This is where I share all my trades taken each and every week.

My reason for keeping a journal is to encourage traders to also keep one for two major reasons:

- Track weekly trading performance.

- To have enough date to be able to work on their trading technique and psychology

Both can only be done when you keep a comprehensive journal, and review it every week.

MONDAY (06/03/2023)

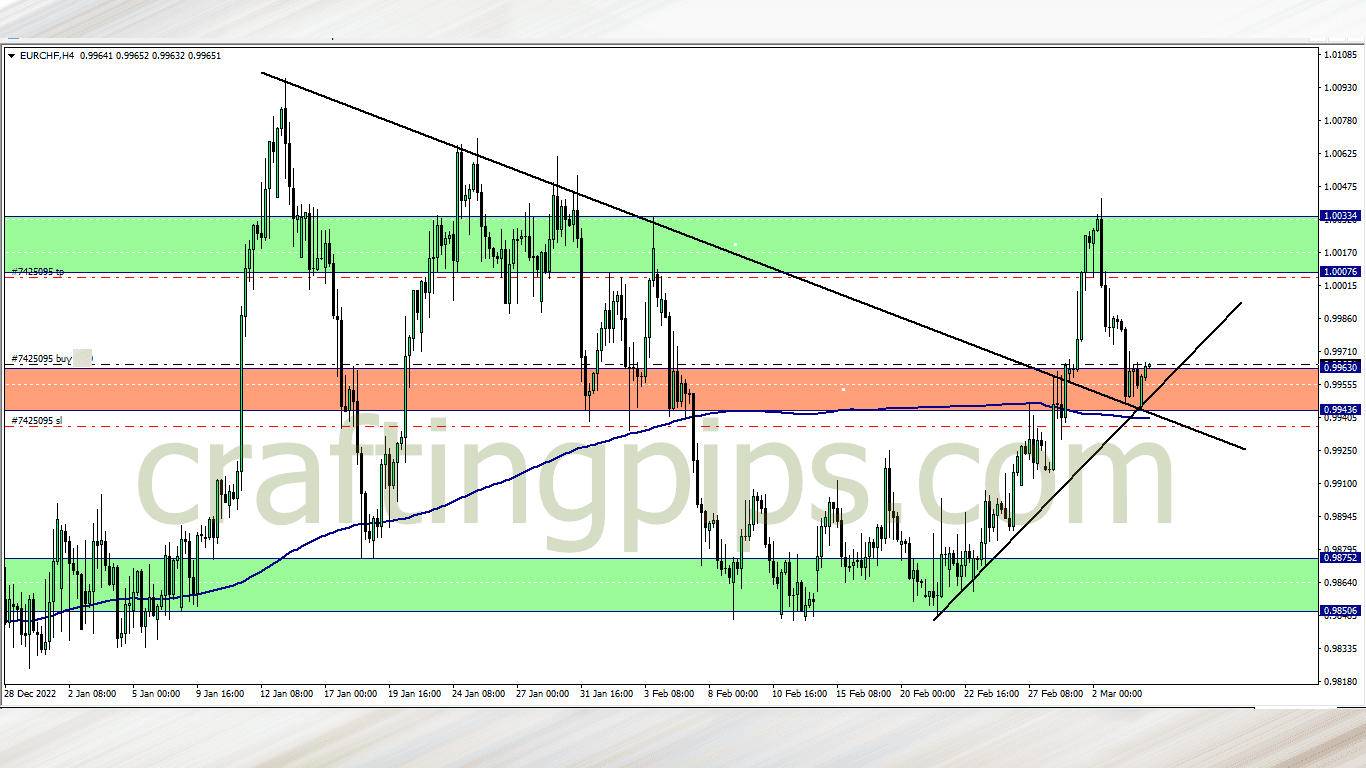

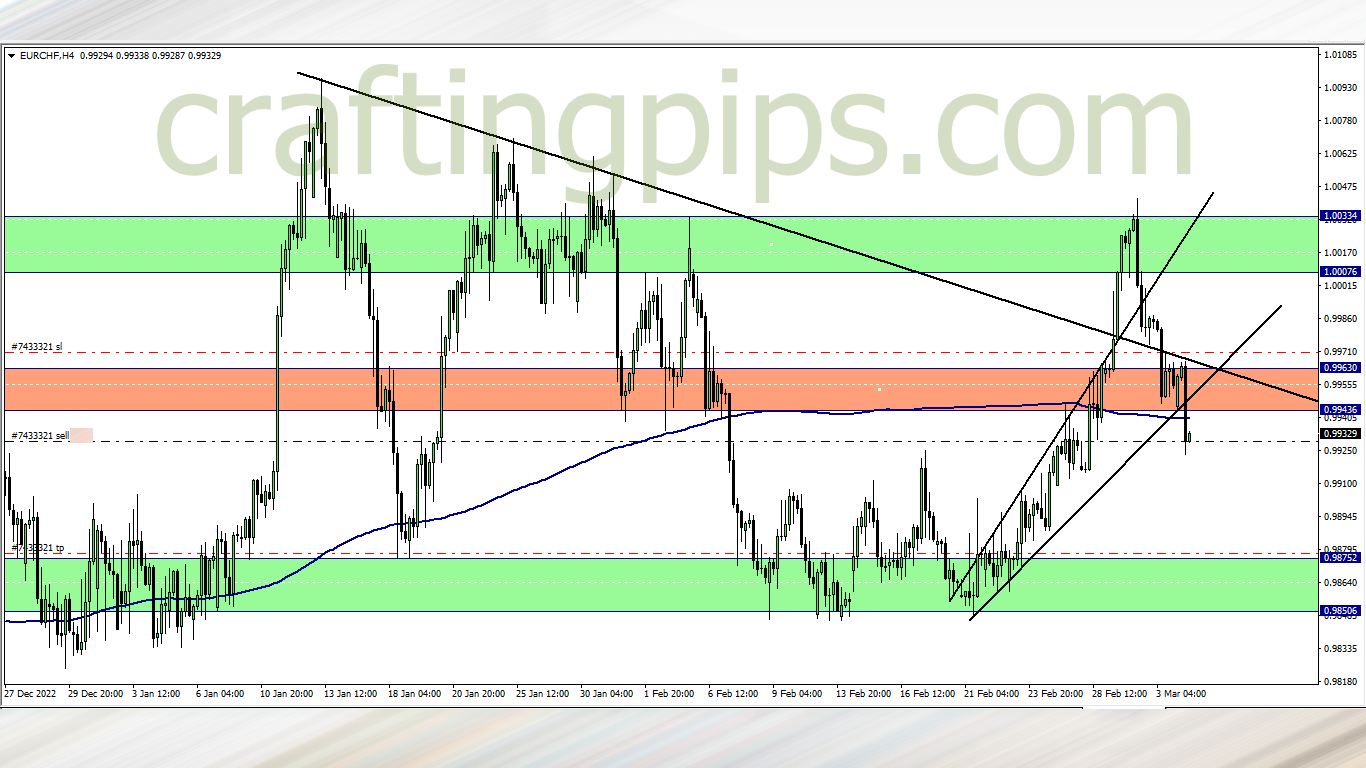

EUR/CHF (7 am)

Analysis: Buying the EUR/CHF based on our weekly analysis

EUR/CHF Update

I closed with a loss (-24 pips). It was a good execution but done on a wrong day. I check my news calendar and I missed the CHF CPI news scheduled for 8.30 am. I trader in our community told raised an alarm after I shared my trade, but I was already in a loss, so I decided to chill and see how it went.

So started the week with a loss. Let’s see how it goes

NZD/JPY Update

This was a trade I took from last week

It’s also a setup I refer to as an “A setup”, meaning it has a high strike rate. On this occasion both positions opened on the trade went bad, so I lost -212 pips. This is a constant reminder that there are no “SURE TRADES” in the market. All we do in this profession is play with probabilities and money management.

EUR/CHF re-entry (11 am)

Analysis: After CPI news on CHF, price broke a key support zone and the 200 ma. This means the bears are back in town. I have reduced my risk on this trade because I am already having 2 bad trades this week. Let’s see how it goes

EUR/CHF Update (5 pm)

I lost -35 pips by manually exiting this trade.

TUESDAY(07/03/2023)

GBP/USD (11.05 am)

Analysis: I picked this setups from our weekly analysis

This setup may not be a perfect triple top, but the multiple rejections before the bearish pinbar already gives us a clue that the bulls are out and tired. There is a high impact news on the USD scheduled for 4 pm (Fed chair Powell testifies), so I am not expecting price to hit TP.

I will manually close the trade if I get some profits from it and before 4 pm.

GBP/USD Update (1.45pm)

Closed trade with +19 pips

WEDNESDAY (08/03/2023)

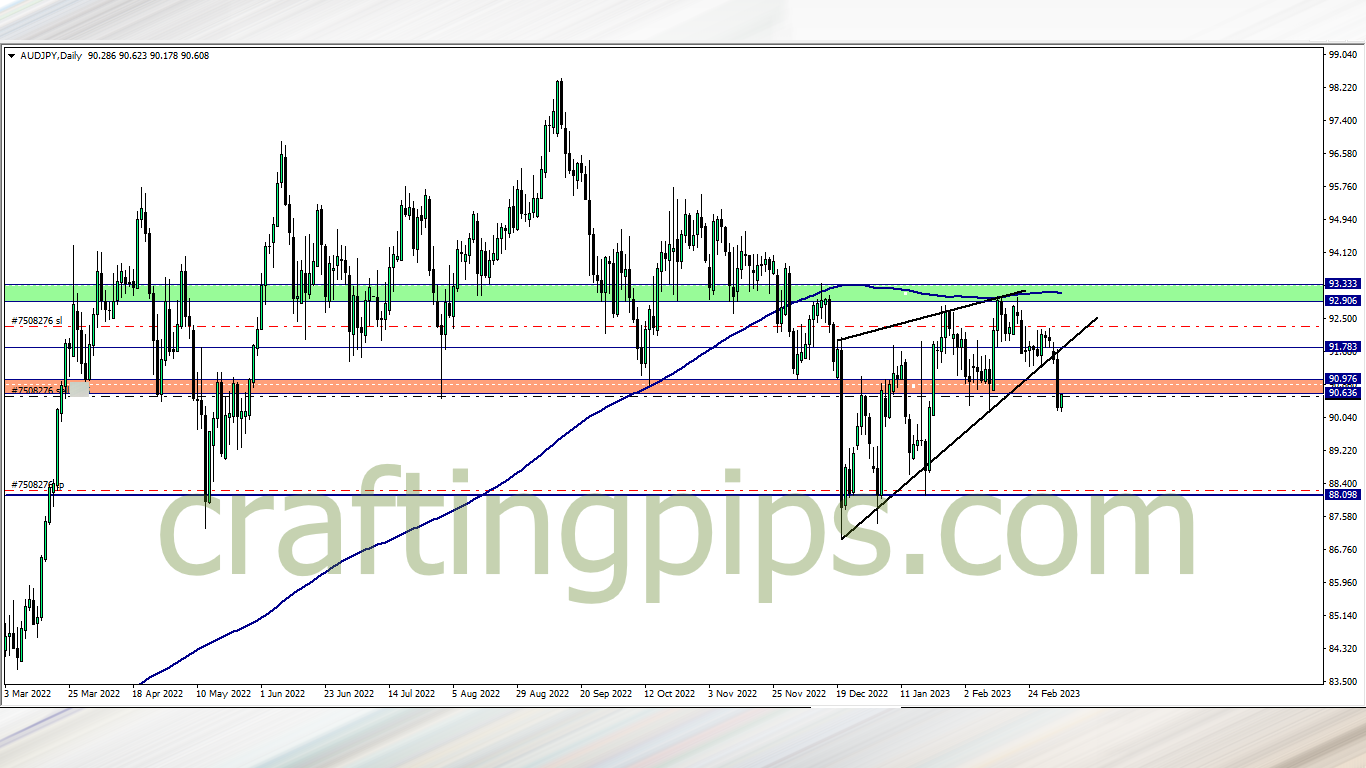

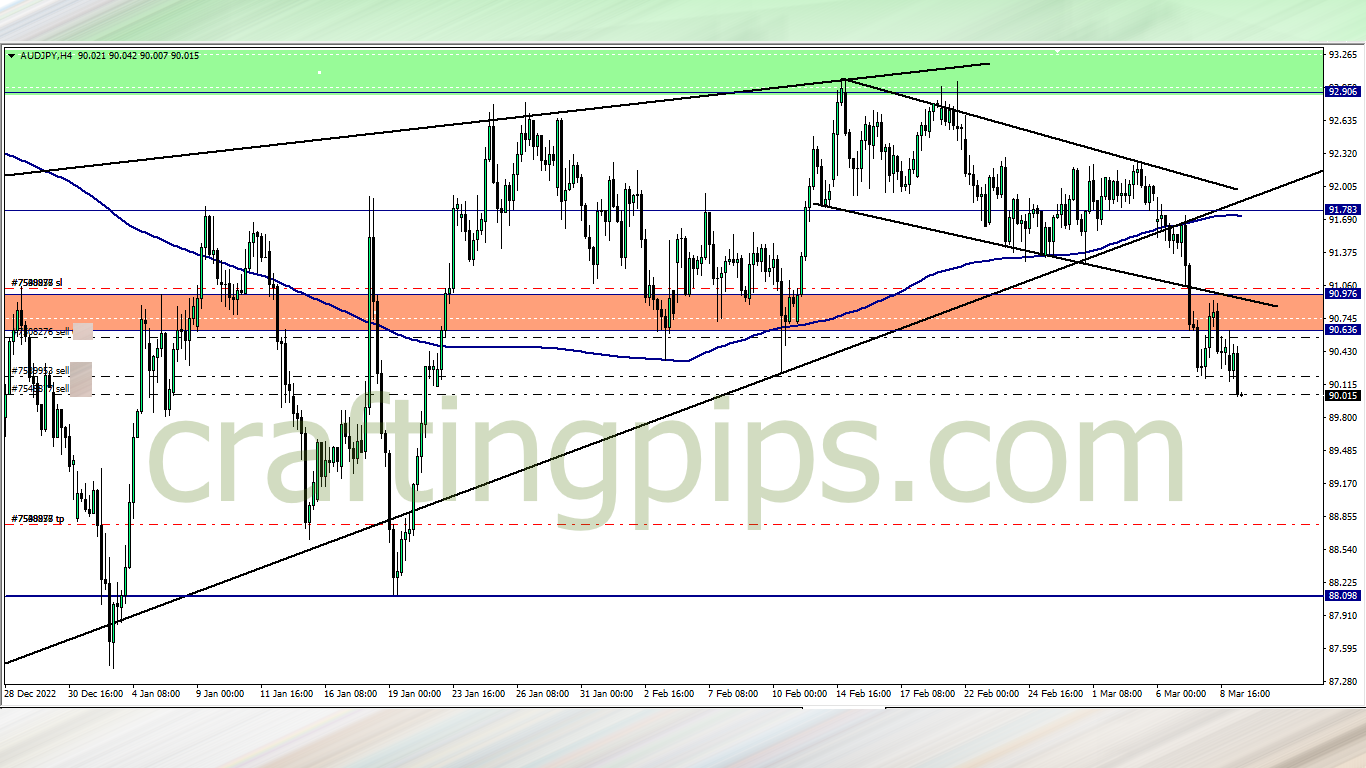

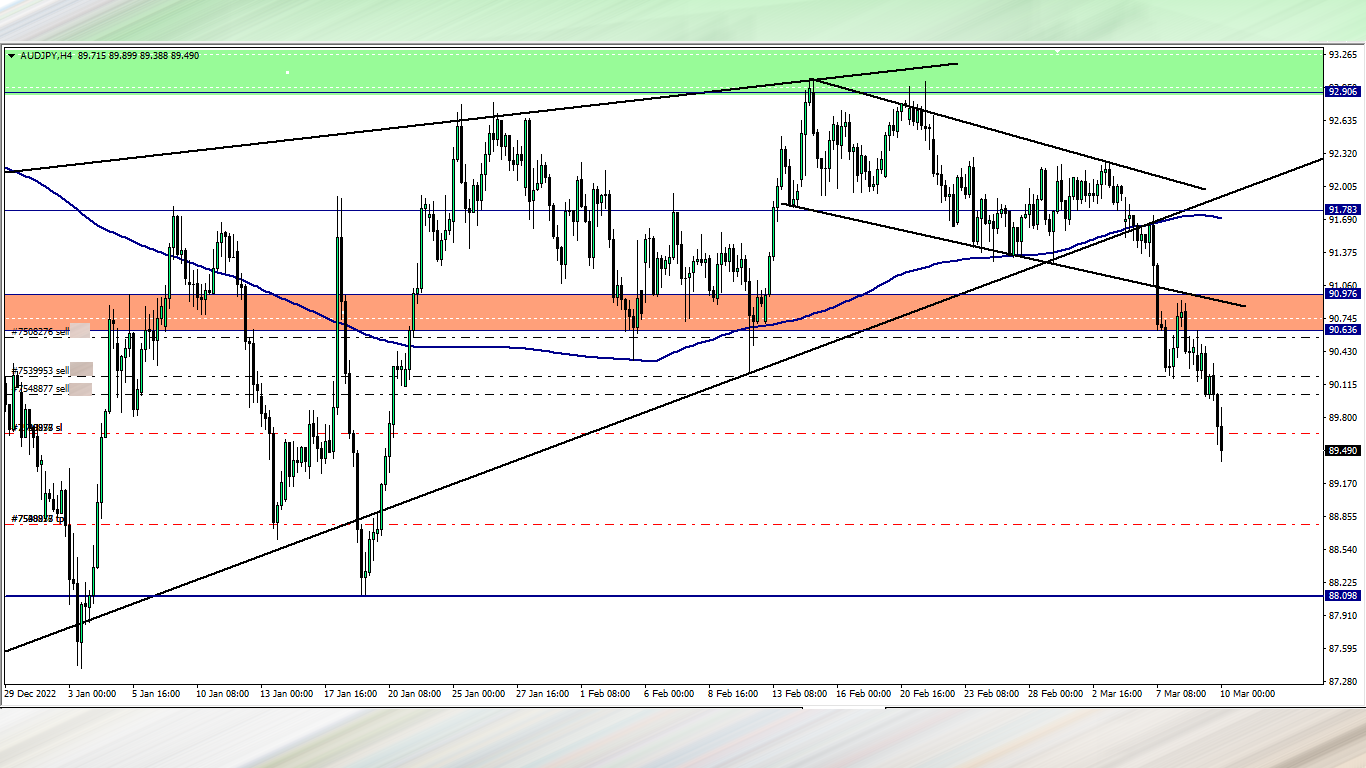

AUD/JPY (5.30 am)

Analysis: My reason for selling can be seen on our Wednesday market analysis. Another reason why I took this trade over the AUD/USD was because the “coast is clear”. Meaning there is no high impact news on any of the currencies till Friday. This will give the trade enough time to materialize

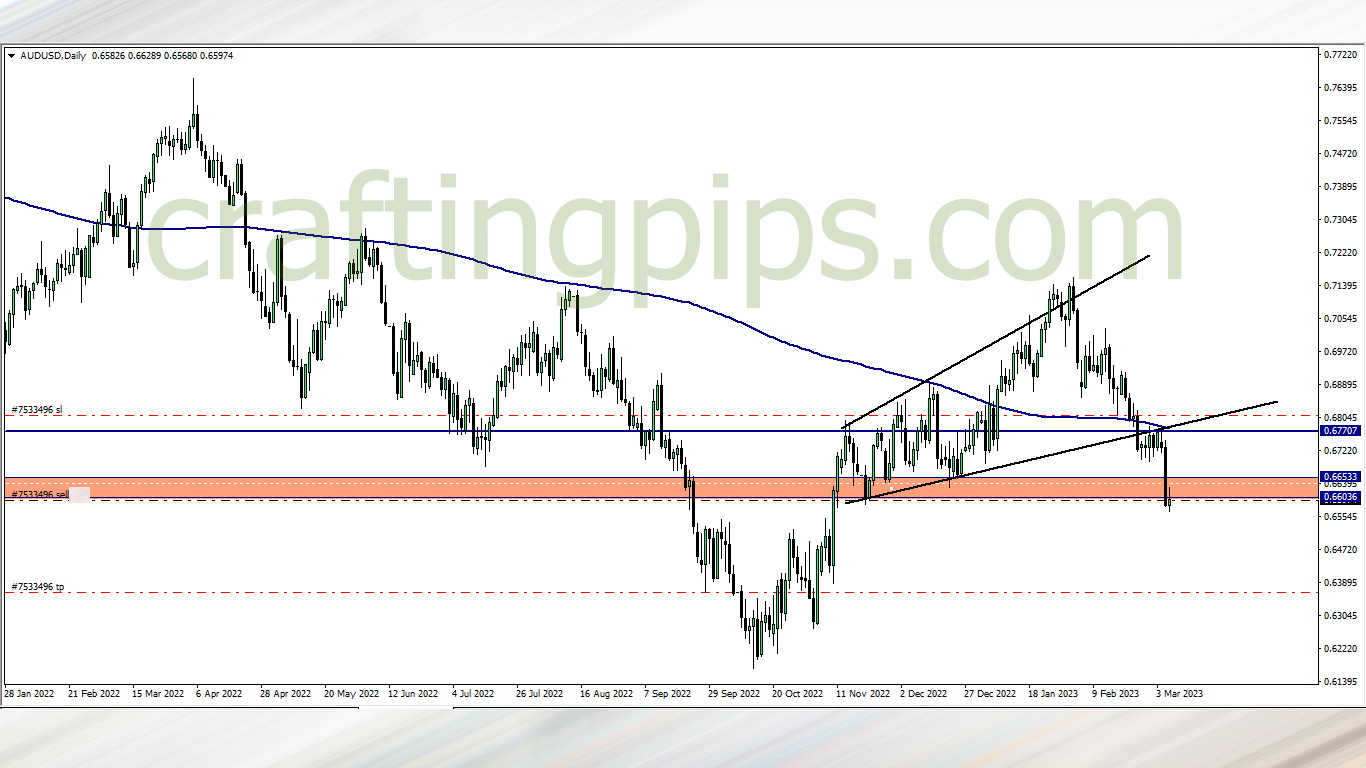

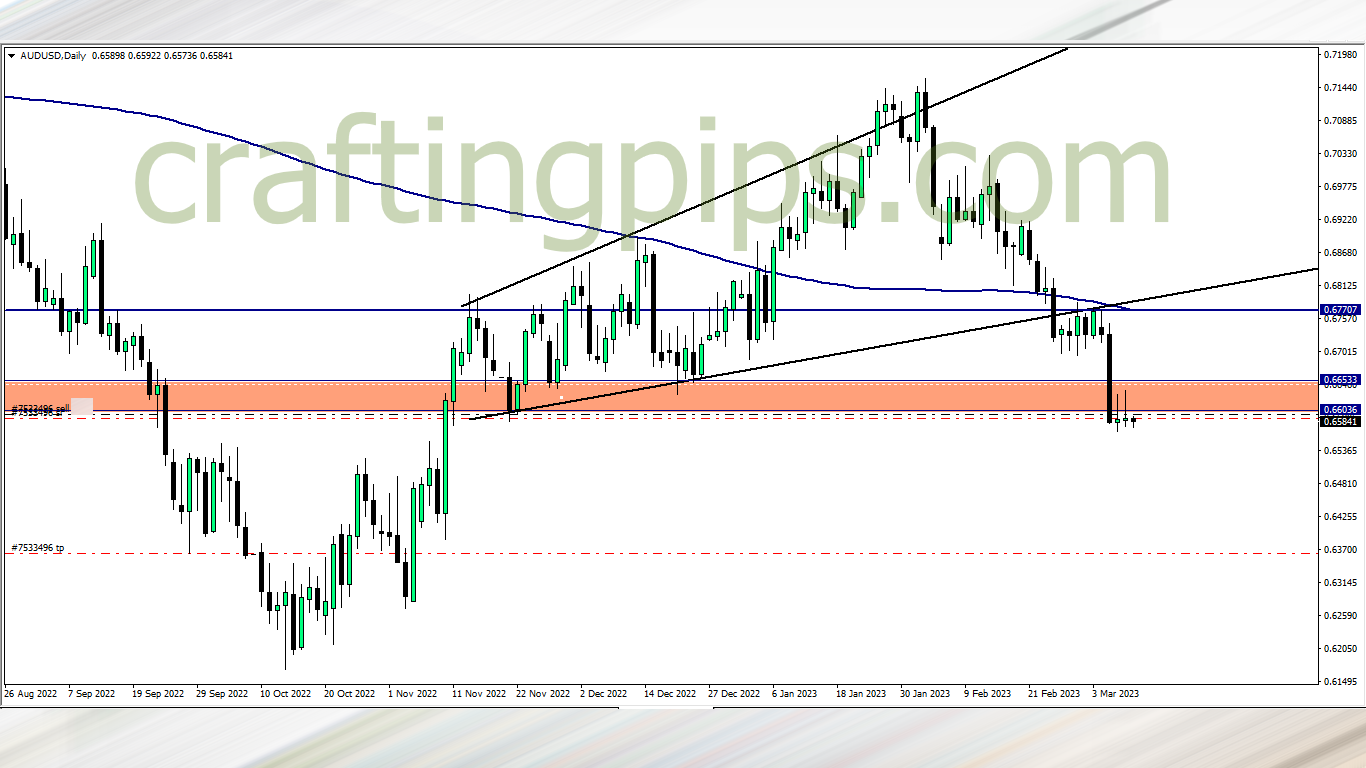

AUD/USD (6.20 pm)

Analysis: My reason for selling can be seen on our Wednesday market analysis. My reason for taking the trade at this time is because we have no high impact news from now till Friday

THURSDAY (09/03/2023)

AUD/JPY Update (3.25 am)

Analysis: Added another position to the existing

AUD/JPY Update (11.05 am)

Analysis: Another trade was added

FRIDAY (10/03/2023)

AUD/JPY Update (3.30 am)

Analysis: I am locking profits tightly on the AUD/JPY because Friday is riddled with high impact news.

The trade finally closed with +185 pips (3 positions)

AUD/USD Update (3.20 am)

Analysis: Closed the AUD/USD trade at breakeven

Trade activity summary for the week

| DATE | PAIRS | BUY/SELL | PIPS MADE/LOST |

| MON (06/03/2023) | EUR/CHF | BUY | – 24 pips |

| EUR/CHF | SELL | – 35 pips | |

| Last week’s trade | NZD/JPY | BUY | – 212 pips |

| TUE (07/03/2023) | GBP/USD | SELL | + 19 pips |

| WED (08/03/2023) | AUD/JPY | SELL | + 185 pips |

| AUD/USD | SELL | Breakeven | |

| TOTAL | – 67 PIPS |

In conclusion:

Many lessons to learn from this week’s bad performance.

Started the week with two bad trades on EUR/CHF. The 1st bad trade was because I did not properly vet the news calendar. There was a high impact news on CHF which I did not see. My attention was drawn to it by a fellow trader in my trading group, but then I was in a little loss, so I decided to go on with the trade

The second loss on the same EUR/CHF was because I placed a tight stop loss on the reverse entry, so the erratic price threw me out of my position. Both trades stung like a bee because they could have been avoided.

My third bad trade was a carry over from last week . I have no issues with the NJ trade because it was well executed but the market had its way on this trade.

The GBP/USD was a not a high probability trade, but had over 60% probability of panning out well, so I greatly reduced my risk because of this and the fact that I was in a losing streak.

My 5th and 6th trades were winners but a massive disappointment to me because I expected more from both based on the fact that they fall within my high probability setups

This is a classical example of what could happen to any trader if the market is approached with excitement, and all the checks are not ticked before one begins to trade. The market this week was also erratic and a little unpredictable.

I closed the week with about -1.8% loss in trading capital. Next week we go again

How did yours go?

NOTE:

Hey traders,

If you are into trading for proprietary firms which I believe you should due to the many advantages involved, check out these carefully selected proprietary firms listed below.

The funded trader needs no introduction, as they are currently becoming one of the most sorted proprietary firms in the industry due to their flexible challenge rules which consist of you being able to use an EA (expert advisory or trading robot) on one of their packages.

Also their packages are pretty affordable, which also comes with unlimited trials even if you fail to hit the set target within the 35 days period.

If you are interested in getting a 5% discount upon purchase, hit THE FUNDED TRADER and use THE0CRAFTER as the coupon code