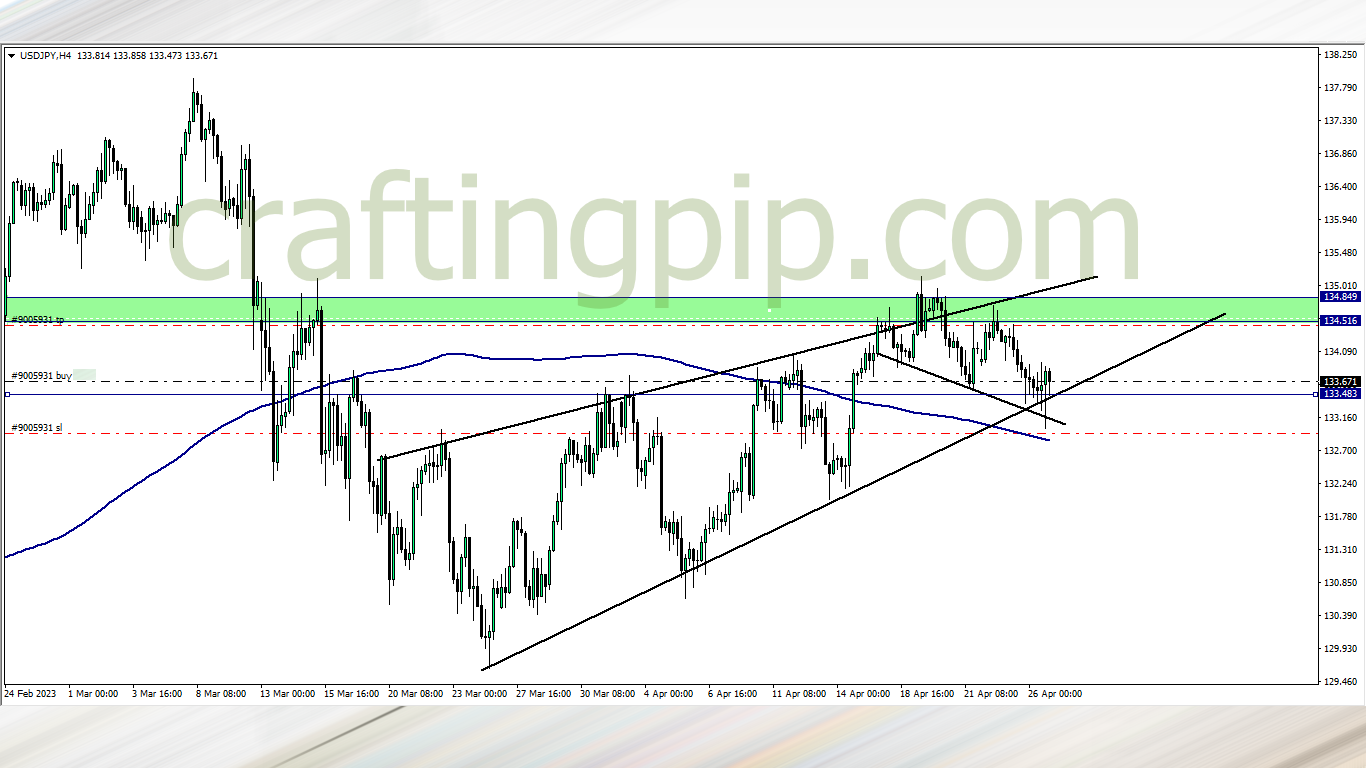

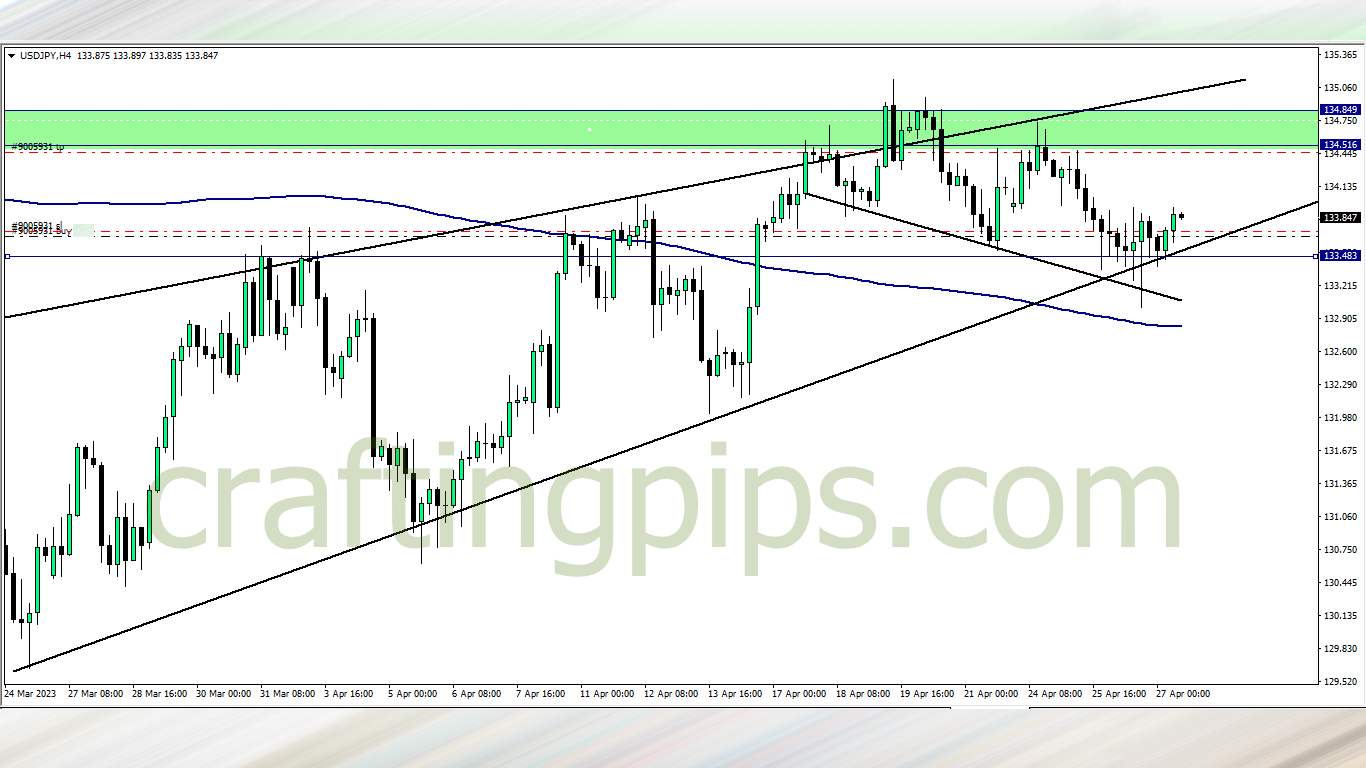

USD/JPY (9.30 pm)

Analysis: My reason for buying was shared on our Thursday market analysis

THURSDAY (27/04/2023)

USD/JPY UPDATE (10.05 am)

Analysis: Locked +5 pips before taking the GBP/CHF trade. Trade also closed with +5 pips as there was a huge pullback before the high impact news

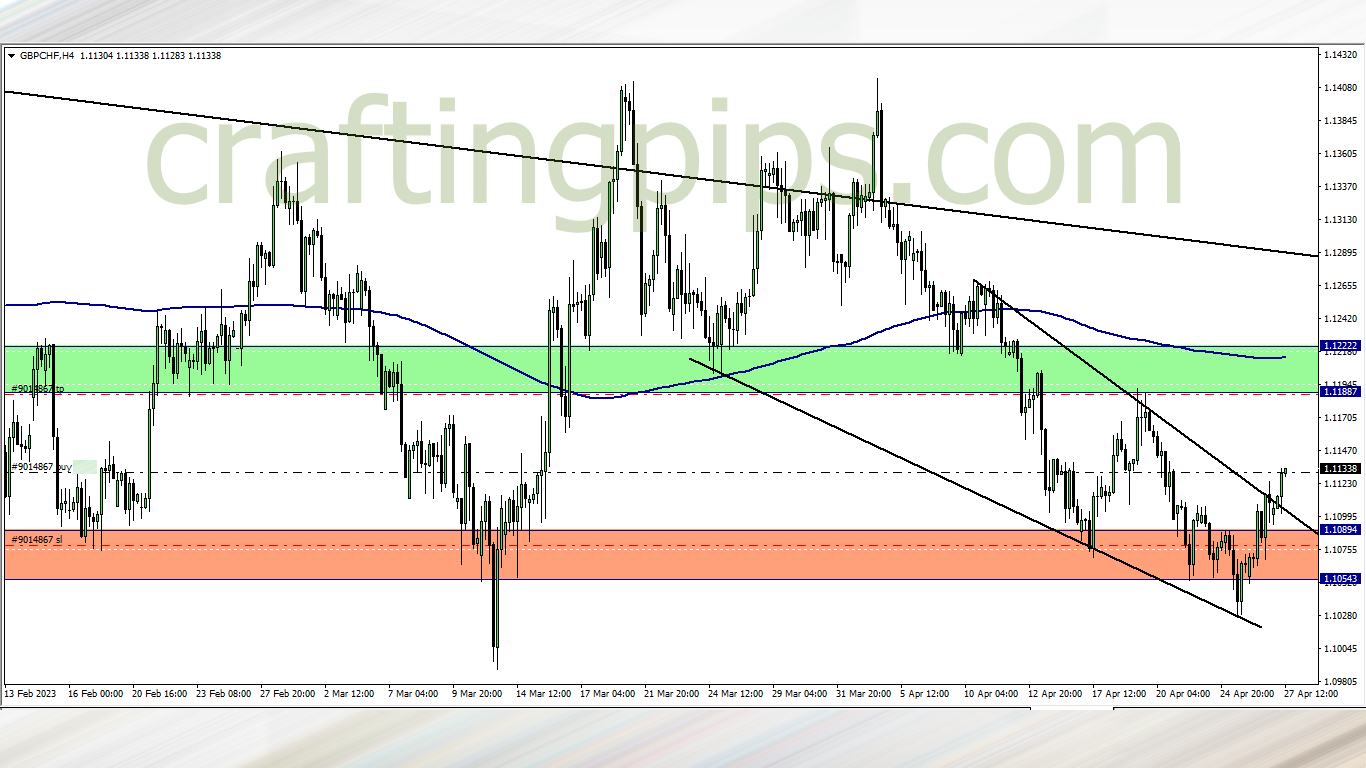

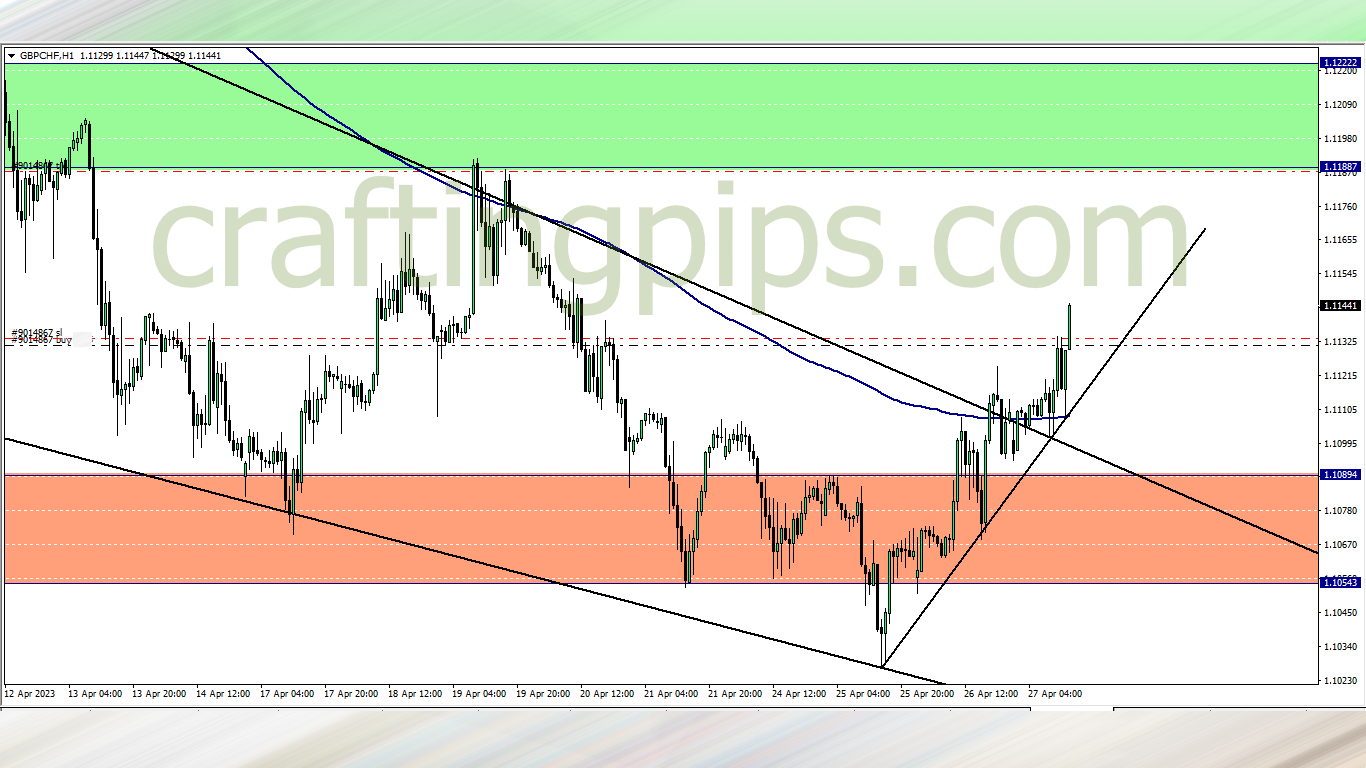

GBP/CHF (10.10am)

Analysis: Price closed with a bullish engulfing candlestick after hitting a key support zone on the daily time frame. hence my hunt for a bullish entry

GBP/CHF Update (10.10am)

Analysis: Trailing SL closed the trade with +15 pips. I could have made more, but I was trading defensively since its the last week of the month

In conclusion:

The week started with a pending trade (CHF/JPY) from last week going bad. I also suffered another loss from a pseudo breakout on the same CHF/JPY.

This week ended in profits because of a super trade (GBP/CAD). I was able to not just scale my GBP/CAD trade, but also push my money management to the metal when a golden opportunity presented itself. The last two trades (GBP/CHF and USD/JPY) was icing on the cake

So I may have closed the week in deficit when it comes to pips, but in profits when it comes to profits.

It was a challenging week in the market but I am happy with the way I executed my trades

Trade activity summary for the month

| 1st TRADING WEEK |

|

|||

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST | |

| MON (03/04/2023) | GBP/USD | SELL | – 71 pips | |

| GBP/CAD | SELL | Pending | ||

| WED (05/04/2023) | CAD/JPY | SELL | Breakeven | |

| TOTAL | -71 pips | |||

| 2nd TRADING WEEK | ||||

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST | |

| MON (10/04/2023) | NZD/USD | SELL | Breakeven | |

| THUS (13/04/2023) | CAD/JPY | BUY | +44 pips | |

| FRI (14/04/2023) | GBP/CAD | SELL | Pending (+88 pips) | |

| TOTAL | + 44 PIPS | |||

| 3rd TRADING WEEK | ||||

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST | |

| MON (17/04/2023) | GBP/CAD | SELL | + 58 pips | |

| CHF/JPY | SELL | Pending (-71 pips) | ||

| TOTAL | + 58 PIPS | |||

| 4th TRADING WEEK | ||||

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST | |

| MON (24/04/2023) | CHF/JPY | BUY | – 140 pips | |

| TUE (25/04/2023) | CHF/JPY | BUY | -174 pips | |

| GBP/CAD | BUY | + 165 pips | ||

| THUS (27/04/2023) | USD/JPY | BUY | + 5 pips | |

| TOTAL | – 144 pips | |||

| GRAND | TOTAL | – 113 PIPS |

NOTE:

In the month of April I had just one losing week (1st week). The other weeks were profitable. Also my number of trades have dropped by over 50% when compared to the first quarter, which brings us to that quote which says: “Less is More” or “Quality over Quantity”

Overall, I closed The month of April in profits, can’t wait for the month of May

How did yours go?

NOTE:

-

THE FUNDED TRADER: https://dashboard.thefundedtraderprogram.com/purchasechallenge-n/?sl=3322 (use the coupon code: THE0CRAFTER)

-

MY FUNDED FX: https://myfundedfx.tech/purchasechallenge/?sl=758

- BESPOKE FUNDING PROGRAMME: https://www.bespokefundingprogram.com/The_Crafter?ref=The_Crafter