My reason for keeping a journal is to encourage traders to also keep one for two major reasons:

- Track weekly trading performance.

- To have enough date to be able to work on their trading technique and psychology

Both can only be done when you keep a comprehensive journal, and review it every week.

MONDAY (27/03/2023)

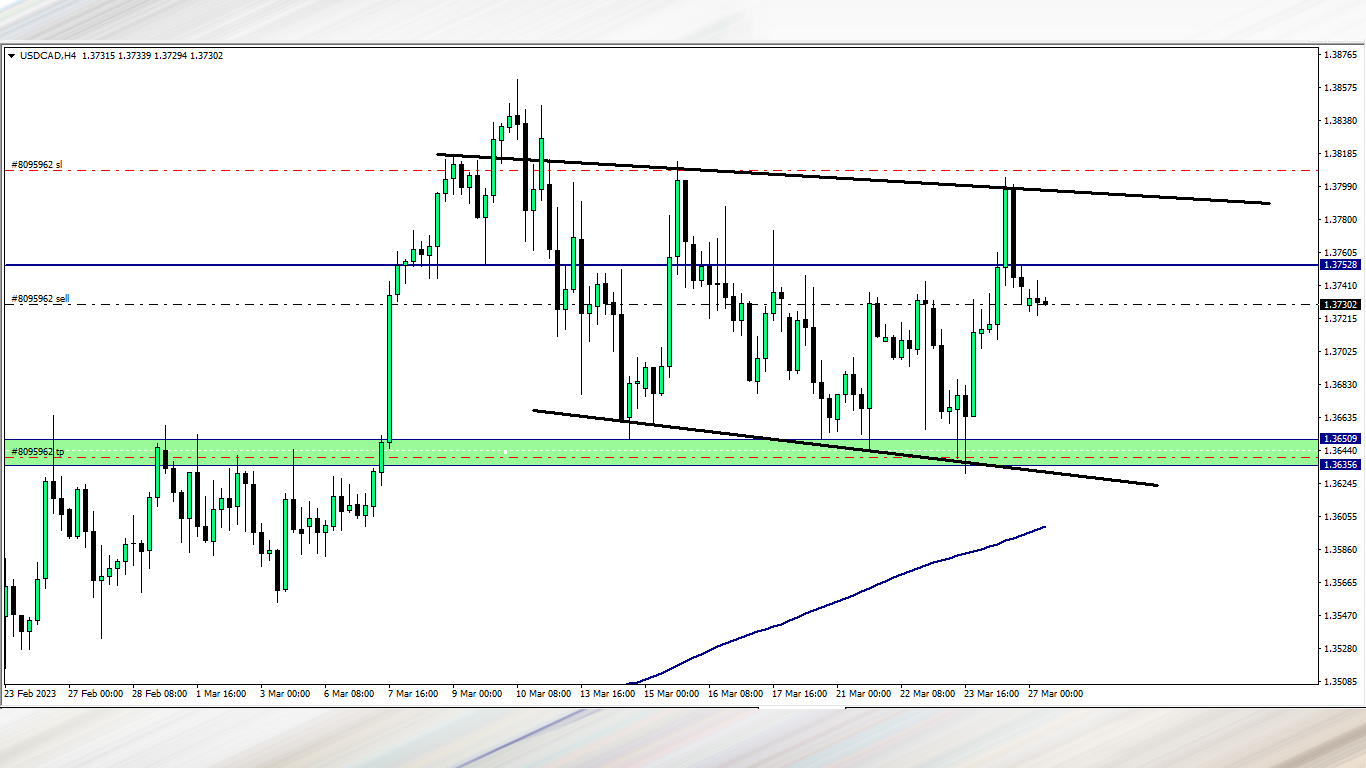

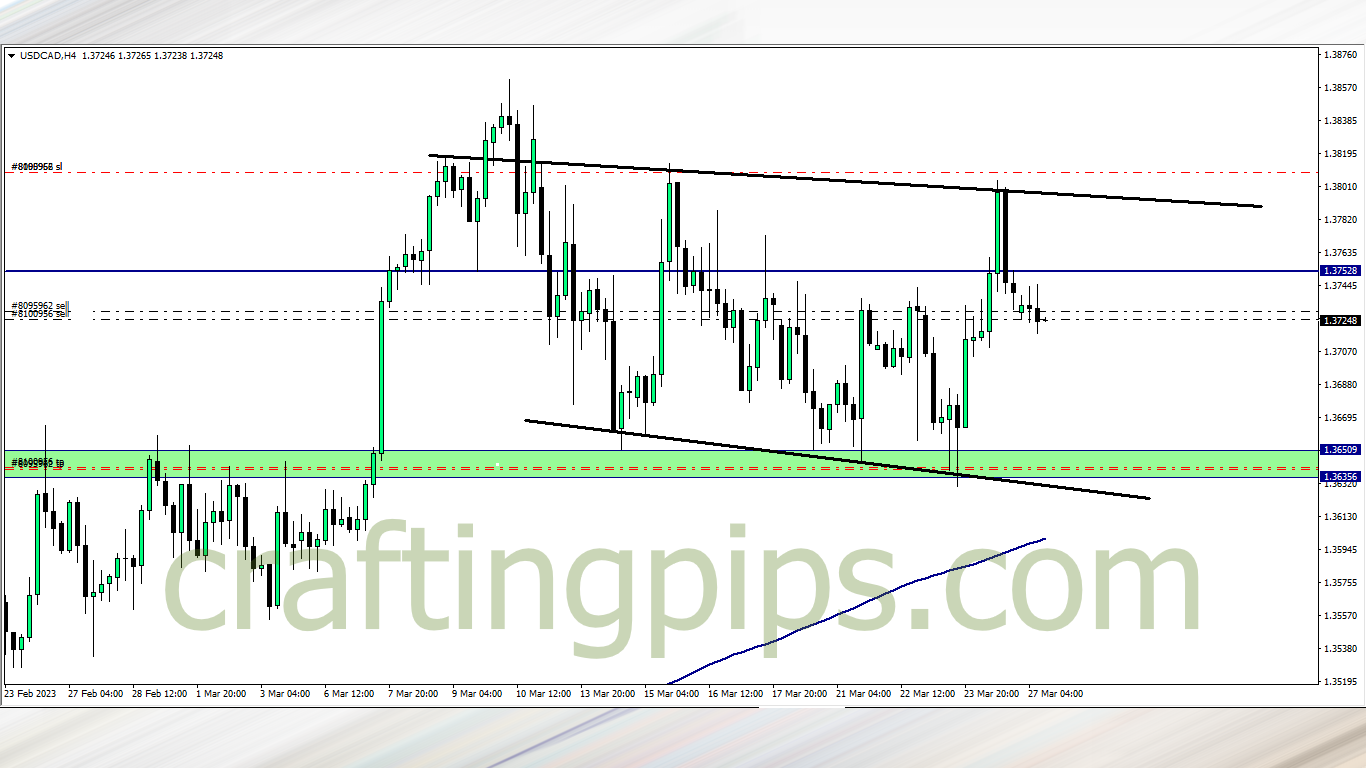

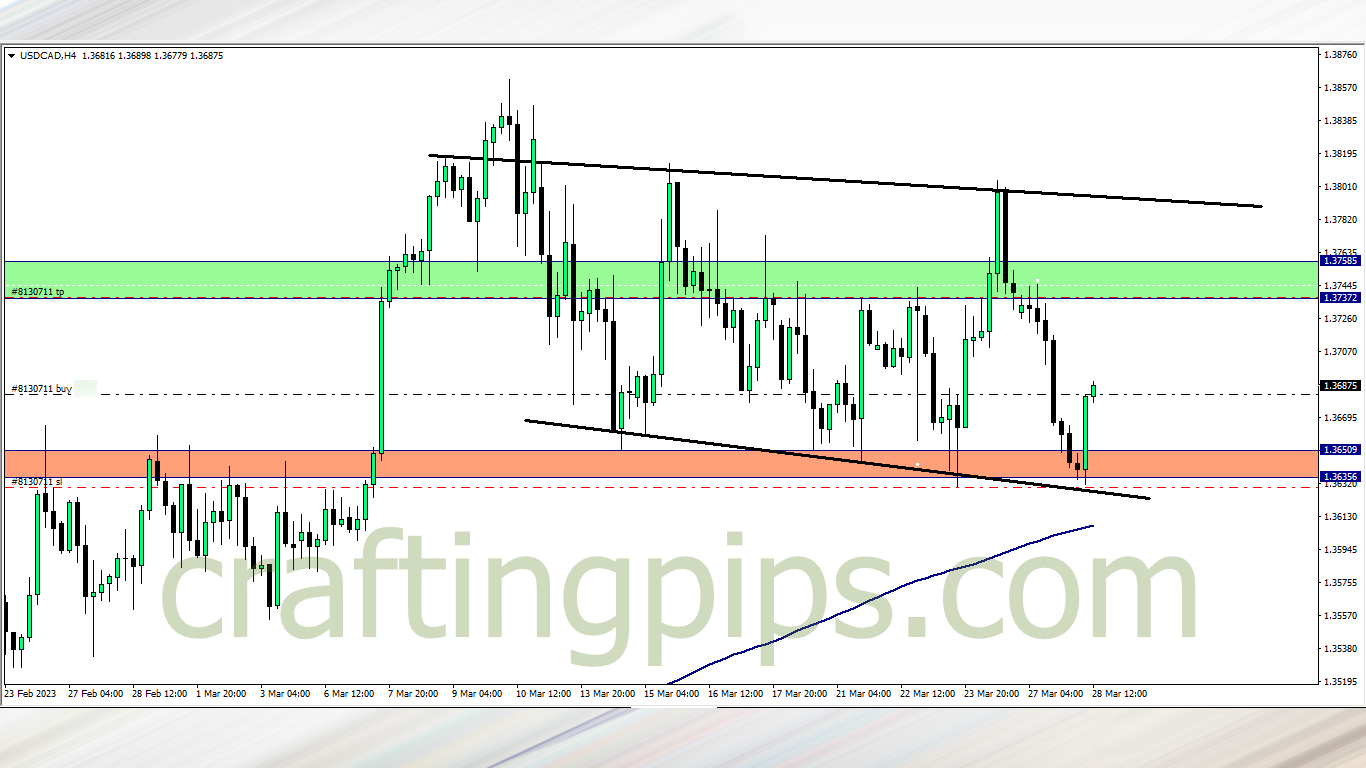

USD/CAD (6.15 am)

Analysis: My reason for selling USD/CAD can be seen on our weekly market analysis

USD/CAD Update (10.05 am)

Analysis: I added a second trade at the close of the 6 am candlestick

USD/CAD Update (2 pm)

Analysis: I started trailing with the close of the 10am CS. Price finally hit my trailing SL, and I closed with +55 pips

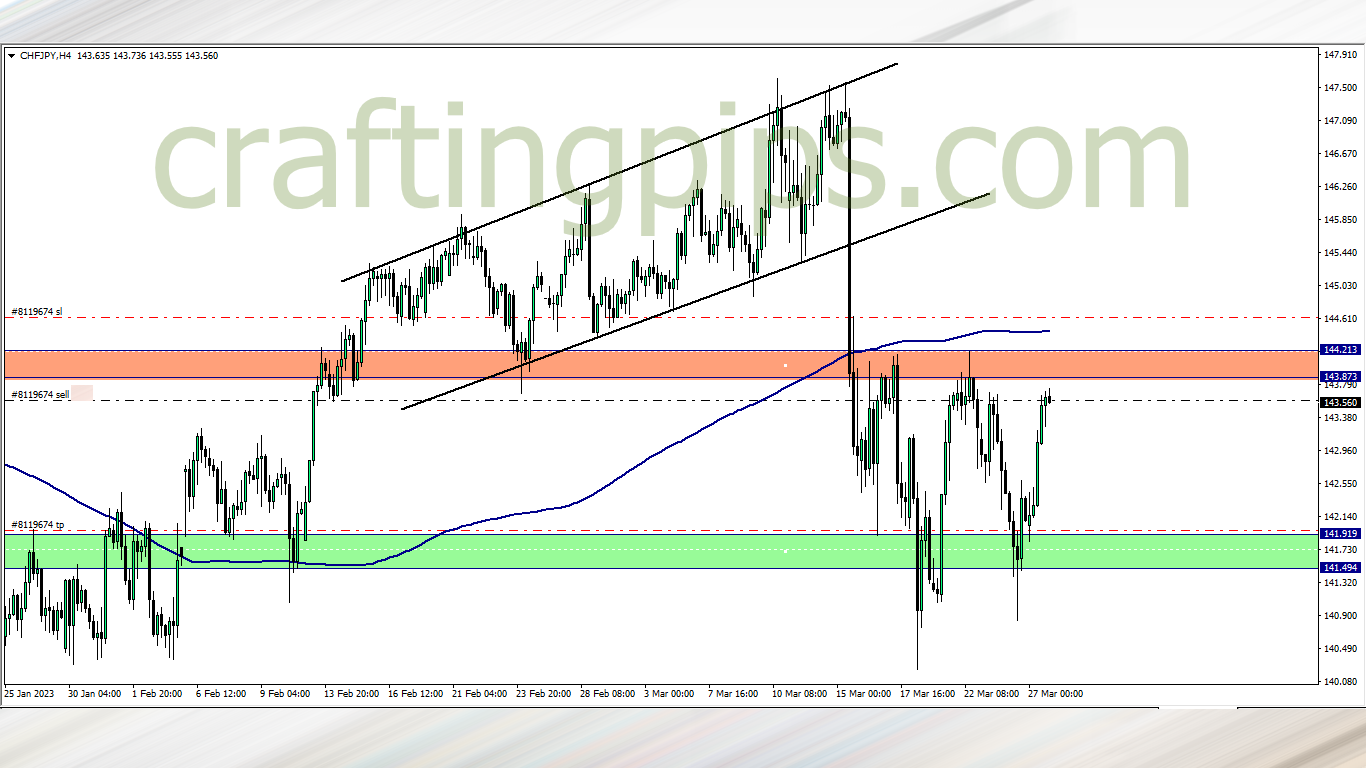

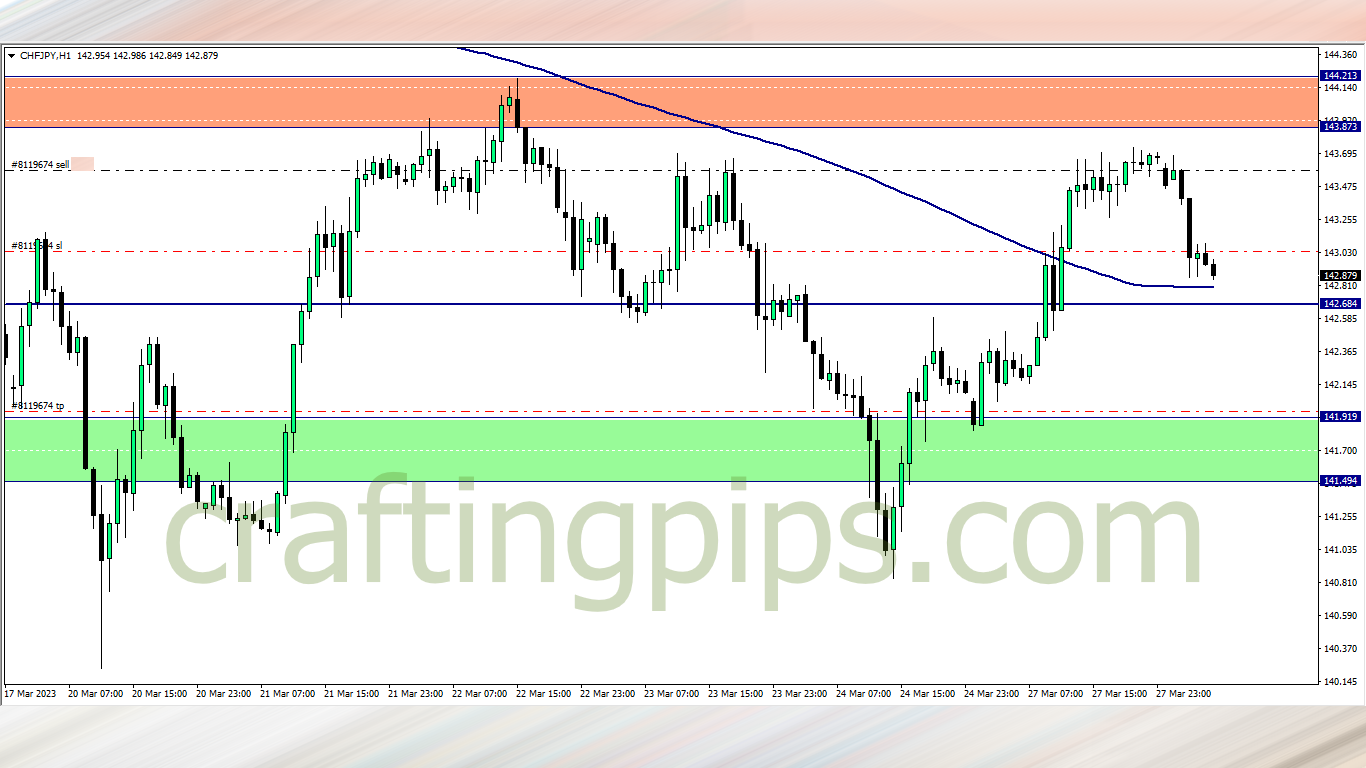

CHF/JPY (8.20 pm)

Analysis: My reason for selling CHF/JPY can be seen on our Tuesday market analysis

TUESDAY (28/03/2023)

CHF/JPY (5 am)

CHF/JPY update (8.30 am)

Closed the trade with +58 pips

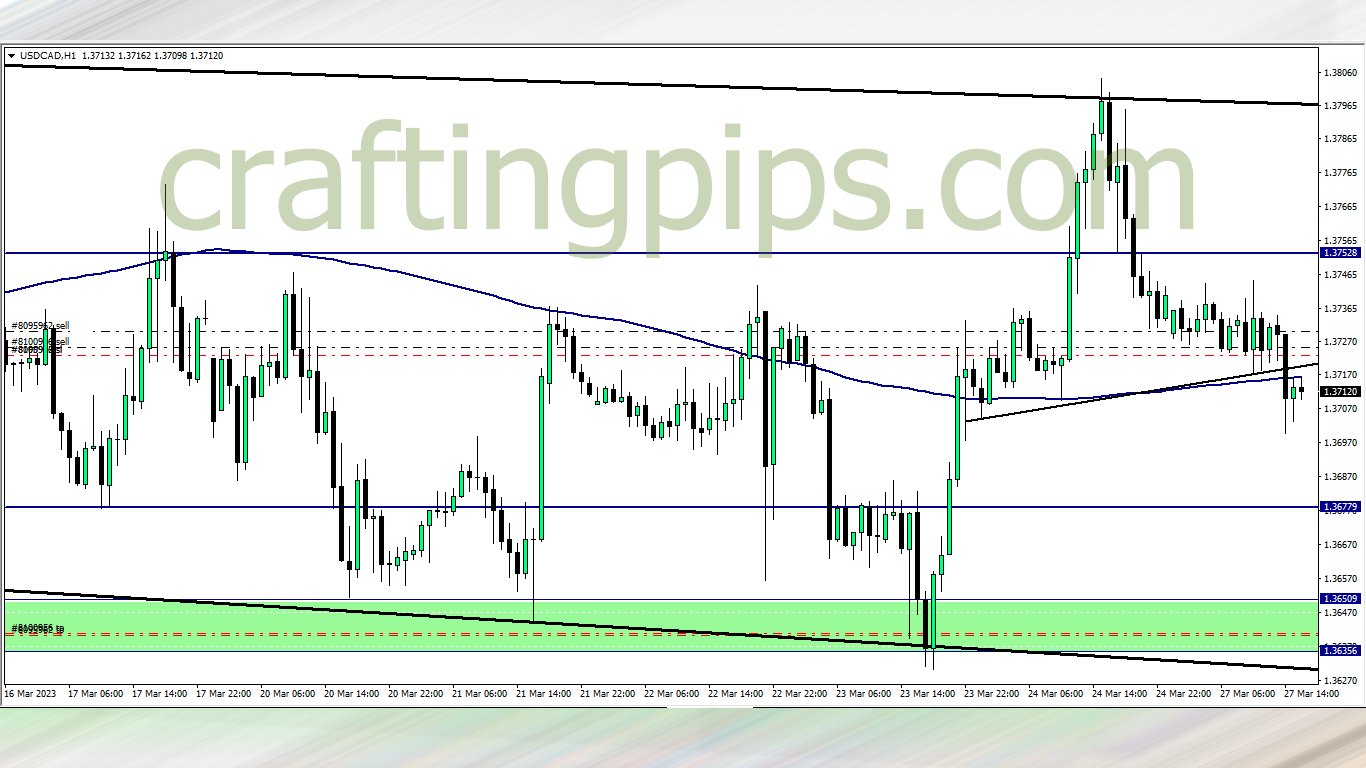

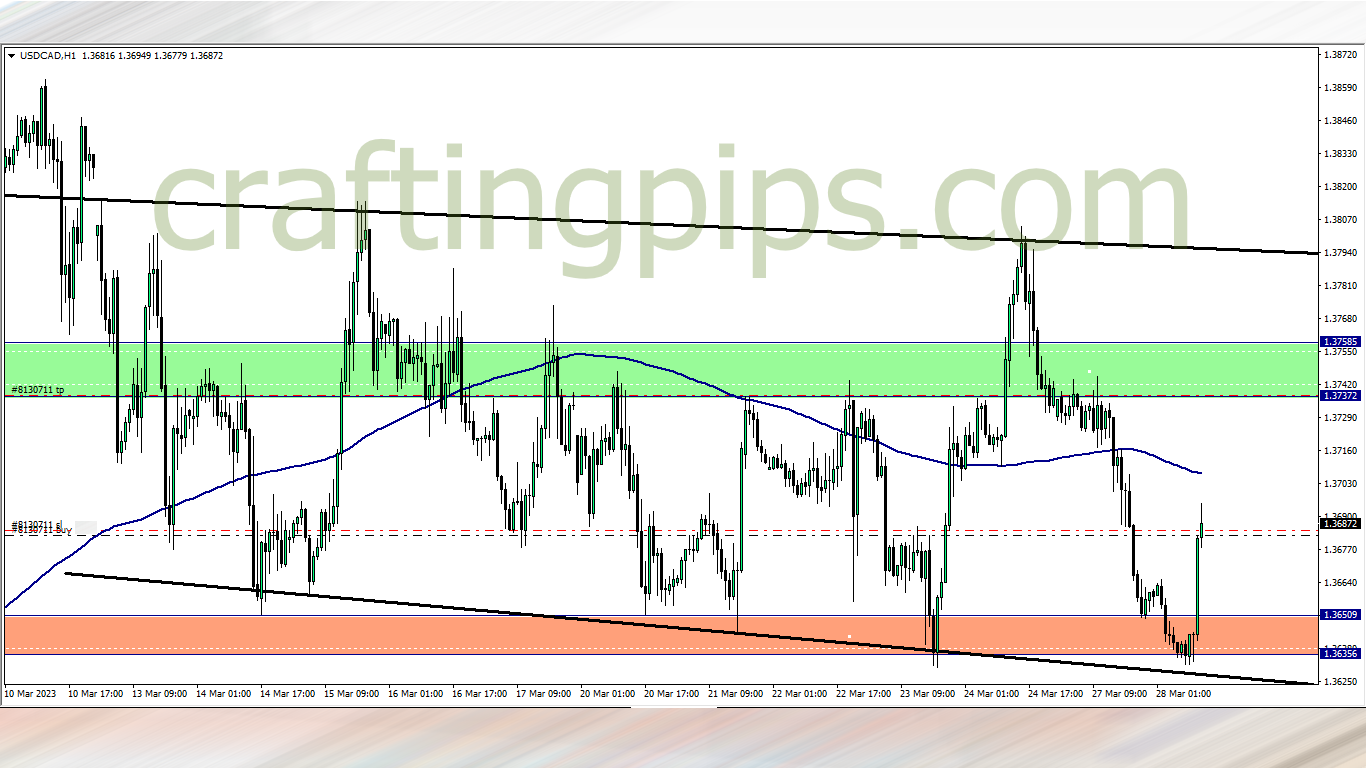

USD/CAD (10.10 am)

Analysis: I have decided to buy the USD/CAD because the bullish engulfing candlestick popped up at a key support zone, and some pips away from the 200 ma. Moreover if you check the daily time frame, the USD/CAD is ranging, so I am capitalizing on that fact.

Note: I am planning to exit the trade before 3 pm (high impact news on the USD)

USD/CAD Update (10.50 am)

Analysis: Decided to place a tight stop loss not just because of the news, but also because of the 200 ma on the 1hr tf. Trade closed at breakeven

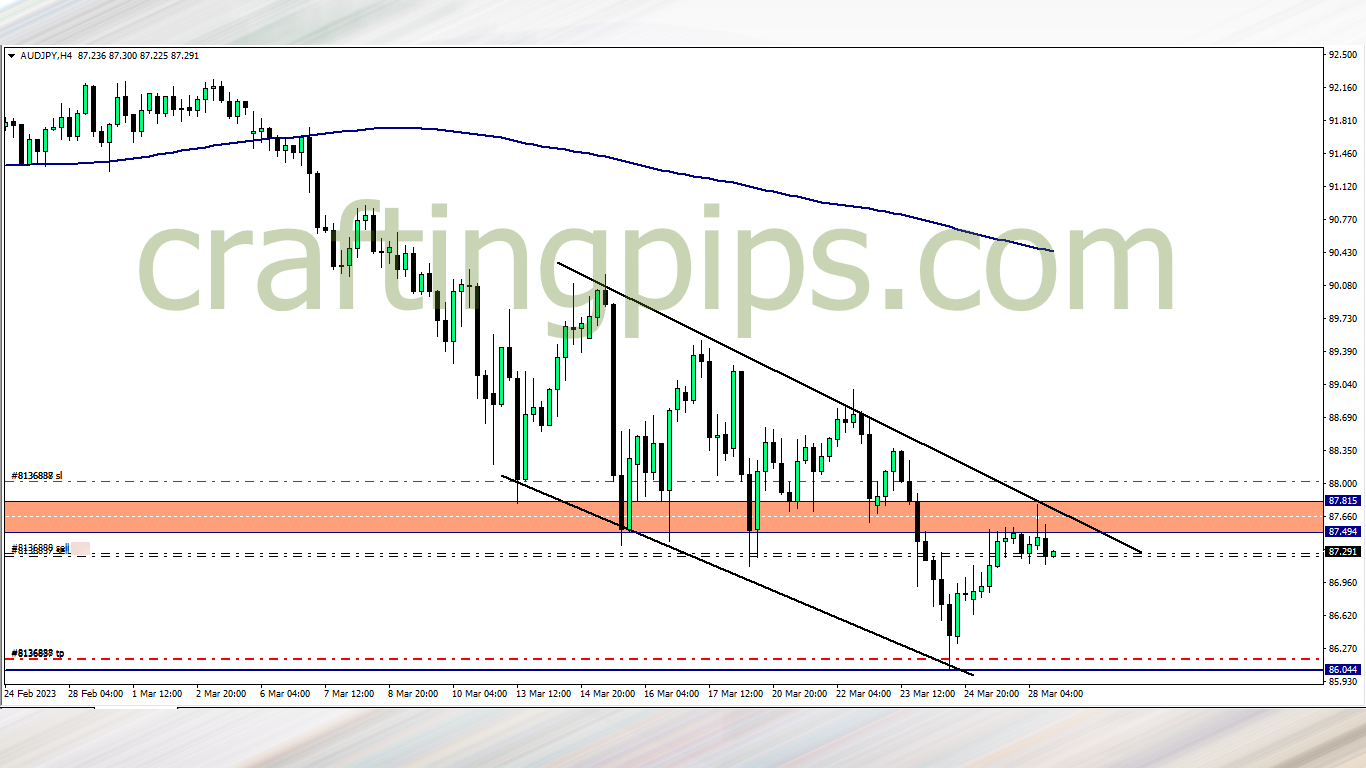

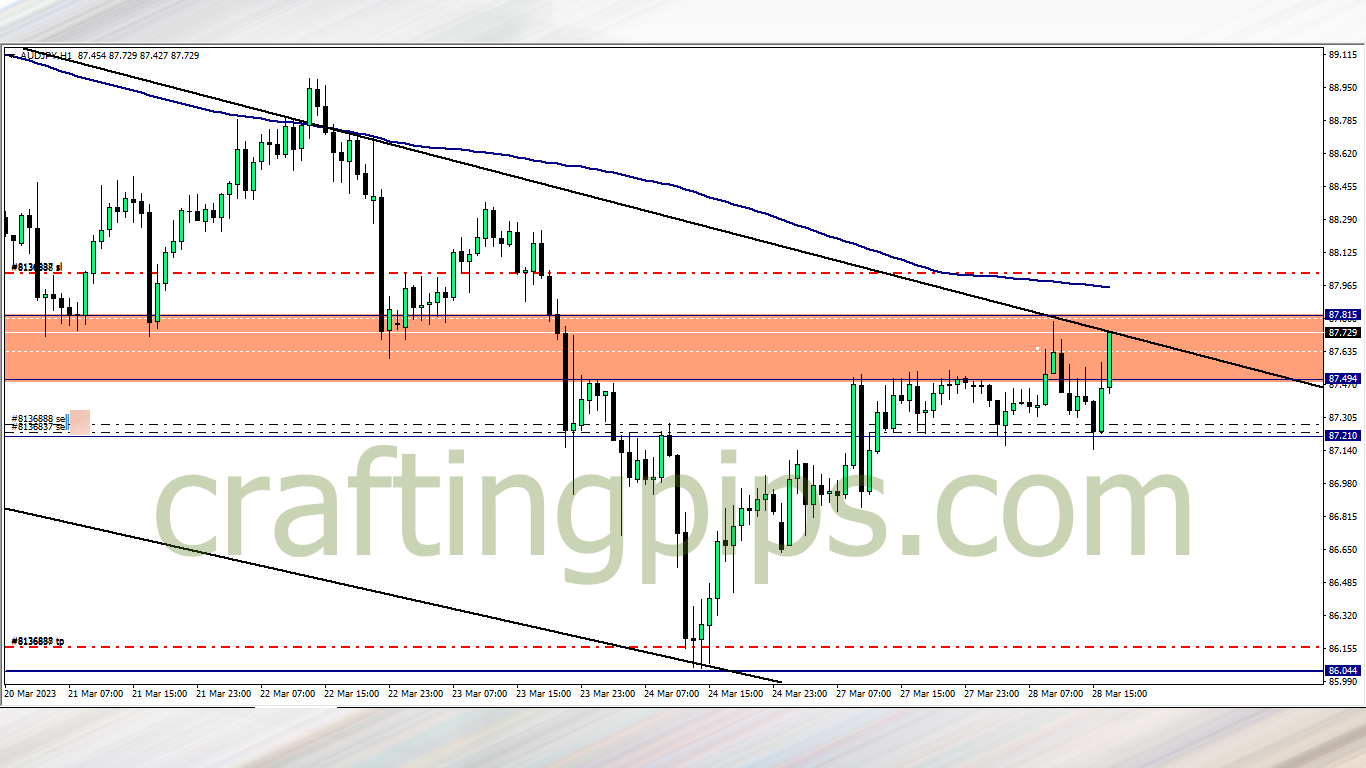

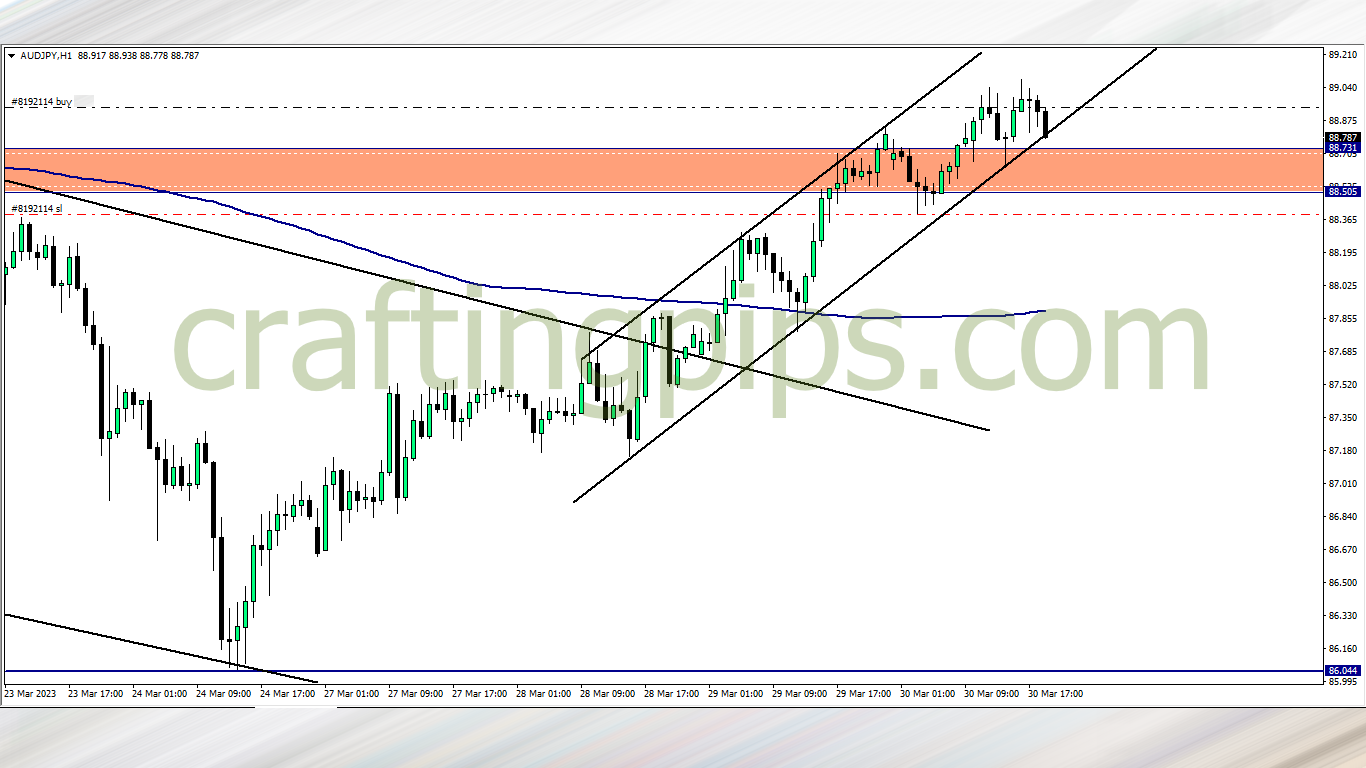

AUD/JPY (2.05 pm)

Analysis: Candlestick formation suggesting weak buyers within a key resistance zone encouraged the sell. Again I will be holding this trade till 1 am (Asian session) due to CPI news on AUD

AUD/JPY Update (3.52 pm)

Analysis: I manually exited AJ a few minutes before the close of the 1-hr CS. Closed with -100 pips loss

WEDNESDAY (29/03/2023)

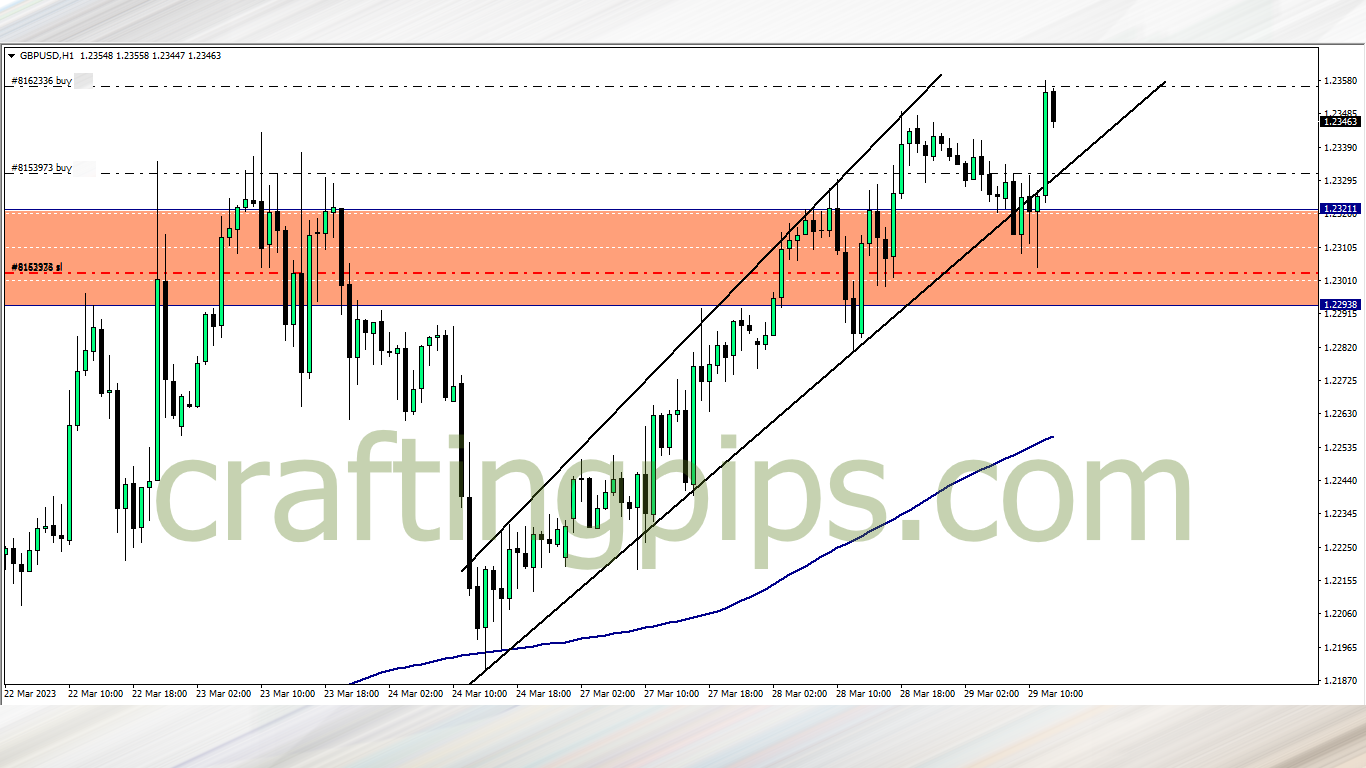

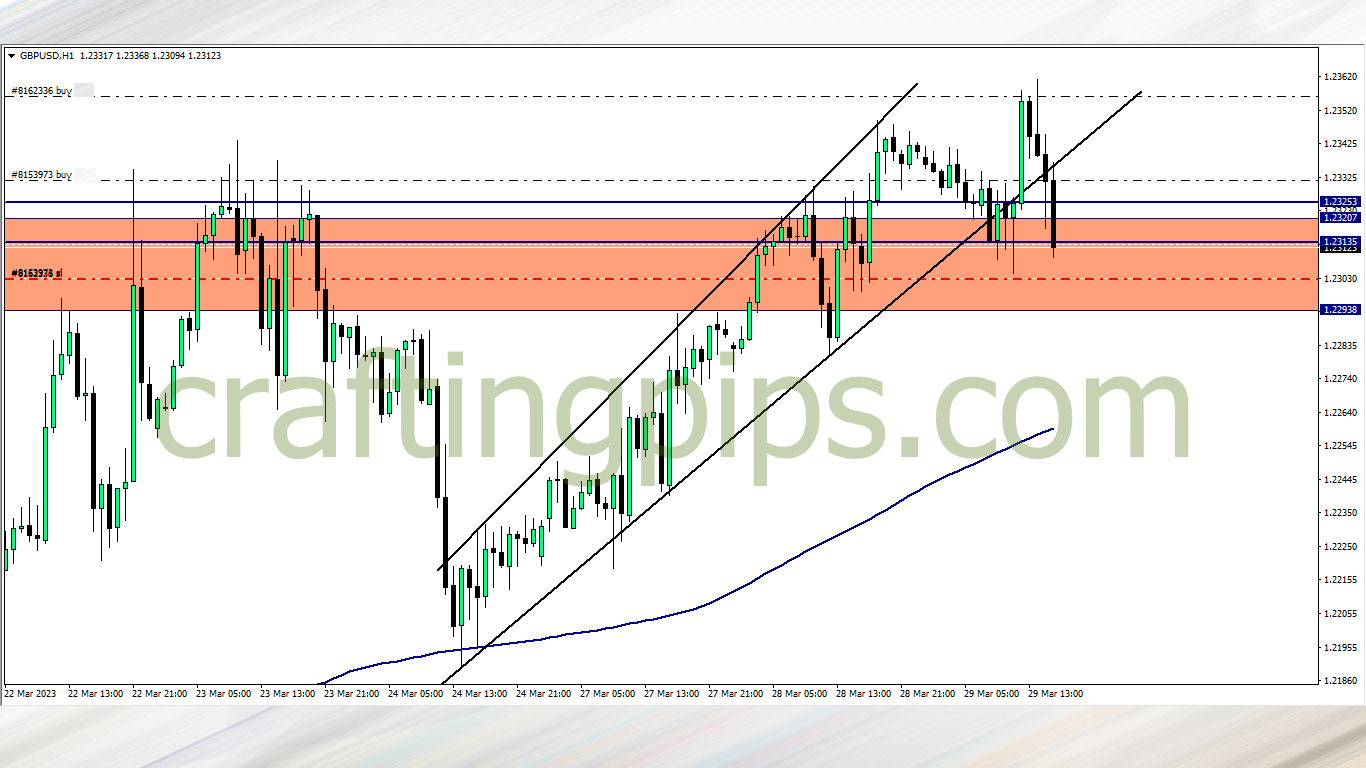

GBP/USD (6.05 am)

Analysis: This trade was inspired by our Wednesday market analysis. One thing to note is that I did not sell the USD/CAD setup shared on Wednesday setup because of the poor R/R. Instead, I opted to buy GBP/USD since there is a viable setup with a better R/R

GBP/USD Update (11.08 am)

Analysis: After price almost taking out my SL, the close of the 9am and 10am candlestick on the 1- hour time frame gave us renewed hope. After price took out the previous high made by Tuesday close of the daily candlestick, I scaled in

GBP/USD Update (2.30 pm)

Analysis: No news, but for some funny reason price decided to fall flat after breaking the previous high. I closed the trade manually, a few pips before I got stopped out. Lost -70 pips

THURSDAY (30/03/2023)

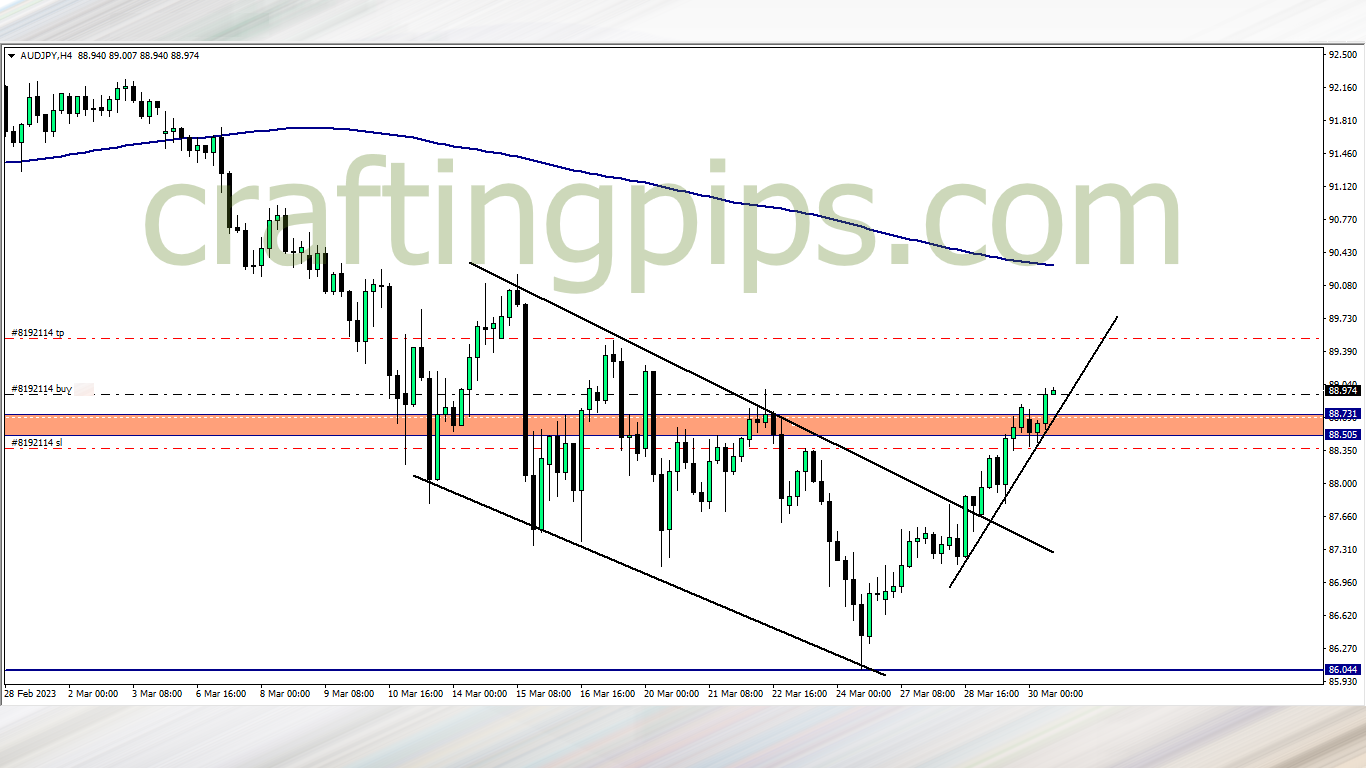

AUD/JPY (10.00 am)

Analysis: My reason for buying AUD/JPY can be seen on our Thursday market analysis

AUD/JPY Update (6.30 am)

Analysis: I exited the AUD/JPY trade with -22 pips loss. The trade spent over 7 hours without making any significant move. Meanwhile NZD/JPY, CAD/JPY, CHF/JPY, EUR/JPY and GBP/JPY moved really well today. I guess sometimes a shitty day can’t be helped

Trade activity summary for the week

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST |

| MON (27/03/2023) | USD/CAD | SELL | + 55 pips |

| CHF/JPY | SELL | +58 pips | |

| TUE (28/03/2023) | AUD/JPY | SELL | – 100 pips |

| WED (29/03/2023) | GBP/USD | BUY | – 70 pips |

| THUS (30/03/2023) | AUD/JPY | BUY | -20 pips |

| TOTAL | – 77 PIPS |

In conclusion:

I went hard this week, and that can be seen in my multiple scaling in and scaling out, but the market had other things in mind.

My last two trades (GBP/USD and AUD/JPY) ought to have been winners if I had not tried any scaling in methods. In trying to to scale in and scale out, your stop lose will become tighter in order to accommodate more open positions.

So if I had NOT gone hard and there were no SCALING IN AND OUT trades in place, my large stop loss would have accommodated the huge pull backs of the market, and I would have closed with just one loss (Tuesday trade)

I lost a little over -2% this week

Trade activity summary for the month

| 1st TRADING WEEK |

|

|||

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST | |

| WED (01/03/2023) | EUR/CHF | BUY | + 46 pips | |

| NZD/JPY | BUY | Pending | ||

| FRI (03/02/2023) | GBP/CHF | SELL | Breakeven | |

| TOTAL | +46 PIPS | |||

| 2nd TRADING WEEK | ||||

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST | |

| MON (06/03/2023) | EUR/CHF | BUY | – 24 pips | |

| EUR/CHF | SELL | – 35 pips | ||

| Last week’s trade | NZD/JPY | BUY | – 212 pips | |

| TUE (07/03/2023) | GBP/USD | SELL | + 19 pips | |

| WED (08/03/2023) | AUD/JPY | SELL | + 185 pips | |

| AUD/USD | SELL | Breakeven | ||

| TOTAL | – 67 PIPS | |||

| 3rd TRADING WEEK | ||||

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST | |

| MON (13/03/2023) | CAD/JPY | SELL | +82 pips | |

| GBP/JPY | SELL | -57 pips | ||

| TUE (14/03/2023) | CAD/JPY | SELL | +202 pips | |

| WED (15/03/2023) | CHF/JPY | SELL | Breakeven | |

| THUS (16/03/2023) | USD/JPY | BUY | -189 pips | |

| FRI (17/03/2023) | NZD/USD | SELL | Breakeven | |

| TOTAL | + 38 pips | |||

| 4th TRADING WEEK | ||||

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST | |

| MON (20/03/2023) | GBP/CHF | BUY | + 5 pips | |

| GBP/USD | BUY | – 48 pips | ||

| TUE (21/03/2023) | EUR/CHF | BUY | Breakeven | |

| WED (22/03/2023) | GBP/JPY | BUY | -116 pips | |

| TOTAL | -179 PIPS | |||

| 5th TRADING WEEK | ||||

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST | |

| MON (27/03/2023) | USD/CAD | SELL | + 55 pips | |

| CHF/JPY | SELL | +58 pips | ||

| TUE (28/03/2023) | AUD/JPY | SELL | – 100 pips | |

| WED (29/03/2023) | GBP/USD | BUY | – 70 pips | |

| THUS (30/03/2023) | AUD/JPY | BUY | -20 pips | |

| TOTAL | – 77 PIPS | |||

| GRAND | TOTAL | – 315 PIPS |

1st QUARTER RESULTS

| JANUARY | PIPS MADE/LOST |

| Total Pips lost | – 426 PIPS |

| FEBRUARY | PIPS MADE/LOST |

| Total Pips lost | – 362 PIPS |

| MARCH | PIPS MADE/LOST |

| Total Pips lost | – 315 PIPS |

| Q1 GRAND TOTAL | – 1,103 PIPS |

For the 1st quarter I am down by -4.45%. My biggest losing Month was March. In a bid to close my first quarter in profits, I closed in more losses than I would usually have. This is a huge inspiration for me.

I am grateful for all the lessons the market presented to me in the first quarter. Looking forward to a better 2nd quarter.

How did your go?

NOTE:

Hey traders,

If you are into trading for proprietary firms which I believe you should due to the many advantages involved, check out these carefully selected proprietary firms listed below.

The funded trader needs no introduction, as they are currently becoming one of the most sorted proprietary firms in the industry due to their flexible challenge rules which consist of you being able to use an EA (expert advisory or trading robot) on one of their packages.

Also their packages are pretty affordable, which also comes with unlimited trials even if you fail to hit the set target within the 35 days period.

If you are interested in getting a 5% discount upon purchase, hit THE FUNDED TRADER and use THE0CRAFTER as the coupon code