My reason for sharing my trade journal is to encourage traders to also keep one for two major reasons:

- Track your weekly trading performance.

- Build a better psychology, which will sharpen your trading intuition

Both can only be done when you keep a comprehensive journal, and review it every week.

MONDAY 15/04/2024

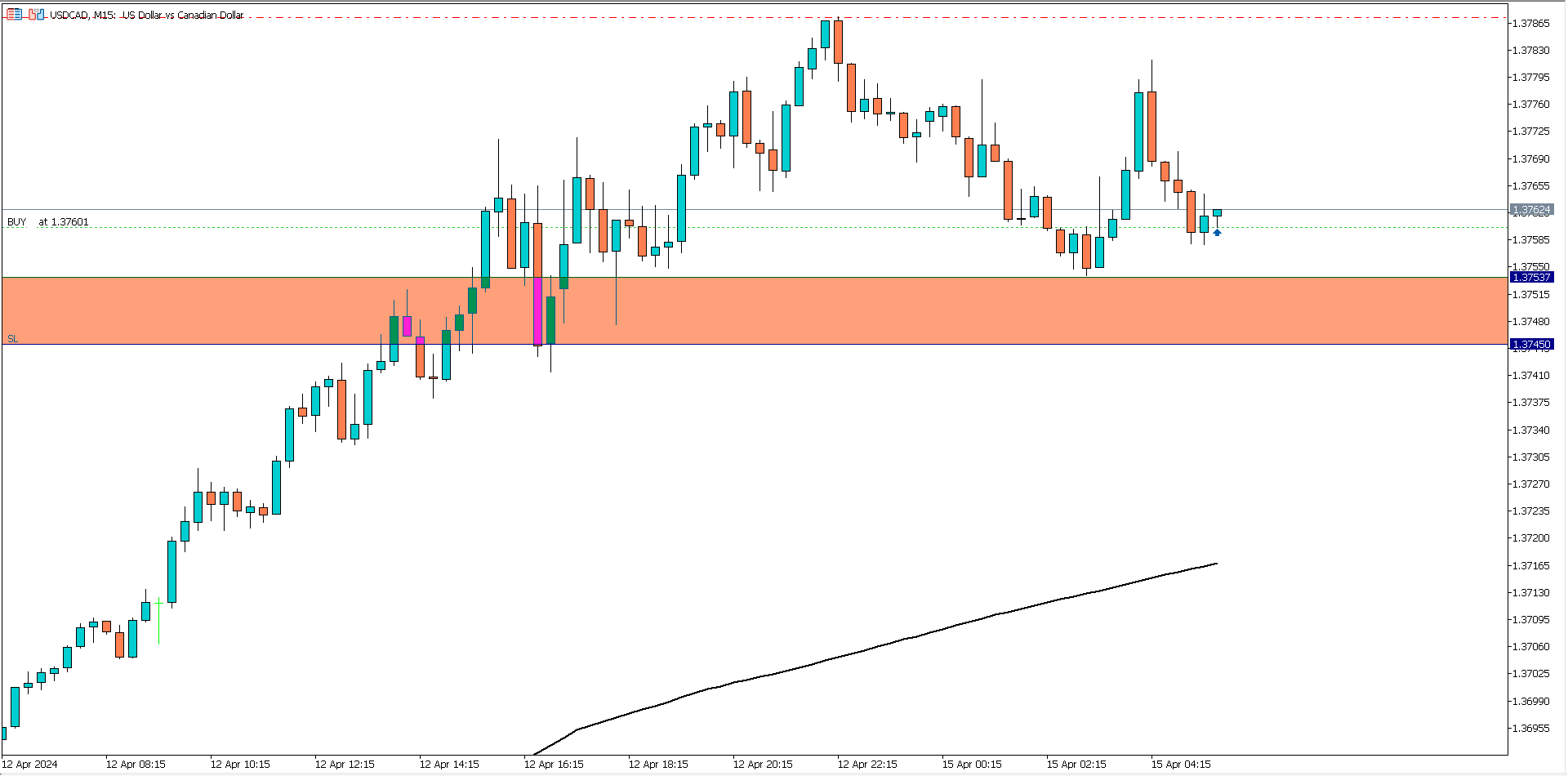

USD/CAD (3.33 am)

Analysis: My reason for buying was shared on our Weekly Market Analysis

USD/CAD Update (7.28 am)

Stop Loss was hit = -14 pips

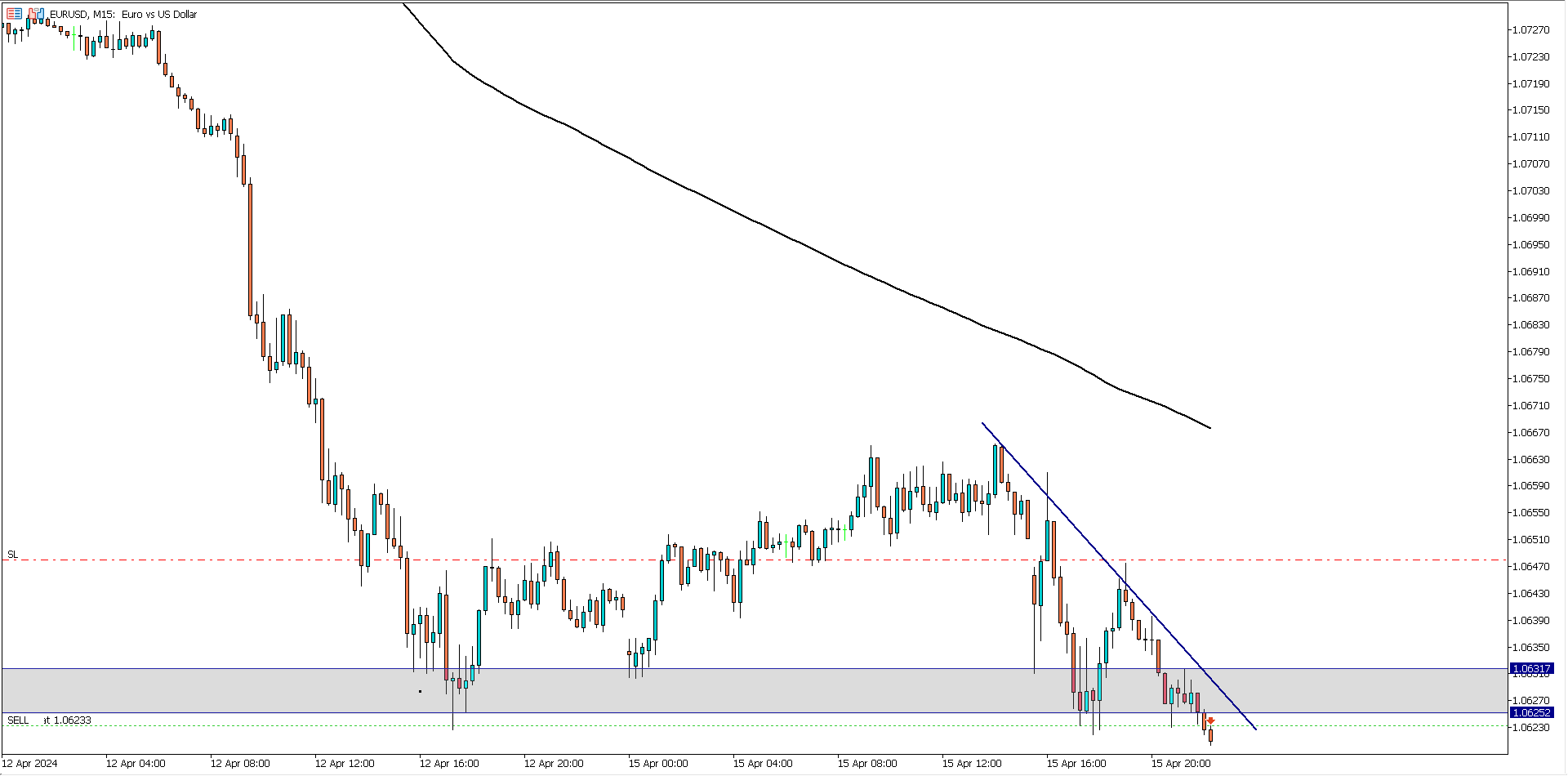

EUR/USD (8.20 pm)

Analysis: My reason for selling was shared on our Weekly Market Analysis

EUR/USD Update (Tuesday 4.29 am)

Closed EUR/USD manually = +11 pips

TUESDAY 16/04/2024

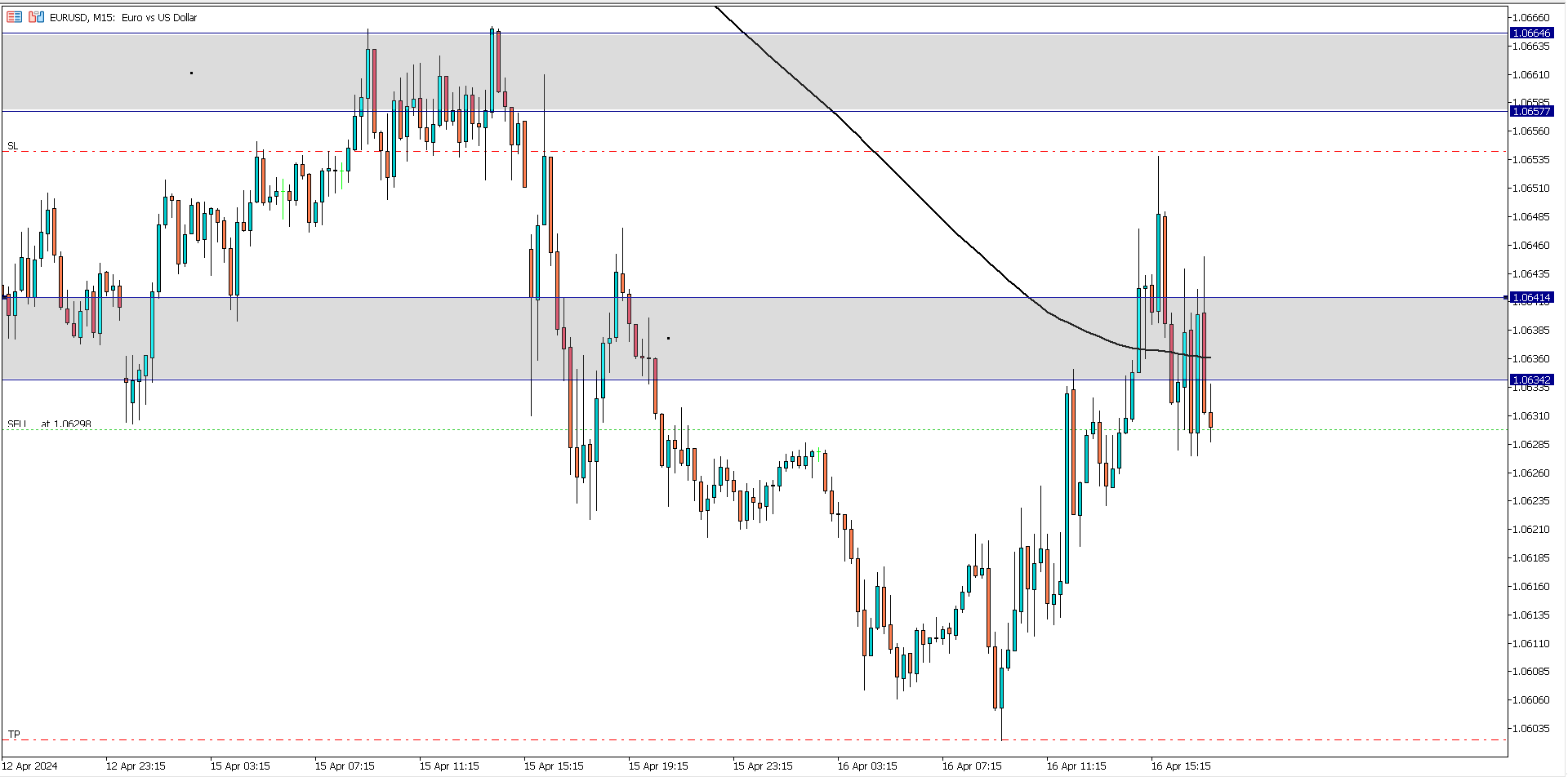

EUR/USD (3:35 pm)

Analysis: My reason for selling was shared on our Weekly Market Analysis

EUR/USD Update (Tuesday 5.39 pm)

Closed EUR/USD manually = +9 pips

WEDNESDAY 17/04/2024

USD/JPY (11.50 am)

Analysis: My reason for buying was shared on our Weekly Market Analysis

USD/JPY Update (Wednesday 3.28 pm)

Manually closed with +7 pips (exited due to upcoming high impact news event)

THURSDAY 18/04/2024

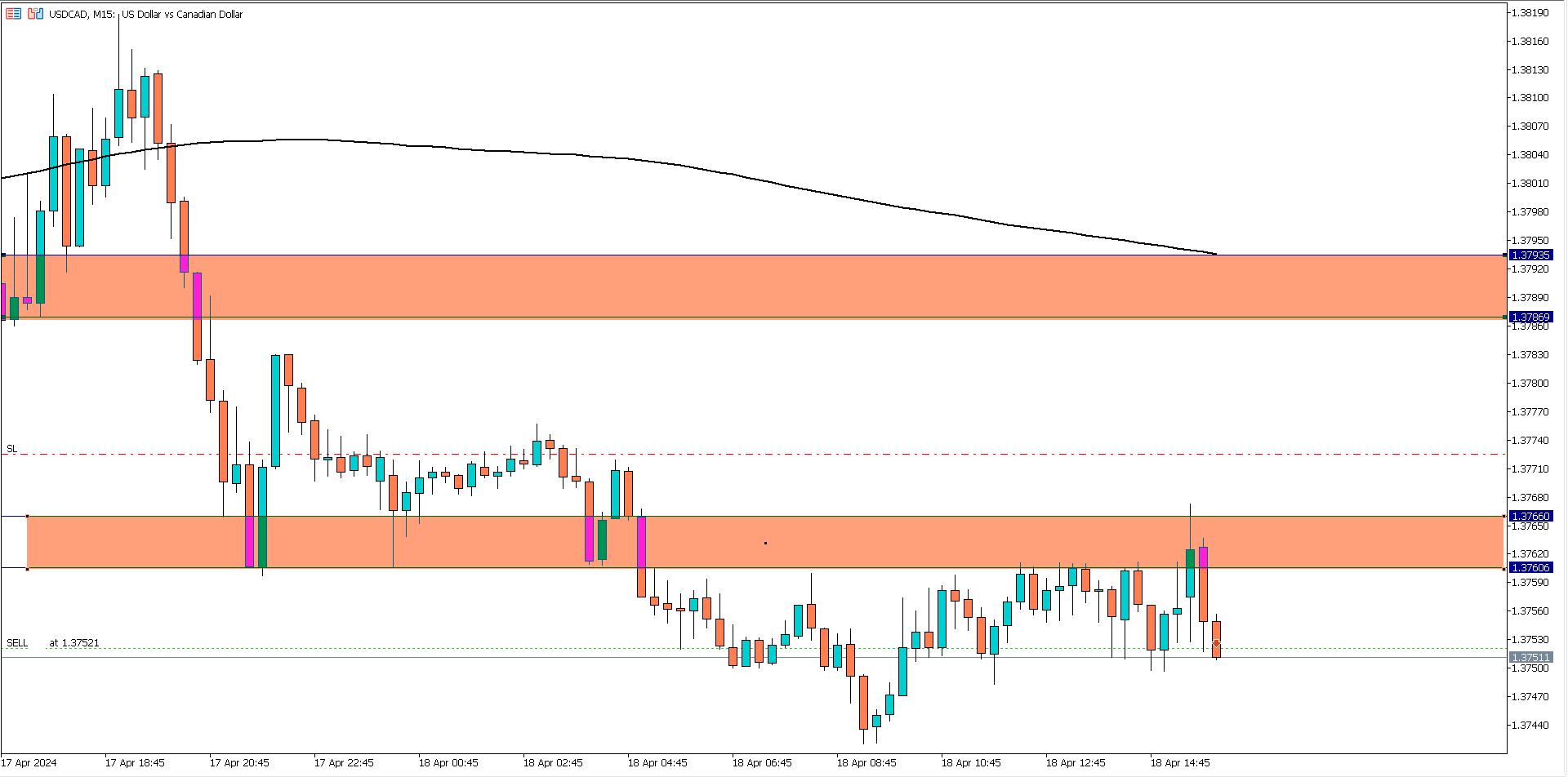

USD/CAD (2 pm)

Analysis: My reason for selling is the fact that, on the daily time frame of the USD/CAD, a reversal has occurred and confirmed

USD/CAD Update (Thursday 6:15 pm)

SL got hit (-20 pips)

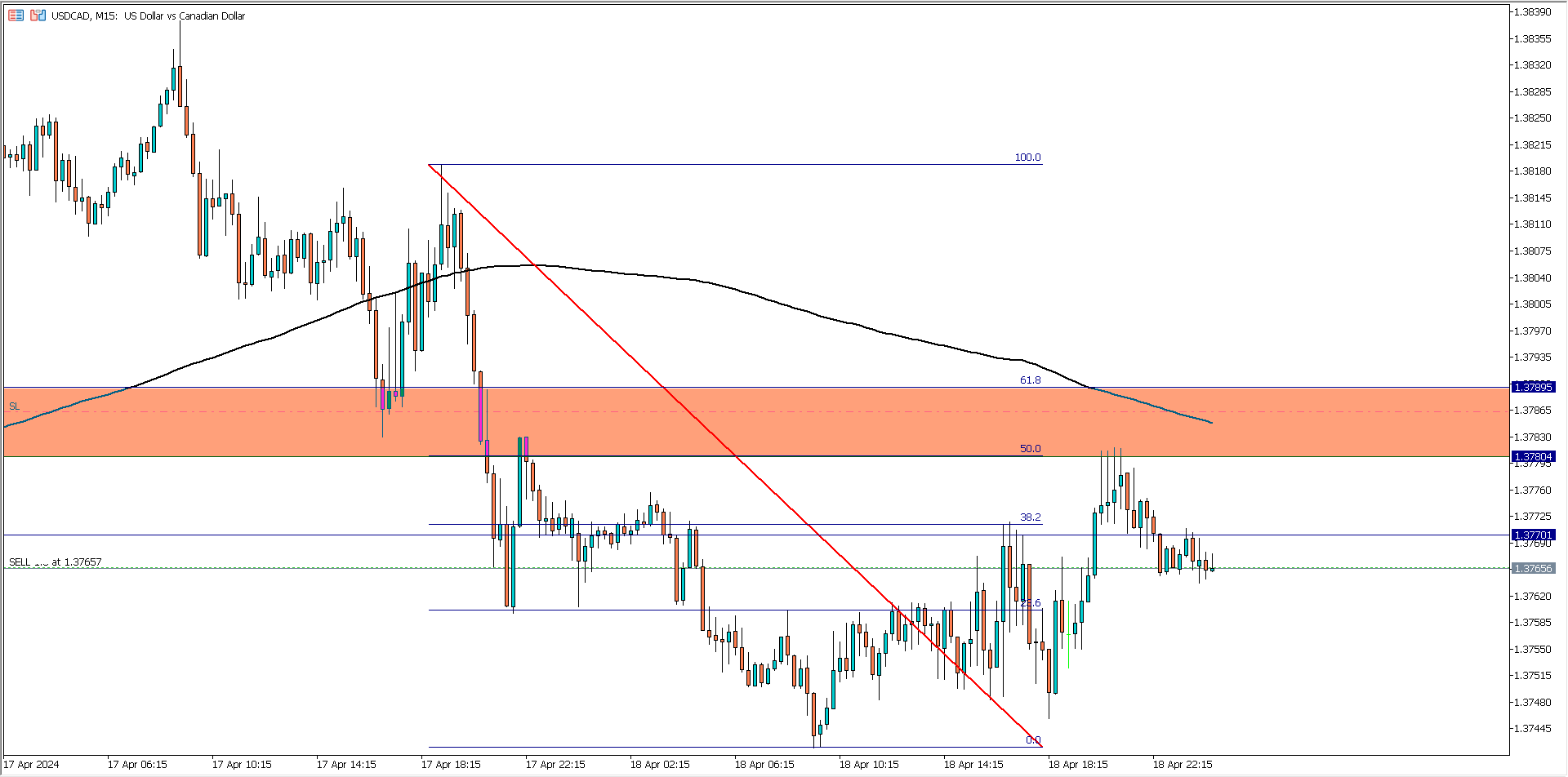

USD/CAD (10.31 pm)

Analysis: Price was still bearish on the larger time frame and on the 15 minutes tf, we can see that the golden ratio on the Fib retracement is holding price tight

USD/CAD Update (Friday 6:15 pm)

SL got hit (-20 pips)

Trade activity summary for the week

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST |

| MON (15/04/2024) | USD/CAD | BUY | -14 pips |

| EUR/USD | SELL | +11 pips | |

| TUE (16/04/2024) | EUR/USD | SELL | +9 pips |

| WED (17/04/2024) | USD/JPY | BUY | +7 pips |

| THUS (18/04/2024) | USD/CAD | SELL | -20 pips |

| USD/CAD | SELL | -20 pips | |

| TOTAL | -27 PIPS | ||

In conclusion:

last week could have been profitable, but the unnecessary thing that I did, was what robbed me off my profits

To start with, the week was a tough one, so I had to go in and out of trades without allowing any of my trades hit TP. By Wednesday I was a little over +1% in profits

Over confidence made me risk over -1% of my capital on the USD/CAD trade I took on Thursday, and the trade went south. Gladly I reduced my risk on the second USD/CAD trade (which also hit SL)

So I closed the week with almost -2% drawdown. If I had followed my money management rules 100%, I probably would have closed the week at breakeven.

But again, this is just a reminder that I am also human, and sometimes emotions do take control when it really counts.

Looking forward to a better…

How did yours go?

NOTE:

- BESPOKE FUNDING PROGRAMME

- FUNDED ENGINEER

- BLUE GUARDIAN (Use the coupon code: CRAFTER)

- GOAT FUNDED

- LARK FUNDING

- SKILLED FUNDED TRADER

- MAVEN TRADING

- MY FLASH FUNDING (Use the coupon code: “FILLIPO” for a -25% discount)

- THE5ERS