My reason for sharing my trade journal is to encourage traders to also keep one for two major reasons:

- Track your weekly trading performance.

- Build a better psychology, which will sharpen your trading intuition

Both can only be done when you keep a comprehensive journal, and review it every week.

TUESDAY 09/04/2024

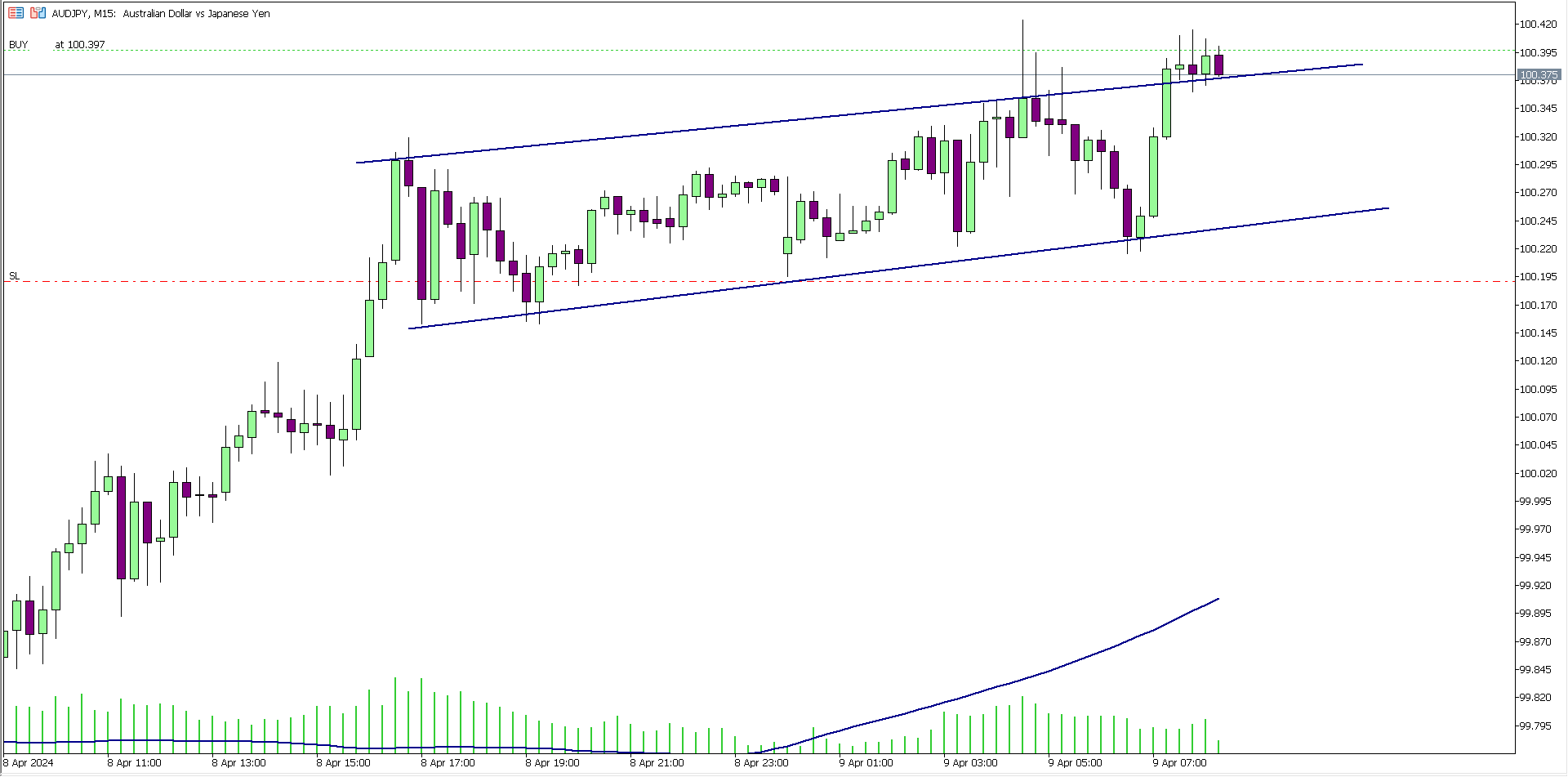

AUD/JPY (6.20 am)

Analysis: My reason for buying was shared on our Tuesday Market Analysis

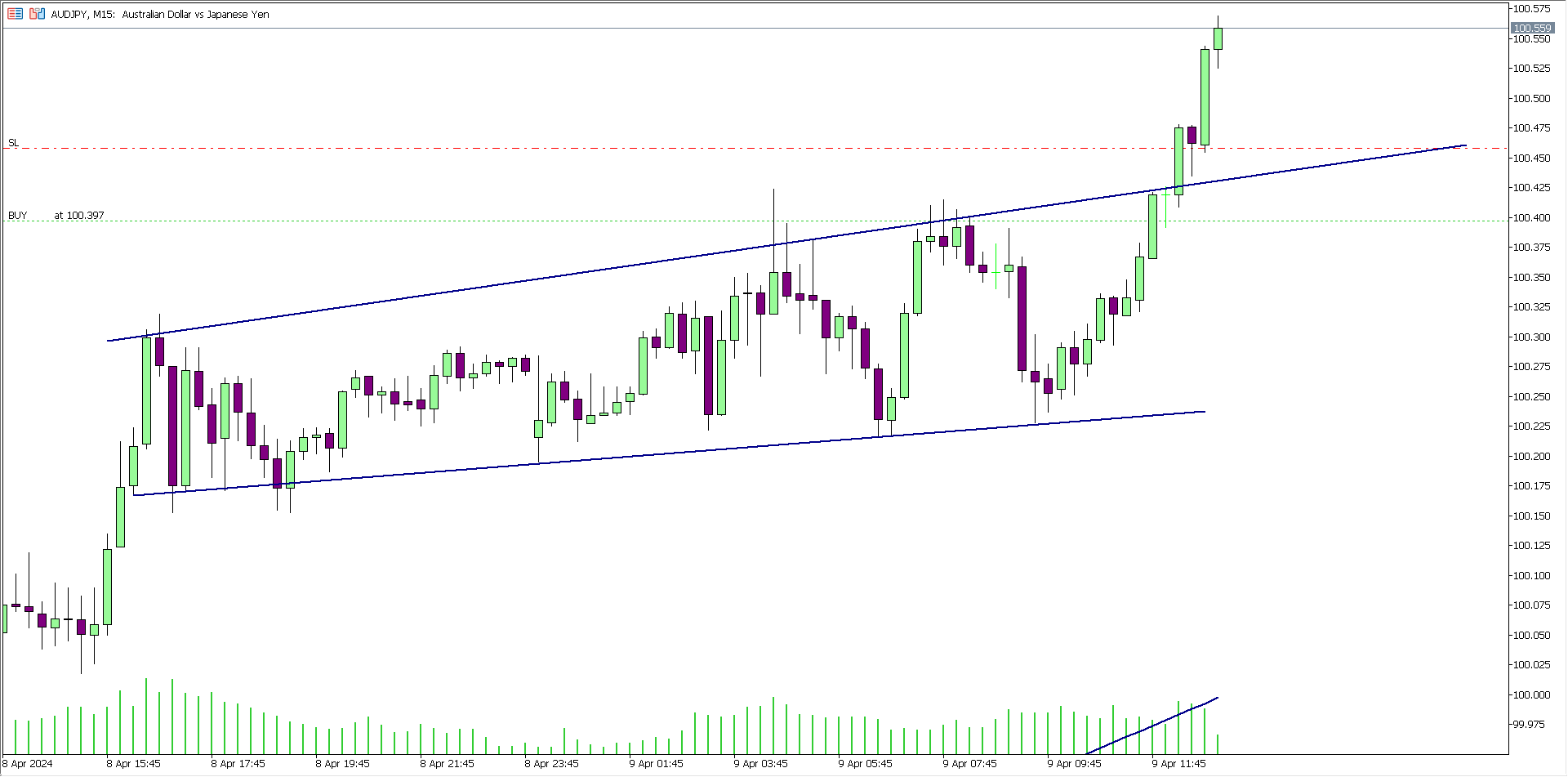

AUD/JPY Update (11.45 am)

Analysis: I closed the trade with +14 pips on my low risk account & +28 pips on my high risk account

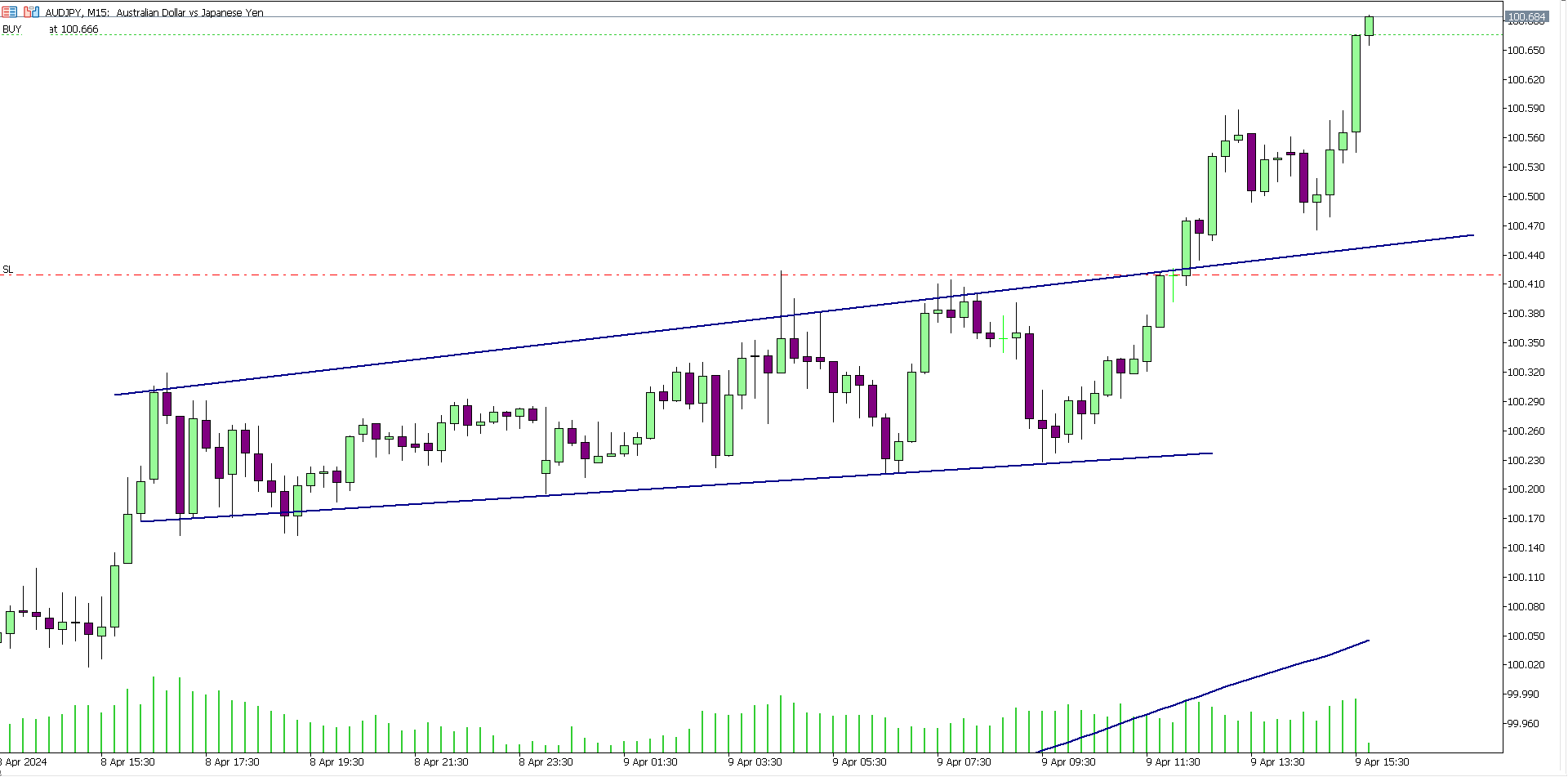

AUD/JPY (1.47 pm)

Analysis: I capitalized on the breakout on the AUD/JPY

AUD/JPY Update (2.47 pm)

I closed the AJ trade with +9 pips (trailing SL)

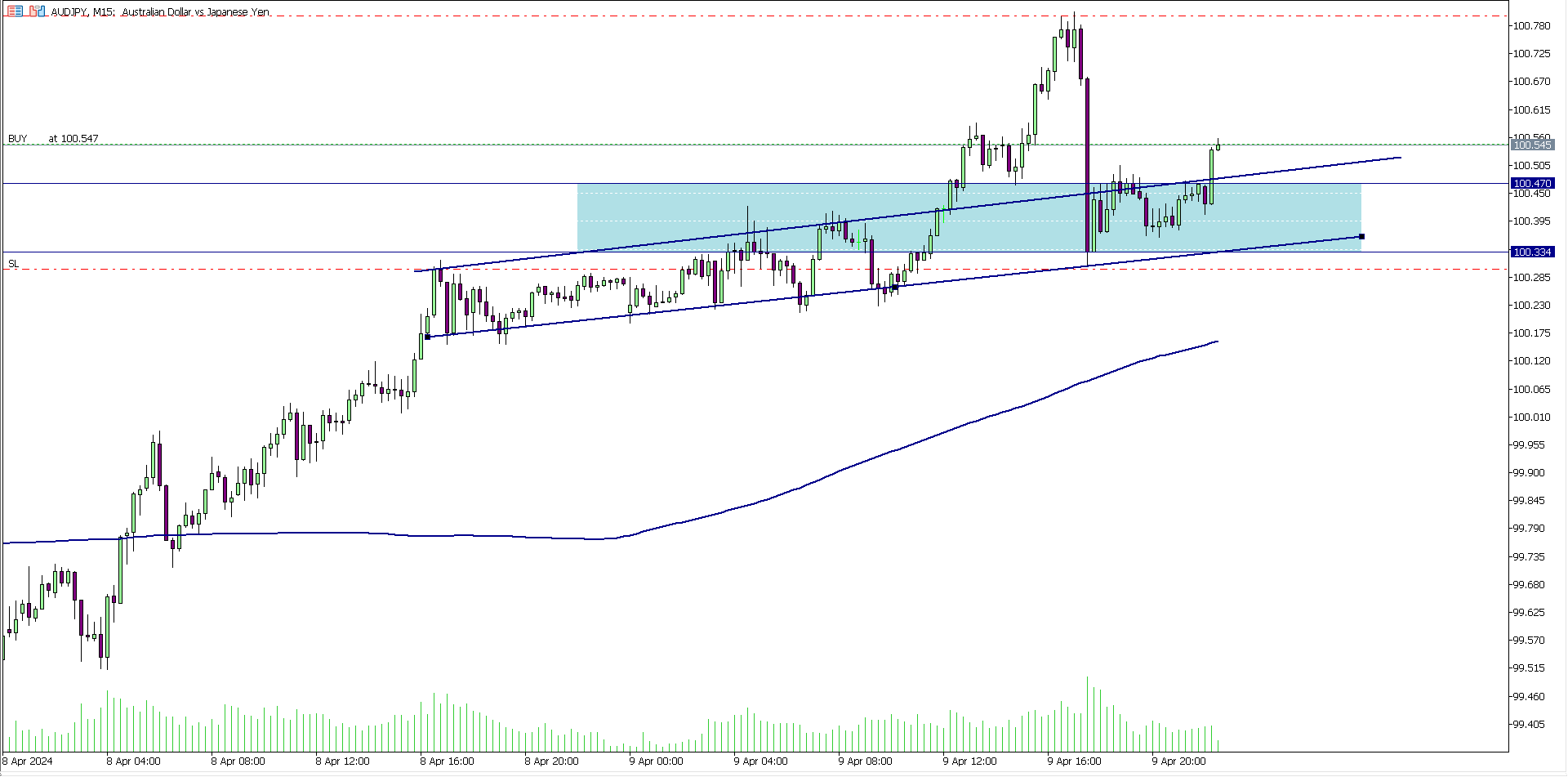

AUD/JPY (8.33 pm)

Analysis: This trade is still based on our Tuesday Market Analysis

AUD/JPY Update (Wednesday 2.04 am)

I closed AJ at breakeven before the red folder news event

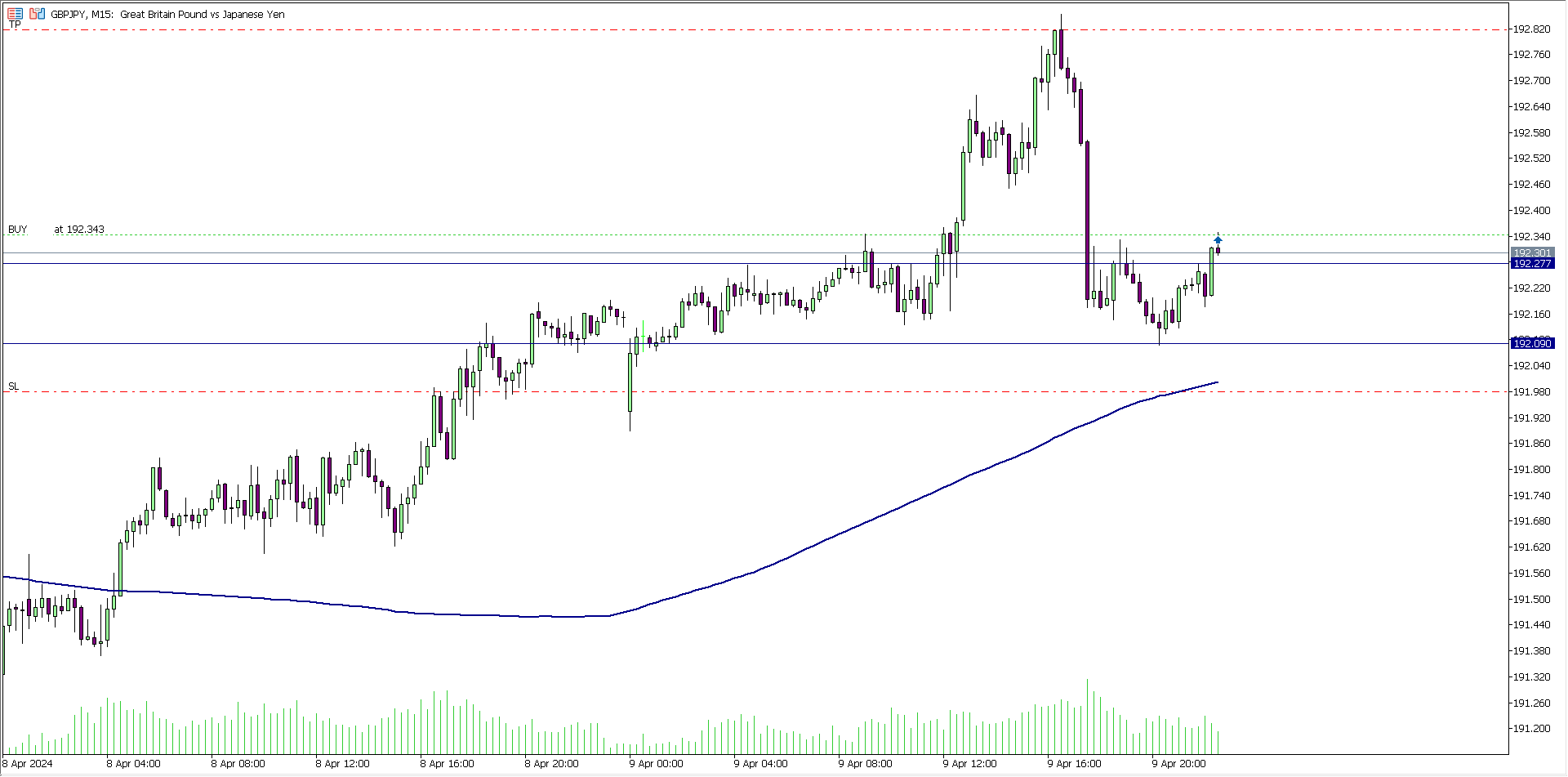

GBP/JPY (8.45 pm)

Analysis: This trade is still based on our Tuesday Market Analysis

WEDNESDAY 09/04/2024

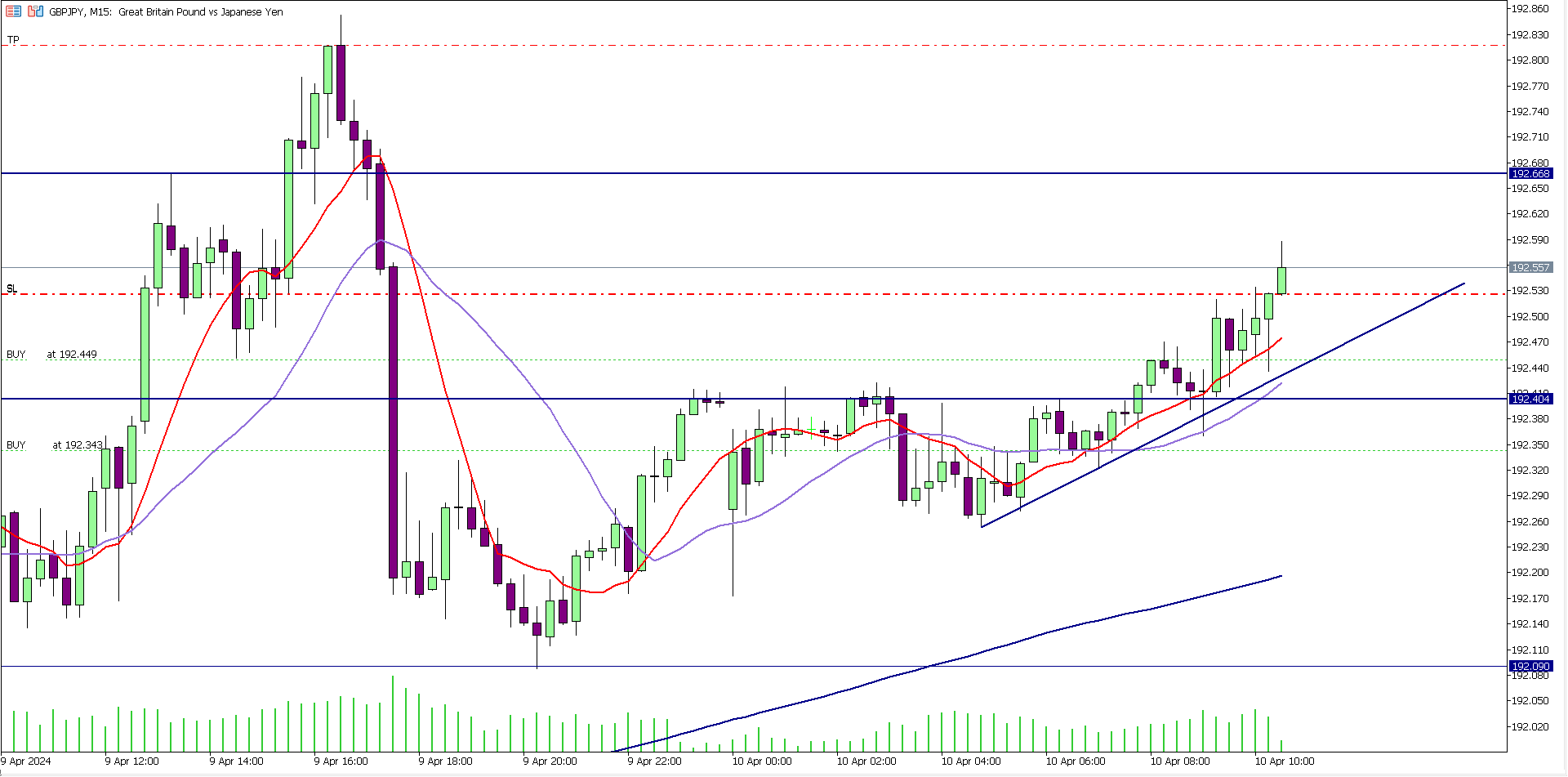

GBP/JPY (8.45 am)

Analysis: I closed this trade (trailing SL) with +26 pips

Trade activity summary for the week

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST |

| TUE (09/04/2024) | AUD/JPY | BUY | + 28 pips |

| AUD/JPY | BUY | + 9 pips | |

| AUD/JPY | BUY | Breakeven | |

| GBP/JPY | BUY | +26 pips | |

| TOTAL | +63 Pips |

In conclusion:

Last week was a blast.

Tuesday was my busiest day of the week, with a total trades of 4 trades taken, GBP/JPY and AUD/JPY spilled into Wednesday but that was it for me.

I missed a trade on the USD/JPY because I slept late on Tuesday, but hey… no regrets

last week I displayed Zen level discipline managing my trades and emotions in the market. My trade executions were also flawless.

That said, I am thankful that the market went our way, and I closed with +3.2% ROI. How did your week go?

NOTE:

- BESPOKE FUNDING PROGRAMME

- FUNDED ENGINEER

- BLUE GUARDIAN (Use the coupon code: CRAFTER)

- GOAT FUNDED

- LARK FUNDING

- SKILLED FUNDED TRADER

- MAVEN TRADING

- MY FLASH FUNDING (Use the coupon code: “FILLIPO” for a -25% discount)

- THE5ERS