My reason for keeping a journal is to encourage traders to also keep one for two major reasons:

- Track weekly trading performance.

- To have enough date to be able to work on their trading technique and psychology

Both can only be done when you keep a comprehensive journal, and review it every week.

MONDAY (13/03/2023)

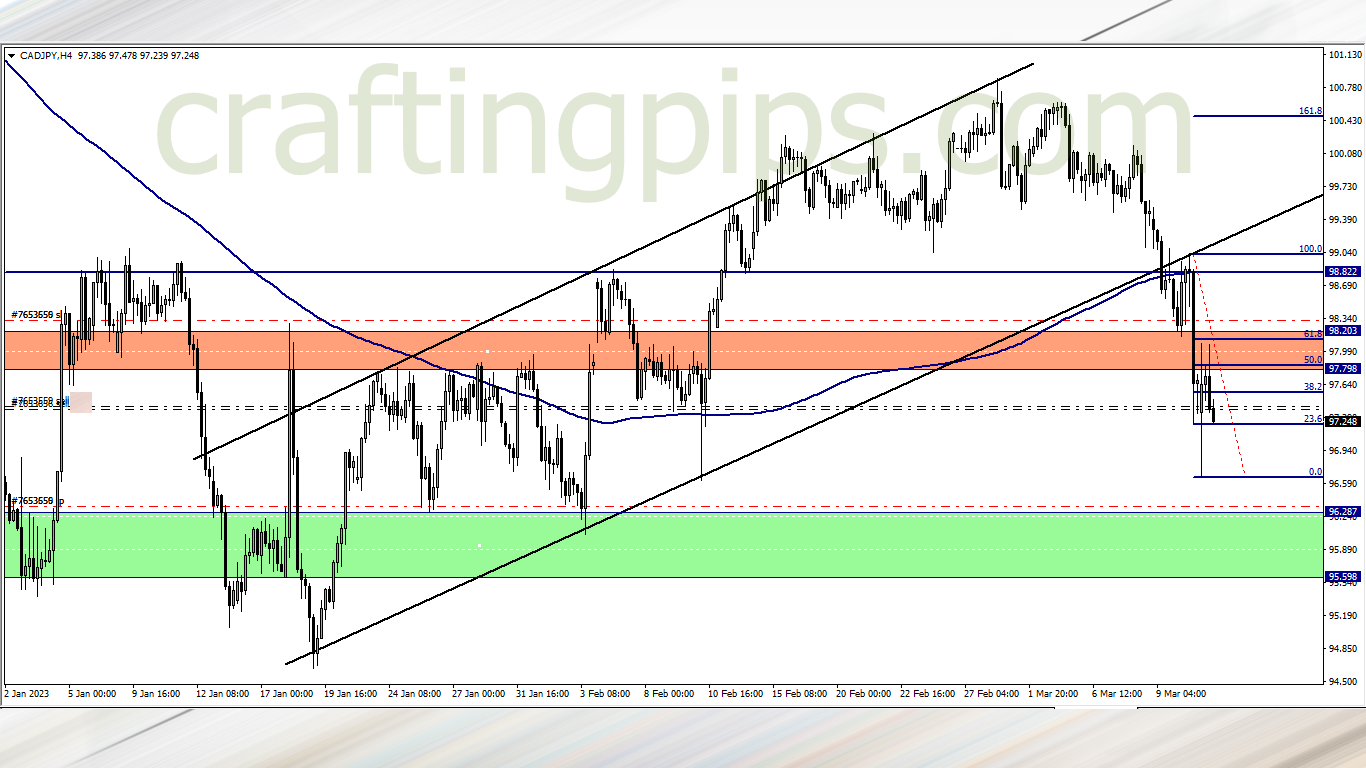

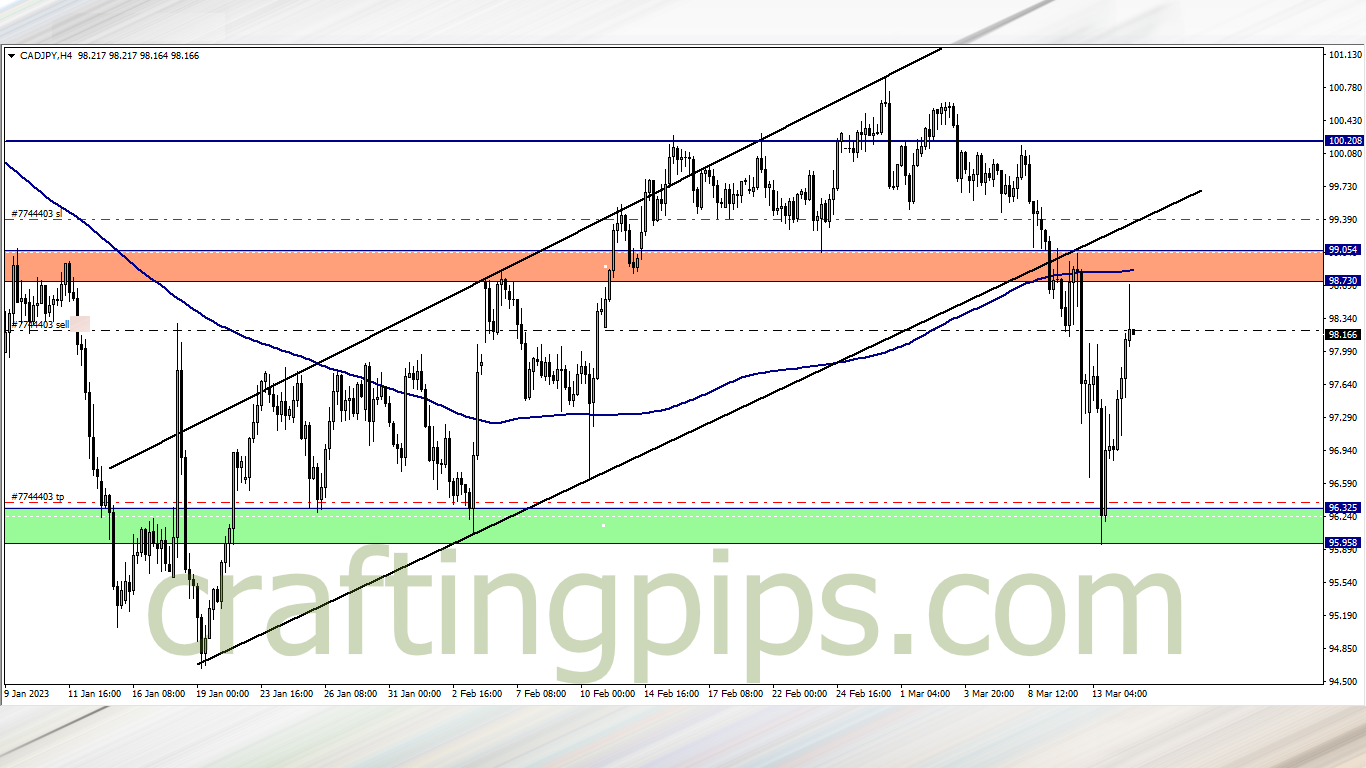

CAD/JPY (10.02 am)

Analysis: The reason I sold CAD/JPY can be seen on our weekly analysis. The Fibonacci golden ratio gave our analysis additional confirmation

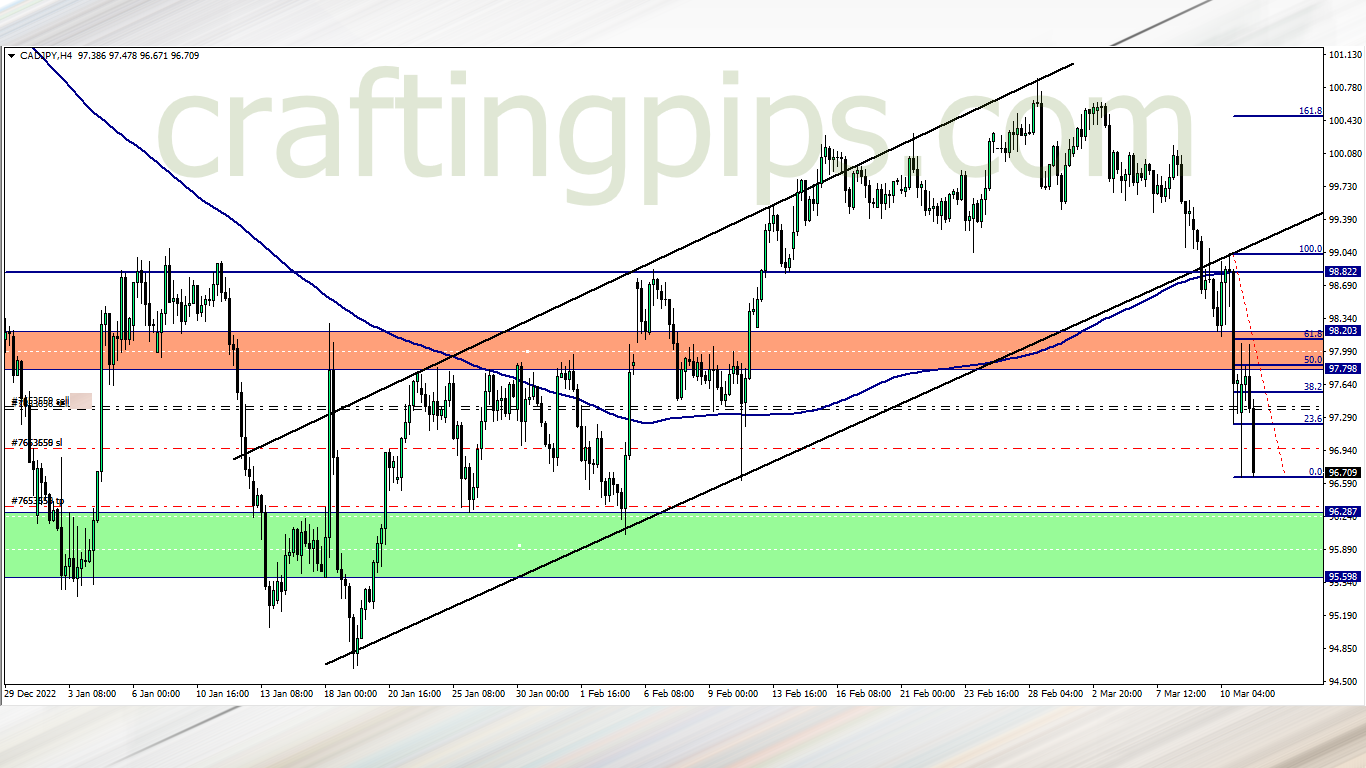

CAD/JPY update (11.12 am)

Analysis: I applied trailing SL immediately price hit my first tp, and that happened under 60 minutes.. Closed the trade with +82 pips

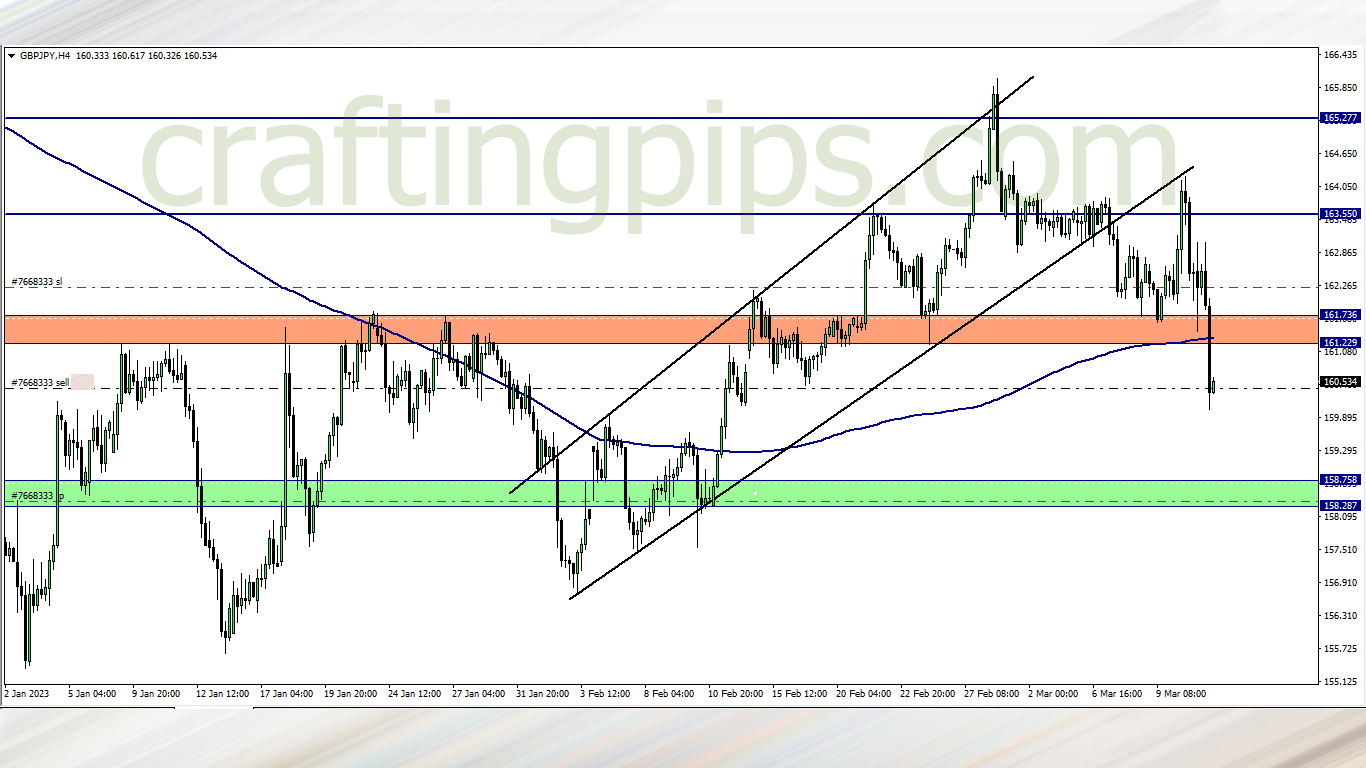

GBP/JPY (2 pm)

Analysis: My reason for selling was because the support zone and 200 ma was broken.

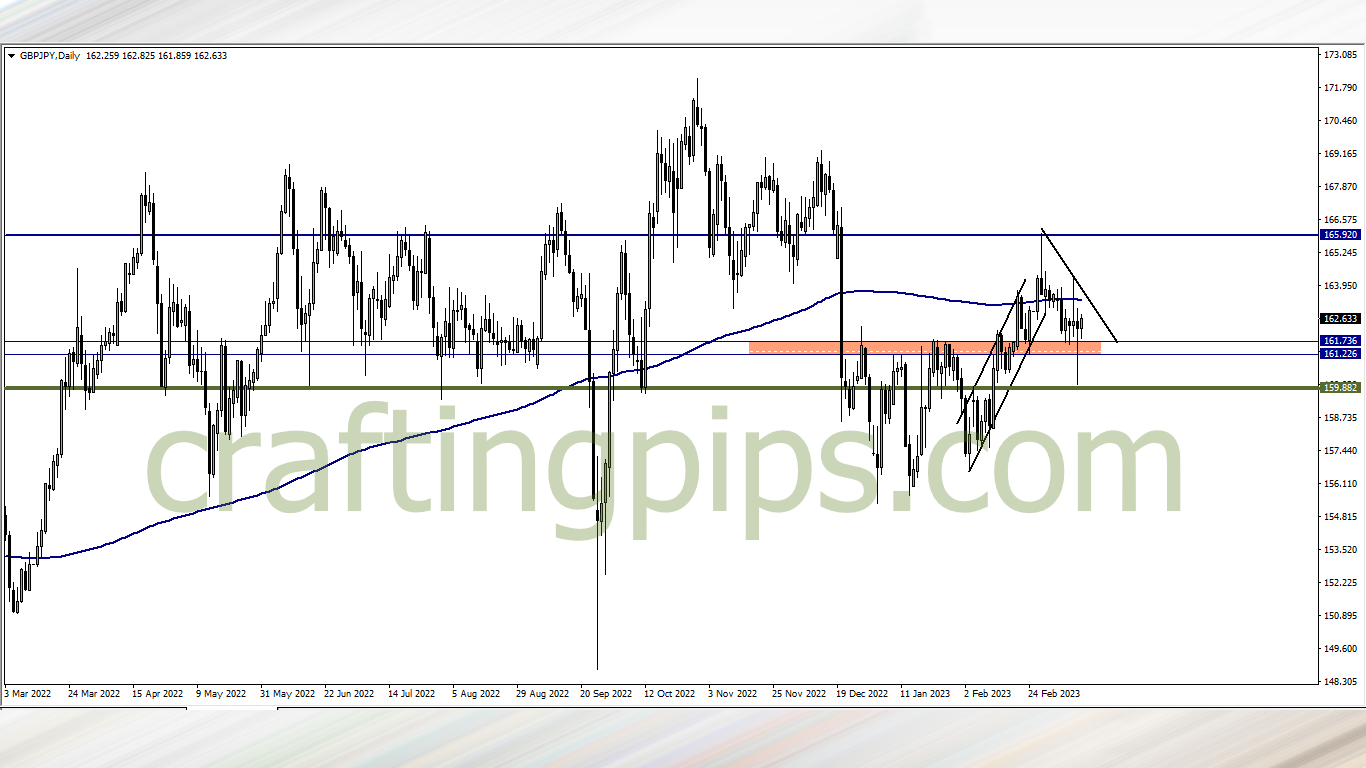

GBP/JPY daily time-frame

Analysis: The daily time frame has shown that daily candlesticks always gets rejected at the green support level. I was carried away by the breakout on the 4 hour time frame, not properly scrutinizing the daily time frame.

Thankfully I got out with -57 pips, and this erased all the profits I initially made on CAD/JPY, so I am currently less than -0.2% down in capital

TUESDAY (14/03/2023)

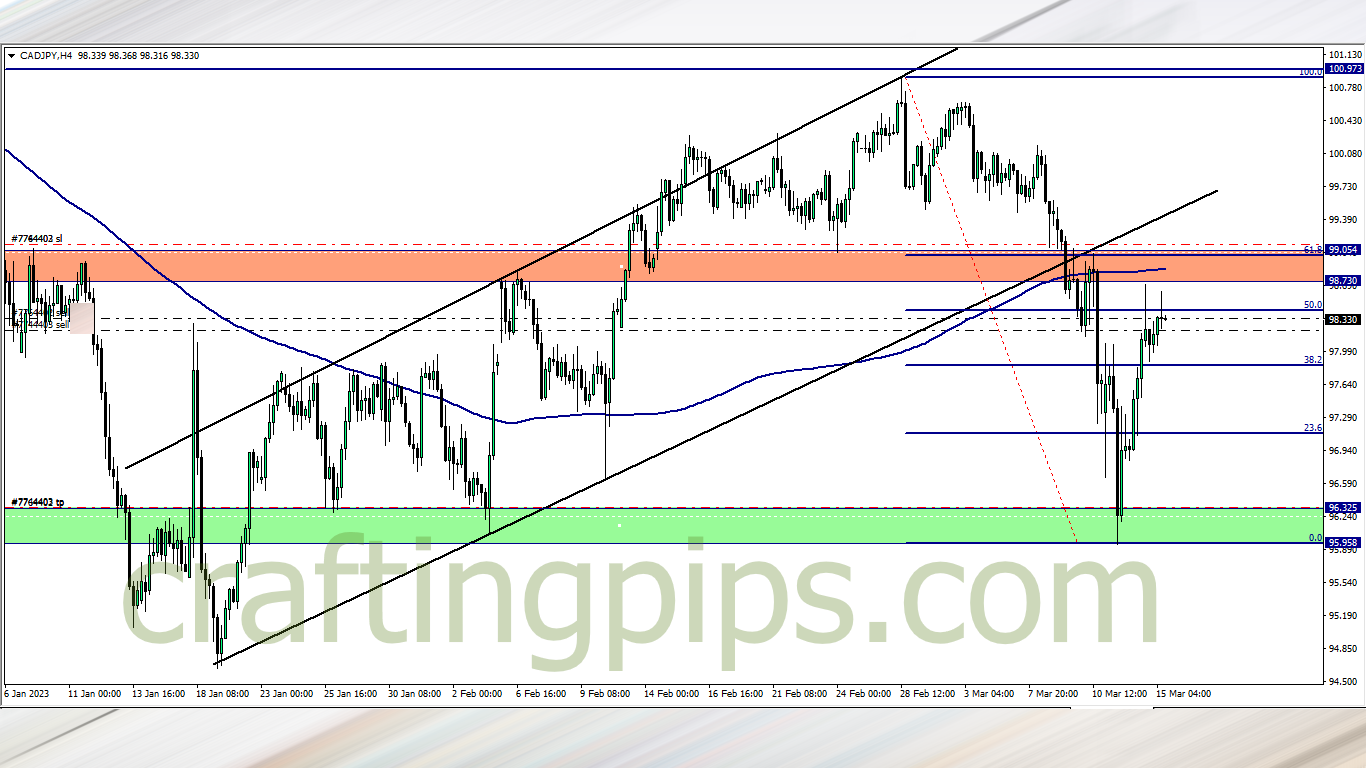

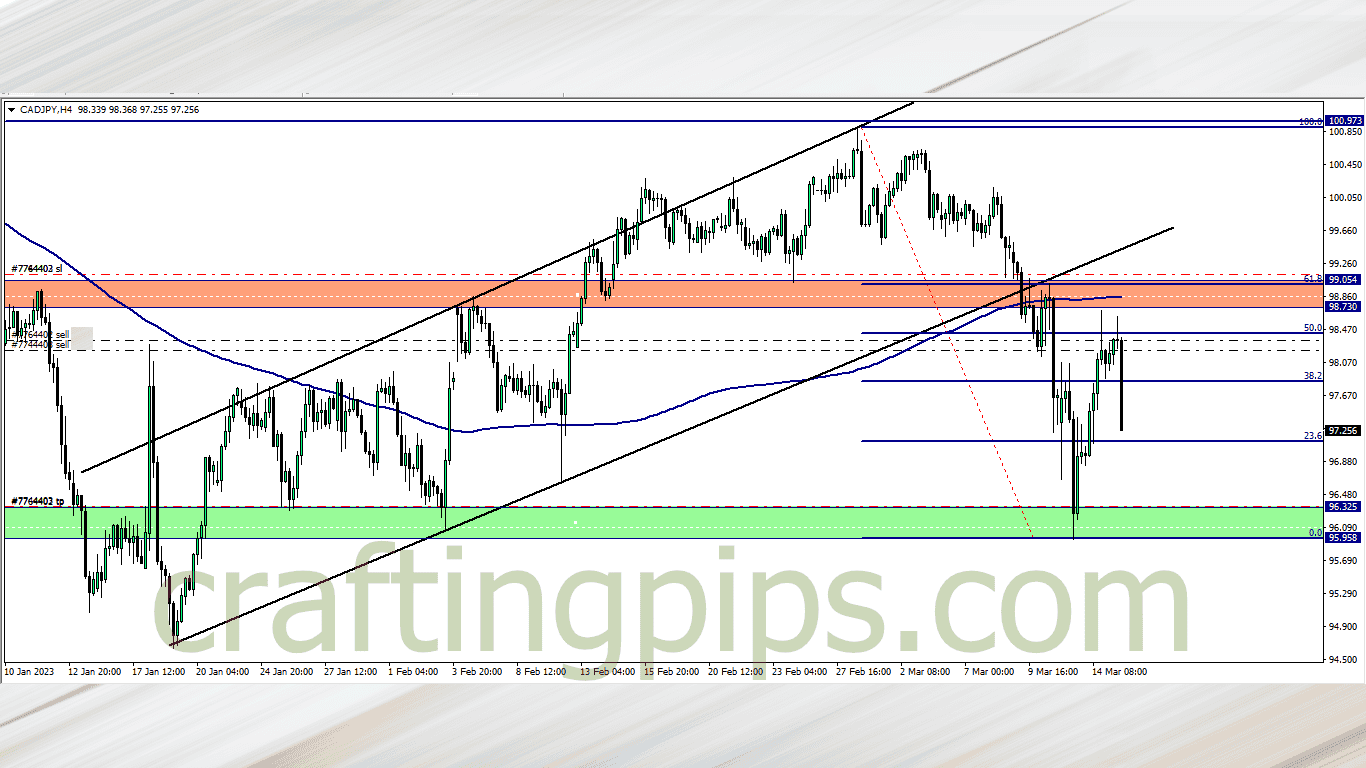

CAD/JPY (6.02 pm)

Analysis: I shared this setup on our Wednesday market analysis. That’s the reason I am selling. The only difference here is that I am selling about 4 hours earlier

WEDNESDAY (15/03/2023)

CAD/JPY Update (10.02 am)

Analysis: Added a second position at the close of the 6am candlestick

CAD/JPY Update (10.50 am)

Analysis: Closed the trade with +202 pips. I did not wait for price to hit my tp

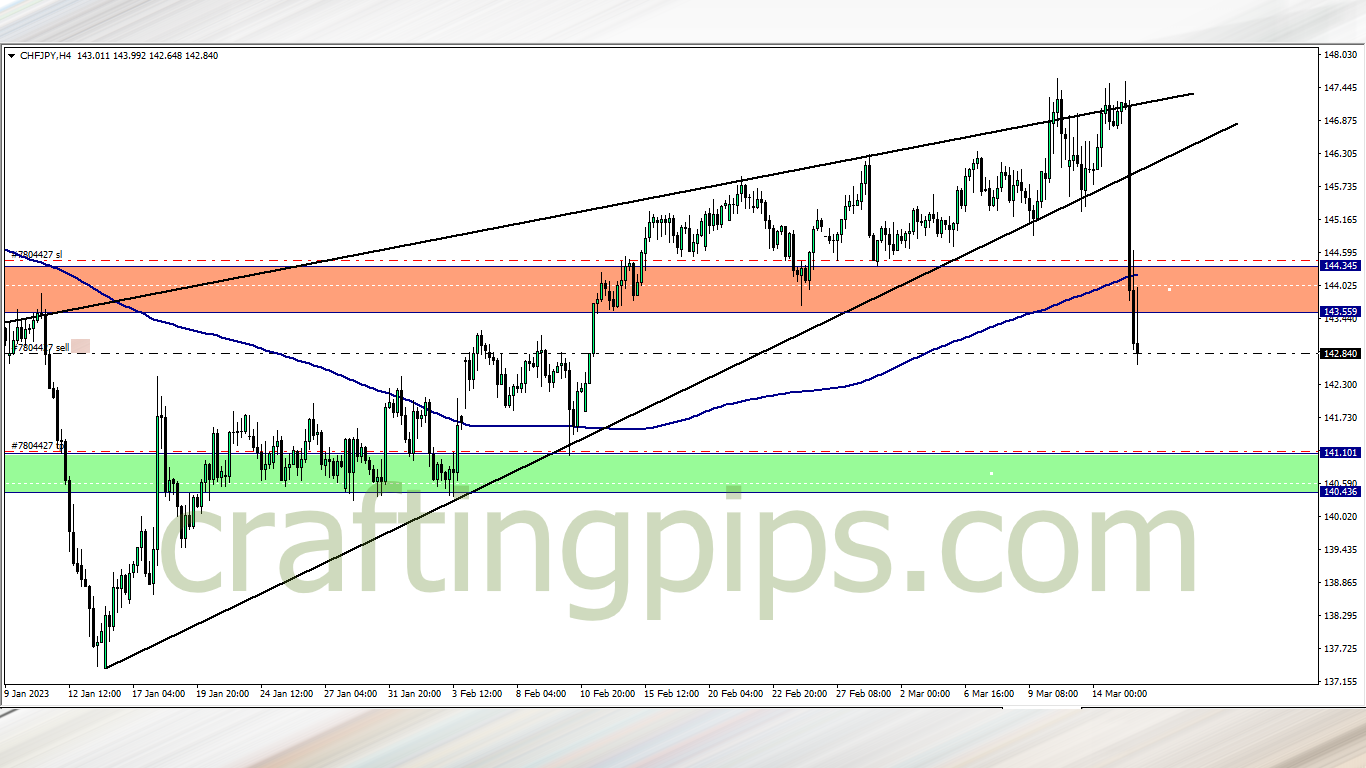

CHF/JPY (9.30 am)

Analysis: I am selling CHF/JPY based on our Thursday market analysis

THURSDAY(16/03/2023)

CHF/JPY Update (3.30am)

Closed the trade at breakeven after I noticed there was reversal patterns forming on the 4 hour time frame, and there was no considerable bearish move

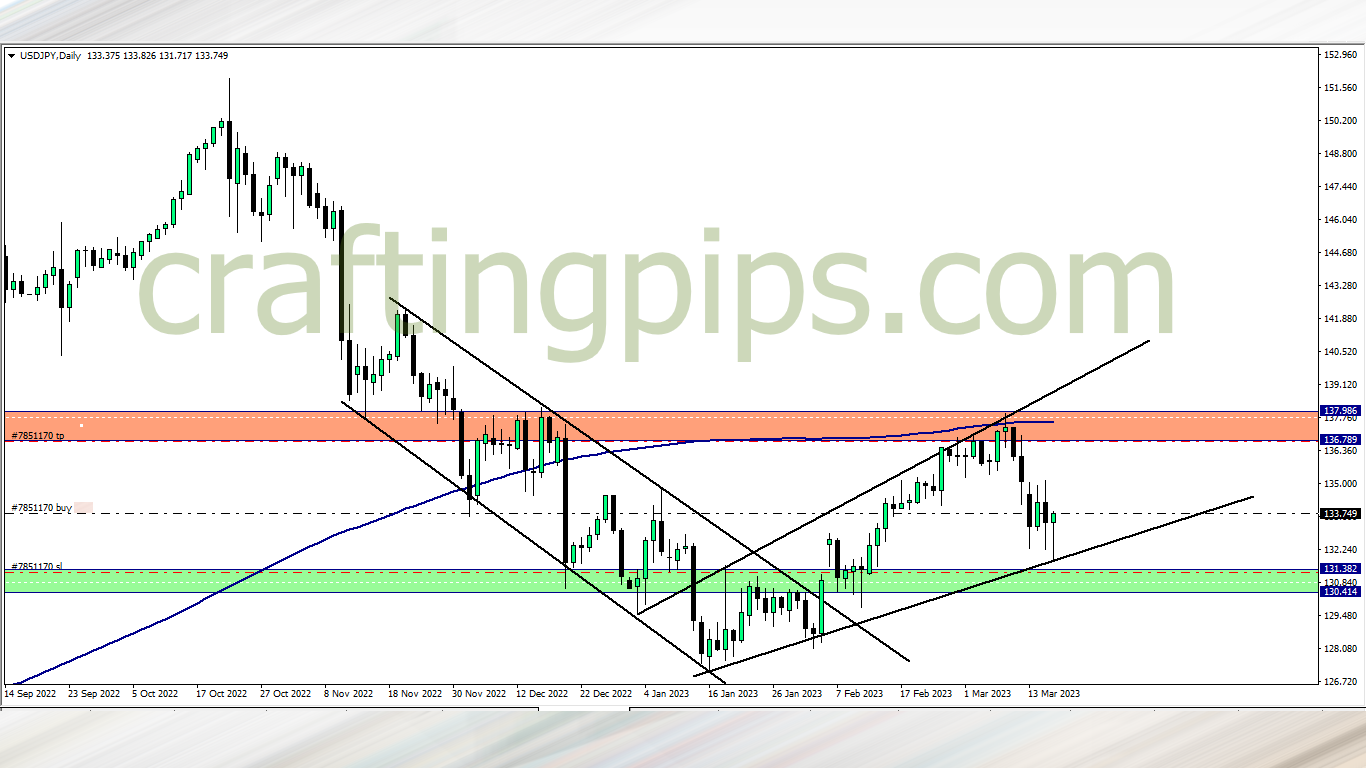

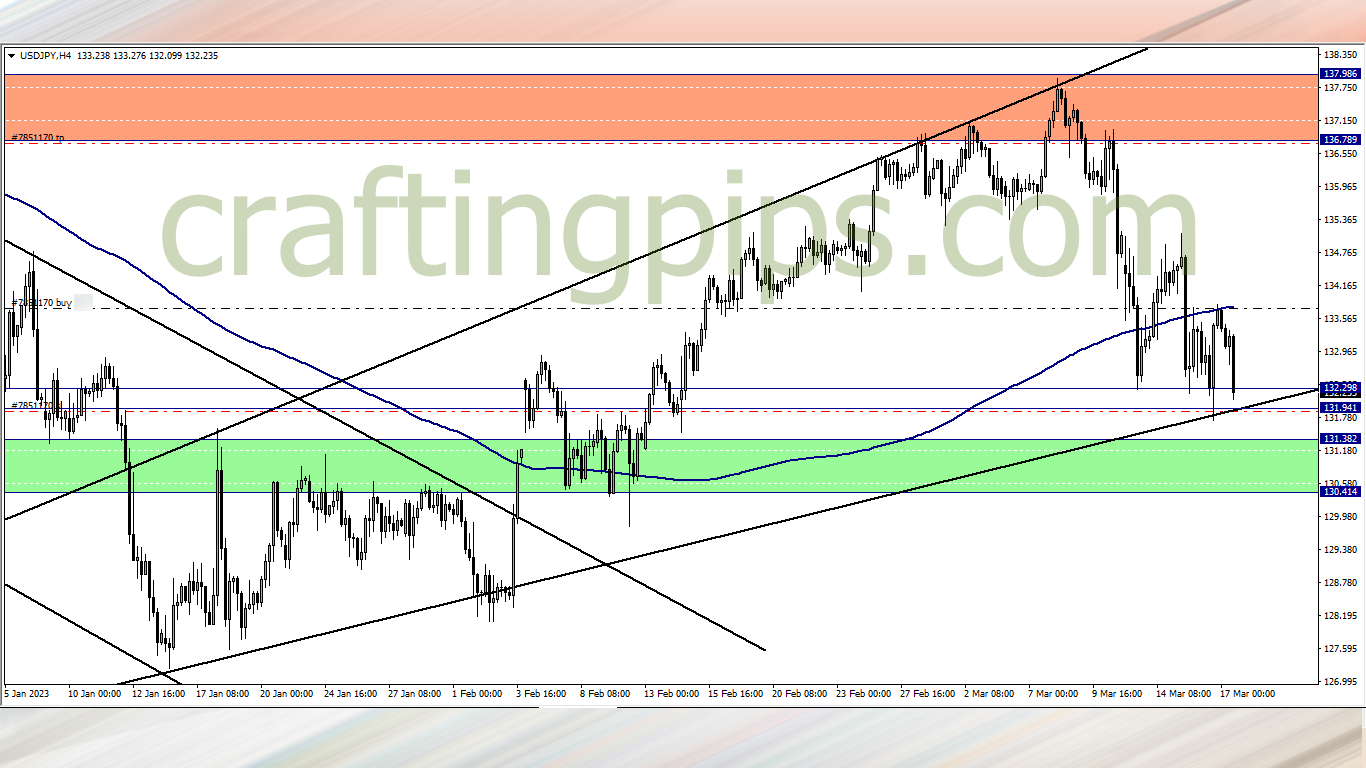

USD/JPY (9.30 pm)

Analysis: I am buying USD/JPY based on our Friday market analysis

FRIDAY (17/03/2023)

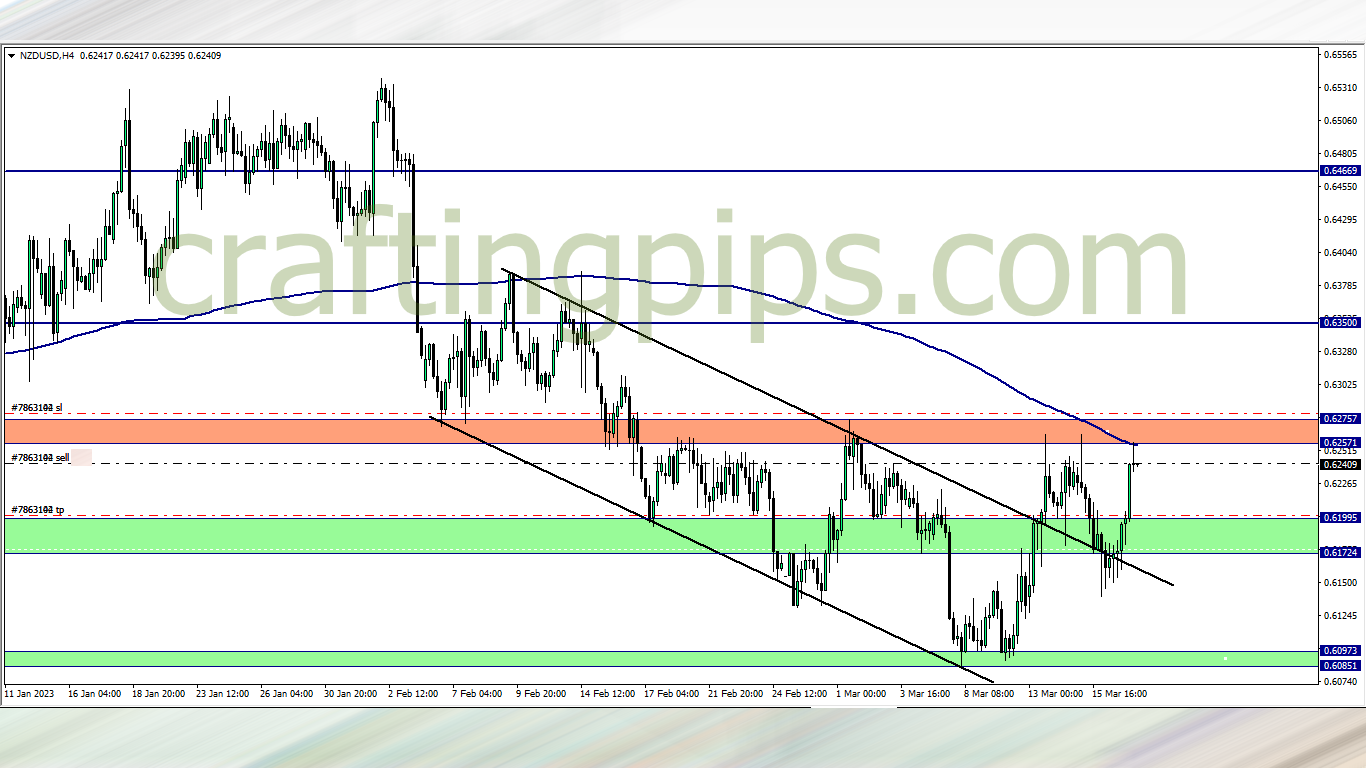

Analysis: My reason for selling is because price has reached a key resistance zone, again price is close to the 200 ma, so I expect a reversal or a deep pullback

NZD/USD Update (3.50 pm)

I closed the NU trade at breakeven. This was decided by 2 pm, after noticing that the bears appeared weak as there was no significant bearish news and the USD high impact news was scheduled for 3 pm.

USD/JPY Update (4 pm)

Analysis: I had to make my SL tighter since we got into the high impact news announcement (3 pm), and the bulls were nowhere to be found. I closed the trade with a -189 pips loss

Trade activity summary for the week

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST |

| MON (06/03/2023) | CAD/JPY | SELL | +82 pips |

| GBP/JPY | SELL | -57 pips | |

| TUE (14/03/2023) | CAD/JPY | SELL | +202 pips |

| WED (15/03/2023) | CHF/JPY | SELL | Breakeven |

| THUS (16/03/2023) | USD/JPY | BUY | -189 pips |

| FRI (17/03/2023) | NZD/USD | SELL | Breakeven |

| TOTAL | + 38 pips | ||

In conclusion:

If there was anything I would try and correct in the future, it would be my GBP/JPY trade. It had all the characteristics of a great setup, just that it was not sufficiently analyzed on the daily time frame.

Secondly, I would not blame my taking the USD/JPY trade, but I will blame myself for holding it that long. I took the trade on Thursday evening (close to the Asian session). All through the Asian session there was no significant move, that should have made me drop the trade because it had exceeded its shelf life, so it fell under the category of expired trade. The same thing happened to NZD/USD and CHF/JPY, and I was happy I dropped them because they would have gone against me.

The same thing happened with the NZD/JPY trade last week (the carry over trade). I took the trade the previous week and after the Asian session I could have easily dropped the trade when there was no move, but I held on to it and closed it with a loss that swallowed my last week’s profits.

Cutting off a high probability trade is extremely difficult especially when you have hard records of such trades doing extremely well, but we will learn.

I closed the week with – 0.08% loss, hence me marking the +38 pips RED

How did your trading week go?

NOTE:

Hey traders,

If you are into trading for proprietary firms which I believe you should due to the many advantages involved, check out these carefully selected proprietary firms listed below.

The funded trader needs no introduction, as they are currently becoming one of the most sorted proprietary firms in the industry due to their flexible challenge rules which consist of you being able to use an EA (expert advisory or trading robot) on one of their packages.

Also their packages are pretty affordable, which also comes with unlimited trials even if you fail to hit the set target within the 35 days period.

If you are interested in getting a 5% discount upon purchase, hit THE FUNDED TRADER and use THE0CRAFTER as the coupon code