My reason for keeping a journal is to encourage traders to also keep one for two major reasons:

- Track weekly trading performance.

- To have enough date to be able to work on their trading technique and psychology

Both can only be done when you keep a comprehensive journal, and review it every week.

MONDAY (20/03/2023)

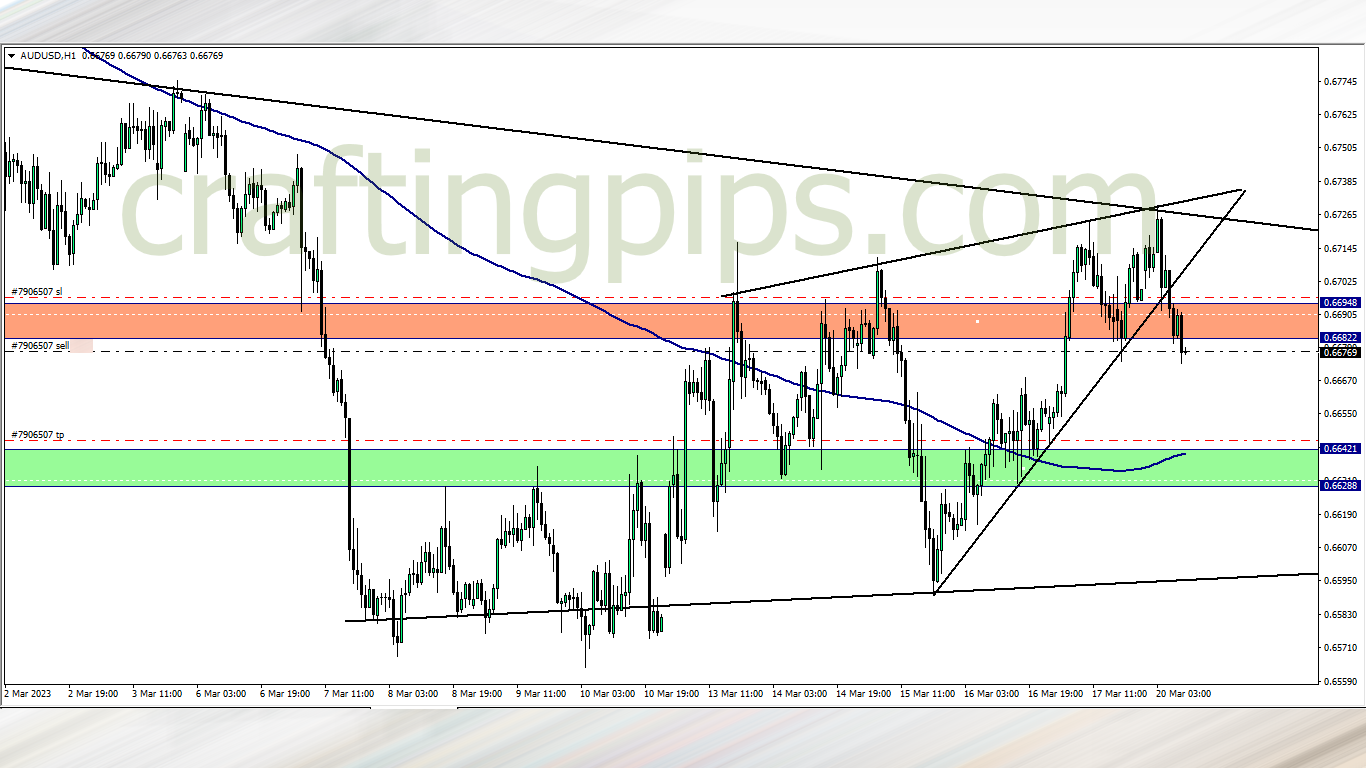

Analysis: The reason for me selling AUD/USD was because on the 4 hour time frame there was a strong bearish engulfing candlestick which suggests the bears dominating the market… To get a good R/R, I went to the 1-hour time frame to look for a decent breakout to make some quick intraday profits.

AUD/USD Update (9.30 am)

My SL was hit and I closed with -20 pips loss

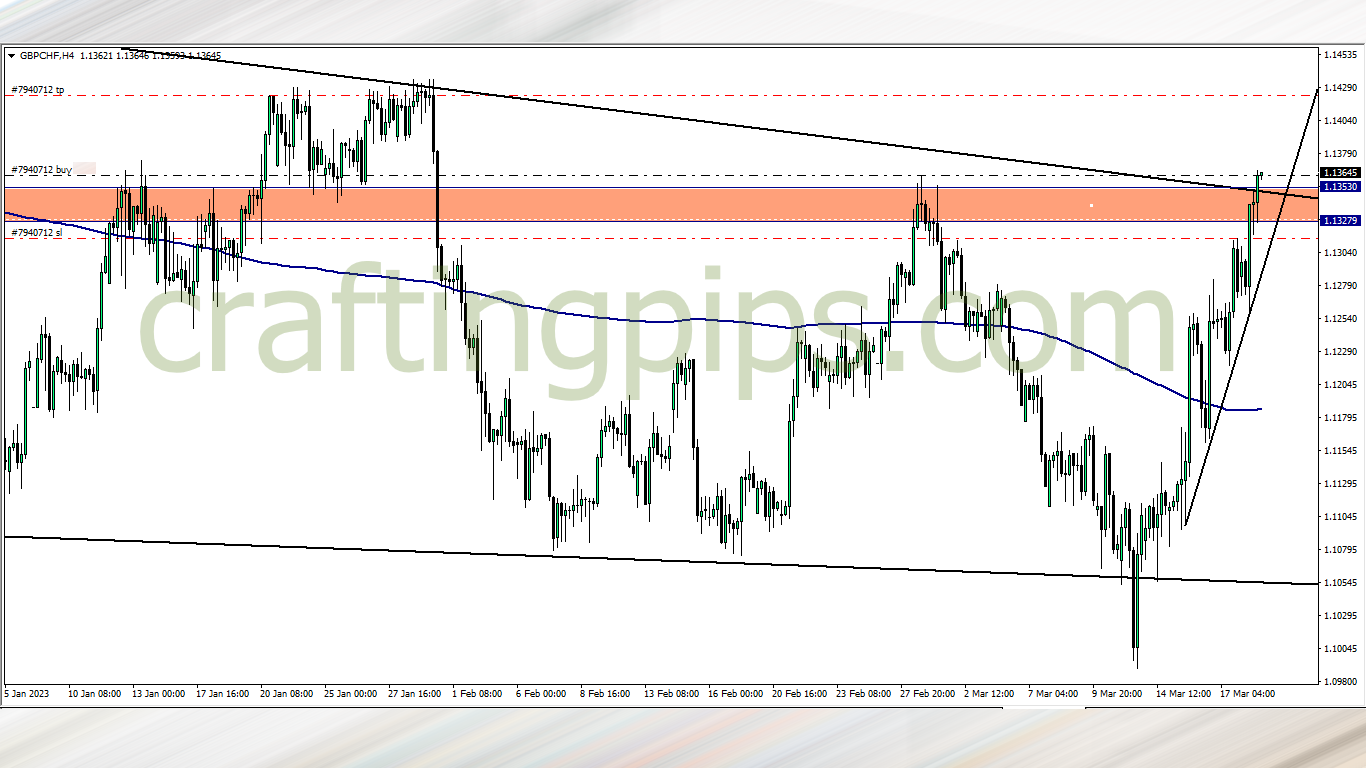

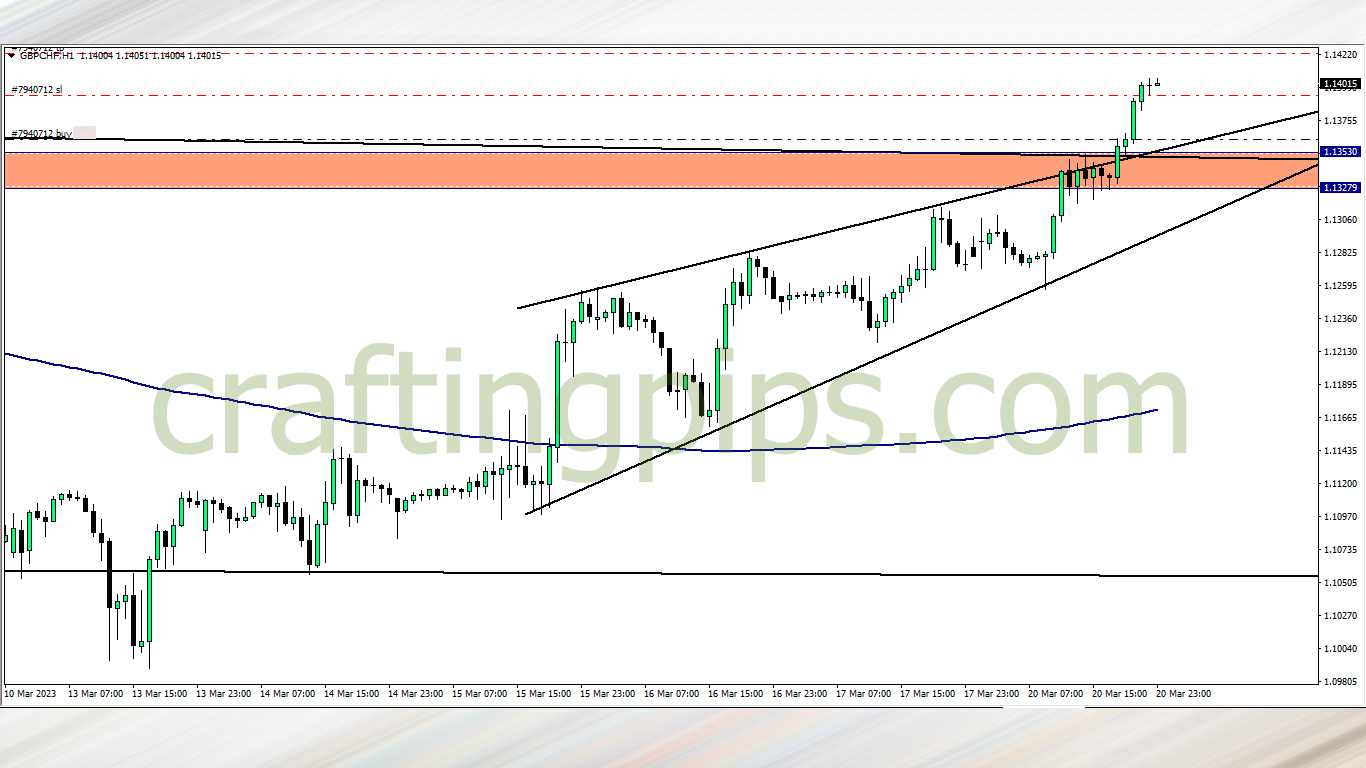

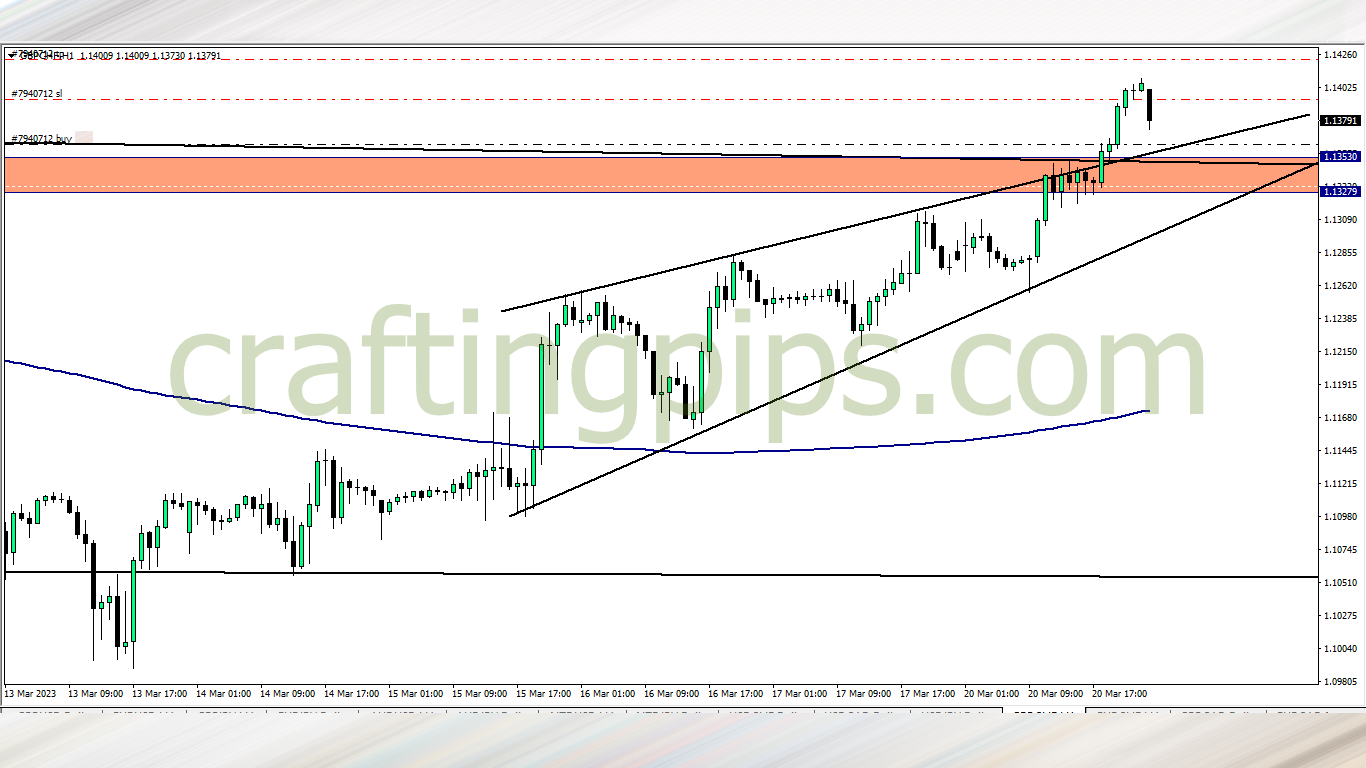

GBP/CHF (6 pm)

Analysis: My reason for buying can be seen on our Tuesday market analysis

GBP/CHF Update (9 pm)

Analysis: I have already locked +32 pips on this trade. So its a risk free trader

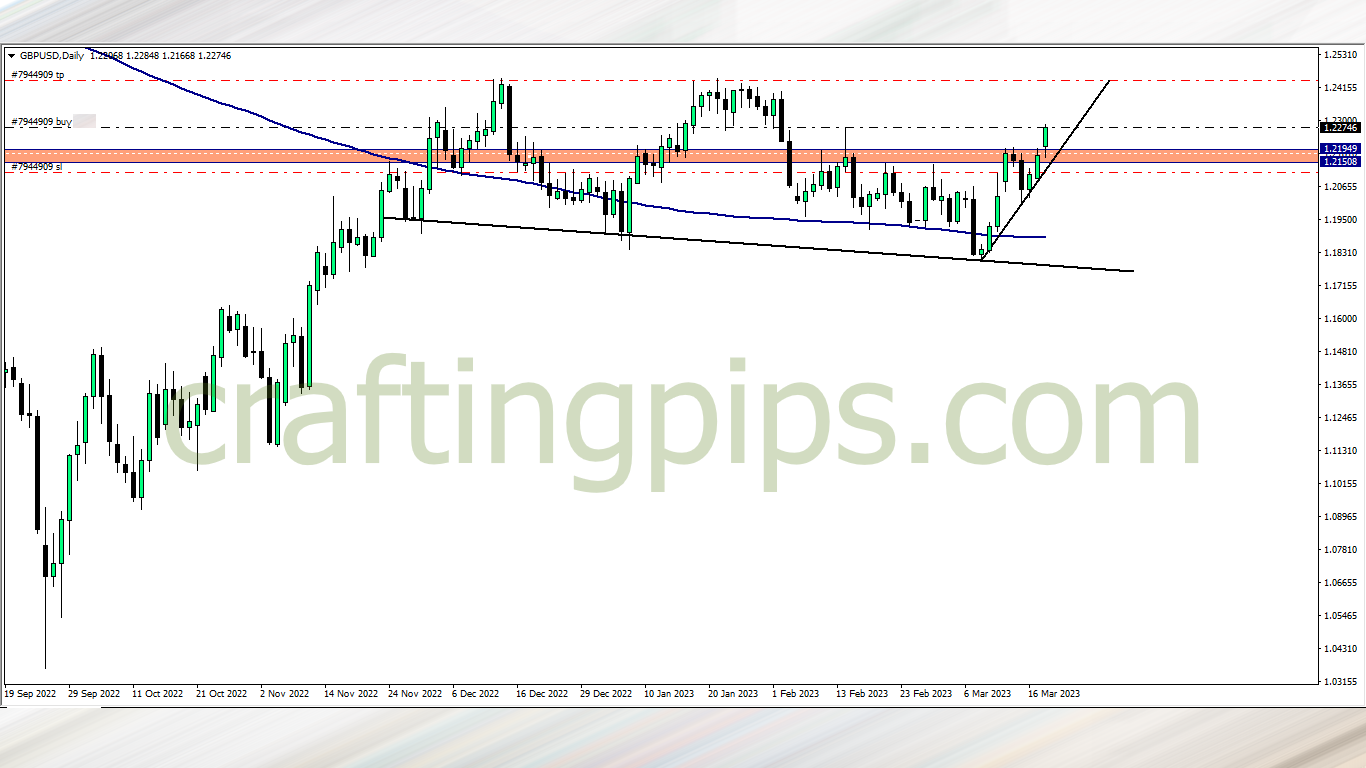

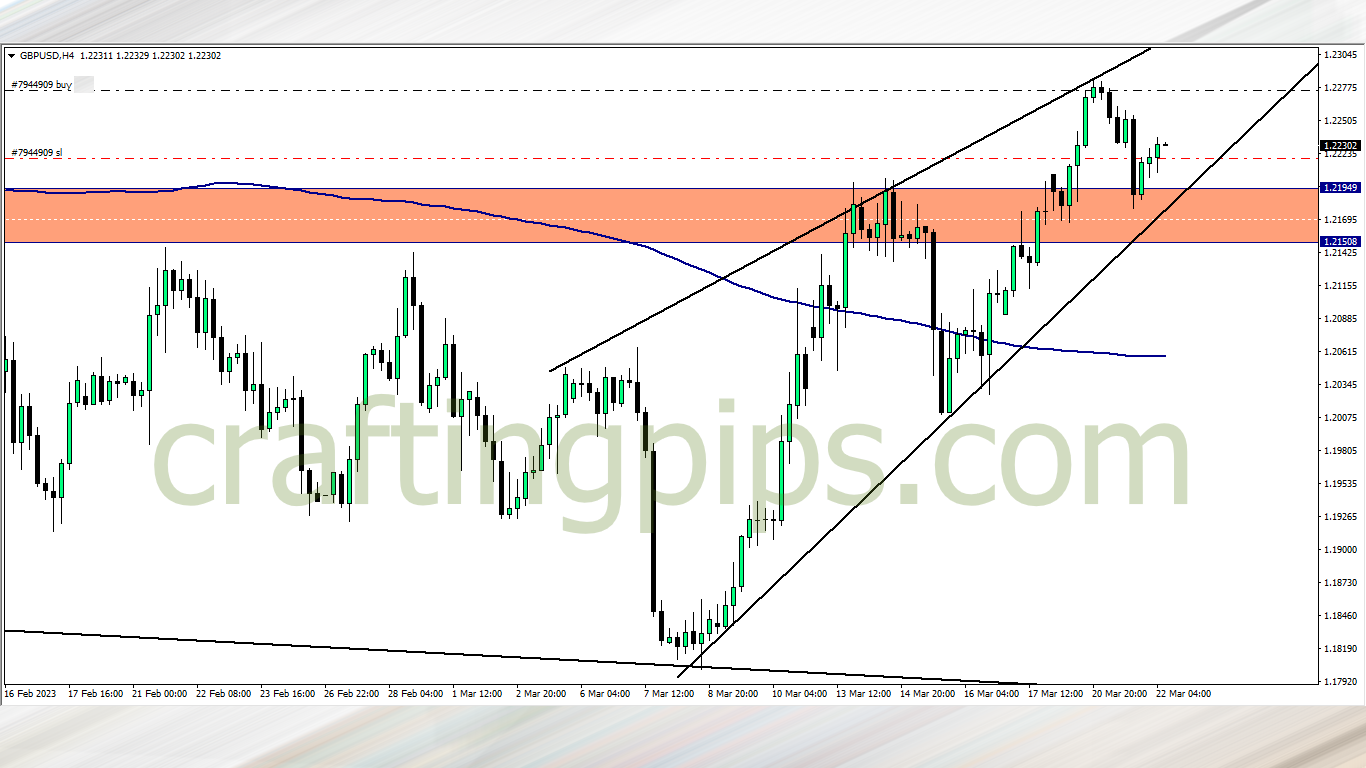

GBP/USD (9.35 pm)

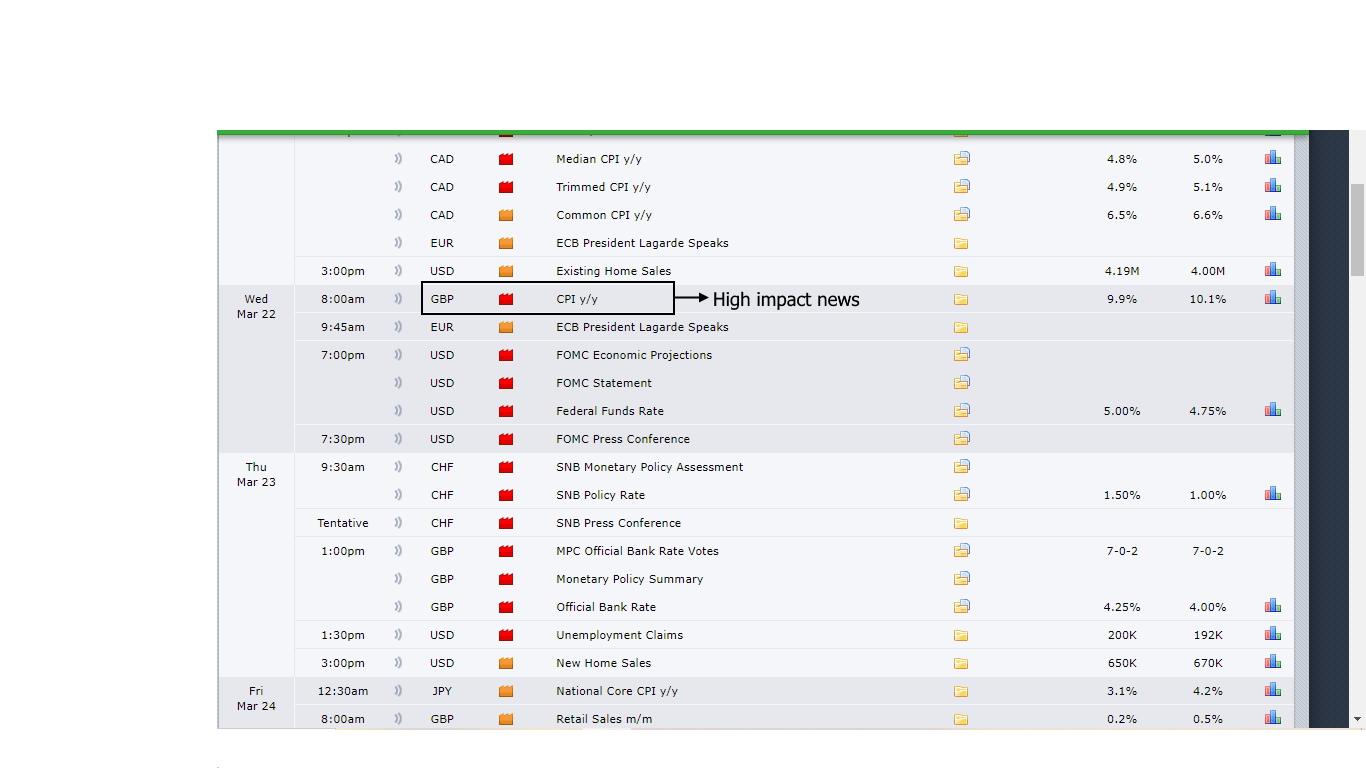

Analysis: My reason for buying can be seen on our Tuesday market analysis. I will be holding this trade for the entire Tuesday if my scaling plans work. The plan is to get out before Wednesday CPI news on GBP

GBP/CHF Update (10.06 pm)

Analysis: This is what slippage looks like.

Fourthy minutes before the 10 pm candlestick appeared, I locked +31 pips on this trade, only for the high volatility to go below my stop loss as seen in the charts and took most of my profits, so I finally went home with +5 pips as against +31 pips

TUESDAY (21/03/2023)

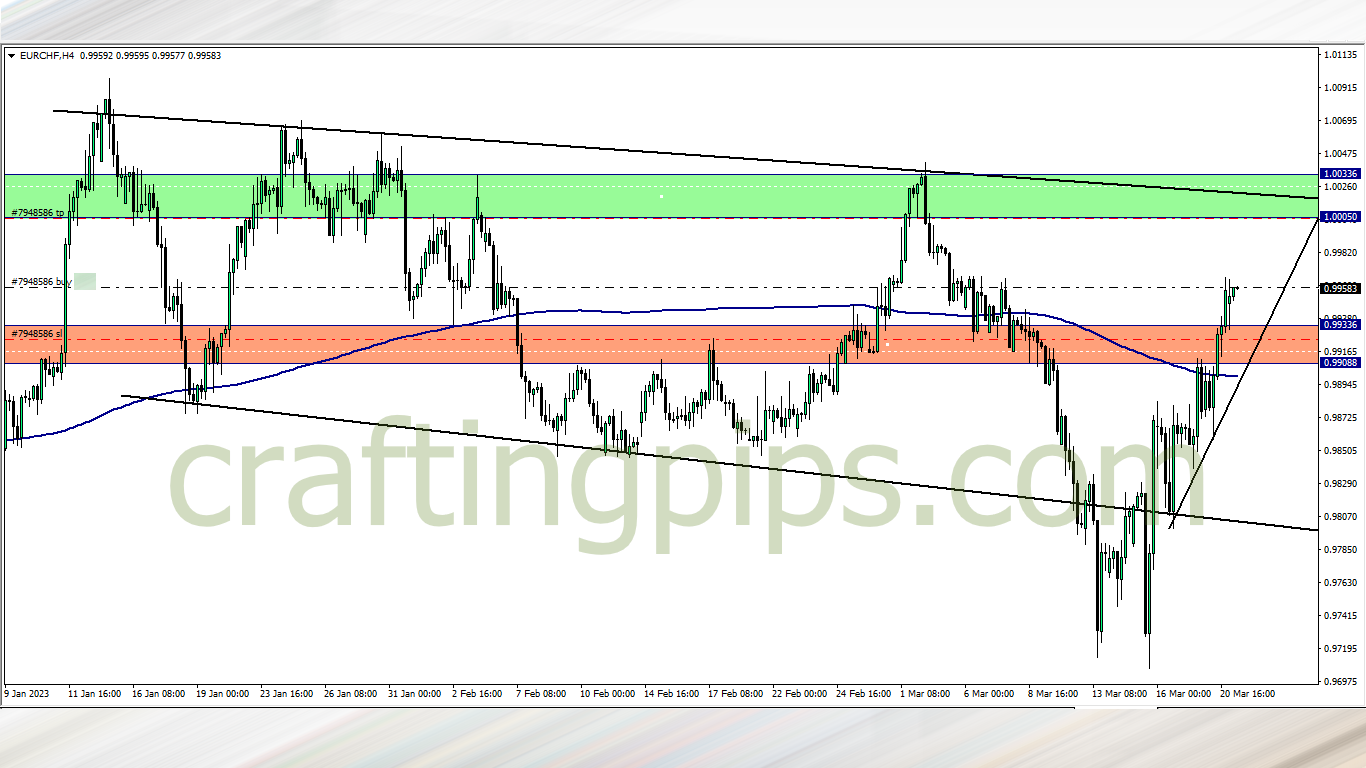

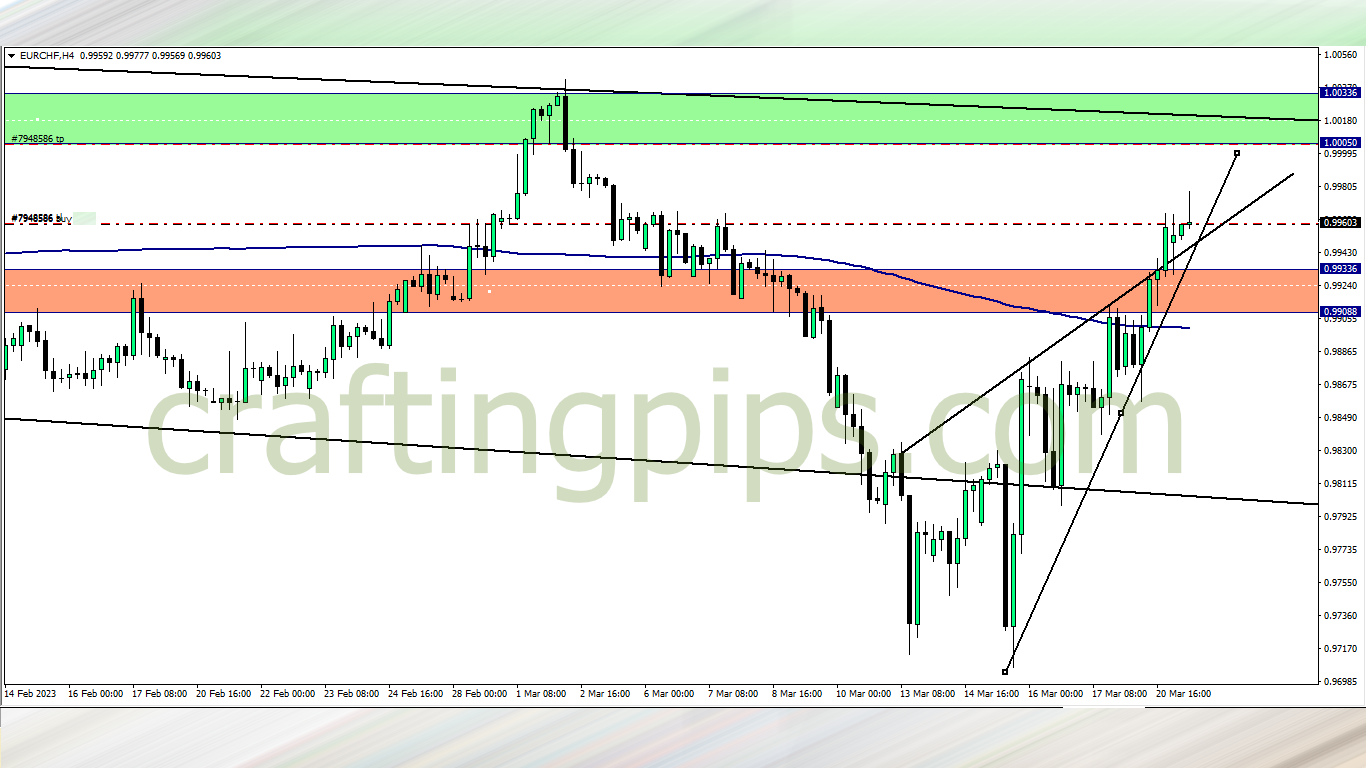

EUR/CHF (6.05am)

Analysis: My reason for buying can be seen on our Tuesday market analysis

EUR/CHF Update (10.00 am)

Analysis: Closed at breakeven… The reason why my trailing SL was tight on this trade was because of the news event on the EUR scheduled for 1.30 pm

WEDNESDAY (22/03/2023)

GBP/USD Update (6.30 am)

Analysis: I have adjusted my SL in anticipation of CPI news (as seen below)… That said, I may exit the trade before the news to prevent slippage (if it happens)

GBP/USD Update (7.30 am)

Manually closed with -48 pips due to the CPI news

GBP/JPY (9.55 am)

Analysis: My reason for buying can be seen on our Wednesday market analysis

GBP/JPY Update (8 pm)

This trade hit my SL, so I lost -116 pips.

Trade activity summary for the week

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST |

| MON (20/03/2023) | AUD/USD | SELL | – 20 pips |

| GBP/CHF | BUY | + 5 pips | |

| GBP/USD | BUY | – 48 pips | |

| TUE (21/03/2023) | EUR/CHF | BUY | Breakeven |

| WED (22/03/2023) | GBP/JPY | BUY | -116 pips |

| TOTAL | -179 PIPS |

In conclusion:

It was a newsy week in the market and I was caught in the whole web of it.

Two trades I planned and executed well was the GBP/USD trade I took on Monday, and the Wednesday EUR/CHF trade.

The GBP/USD closed in negative because I exited a few minutes before CPI news. If I had remained through the news, I would have closed with at least a breakeven

The EUR/CHF closed at breakeven because I exited shortly before the high impact news on EURO. I was happy I did because my SL would have gotten hit.

The market cheated me with the GBP/CHF trade, so I closed with little profits. The reason why I say: “I was cheated” was because slippage happened and price went below my trailing stop loss before it triggered. This happened 6 minutes after the daily candlestick closed as seen in the GBP/CHF chart above

GBP/JPY was a perfect setup, and it did move as predicted, but a couple of hours before FOMC news, there was a deep reversal which I decided to nurse through the news and my SL got hit. I am not pleased with my GJ trade because I should have placed a tight SL as soon as I was in profits. Or closed with with smaller loss before it hit my SL

I decided to call it a week after Wednesday loss on GJ. There was no point going on as my emotional and psychological tank needed a refill.

Closed the week with about -1.60% loss in capital. Hopeful for next week

How did your trading week go?

NOTE:

Hey traders,

If you are into trading for proprietary firms which I believe you should due to the many advantages involved, check out these carefully selected proprietary firms listed below.

The funded trader needs no introduction, as they are currently becoming one of the most sorted proprietary firms in the industry due to their flexible challenge rules which consist of you being able to use an EA (expert advisory or trading robot) on one of their packages.

Also their packages are pretty affordable, which also comes with unlimited trials even if you fail to hit the set target within the 35 days period.

If you are interested in getting a 5% discount upon purchase, hit THE FUNDED TRADER and use THE0CRAFTER as the coupon code